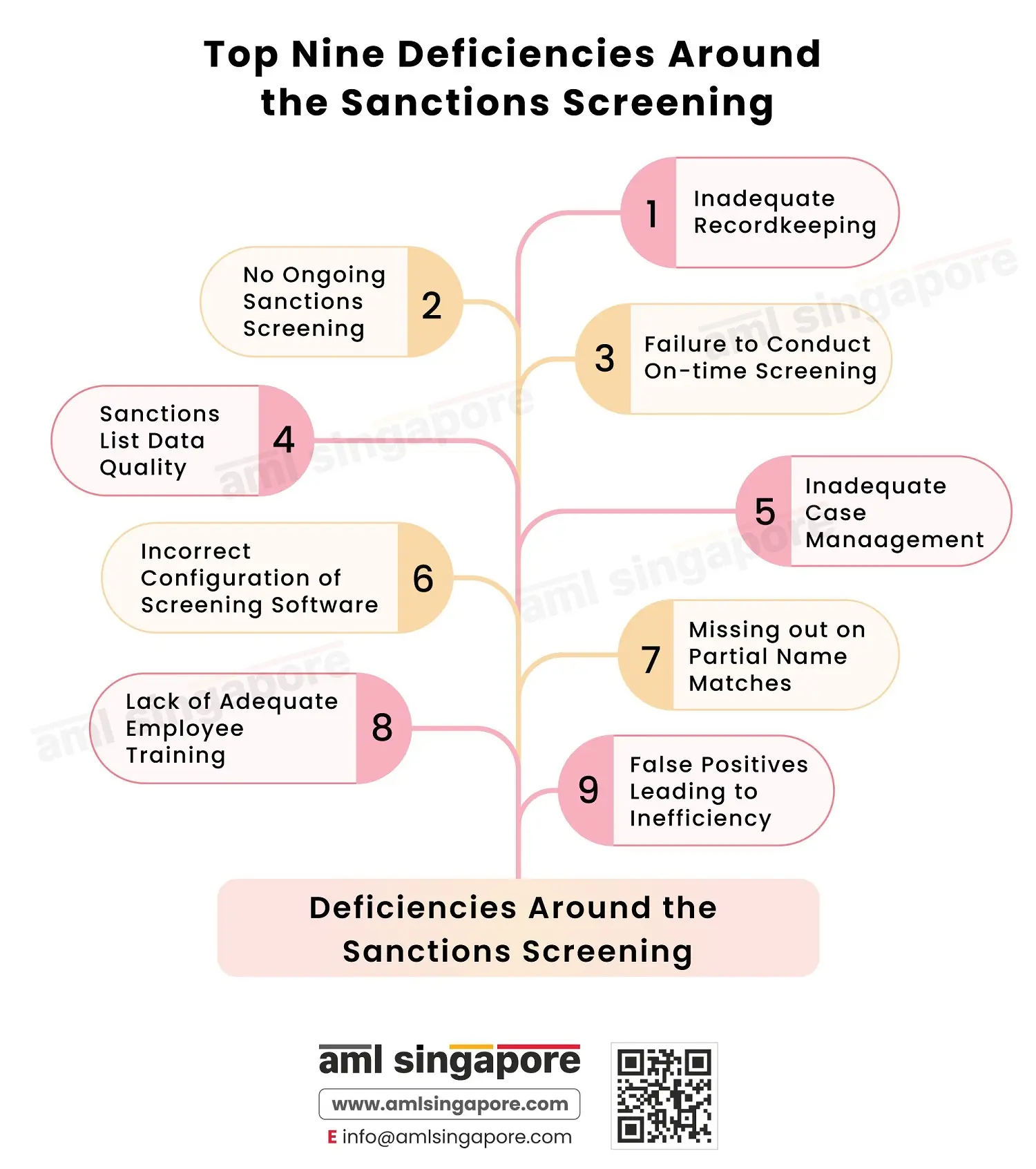

Top Nine Deficiencies Around the Sanctions Screening

Top Nine Deficiencies Around the Sanctions Screening

This infographic deals with the top nine deficiencies around the sanctions screening performed by the regulated entities. Financial Institutions, Designated Non-Financial Businesses and Professions, and must consider whether the countries they deal with, are subject to Targeted Financial Sanctions (TFS).

Further, they also need to check that the entities and individuals they deal with are not sanctioned entities or individuals. Often, these checks are not correctly made, exposing the entity to ML/TF risks and regulatory fines and penalties.

1. Inadequate Evidence

- Deficiency: Failure to maintain records of sanction screenings carried out.

- Solution: Use sanction screening software that maintains records of sanctions screening carried out on a fresh and ongoing basis.

2. No Ongoing Sanctions Screening

- Deficiency: Failure in screening of individuals and entities against the latest and relevant sanctions lists on an ongoing basis

- Solution: Implement a screening software that supports scheduled automated screening of customers on a daily basis, and the feature is turned ON.

3. Failure to Conduct On-time Screening

- Deficiency: No sanctions screening is conducted before customer onboarding or before establishing a business relationship.

- Solution: Make on-time sanctions screening a part of your AML compliance program and train front-line employees accordingly.

4. Sanctions List Data Quality

- Deficiency: Conducting sanctions screening through unreliable or secondary sources not issued by authority.

- Solution: Only rely upon the sanctions list issued by the competent authority.

5. Inadequate Case Management

- Deficiency: Inadequate management of Sanctions alert data, including:

- Alert logs

- Evidence of screening

- Reasons for Closing alerts and the approval process

- Inadequate due diligence records,

- Key attributes of the sanctioned person include Aliases, nationality, etc.

- Solution: Use AML software that automates case management and covers all the required information.

6. Incorrect Configuration of Screening Software

- Deficiency- The sanction screening software is not aligned with the risk-based approach taken by the firm, and not all relevant sanctions lists are used while screening a customer.

- Solution- Take a professional software implementation service to ensure that the screening software is configured correctly to consider all types of sanctions and watchlists.

7. Missing out on Partial Name Matches

- Deficiency- Neglecting partial name matches found during sanctions screening.

- Solution- Check for various attributes such as date of birth and aliases to confirm or eliminate partial name matches and submit a Suspicious Transaction Report if there’s still no conclusion.

8. Lack of Adequate Employee Training

- Deficiency: Employees are not provided with the adequate sanctioning screening procedure and actions needed based on screening.

- Solution: In-depth sanctions screening training must be conducted under the guidance of expert AML professionals.

9. False Positives Leading to Inefficiency

- Deficiency: Non-sanctioned individuals and entities are flagged, leading to unnecessary efforts in alert remediation.

- Solution: Compare the right factors to quickly detect false positives.