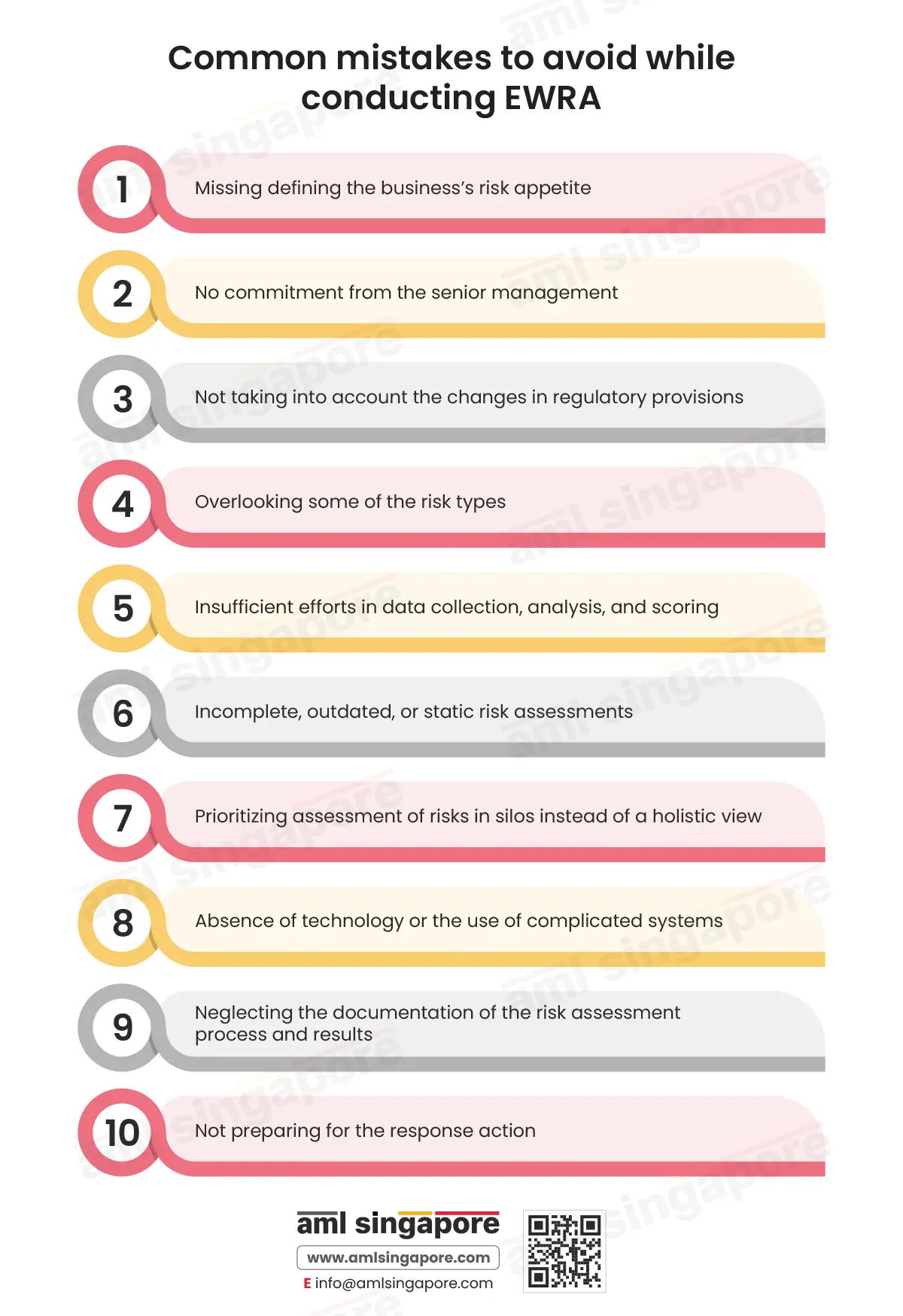

Top 10 mistakes to avoid while conducting ML/FT Enterprise-Wide Risk Assessment

Top 10 mistakes to avoid while conducting ML/FT Enterprise-Wide Risk Assessment

Enterprise-Wide Risk Assessment is an essential ingredient of an AML compliance program, enabling regulated entities to stay wary of the financial crime risks to their business. Once they identify the risks, they can apply relevant measures to mitigate or manage them.

As the effectiveness of the AML program is highly dependent upon the analysis of the Enterprise-Wide Risk Assessment (EWRA) or the Business Risk Assessment, the regulated entities cannot go wrong with it. If the risk assessment is erroneous or the evaluation of any risk factor is missed, the regulated entity might face repercussions. Unidentified risks might affect your business, leading to money laundering or other financial crime vulnerabilities. It affects your operations, business reputation, and financials.

So, avoiding common mistakes in such risk assessments is wise. Keep a note of them and dodge their attack.

Let’s examine these common mistakes regulated entities may make while carrying out EWRA.

Top mistakes to avoid while performing AML Enterprise-Wide Risk Assessment

The regulated entities must thoroughly conduct the business risk assessment, considering all the relevant risk scenarios and their possible impact on the business. An inadequate or inaccurate risk assessment degrades the entity’s overall anti-money laundering efforts and compliance. So, you must be cautious of these mistakes and overcome them.

The following are the common pitfalls to avoid while performing AML risk assessments:

Missing defining the business’s risk appetite

An entity’s financial crime risk appetite means how much risk the business can and is ready to tolerate. It includes types of risks and their severity. It differs from business to business. The regulated entity must answer this question, “How much ML/FT risks is it ready to bear to achieve the strategic goals and objectives?” before proceeding with the risk assessment exercise. Also, when the risk appetite is defined and documented, the same serves as a base for developing the entire AML framework on a risk-based approach.

No commitment from the senior management

The EWRA task begins with management-approved risk appetite and ends with their approval of the outcome of the final risk assessed.

When the senior management does not get involved in the process, the entity might face teething issues in diligently concluding the EWRA, which may ultimately impact the quality of AML measures and result in a conflict of interest between AML’s compliance function and the business goals.

Thus, the senior management’s commitment to the risk assessment process is very critical.

Not taking into account the changes in regulatory provisions

Regulations keep changing. Monetary Authority of Singapore (MAS) or other AML supervisory authorities release new guidelines to tackle emerging threats, setting new benchmarks for AML compliance. All such updates and amendments must be considered because they affect the risk assessments. When critical regulatory provisions are missed while carrying out the EWRA, the entity may pay a huge price due to non-compliance and an inefficient AML program.

Overlooking some of the risk types

Risk assessment for any business involves studying and analyzing the risks from:

- Customers/clients

- Transactions

- Geography

- Delivery methods

- Products and services

- Technology

Developing a comprehensive business risk profile is challenging if the entity misses evaluating any of these risks. In the future, the regulated entity might face money laundering threats from the skipped risk factors, leading to non-compliance penalties and reputational damage. So, all these risk factors must be considered in assessing the ML/FT risk.

Insufficient efforts in data collection, analysis, and scoring

Risk assessment is not a simple activity. It requires dedicated efforts towards assessing the business exposure, considering qualitative and quantitative risk attributes. Any lazy attitude towards exercise can affect the assessment results. So, the regulated entity must be thorough in:

- Collecting data for the assessment

- Studying the customers, geographies, delivery methods, offerings, and transactions

- Analyzing each data point

- Using sophisticated risk-scoring models to score risks

- Evaluating the risks by their severity, likelihood, frequency, and impact

- Scientifically categorizing and rating the risk parameters as high, moderate, and low risk

If the data used for risk assessment is incomplete or inaccurate, the business risk assessment will not be relevant and in alignment with your goals. The entity may end up duplicating the efforts in re-doing the exercise or lead to half-baked results. So, reliance on a comprehensive and quality data set is critical in EWRA.

Incomplete, outdated, or static risk assessments

- What is the frequency of conducting risk assessments in a year?

- Whether all the latest regulations and laws have been considered while conducting risk assessments?

- Whether all the potential threats to the business have been taken into account?

- What about the industry trends and emerging ML/FT typologies? Have those been assessed for their potential impact on business?

- Is your risk assessment updated to factor in the new business statistics or changing circumstances?

If the answer to the above questions is “No, ” then the risk assessment exercise cannot significantly benefit the entity’s AML efforts.

The entity must keep updating EWRA frequently, incorporating changes in industry, clients, transactions, regulations, geopolitics, etc. The entity must study and assess the emerging risks to improve the effectiveness of the business risk study.

The regulated entity must adjust the Enterprise-Wide Risk Assessment based on past assessments’ accuracy level and usefulness. The entity must check whether the past risk analysis was applicable or inaccurate; if inaccurate, necessary changes must be made.

So, focus on complete, up-to-date, and dynamic AML risk assessments.

Prioritizing assessment of risks in silos instead of a holistic view

When considering a client’s risks, the entity must not consider just one factor. An isolated view of one risk does not give a complete picture. The entity must analyze the client risk from all factors:

- What are the risks from the client’s nature of business?

- Is there anything irregular about the products and/or services requested by the client?

- Are their delivery methods involving any money laundering activity?

- Does their headquarters or registration location harm the entity’s business?

- Is their preference for specific transaction types detrimental to the regulated entity’s AML compliance efforts?

Suppose a high-risk client is based in a tax haven with no AML regulations. It is riskier than a high-risk client in a normal country with strict AML regulations.

This requires the entities to consider all these factors at the same time. If each risk is evaluated individually, it may yield a limited picture of risks. In contrast, a parallel assessment of the different risk aspects will give a holistic view of the business’s total exposure to ML/FT.

Absence of technology or the use of complicated systems

Sometimes, the methods deployed for manually assessing the risk are too simplistic and inadequate, generating no quality results. Such risk assessments might be inaccurate, time-consuming, and miss some critical data points. So, deploying sophisticated EWRA methods, including advanced tools and technology for carrying out enterprise-wide ML/FT risk assessment, is best.

Neglecting the documentation of the risk assessment process and results

AML risk assessment will help the business plan the corrective actions to combat financial crimes. EWRA empowers the entity to adopt a risk-based approach to mitigate, manage, or prevent these risks. For depending on the EWRA and ensuring consistency in the measures implemented, it is necessary to document EWRA methodology, risk factors considered, the base for extracting quantitative data, final risk assessed, etc.

Further, maintaining adequate EWRA documentation is also a regulatory obligation. So, the regulated entities must not miss documenting their process, results, and conclusions to strengthen AML compliance efforts.

Not preparing for the response action

Enterprise-Wide Risk Assessment serves a purpose in the entity’s AML compliance function. It is not just an exercise. It must lead to the next step towards the AML journey.

The entity must decide how to respond to these risks based on the ML/FT risk appetite. The entity might accept a few while eliminating or reducing the impact of the others. The outcome of the EWRA must be utilized for formulating and executing a risk mitigation and management plan.

AML Singapore’s Role in Accurately Conducting the Enterprise-Wide Risk Assessment

The above discussion will help you avoid common mistakes while assessing risk assessments. However, let AML Singapore ease your burden of conducting and maintaining the EWRA up-to-date, empowering you to manage your risks effectively.

AML Singapore is a leading AML consultancy firm offering complete handholding support to the regulated business in Singapore to achieve AML compliance.

We help conduct thorough Enterprise-Wide Risk Assessments, yielding relevant results to form a strong foundation for customized AML/CFT measures.

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise- Wide Risk Assessments to implementing the robust AML Compliance framework. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.