Understanding the Layering Stage of Money Laundering

Understanding the Layering Stage of Money Laundering

Money laundering is a global issue that is badly affecting the world at large. Understanding how money laundering activities occur is pertinent to curb this financial crime. The money laundering process involves different stages – Placement, Layering, and Integration. In the placement stage, the criminals introduce unlawful money into the legal system using sophisticated techniques that do not raise the alarm with the authorities. At the same time, the layering stage of money laundering is the critical phase of the process where the source and owner of the illegal funds are disguised.

Layering, as the word suggests, means adding layers – carrying out multiple transactions and moving around the money frequently from one account or person to another. Several dummy transactions are executed without any business sense to hide or layer the illegally obtained proceeds, making it difficult for the authorities to trace back the source of the criminal proceeds and the owner of these funds. The methods include gambling, online games purchase, currency exchanges, routing transactions through shell and shelf companies, electronically transferring money from one account to another in a different institution in a foreign country, etc. Layering aims to maximize the distance between the funds and their source, to disguise the original nature of the illicit funds, making it hard to track.

The third stage in the money laundering process is Integration, in which the criminals either withdraw the unlawful money that now appears lawful, post multiple layers created in the financial system or integrate the same into further criminal activities. Now the criminals invest the money into legal, financial instruments or purchase high-value items such as fine arts. They also invest money in real estate, which is again prone and infamous for money laundering.

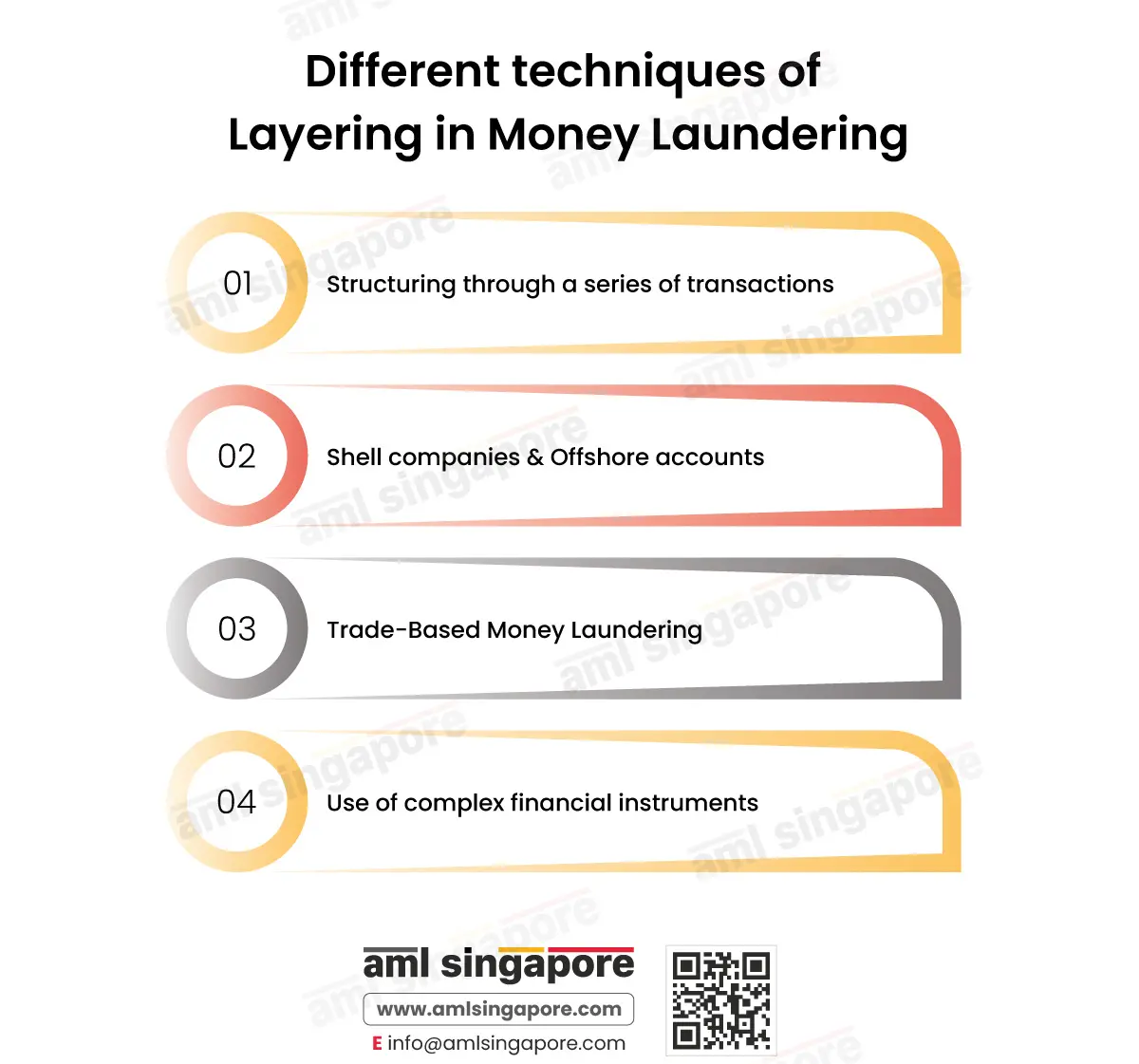

What are the common layering techniques used in money laundering?

Criminals use various tricks in the book to hide the source of their illicit money and pass it into the legal system without getting noticed. Let’s discuss criminals’ different methods for layering their illegally acquired money.

1. Structuring through a series of transactions:

Structuring is a popular technique of breaking transactions into smaller ones and involving multiple accounts to avoid reporting threshold and, thus, escape scrutiny. This money is moved across different bank accounts in the same financial institution or various institutions in several countries in smaller denominations. This is a commonly used method at the placement and layering stage of money laundering, wherein criminals avoid large amounts that immediately attract attention, but multiple unrelated parties are involved through a series of transactions of smaller values to avoid any alert generation.

2. Shell companies & Offshore accounts:

These are the most common vehicles for money laundering. It’s difficult for the authorities to track down the Ultimate Beneficial Owner (UBO) because these companies’ operations are shrouded in secrecy. It is difficult to track the origin of the funding, and criminals take full advantage of the loopholes. These companies exist only on paper with fake management, but the cash flow is actually in offshore bank accounts. These bank accounts are in countries with no transparency regulations or strict secrecy compliance, which makes getting information about the UBO difficult.

3. Trade-Based Money Laundering:

It is also a popular method of laundering money, used for the layering stage, where the funds are transferred between parties creating a trail of bogus transactions with fake documentation of the purchase/sale of goods. Here false invoices are generated to validate cash movement from one bank account to another. The criminals move the money through legitimate companies claiming to make payments for goods that are not purchased. This creates a complex web of intricate transactions that obscures the source and owner of the illegal proceeds moved under cover of fake shipping documents.

4. Use of complex financial instruments:

Criminals use sophisticated financial assets and instruments such as stock options and futures, commodity derivatives, etc., to create an additional layer of complex transactions. These instruments make tracking illicit funds back to their source very difficult.

List of potential red flags indicating the layering stage of money laundering:

Understanding the layering stage and its methodology is pertinent to identifying these suspicious activities and timely reporting.

Here is an illustrative list of red flags that suggest the presence of layering activities around illegal proceeds:

- Identifying the transactions where multiple transfers are involved. For example, the multiple transfers of funds between accounts, in different countries, without any business rationale. Further, the frequent movement of funds between accounts in foreign countries in perfectly round numbers may suggest a suspicion related to layering.

- Multiple transactions for conversions of different currencies in a short time span suggest layering aimed to complicate the transaction trail.

- Using shell companies or offshore accounts without any apparent business connection is a layering red flag. This can be identified by looking at whether the company has any physical existence or whether the volume of transaction matches the nature of declared business activities of the recipient and transferor.

- Transactions between group entities, such as too many subsidiaries or complex ownership structures, without any economic rationale, indicate layering done to make tracing the origin of illegal funds challenging.

- Trade-based money laundering techniques, such as excessively overpriced or underpriced products, suggest manipulating the transactions to obscure the illegal proceeds.

- Frequent movement of funds through countries classified as high-risk, with high rates of corruption, weak anti-money laundering regulations, etc.

How do AML measures help prevent the layering stage of money laundering?

Further, a robust Customer Due Diligence (CDD) program must be implemented, including the KYC process, screening, and customer risk assessment to identify each customer’s risk to the business. Enhanced Customer Diligence measures must be adopted for high-risk customers and suspicious activities/transactions.

Effective systems and programs for business relationship and transaction monitoring must be implemented to detect unusual activities or suspicious customer behaviour. The policy documentation should enlist the potential risk indicators, including red flags related to the layering stage of money laundering, that the employees should look out for while transacting with customers. The senior management and employees must be adequately trained around AML measures and their roles and responsibilities to identify and prevent money laundering activities.

Procedures for reporting suspicious transactions with the authorities must be well-defined and communicated with the relevant team members.

Adopting reliable and effective AML measures, systems, and tools shall help regulated organizations identify and prevent transactions attempted for layering purposes.

How can AML Singapore assist you in safeguarding your business from being used as a Layering conduit?

Layering hides the source of the unlawful money acquired via different means with multiple transactions within the country or with different jurisdictions across the globe. The motive is to move the money multiple times and make it hard for the authorities to identify the illegal funds’ source and owner. Business organizations must fight this challenge of identifying suspicious activities and preventing money laundering.

You can always seek the help of experts who can help you lay down comprehensive internal policies, procedures, and controls and integrate them with the right processes, such as KYC – Know Your Customer, Customer Due Diligence, Transaction Monitoring, identifying suspicion and filing Suspicious Transaction Reports, etc. You can streamline the anti-money laundering process and prevent criminals from exploiting your organization. Protect your customers’ interests and prevent reputational damage by integrating and maintaining robust anti-money laundering processes.

AML Singapore is one of the fastest-growing AML consultants in Singapore with a mission to help businesses fight the growing danger of money laundering. We have the best tools, expertise, and knowledge of the updated laws and help business organizations implement a robust anti-money laundering framework to ensure 100% compliance with the AML laws. We assist regulated entities in Singapore in tailoring IPPC, training the team, assistance in setting up an in-house AML compliance department, managing the outsourced KYC and CDD and identifying the right AML solution to manage your money laundering risk.

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise- Wide Risk Assessments to implementing the robust AML Compliance framework. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.