Transaction-Based AML Compliance by PSPM Dealers under Singapore AML Laws

Transaction-Based AML Compliance by PSPM Dealers under Singapore AML Laws

AML regulations in Singapore mandate the Dealers in Precious Stones and Precious Metals (PSPM) to comply with AML obligations to detect and report money laundering or terrorism financing-related red flags.

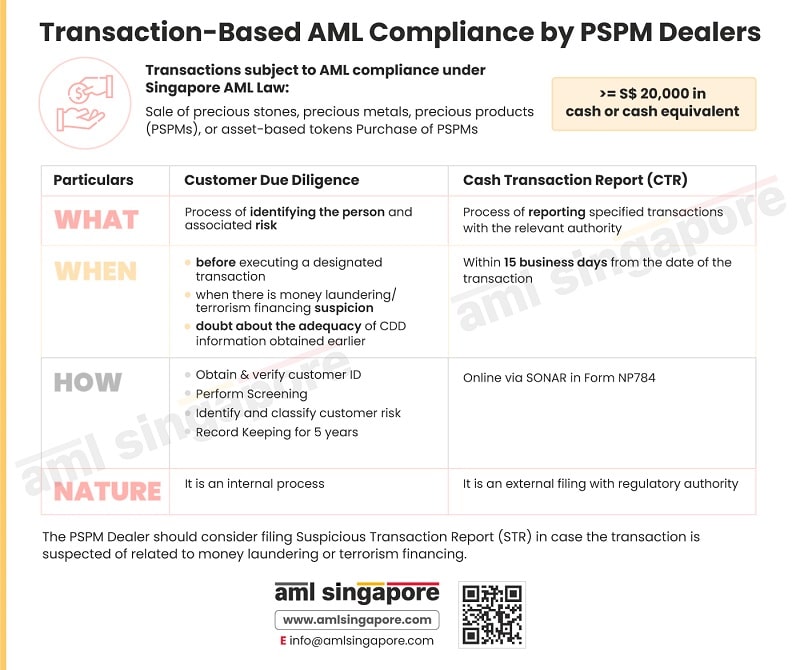

As part of the overall AML compliance requirements, the Dealers in PSPM must apply specific measures at the transaction level, which primarily involves performing Customer Due Diligence (CDD) and reporting the designated transactions via Cash Transaction Report (CTR). Here, the designated transactions mean the sale of PSPM of an amount equal to or exceeding S$20,000 in cash or cash equivalent.

Customer Due Diligence is to be conducted before onboarding the customer or executing the transaction, while the dealers get 15 days to report the transaction by filing the CTR.

CDD is an internal measure that identifies and verifies the customer and the beneficial owners. While CTR is an external reporting to be done online via SONAR.

Here is a visual chart discussing the transaction-level AML compliance obligations imposed upon the dealers in precious stones and precious metals – Customer Due Diligence and filing of Cash Transaction Report.

With years of experience and subject knowledge, AML Singapore can assist the PSPM dealers in ensuring timely compliance with AML regulatory landscape as applicable in Singapore. We can assist the business in designing and implementing tailor-made AML/CFT programs and impart training to the team to ensure 100% AML compliance and avoid administrative penalties.

Adequately manage your AML compliance with CDD and CTR!