Understanding the Three Lines of Defence in Singapore’s AML Laws

Understanding the Three Lines of Defence in Singapore's AML Laws

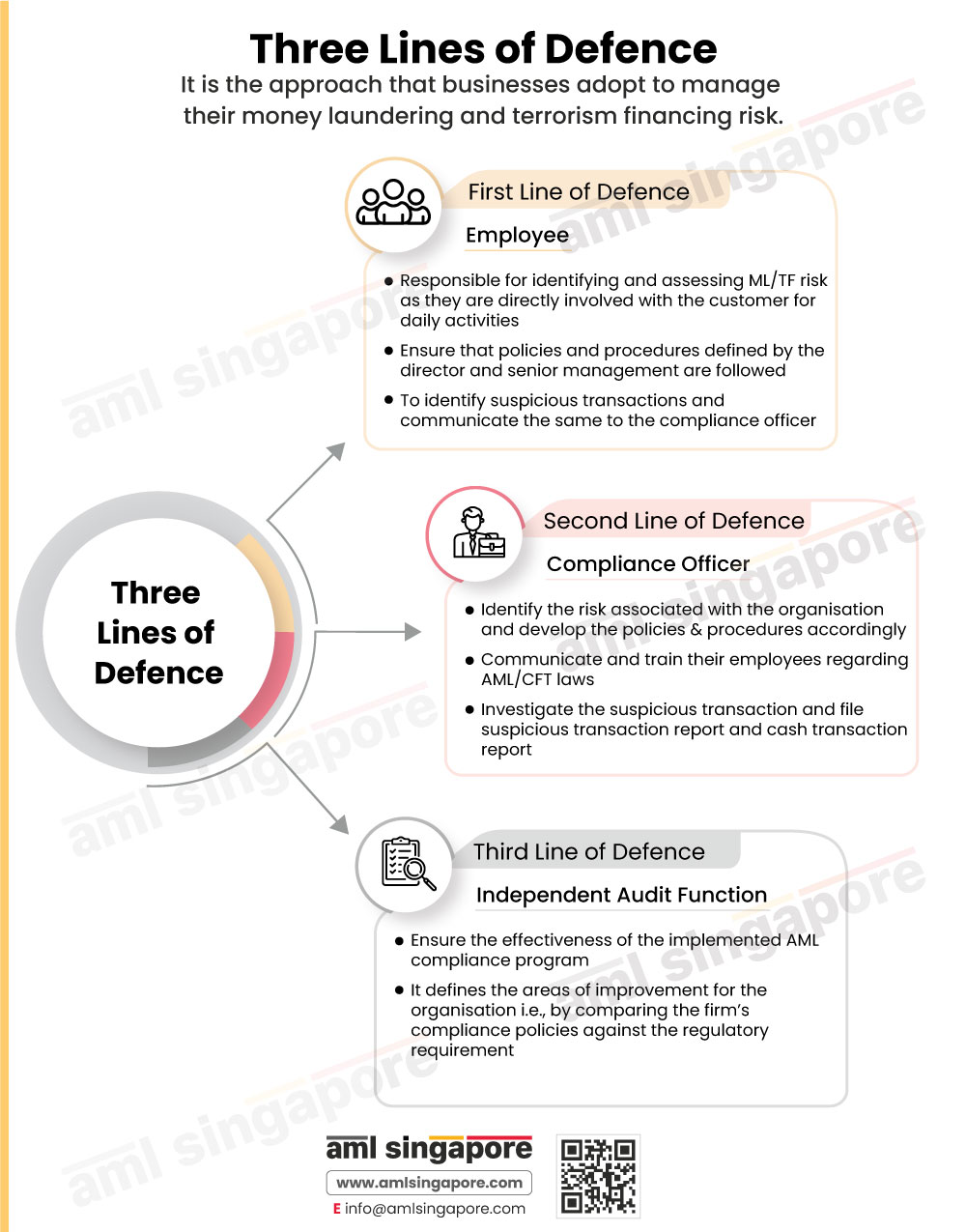

In the world of financial crimes, it’s important that the regulated entities put proper controls into place to counter money laundering and terrorist financing. The three lines of defence, viz., Employees, Compliance Officer, and Independent AML Audit, serve as a safeguard for the business to fight against money laundering and terrorist financing risks. In this infographic, we will discuss the three lines of defence.

Employees are the first line of defence. The front office employees deal directly with the customers. The back office staff deals with the suppliers. The employees must understand ML/TF typologies, red flags, and the AML/CFT framework of the entity to fight against financial crimes. As and when they have a suspicion, they must bring it to the notice of the compliance officer and get the Suspicions Transaction Report (STR) submitted to the authorities.

The Compliance Officer is the second line of defence. He carries out the Business Risk Assessment and quantifies the ML/TF risks. He drafts the AML/CFT framework of the entity and aligns it with the business risk assessment carried out by the entity. He implements the AML/CFT policies and procedures and sees that the controls are working as intended. The compliance officer trains the people in the compliance department and the front office staff. He also provides overall training to the other back office team. He is responsible for filing the Suspicious Transaction Report to the Suspicious Transaction Reporting Office (STRO).

Independent AML audit is the third line of defence. It provides assurance that the firm is adequately addressing the ML/TF risks and compliant with the regulatory requirements. Independent AML Audit helps identify gaps and improvement areas and take corrective actions.

The top management carries the ultimate responsibility to ensure strong governance and sound AML/CFT risk management.

Three lines of defence is the approach that businesses adopt to manage their money laundering and terrorism financing risk.