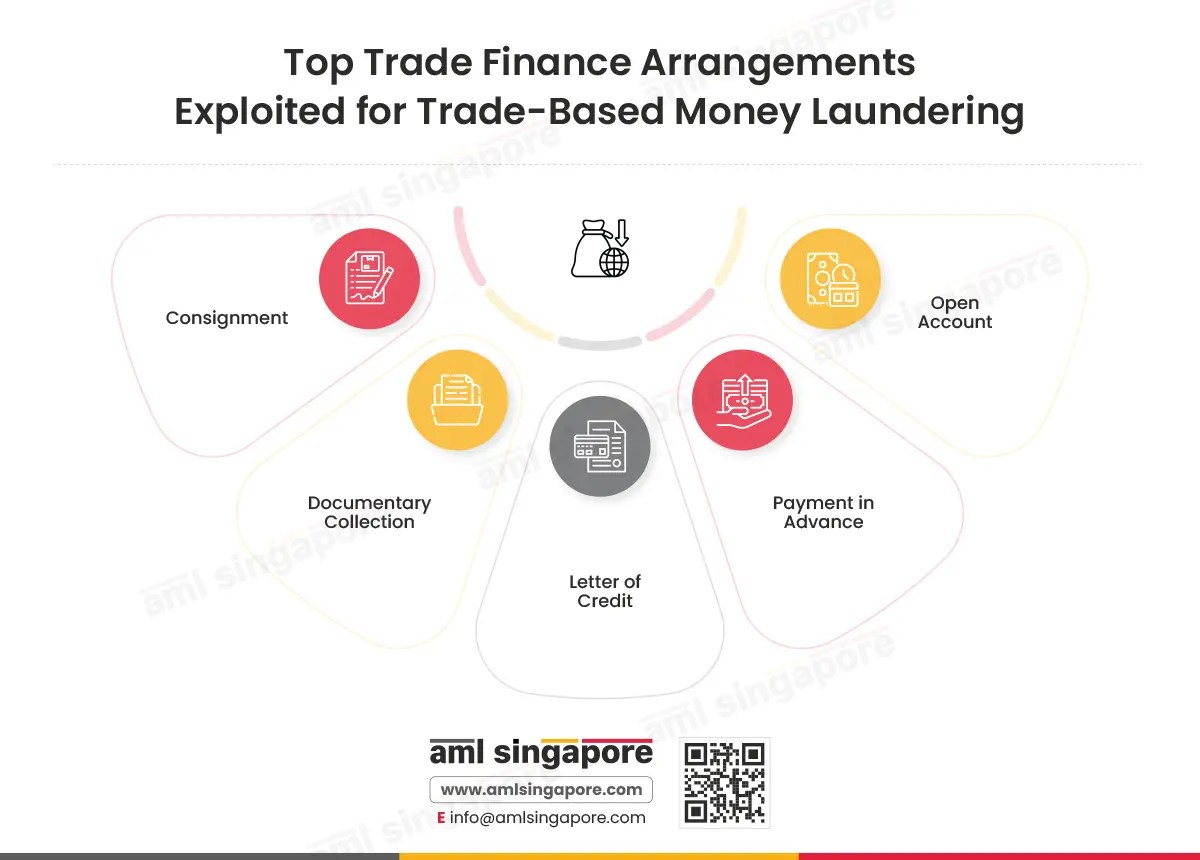

Top Trade Finance Arrangements Exploited for Trade-Based Money Laundering

Today, we live in a global village where businesses depend on global supply chains, making imports and exports a necessity. However, this status quo presents its own set of challenges. This illustration depicts the Top Trade Finance Arrangements Exploited for Trade-Based Money Laundering. The illustration is aimed at raising awareness amongst regulated entities in Singapore about the ways in which TBML can be executed.

Here’s a non-exhaustive list of Trade Finance Arrangements Exploited for Trade-Based Money Laundering:

Use of Consignment for Trade-Based Money Laundering (TBML)

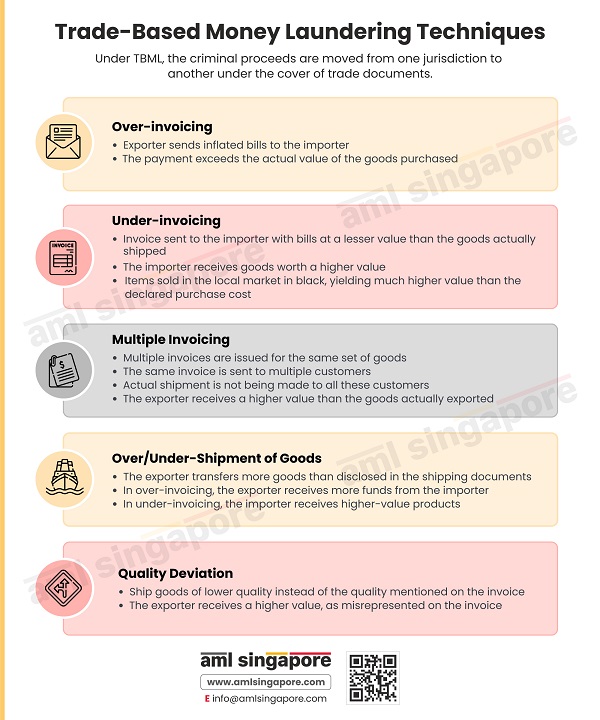

Consignment is a popular choice among criminals for TBML as, in this case, the importer does not make payment to the exporter until the goods are sold to the final consumer. The importer has the option of sending the goods back to the exporter at a pre-determined price as per their agreement if the goods do not sell.

These provisions for flexibility in payment can give the importer an opportunity to manipulate the sales figures before payment is due to the exporter, or the importer and exporter can collude to create false invoices.

Documentary Collection as an Instrument for Trade-Based Money Laundering (TBML)

Documentary Collection is another instrument of trade finance where a bank is an intermediary between importer and exporter during the shipment of goods. The bank collects shipment documents from the exporter, and only then the payment is released by the importer.

However, the lack of standardisation in document formats makes it easy for criminals to create false documents, leaving out the scope for TBML.

Letter of Credit in Trade-Based Money Laundering (TBML)

Letter of Credit (LoC), also commonly known as documentary credit, is an arrangement used in international trade where a buyer’s bank issues a letter of credit to the seller, agreeing to pay a specified amount to the seller if certain pre-determined conditions are met.

Some of the common typologies suggest that LoCs may be used for the round-tripping of funds for the purpose of money laundering. There are also many variations of LoC, like back-to-back credit, which can be used to hide the origin of funds.

Misuse of Advance Payment for Trade-Based Money Laundering (TBML)

Advance Payment of goods by cash or other methods like wire transfer makes it easier to generate false invoices for the goods, making it an easy choice for TBML.

Open Account as a Tool for Trade-Based Money Laundering (TBML)

An open account is a trade finance instrument that provides importers the flexibility to make payments at a later date after the goods or services are availed.

However, criminals also prefer open accounts as an instrument for TBML as they can distance the source of their illegal funds from their illegal activities.

Securing Trade Finance Arrangements Against Trade-Based Money Laundering (TBML)

Imports and exports are the base of the global supply chains and economy. The trade finance arrangements given above play an important role in facilitating exports and imports.

So, with this illustration, regulated entities can become more aware of the means of misuse of the trade finance instruments in TBML to protect their business and global economy from the risks of financial crimes.

When Trade Finance Meets Crime, Will You Spot the Signs?

Detect TBML red flags like a pro with AML Singapore