Unravelling AML Program Failures: Causes and Solutions

Unravelling AML Program Failures: Causes and Solutions

The AML Program designed and implemented by the regulated entities must efficiently and effectively identify the money laundering and terrorism financing risks. It must comply with the AML regulations of Singapore. To ensure the protection of the business against financial crime and stay regulatory compliant, it is pertinent to identify the reasons causing an AML program to fail and immediately address these gaps.

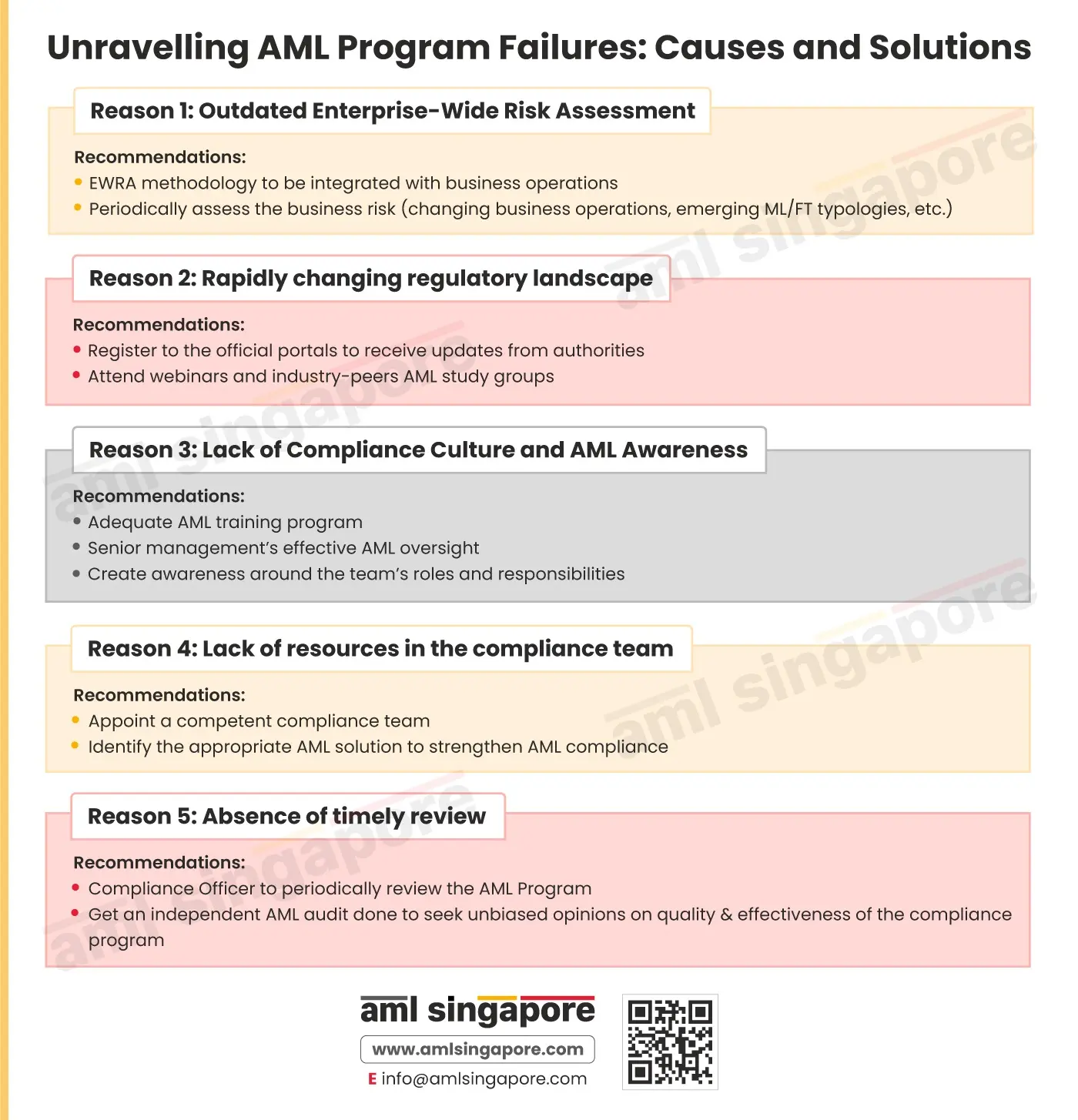

Here is an infographic discussing some of the key reasons for the AML Program’s failure:

- Assessment of the business’s risk is outdated and does not consider the current business profile (Irrelevant Enterprise-Wide Risk Assessment)

- Difficulties in keeping pace with the regulatory changes, making the existing AML framework inadequate and ineffective to combat ML/FT

- Insufficient support from employees and senior management towards AML compliance, possibly because of a lack of AML awareness amongst the team

- Inadequate resources available for managing AML compliance (no tools or incompetent AML Compliance Officer)

- No policy for periodically reviewing the AML measures (unless reviewed, the loopholes in the AML program cannot be detected and, thus, cannot be enhanced)

The infographic also elaborates the remediation measures (such as AML training, periodic assessment of business risk, AML audit, etc.) necessary to correct these causes and foster the quality and effectiveness of the AML Compliance Program.

Let AML Singapore assist you in reviewing your existing AML framework (Internal Policies, Procedures, and Controls (IPPC)) and identify the areas that need to be attended to and corrected on a priority basis. Strengthen your AML Program to align with your business risk assessment and AML laws of Singapore to prevent financial crime risk and non-compliance penalties.