Understanding WMD Proliferation and Proliferation Financing (PF)

What is Weapons of Mass Destruction (WMD) Proliferation and Proliferation Financing (PF)?

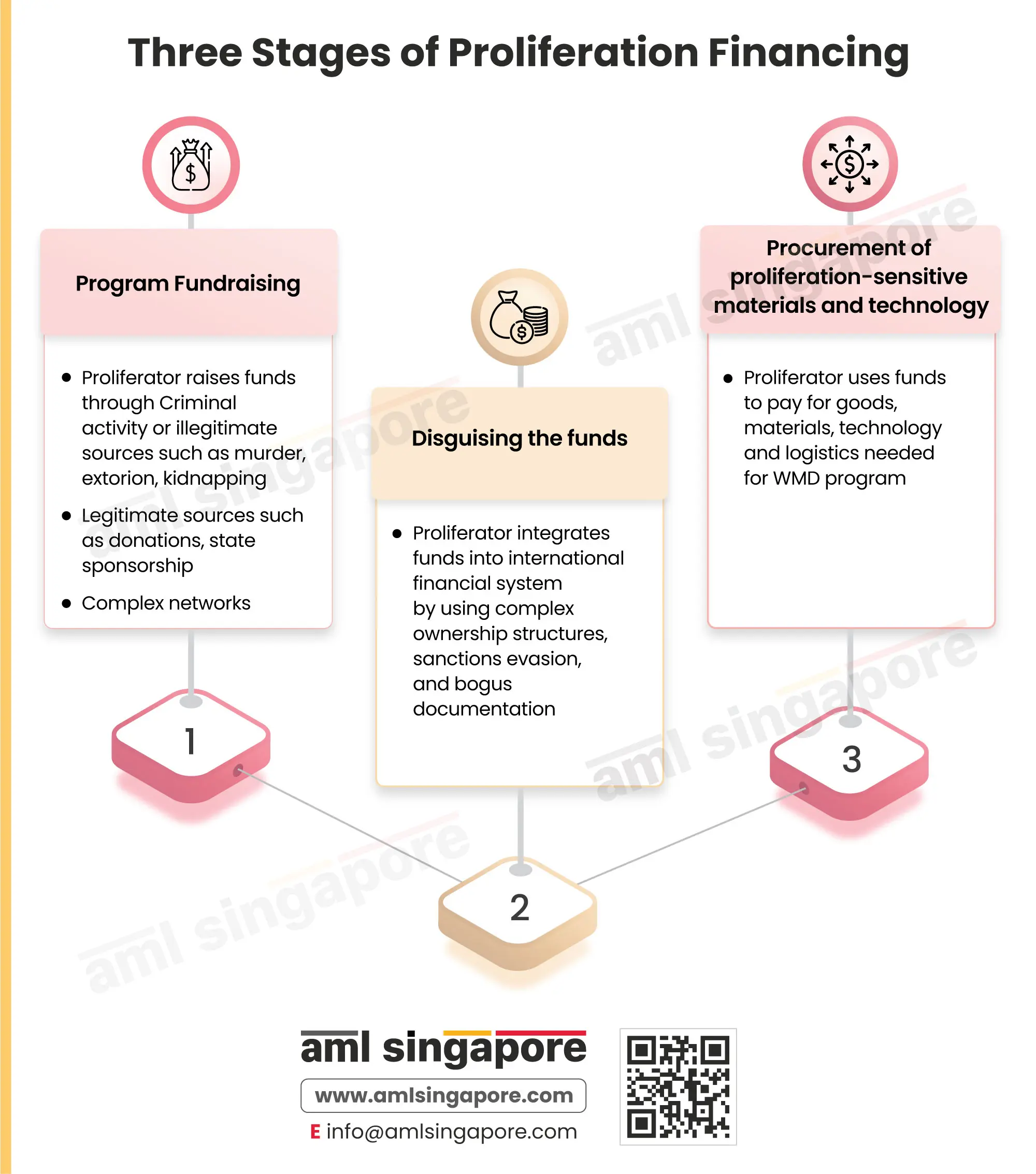

Weapons of Mass Destruction (WMD) Proliferation refers to the illegal manufacture, acquisition, possession, development, export, trans-shipment, brokering, transport, transfer, stockpiling or use of nuclear, chemical, or biological weapons and their means of delivery and related materials (including both dual-use technologies and dual-use goods used for non-legitimate purposes).

The primary motive behind Proliferation Financing (PF) is to support a sanctioned state or further an ideology for power or profit. Iran and the Democratic People’s Republic of Korea (“DPRK”) come at the top of the list of countries involved with PF activities, such as the nuclear weapons program. The United Nations Security Council (“UNSC”) and the Financial Action Task Force (“FATF”) have issued various reports highlighting PF typologies and the techniques used by proliferators for sanctions evasion.

The financing of proliferation refers to the risk of raising, moving, or making available funds, other assets or other economic resources, or financing, in whole or in part, to persons or entities for purposes of WMD proliferation, including the proliferation of their means of delivery or related materials (including both dual-use technologies and dual-use goods for non-legitimate purposes.)

Proliferation Financing could be very complex to identify and detect. It may not be directly related to the physical flow of goods but may also include:

- Insurance and Re-insurance services

- Trust and Corporate Services

- Third-Party Agent Services

- Credit line for shipment of WMD or components thereof

- Financial Transfers

National and International Standards and Laws to Fight Proliferation of WMDs and Proliferation Financing

Singapore Laws:

Laws Applicable to Financial Institutions:

- Financial Services and Markets (Sanctions and Freezing of Assets of Persons —Democratic People’s Republic of Korea) Regulations 2023 (FSM DPRK Regulations)

- Financial Services and Markets (Sanctions and Freezing of Assets of Persons — Iran) Regulations 2023 (FSM Iran Regulations)

Laws Applicable Individuals and Entities Other than Financial Institutions:

- United Nations (Sanctions — Democratic People’s Republic of Korea) Regulations 2010 (UN DPRK Regulations)

- United Nations (Sanctions — Iran) Regulations 2019 (UN Iran Regulations)

International Standards

- UNSCR 1540 (2004)

- UNSCR 1718 (2006)

- UNSCR 1874 (2009)

- UNSCR 2087 (2013)

- UNSCR 2094 (2013)

- UNSCR 2231 (2015)

- UNSCR 2270 (2016)

- UNSCR 2321 (2016)

- UNSCR 2356 (2017)

- UNSCR 2371 (2017)

- UNSCR 2375 (2017)

- UNSCR 2397 (2017)

- FATF Recommendation 1

- FATF Recommendation 2

- FATF Recommendation 6

- FATF Recommendation 7

- FATF Recommendation 15

Any updates to the UNSC sanctions lists are given an effect in Singapore’s domestic laws on an immediate basis

What are the types of Proliferation Financing?

1. Terrorism Financing

Here, the terrorist organisations are financially supported to procure WMDs.

2. State Financing

Here, a state is financed by another state or state-controlled entity to enable it to procure WMDs.

The financing of proliferation refers to the risk of raising, moving, or making available funds, other assets or other economic resources, or financing, in whole or in part, to persons or entities for purposes of WMD proliferation, including the proliferation of their means of delivery or related materials (including both dual-use technologies and dual-use goods for non-legitimate purposes.)

Why is the detection and prevention of proliferation of Weapons of Mass Destruction and Proliferation Financing important?

Various countries develop Weapons of Mass Destruction to establish their power and have a variety of ill motives. The Proliferation of WMDs and Proliferation Financing help them achieve their objectives and create global instability.

The use of WMDs results in large-scale loss of life, and hence, it is important that the proliferation of Weapons of Mass Destruction (WMD) and Proliferation Financing are detected and prevented.

The Financial Action Task Force (FATF) recommends countries implement UNSC Resolutions concerning the prevention, disruption, and suppression of the proliferation of weapons of mass destruction (WMD) and Proliferation Financing. The countries are required to apply a freezing mechanism without any delay.

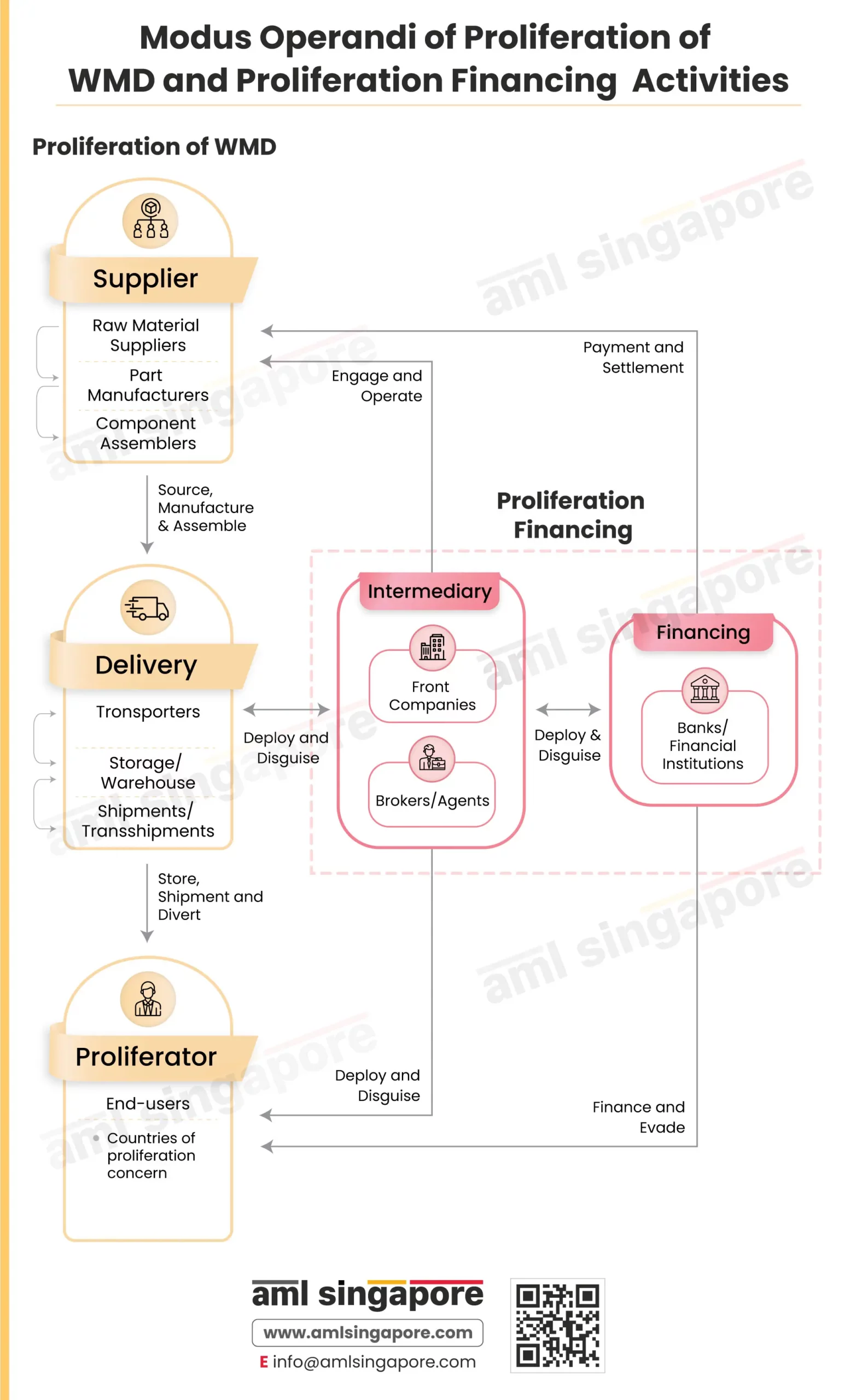

3 Stages of Proliferation Financing

To understand Proliferation and Proliferation Financing, it is essential first to understand the 3 stages of proliferation financing

1. Program Fundraising

2. Disguising the funds

Disguising funds is a stage where the origin of the funds raised is made to look legitimate through a web of transactions within the complex business network by creating bogus invoices inter-se, usually through shell companies. In this stage, the proliferator blends the proceeds of crime with the international financial system. Many fake documents or paper trails are created to obscure the true nature of the origin of funds.

3. Procurement of proliferation-sensitive materials and technology

In the third stage, the proliferator uses the funds accumulated to pay for the goods, materials, technology, and logistics needed for its WMD proliferation program.

How does Proliferation Financing differ from Money Laundering and Terrorist Financing?

Sr | Criteria | Money Laundering | Terrorist Financing | Proliferation Financing |

1 | Stages | Placement à Layering à Integration | Fund Raising à Moving à Using | Fund Raising à Concealing à Procuring materials/technology |

2 | Motivation | Personal Benefit, Profit-maximisation. | To support a political, religious or psychological ideology. | For projecting a state as a global power, recognition, profit-making, or support a sanctioned state. |

3 | Intention | To legitimise the ill-gotten money. | To force others to do things through violent means. | To procure goods to develop WMD without getting caught. |

4 | Funding Sources | Illegal activities – predicate offences, tax evasion. | Illegal activities – predicate offences, improper use of donated funds. Legal means – donations, employment, business income, etc. | Illegal activities – Predicate offences. Legal means – foreign government sponsors, business income, employment, donations, etc. |

5 | Conduits | Banks and financial institutions. | Hawala, exchange houses, cash couriers. | Banks and Financial Institutions |

6 | Transaction Amount | Large amounts structured in a way to avoid monetary threshold | Small amounts below the monetary threshold | Moderate amounts |

7 | Methodology | Shell companies, Offshore secrecy havens, bearer shares, complex transactions. | Smuggling of cash and precious items, formal banking system, money exchange houses, Hawala. | Normal business transactions structured in such a way that they hide the source of funds. |

8 | Money Trail | Circular | Linear | Linear |

9 | Countering Mechanism | Suspicious transactions identification – Unusual transactions considering a person’s profile. | Suspicious relationship identification – transactions between unrelated parties. | Suspicious individuals, entities, transactions, states, goods and materials identification. |

Red Flags Associated with Proliferation Financing

Customer Profile Risk Indicators for combating proliferation financing are where the customer:-

- Provides vague or incomplete information about their proposed trading activities or legal entity, its owners, or senior managers appearing in sanctioned lists or negative news during ongoing monitoring or subsequent stages of due diligence.

- Is a person connected with a country known for proliferation financing.

- Is dealing with dual-use goods or complex equipment for which they lack technical background or which is inconsistent with their line of activity or usual course of business.

- Involves complex trade networks involving numerous third-party intermediaries, unnecessarily creating a web of transactions.

Transaction Activity Risk Indicators

- The transaction involves designated individuals or entities subject to reporting requirements.

- The transaction involves higher-risk countries or jurisdictions, other entities with known deficiencies in AML, CFT, countering of proliferation financing controls, or possible shell companies.

- Transactions that involve items controlled under dual-use or export control regimes or the customers have previously violated requirements under dual-use or export control regimes.

- Transactions where the customer is domiciled in a country with weak implementation of relevant UNSCR obligations and FATF Standards or a weaker export control regime than Singapore’s.

Maritime Sector Risk Indicators

- Transaction involves containers whose numbers have been changed or ships renamed.

- Shipment of goods takes a circuitous route, or the financial transaction is structured circuitously.

- Transaction involves the shipment of goods inconsistent with standard geographic trade patterns or consumer patterns (e.g. The country involved would not usually export or import such goods)

- The destination of a shipment is different from the importer’s location.

- There are inconsistencies in the information, including trade documents and financial flows (e.g., names, companies, addresses, ports of call and destinations).

Trade Finance Risk Indicators

- The customer requests a letter of credit for trade transactions for the shipment of dual-use goods or goods subject to export control.

- There is a lack of complete information or inconsistencies in trade documents and financial flows, such as names, companies, addresses, destinations, etc.

- Transactions include wire instructions or payment details from or due to parties not identified on the original letter of credit or other documentation.

Assessing the risks associated with Proliferation Financing

Proliferation Financing risk assessment is based on the risk-based approach (RBA) prescribed under Singapore Law and FATF recommendations. A Proliferation Financing risk can be seen as the result of three factors: threat, vulnerability, and consequence.

The threats are discussed as red-flag indicators and refer to designated persons and entities that can potentially evade or breach PF-TFS (Targeted Financial Sanctions). Critical Proliferation and PF threats include countries like North Korea and Iran, along with terrorist groups who are always assumed to be interested in nuclear weapons and radiological materials.

Vulnerabilities can be seen as the evasion of sanctions or non-implementation of sanctions. PF vulnerabilities may be based on factors such as business structure or sector (banking or insurance), products or services (virtual assets or money transfer services), customers and transactions (customers from high-risk jurisdictions like Iran).

Consequences refer to the outcome where proliferators use the funds to acquire materials, items, or systems for developing and maintaining illicit nuclear, chemical, or biological weapon systems.

A Proliferation Financing risk assessment may follow the same stages as an ML/TF risk assessment, and they are identifying, assessing, and understanding the PF risk in an entity’s business and taking reasonable steps to manage and mitigate PF risks.

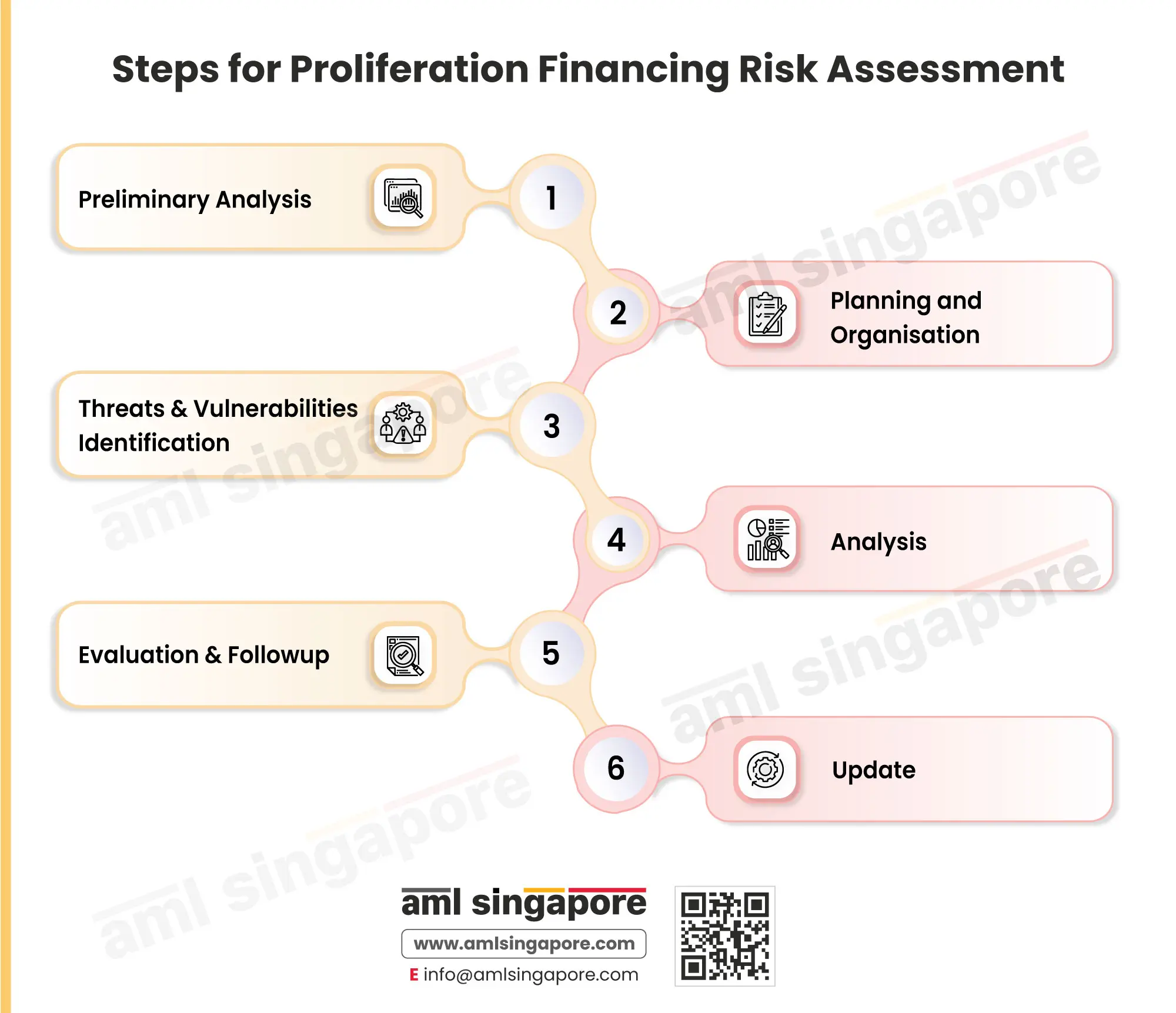

6 Steps for Proliferation Financing Risk Assessment

- Preliminary Analysis

- Planning and Organisation

- Threats and Vulnerabilities Identification

- Analysis

- Evaluation and Followup

- Update

PF risk needs to be identified and assessed concerning:

- customer’s profile

- if the customer is sanctioned by any of the Sanctions Lists

- identification of individuals and ultimate beneficial owners against the names in the sanctions list during the screening process

- customer’s country of origin and present location

- countries or territories where the entity has operations in

- nature of product or services engaged in, such as PSPMs or VASPs (e.g. value, liquidity, or source)

- the services provided (e.g. retail, wholesale, manufacture, or export/import)

- mode and value of transactions (e.g. cash, in-kind payments, bank transfer, credit card, virtual currencies, or digital payment tokens); and

- delivery channels (e.g. the over-the-counter, courier or delivery to a foreign country or territory)

Thus, knowledge of PF risk helps with combating proliferation financing.

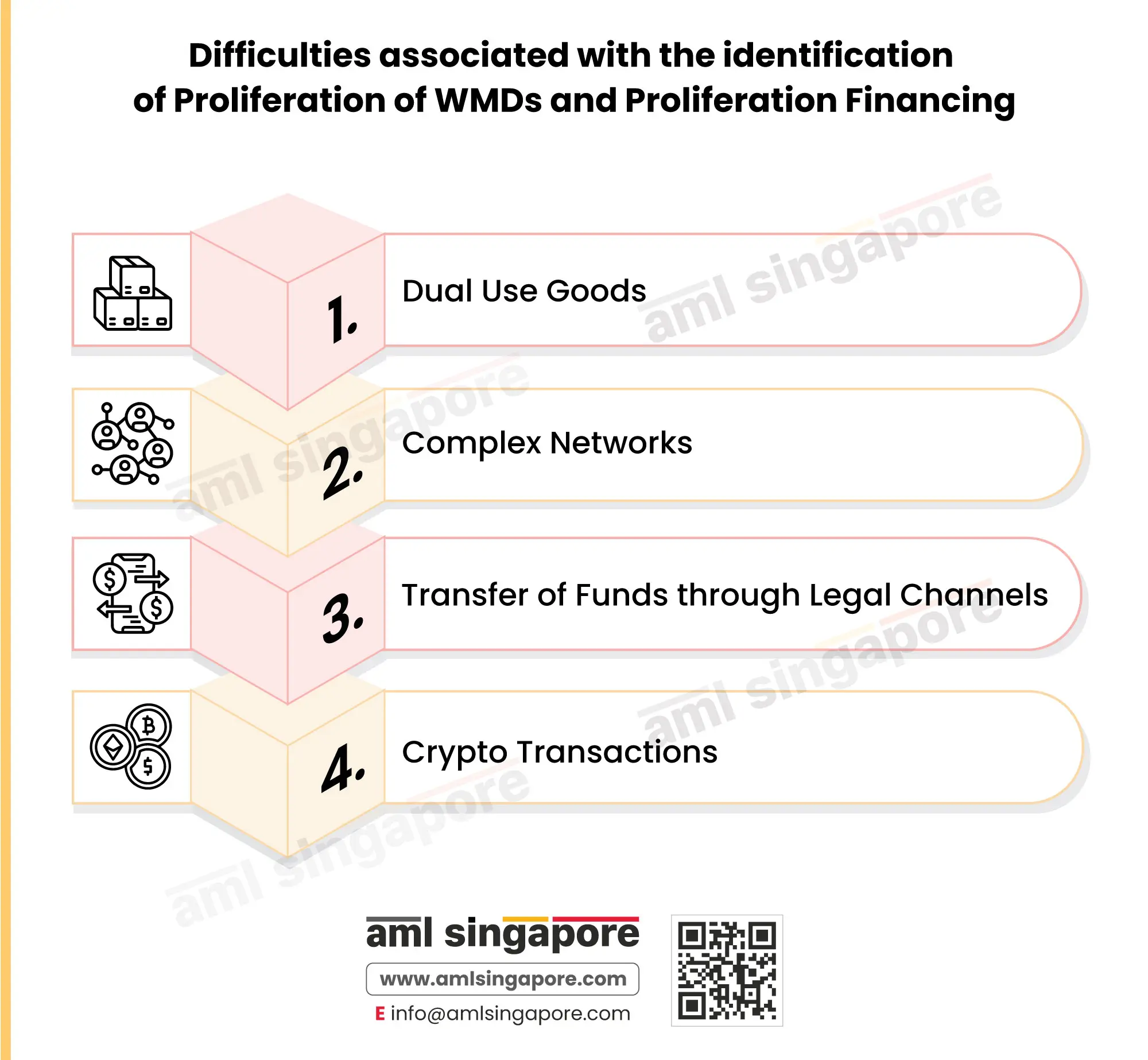

Difficulties associated with the identification of Proliferation of WMDs and Proliferation Financing

1. Dual Use Goods

Dual Use Goods have legitimate uses as well. Proliferation of WMDs is easier to detect if the fully manufactured products are bought. Dual-use chemicals make it difficult to separate them from legitimate and illegitimate use. Further, it requires a specialist to identify such materials.

2. Complex Networks

Complex Networks are created to facilitate trading WMDs and components used therein. Criminals create false documentation, making it even more difficult to identify proliferation financing. Further, agents, front companies, and false end-users are used to conceal the true identity behind such transactions.

3. Transfer of Funds through legal channels

Often, the funds are transferred through legal channels for a transaction that appears perfectly in line with normal business transactions. The source of funds is normally legitimate, causing no suspicion, but only the end-user identification is obscured.

4. Crypto transactions

Crypto transactions are harder to detect. New platforms built on distributed ledger technology, i.e.’ blockchain’, support anonymity and make it difficult to identify the criminals and the underlying transactions.

Measures to Prevent and Mitigate Proliferation Financing Risk

- Compliance management arrangements

- Ongoing or regular program to train employees on the IPPC.

- Enhanced measures to manage and mitigate the risk of ML/TF/PF where higher risks are identified.

- Ideally, the IPPC should cover aspects such as

- Assessment of risks faced by the business.

- Appointment of compliance officer and charting out their roles and responsibilities.

- Procedures in place for carrying out diligence measures such as Customer Due Diligence (CDD) and Enhanced Customer Due Diligence (ECDD).

- Procedures to fulfil reporting obligations to Singapore’s Financial Intelligence Unit – Suspicious Transaction Reporting Office (STRO), such as Suspicious Transaction Reports (STRs), Cash Transaction Reports (CTRs) and Cash Movement Reports (CMRs) to analyse and detect Money Laundering, Terrorism Financing, Proliferation Financing, and other serious crimes.

- Record-keeping requirements.

- Further, the IPPC should be consistent across the group/branches and subsidiaries; in simple words, group oversight should be taken care of, the branch or subsidiary in a foreign country or territory having laws for the prevention of ML/TF/PF that differs from Singapore, then adequate measures must be applied to ensure consistency in mitigation measures across the group.

Best Practices to Counter WMD Proliferation and Proliferation Financing

- Screening of customers, suppliers, goods, and third-parties associated with the transaction.

- Staff training on Dual-Use Goods, PF red flags, WMD and PF typologies

- Transaction Monitoring

- Validation of shipping container numbers

- Maintaining up-to-date sanction lists

- Checking if a Government license is required to transact in certain goods

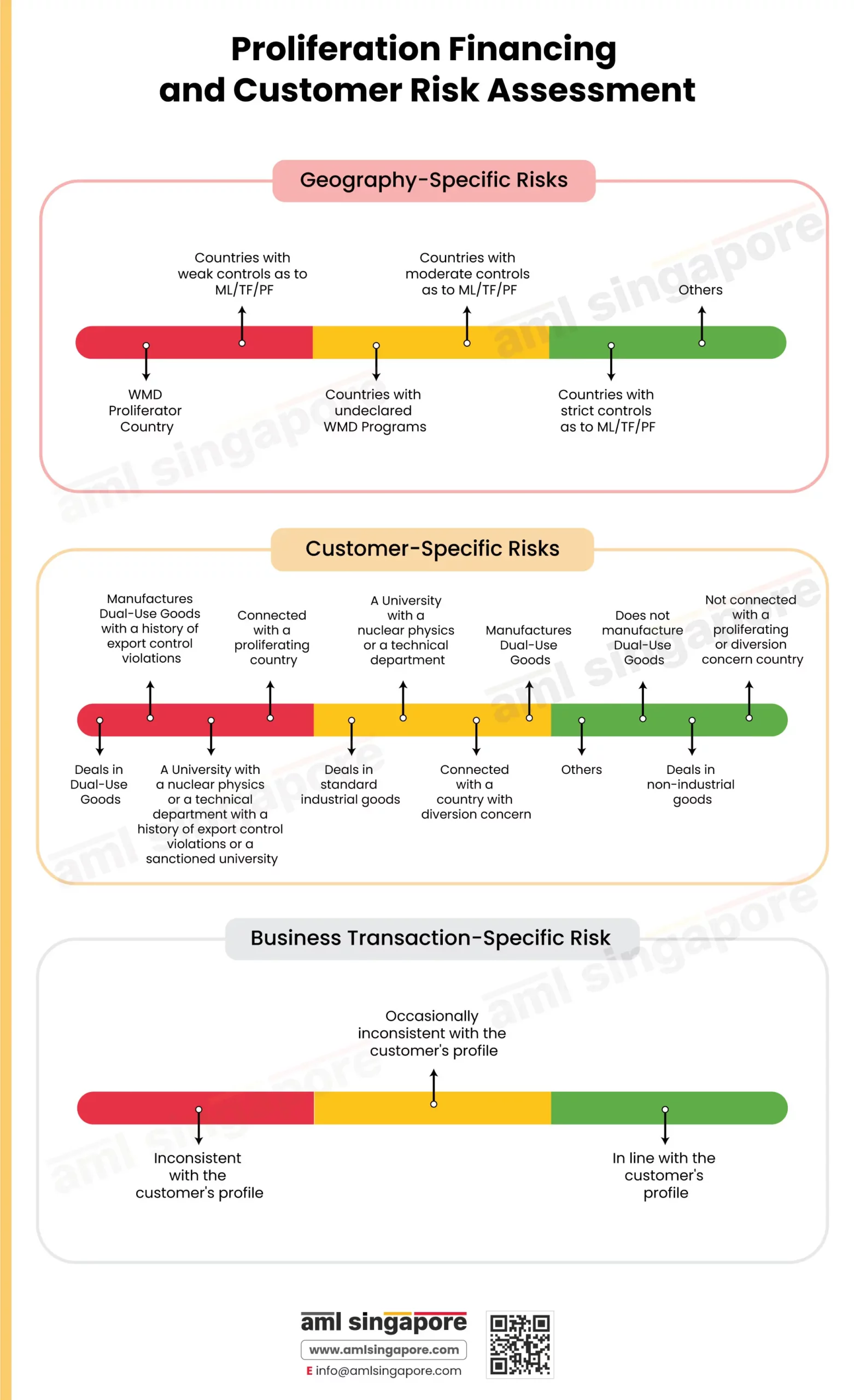

Proliferation Financing and Customer Risk Assessment

While assessing the overall risks associated with a customer, WMD Proliferation and Proliferation Financing risks must also be considered.

|

Criteria |

High |

Medium |

Low |

|

Geography |

WMD Proliferator Country |

Countries with undeclared WMD Programs |

Others |

|

Geography |

Countries with weak controls as to ML/TF/PF |

Countries with moderate controls as to ML/TF/PF |

Countries with strict controls as to ML/TF/PF |

|

Customer |

Deals in Dual-Use Goods |

Deals in standard industrial goods |

Deals in non-industrial goods |

|

Customer |

Manufactures Dual-Use Goods with a history of export control violations |

Manufactures Dual-Use Goods |

Does not manufacture Dual-Use Goods |

|

Customer |

A University with a nuclear physics or a technical department with a history of export control violations or a sanctioned university |

A University with a nuclear physics or a technical department |

Others |

|

Customer |

Connected with a proliferating country |

Connected with a country with diversion concern |

Not connected with a proliferating or diversion concern country |

|

Business Transactions |

Inconsistent with the customer’s profile |

Occasionally inconsistent with the customer’s profile |

In line with the customer’s profile |

Conclusion

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise- Wide Risk Assessments to implementing the robust AML Compliance framework. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.