Trade-Based Money Laundering: Understanding the techniques to combat TBML

Trade-Based Money Laundering: Understanding the techniques to combat TBML

Trade-based money laundering is one of the money laundering methods widely used by money launderers.

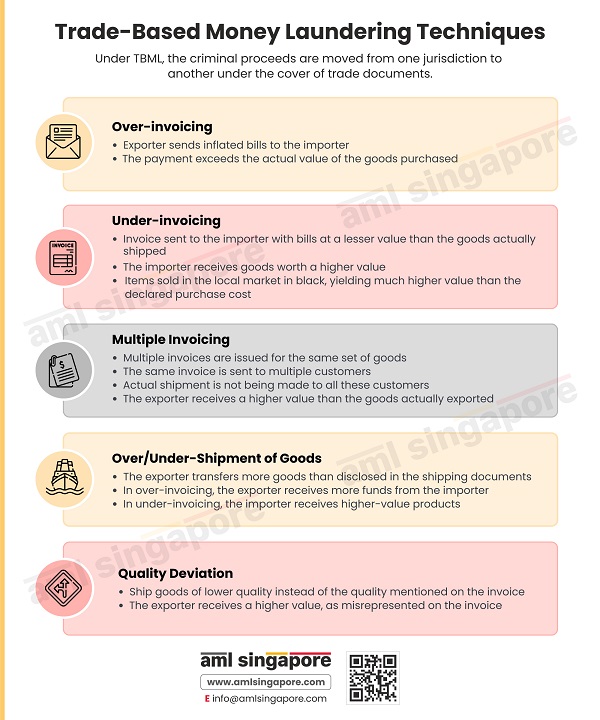

Through Trade-Based Money Laundering (TBML), financial criminals cleanse their illicit funds using commercial transactions in nature of the supply of goods with some distortion or manipulation related to goods, documentation, quality, etc.

Regulated entities need to understand the techniques used by the launderers under TBML to detect and prevent financial crime promptly. Some of the common TBML forms used for moving criminal proceeds across borders, aimed to avoid the attention or inquiry from the authorities, are:

- Over-invoicing involves making the fake documentation show higher value as compared to goods exported

- Under-Invoicing, where more goods under the disclosure of lower value than actual

- Multi-Invoicing, where multiple invoices are issued to one or multiple parties for the same set of goods

- Over/Under-Shipment is similar to over/under-invoicing, wherein the quantity mentioned in the invoice and the goods exported vary

- Quality deviation between what is mentioned on the invoice and the goods shipped

Here is an infographic discussing some of the critical forms of TBML exploited by launderers to launder illegal money and make them appear as if generated from routine trade activities, understanding which is crucial for regulated entities to identify such TBML instances and timely report the same.

AML Singapore can assist the regulated entities in documenting and understanding the ML/FT red flags, including TBML risk indicators, allowing the AML Compliance Officer and the team to promptly detect the financial crime risks and apply adequate risk mitigation measures. We also impart comprehensive AML training to the regulated entities’ team, including senior management, on the overall AML compliance framework and their roles and responsibilities towards AML.