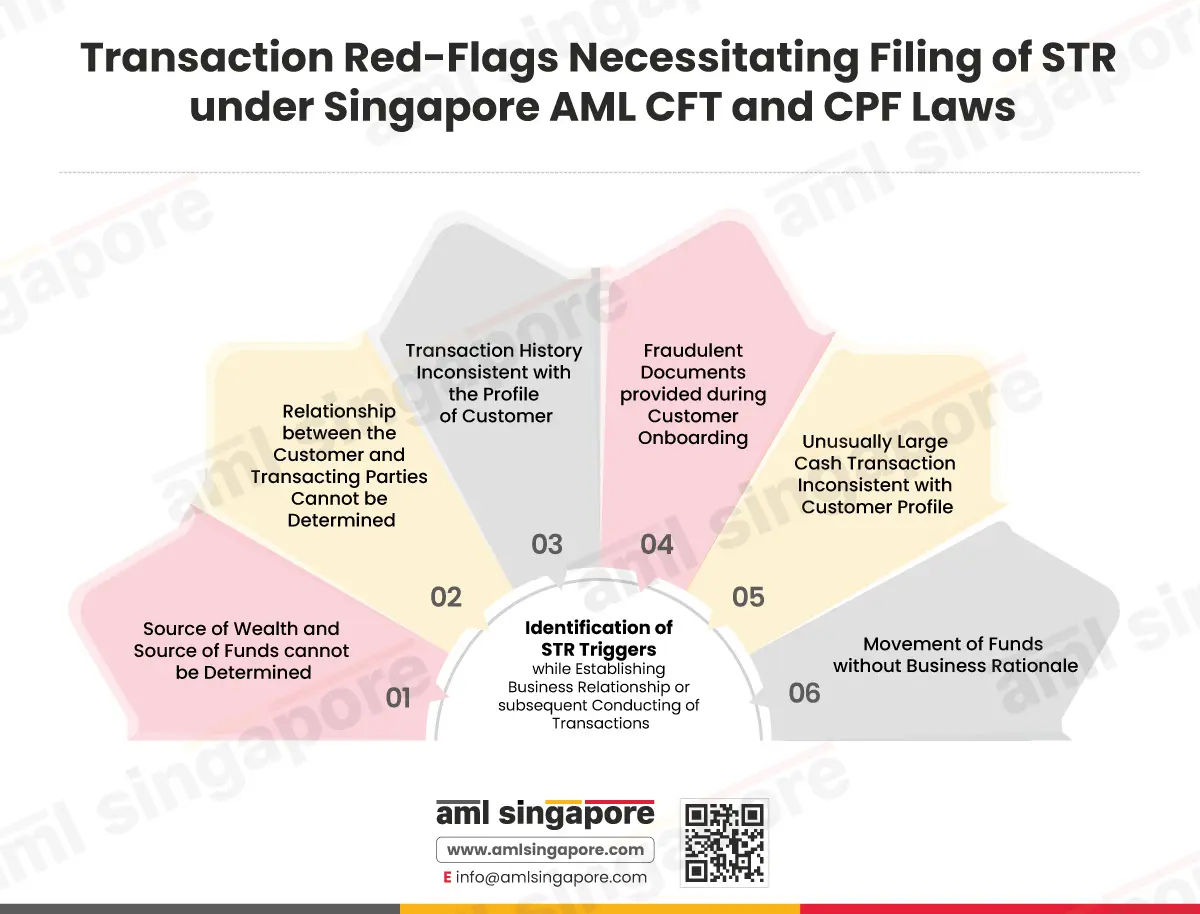

Transaction Red-Flags Triggering filing of STR

Transaction Red-Flags Triggering filing of STR

The reporting requirement for suspicious transactions in Singapore is governed under the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act 1992 (CDSA) and the Terrorism (Suppression of Financing) Act 2002 (TSOFA). Through this infographic, Regulated Entities can identify triggers that necessitate filing a Suspicious Transaction Report (STR) with the Suspicious Transaction Reporting Office (STRO), Singapore’s Financial Intelligence Unit (FIU), to ensure compliance with regulatory requirements and mitigate Money Laundering (ML), Financing of Terrorism (FT), and Proliferation Financing (PF) risks.

Some of the common triggers for filing of STR while establishing business relationships or subsequent conducting of transactions are as follows:

The Source of Wealth and Source of Funds cannot be determined

Regulated Entities cannot determine the Source of Wealth and Source of Funds while conducting Enhanced Customer Due Diligence of high-risk customers.

Relationship between the Customer and Transacting Parties Cannot be Determined

Where a Regulated Entity is unable to identify the relationship between the customer and their transacting parties, for example:

- If a customer buys or sells large quantities of precious metals and stones, it is an act that is not in line with the customer’s financial background or business activity, then STR must be filed.

- If an unrelated third party unexpectedly pays for the customer’s credit card bills or other charges, this a transaction red-flag requiring filing of STR.

Transaction History Inconsistent with the Profile of Customer

Current transaction by a customer is inconsistent with the usual or past pattern of conducting transactions, such as:

- If the customer’s account receives large amount of funds that do not align with customer’s salary.

Fraudulent Documents provided during Customer Onboarding

When a customer provides fraudulent, fake, forged, or suspicious documents about customer identification, such as identity proof or address proof and any other document establishing financial standing and history of customer such as bank statements, credit-card history.

Unusually Large Cash Transaction Inconsistent with Customer Profile

Since cash transactions are not easy to track like other formal payment channels like banking, transactions involving large sums of cash must reported at the first instance of unusual behaviour that is inconsistent with customer profile.

- If an unusually high number of small denomination currency notes are exchanged for higher denomination currency notes.

- If the customer’s overall payment exceeds the threshold amount but the payment is divided into multiple small payments that are below the threshold in an attempt to structure the transactions.

Movement of Funds without Business Rationale

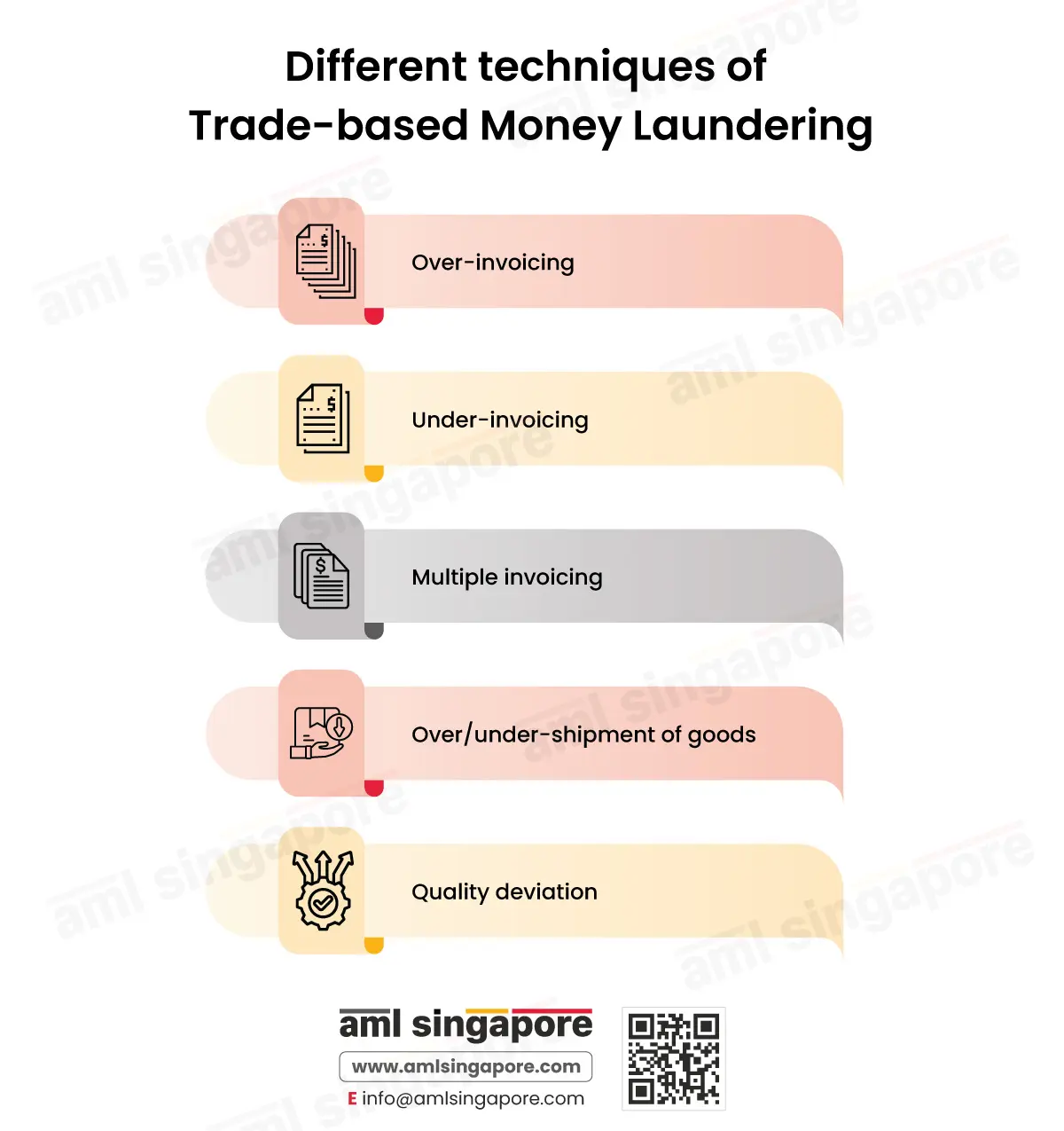

If a Regulated Entity comes across customer transactions that are not in line with their business conduct, such as:

- Trade financing methods like letters of credit are used for the movement of funds across high-risk jurisdictions where the customer has no business activity.

- If the customer withdraws funds immediately after they are deposited without any justifiable reason.

Conclusion

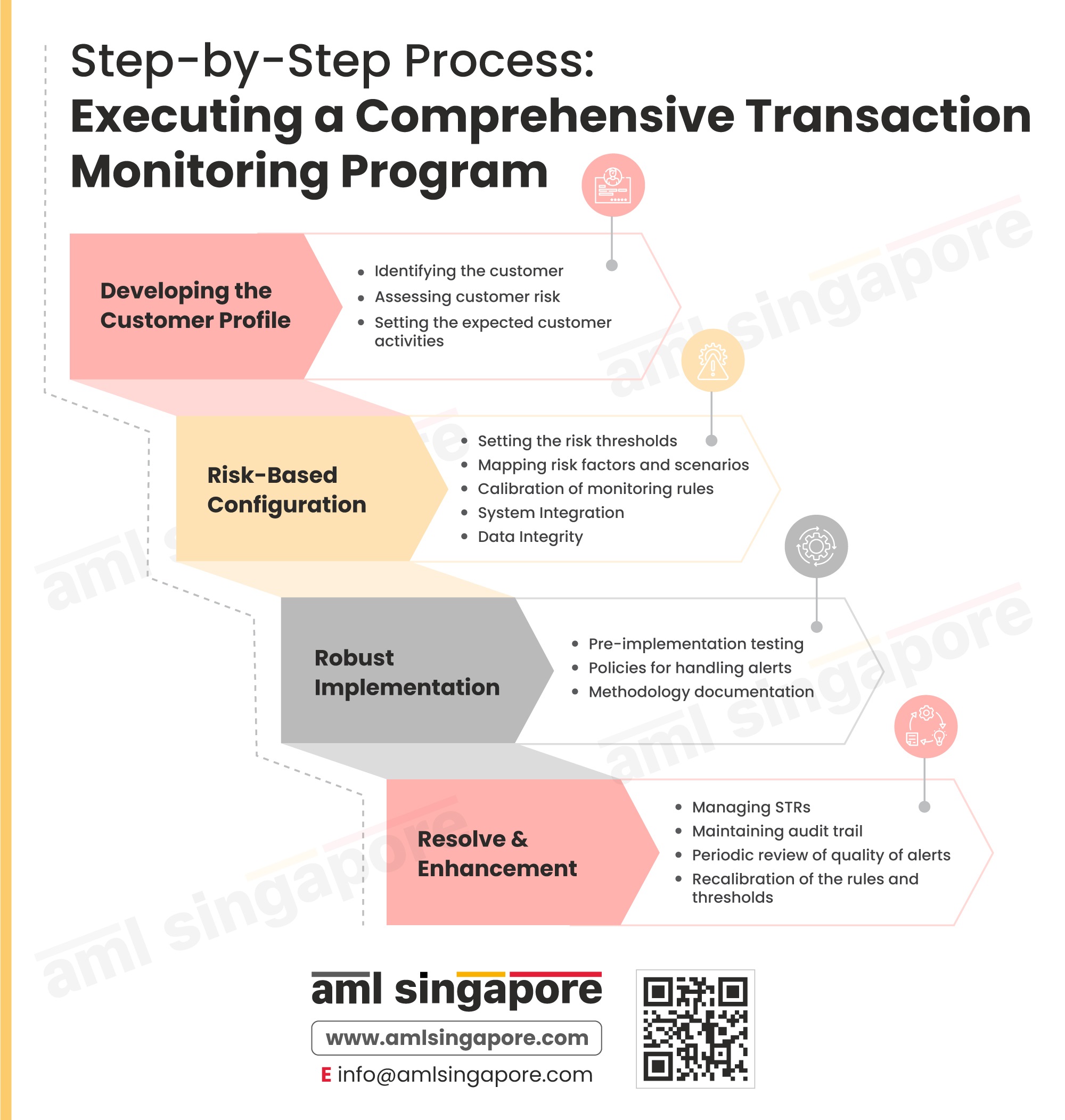

Regulated Entities in Singapore must develop robust customer due diligence, ongoing monitoring programs, enhanced customer due diligence measures, and transaction monitoring controls to identify and report suspicious transactions promptly to ensure compliance with Anti Money Laundering, Counter Financing of Terrorism, and Counter-Proliferation Financing (AML,CFT and CPF) laws and requirements.

Related Posts

Worried about your Company’s AML Compliance Requirements?

Let go of all your business-related compliance concerns with AML Singapore.