When to Review Enterprise-Wide Risk Assessment to comply with Singapore AML Laws?

When to Review Enterprise-Wide Risk Assessment to comply with Singapore AML Laws?

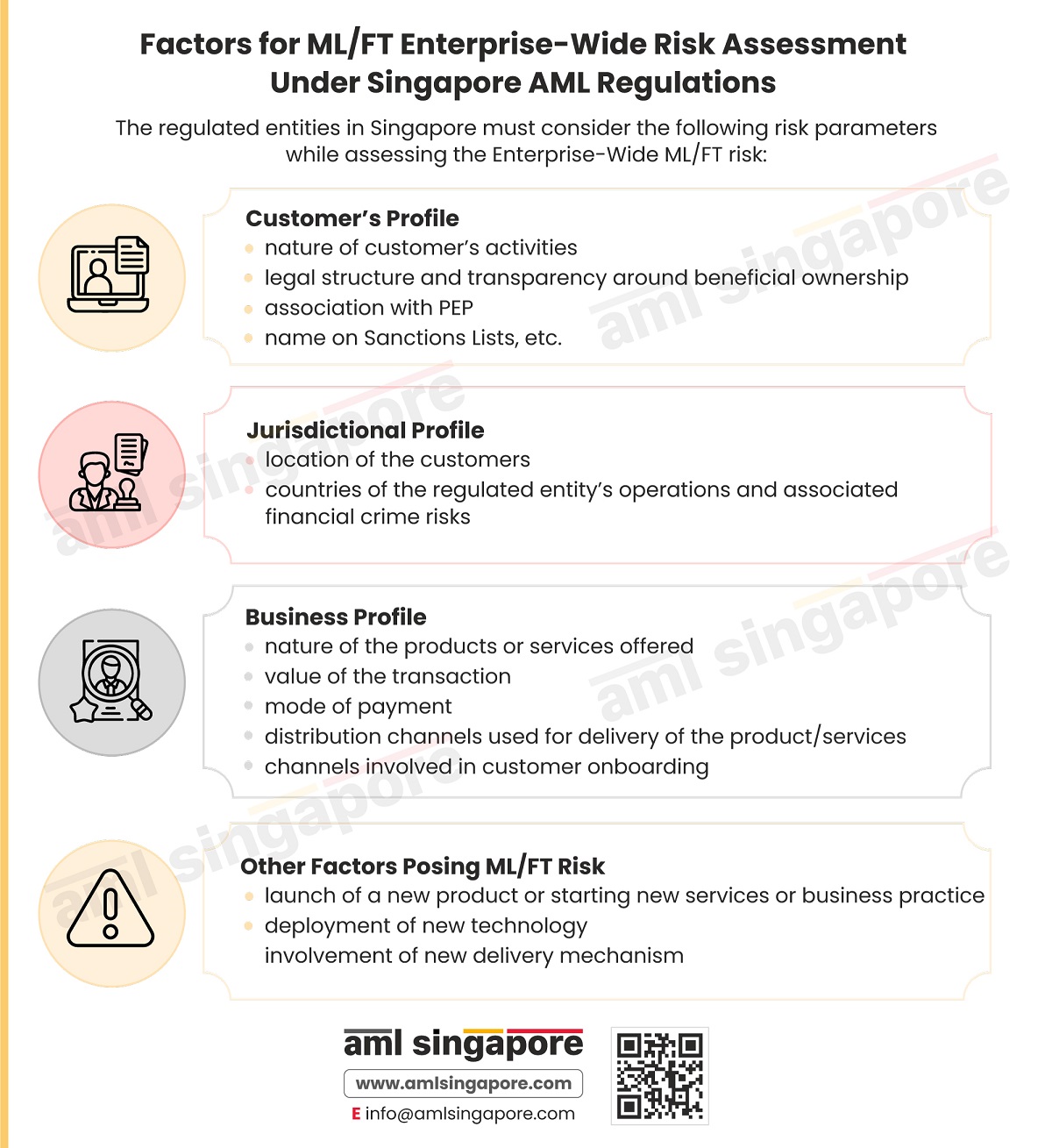

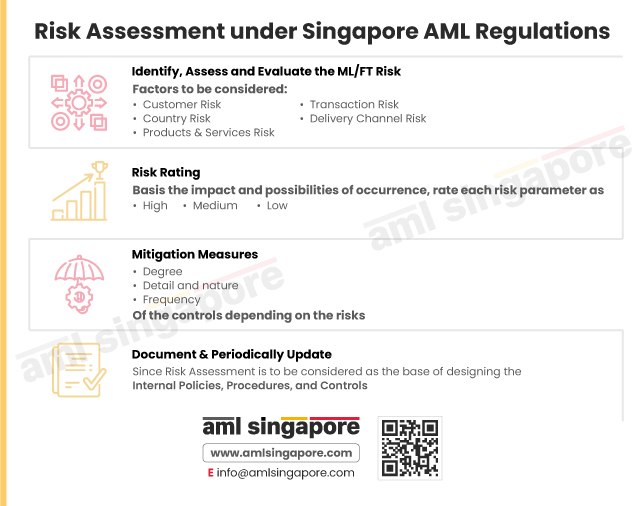

AML enterprise-wide risk assessment, also known as business risk assessment, is the process conducted to assess and identify the risk factors, their impact on the business, and the possibility of their occurrence.

Based on AML EWRA, one can identify and implement the controls, policies, and procedures needed to create an AML program to mitigate the risks of money laundering and other financial crimes.

However, it’s not a one-time job and requires continuous updates based on changes in various factors. Thus, EWRA is a dynamic process, helping the regulated entities to stay on top of the business’s vulnerabilities to ML/FT.

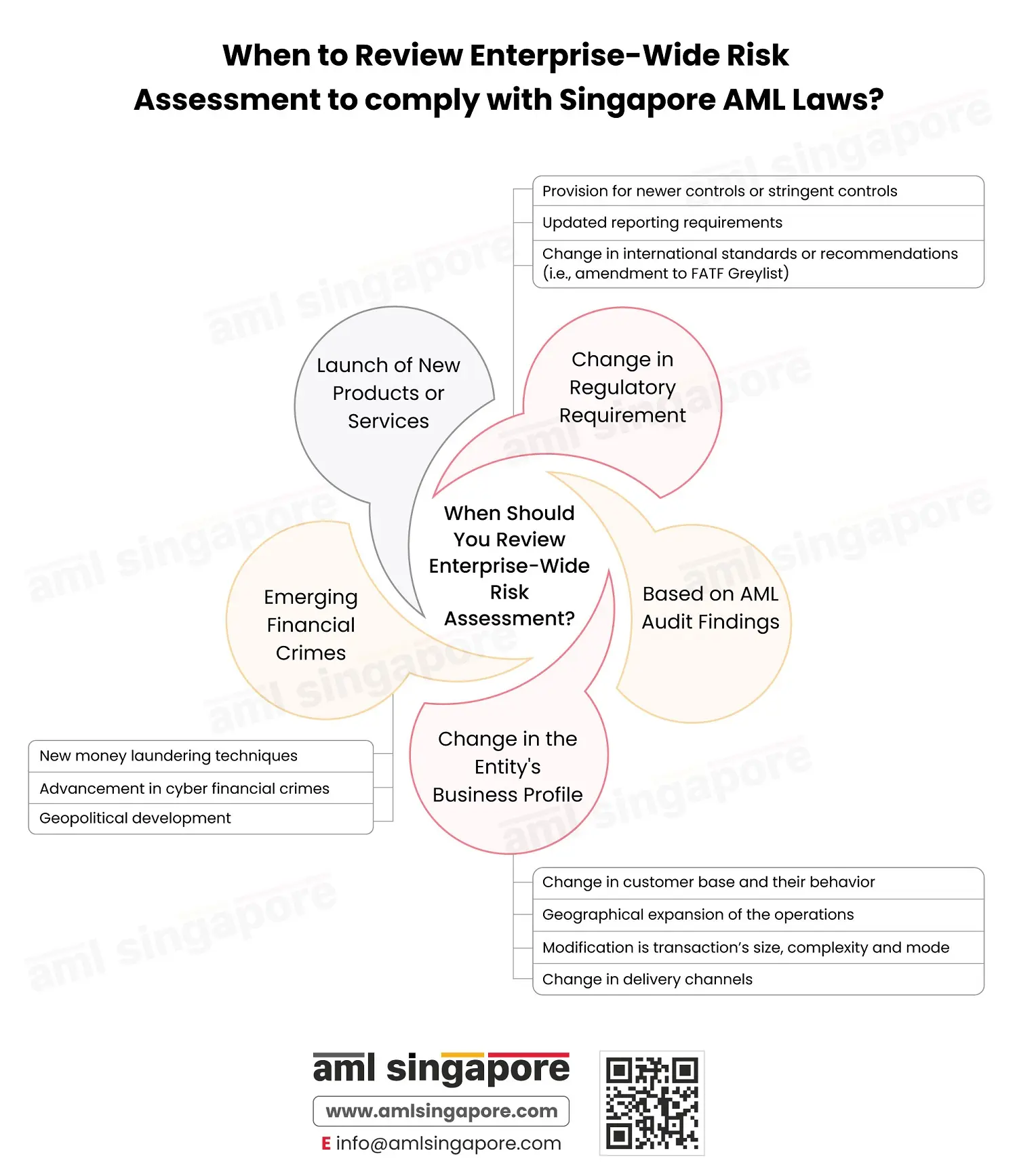

The infographic showcases these trigger points when a regulated entity needs to relook and revise the EWRA.

Some of the events or circumstances, when a regulated entity must re-assess the ML/FT risk, are:

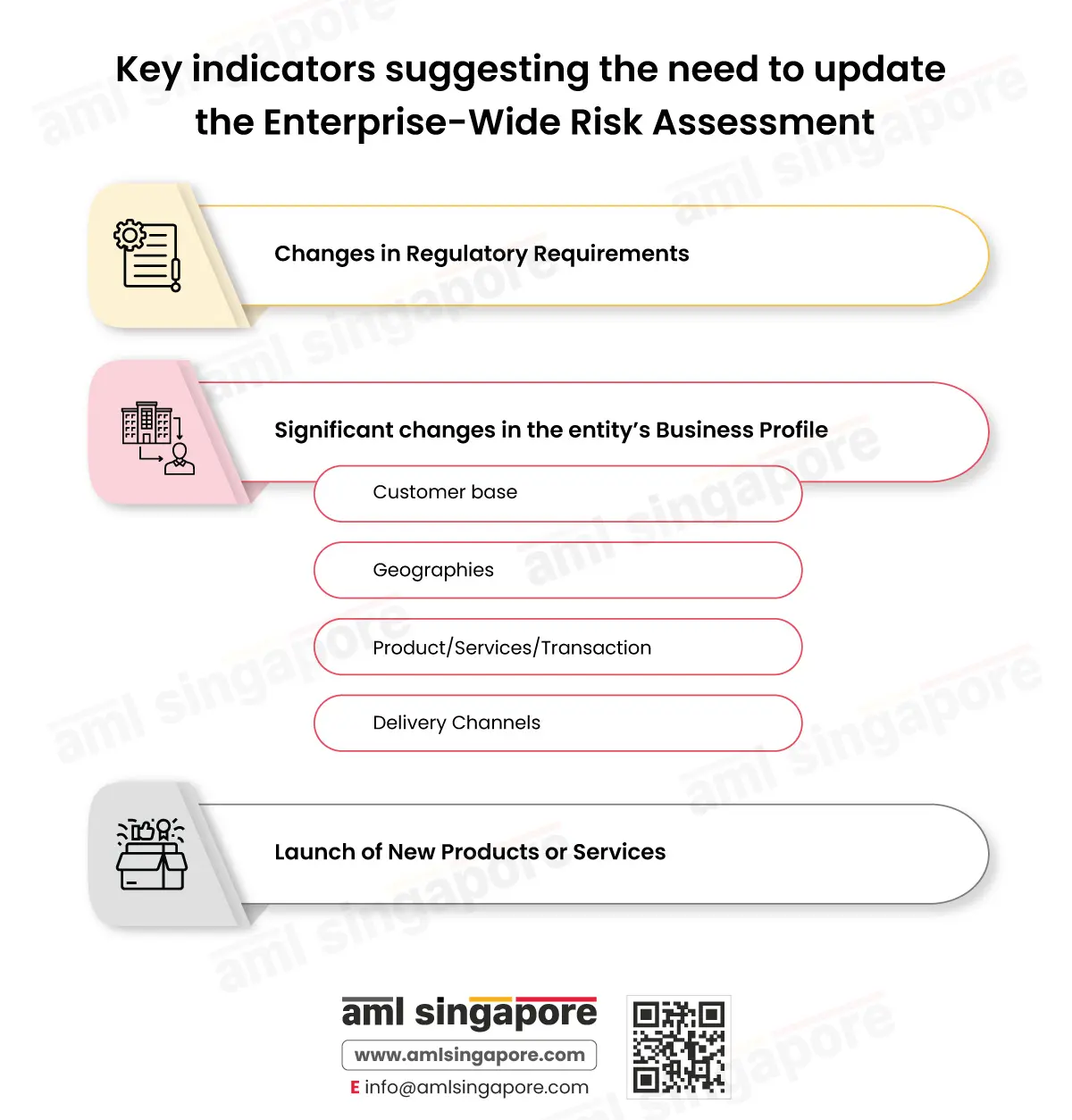

- Change in AML regulatory landscape (whether local or international)

- Launch of new products or services

- Significant shift in the business profile (such as change in customer base, introduction of new delivery channels)

- Encounter of the new ML/FT typologies or trends

- Any risk identified by the auditor or auditor’s recommendations around risk mitigation measures