Top 10 AML compliance mistakes made by cash-intensive businesses

Top 10 AML compliance mistakes made by cash-intensive businesses

Are you dealing more in cash in your business? Or working in a cash-only entity? Yours is a cash-intensive business, and you are at a higher risk of money laundering and similar financial crimes. This is because of the following traits of cash:

- It is easier to mix illegitimate funds in a cash-intensive business and convert them into legal funds.

- Fake transactions, customers, or unprovided extra services can be resorted to put illicit cash in the legal financial system.

- Because of the absence of an electronic trail, tracking and recording it is also a challenge.

- Even counterfeit currency makes cash a medium for criminals to commit crimes.

- Cash also faces the risks of theft and robbery, adding to its woes.

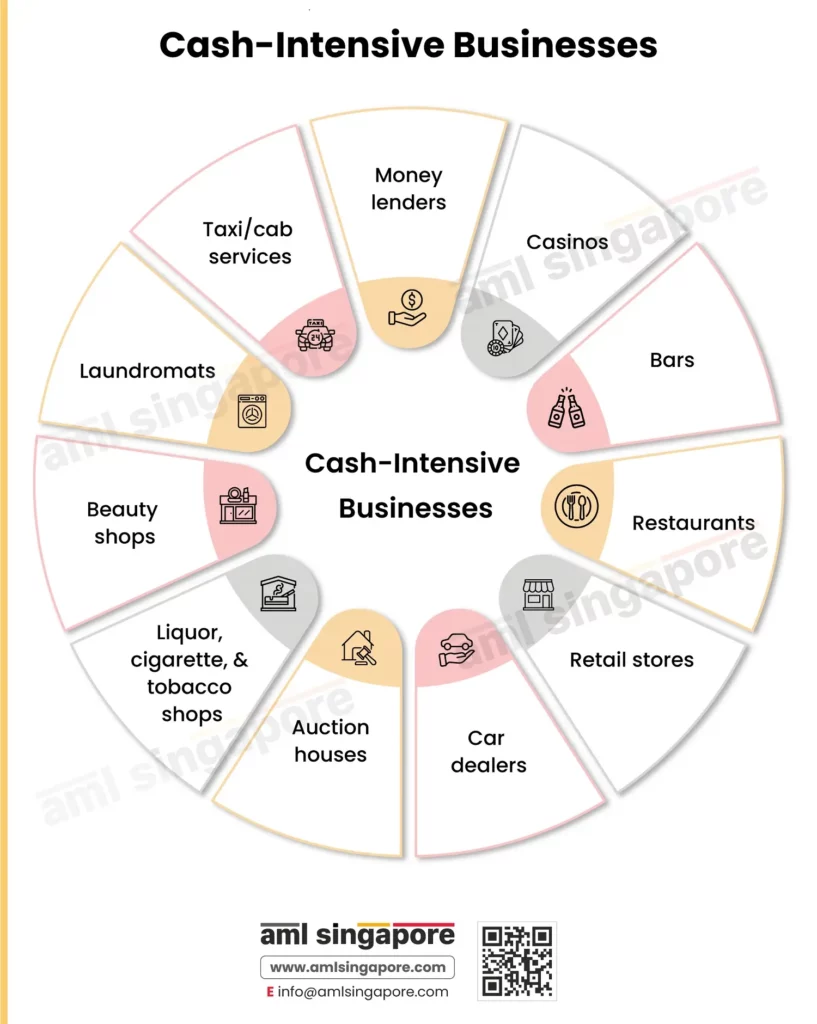

Since the laundering happens daily, it is slow but more liquid. Such cash-intensive businesses can be any of the following:

- Money lenders

- Casinos

- Bars

- Restaurants

- Retail stores

- Car dealers

- Auction houses

- Liquor, cigarette, and tobacco shops

- Beauty shops

- Laundromats

- Taxi/cab services

- And many more

Since a higher risk of money laundering looms over such cash-intensive business, you must be extra careful. You must pay full attention to suspicious transactions and transaction reporting. It would be best if you were wary of some common red flags to detect suspicious transactions. We discuss the red flags for cash-intensive businesses in the next section.

Red flags of money laundering in cash-intensive businesses

It’s not difficult to suspect involvement of money laundering in cash-intensive business. You can look for the following signs:

- Repeated and excessive transactions with one party, entire payment in cash

- A business requiring or generating more cash than a business in a similar location, business model, and product/service

- No match between a business’s cash-generating capacity and profile or commercial activity.

- Specific large amounts of cash payments or receipts in a certain period of the year, which remains consistent across many years

- Too many small transactions of cash deposits or a single large cash deposit online without contacting the bank

- The presence of non-resident beneficial owners of such cash-intensive businesses

- Absence of commercial justification for a significant, cash-only transaction

- Large payments in cash by a third party unrelated to the business

- Large cash transactions with no information on the origin of funds

- Special requests to conduct transactions in cash with no apparent logic

- Large cash payments or receipts for transactions in future

- Large differences between the charged price and the actual value of products/services in the transaction

Cash-intensive regulated businesses must make a note of these red flags. They must spot such transactions and investigate them further. Detailed investigation can help you reduce your exposure to money laundering vulnerabilities. Besides, you must use the following measures to follow AML laws:

- Conduct proper due diligence on your customers

- Investigate all your transactions to spot the likelihood of money laundering

- Maintain records of all transactions with relevant details

- Train all your employees to spot such transactions and customers

- Conduct regular risk assessments of your business to identify potential threats

All these measures enable you to adhere to the necessary Singaporean AML requirements. You must make strong efforts to follow every obligation expected from you by the MAS. These measures can help you prevent money laundering threats.

But during these processes, you must ensure you do not make mistakes. You need to dodge them and adopt strong tactics to move ahead.

We’ll look into these mistakes in the next section so you have an idea and don’t commit them.

Common pitfalls of AML compliance for cash-intensive businesses

1. Lack of a proper AML framework aligned with your business’s compliance needs

The cash-intensive regulated entities must define their AML framework to counter money laundering and terrorist financing risk. The entity must take a risk-based approach and conduct an Enterprise-Wide Risk Assessment. Further, the entity’s Internal Policies, Procedures, and Controls (IPPC) must be aligned with the Enterprise-Wide Risk Assessment.

The IPPC for a cash-intensive regulated business must have the following elements:

- Customer Due Diligence

- Circumstances requiring Enhanced Customer Due Diligence (ECDD)

- Procedures for identifying Politically Exposed Persons (PEPs)

- Ongoing Monitoring

- Reliance on third party for CDD

- Exceptions to CDD measures and timing

- Client acceptance policy

- Client exit policy

- Sanctions screening

- Record Management

- Detection and Reporting of Suspicious Transactions

- Audit of the PPC

- Compliance Management Arrangements

- Staff Training

2. No idea of the common red flags in transactions or customers

When you aren’t aware of the ML/TF red flags, how would you spot suspicious transactions? If you cannot detect suspicious transactions, you will unknowingly participate in them. And thus, you become a victim of money laundering or any other financial crime.

Comprehend that a cash-intensive business has a high vulnerability to money laundering risks. Recognise this fact and understand the importance of AML compliance. Keep a note of all the indicators of suspicious transactions in cash-intensive business.

When you have them in your mind, you can spot them immediately. And you can prevent or reduce their impact. You can even check your old transactions to identify if any of those were unusual, inconsistent, or have a red flag.

3. Failure to conduct thorough due diligence of customers

Identifying your customers and verifying their identities through documentary proof is crucial. Through due diligence, you can assess their risk level. Also, you must monitor them throughout their journey to assess risk level changes.

If you miss doing so, you’ll never be able to identify the risks your customers pose to your cash-intensive business. It’s not only about the customer but also their offerings, geographical presence, and transactions. Your business can face money laundering threats from any of these factors. So, you must analyse these factors to prevent exposure to financial crimes.

While doing so, use technological systems and solutions. Take a risk-based approach to CDD for efficient allocation of time and resources. Ensure that you conduct it frequently for up-to-date information. For effective management, train your employees on CDD and customer risk profiling.

4. Failure to conduct Enhanced Customer Due Diligence (ECDD)

Your customer due diligence initiatives help you separate high-risk and low-risk customers. This categorization helps you move ahead in your due diligence and AML activities. The same scrutiny does not apply to both categories of customers. That is why simplified due diligence is essential for every customer.

But after this, when you identify the high-risk customers, do not forget to enhance your due diligence efforts. These high-risk customers can be:

- Politically Exposed Persons (PEPs)

- Sanctioned individuals or entities

- Feature in terrorist lists or other watchlists

- Engaged in high-risk transactions

Once you identify these customers, apply enhanced customer due diligence before transacting with them. Investigate them further to detect any risks to your cash-intensive business. Think well and analyse such customers more. Take a risk-based decision before going ahead with the business relationship.

5. Absence of employee training in the execution of AML activities

What happens if your employees are unaware of the importance of AML activities? What if they are not attentive to suspicious transactions and customers?

You will be unable to perform your AML measures. You stay non-compliant with AML regulations in Singapore. And then you lose customer trust and reputation, and might have to pay penalties. So, it is better to train your employees on AML compliance.

Teach them all the requirements to comply with. Make them understand the importance of AML compliance for your cash-intensive business. Provide ongoing training to ensure they stay up-to-date with the latest regulations. When they fulfil their roles effectively, they help create a strong AML culture.

So, emphasise the importance of AML compliance to avoid money laundering risks.

6. Missed opportunities in transaction monitoring

Transaction monitoring is the most critical aspect of a cash-intensive business. Each of your transactions is different, involving different customers and cash value. You must assess these transactions to stay aware of potential money laundering threats. You must know the following:

- Parties involved

- Volume

- Value

- Nature and complexity level

- Distribution channels

- Product/service involved

- Source of funds

- Documentation

- Other necessary aspects of the transaction

By knowing these aspects, you can know everything about a transaction. Thus, you can detect the suspicious ones. In its absence, you’ll be unable to detect risky customers and transactions.

Also, remember that it is not a one-time exercise. You must track transactions constantly to generate alerts whenever something is unusual. Scan them closely from every angle. Examine the patterns and trends. Generate an alert when it doesn’t align with the usual. Investigate it further.

7. Neglecting regular risk assessments of your business

Knowing the risks is essential to develop a risk-based approach to preventing money laundering. It is possible with regular risk assessments of your business.

These enterprise-wide risk assessments enable the detection of risks and their evaluation to understand their gravity and impact. Once you understand this, you can develop measures to mitigate, manage, or prevent them. After this, you can take a risk-based approach to fight these financial crimes. This approach also enhances your efforts towards meeting the regulatory expectations. Conducting them frequently lets you capture the changes in risks and business conditions.

Without such risk assessments, you will not know the risks to your cash-intensive business. Without this knowledge, it is challenging to develop measures against money laundering. So, do not neglect to conduct frequent risk assessments.

8. Underutilising technology in AML compliance activities

Technology is a big game changer in AML. Many countries worldwide have accepted technological solutions to support their AML initiatives. It can be a helpful tool even for cash-intensive businesses. Although cash doesn’t have an electronic trail, you can use technology to perform AML tasks for cash.

But what is more important is understanding the significance and use of technology in AML.

You can deploy automatic systems for KYC, CDD, transaction monitoring, and risk assessments. The addition of technology makes the detection of suspicious transactions and customers easier. You can use advanced AI, ML, and data analytics technologies for effective results. Thus, technology prevents money laundering and makes your AML compliance efforts more relevant.

9. Inability to track the performance of AML framework and improve thereon

So, you have implemented all the relevant AML measures in your entity. You have a well-defined AML framework with the necessary policies and internal controls. You have procedures for KYC, KYT, due diligence, transaction monitoring, and risk assessment. All this is good.

But how will you know if they align with your business goals? Are they reaping results for your business? Are they effective in achieving AML compliance?

You can find answers to these questions only through audits and performance reviews of the AML framework. So, create and use relevant performance metrics for your AML program. Establish performance indicators to review the adequacy of these measures to achieve AML compliance.

With these performance metrics, you can audit your AML procedures. You can check whether these are enough to prevent money laundering threats. If not, you can develop improvement strategies and adapt to changing risks.

10. Insufficient reporting, recording, and documentation

So, you have not committed any of the above mistakes in your AML compliance. You have implemented each initiative and achieved your AML compliance. But how will you prove this to MAS and other regulatory authorities in Singapore?

As evidence, you must have proper records, reports, and documents.

Documentation is a critical aspect of AML compliance. Whatever techniques and results you find from these AML measures, you must save them. Even your customer interactions and communication with regulatory authorities are vital. Maintaining all these records in proper format and templates is necessary. You also need to submit reports to authorities under AML reporting requirements.

Missing any of these would mean non-compliance. If MAS asks you for any records during audits or investigations, you must have them. Absence would lead to remediation plans by MAS, penalties, or declaration of non-compliance.

So, now you know the common mistakes cash-intensive businesses make in AML compliance. If you are one such cash-intensive business, be better prepared. Avoid these pitfalls and adopt industry best practices to follow Singaporean AML regulations.

If you need help in any aspect of AML compliance, AML Singapore is your one-stop destination.

We are a prominent provider of AML compliance services to entities in Singapore. We understand the significance of AML for a business and help you prioritise it. We can help you:

- Create relevant AML frameworks

- Track transactions to detect suspicious activities

- Assess customers to build their risk profiles

- Put in place appropriate AML policies, procedures, and controls

- Select the best technology solution for AML

Achieve your AML goals faster and more accurately with our partnership. Our AML consultants safeguard your business from ML/TF threats and put it on the right track. So, let us know if you need any help in AML compliance.

Fortify your business against financial crimes,

With our AML best practices and industry standards.

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise- Wide Risk Assessments to implementing the robust AML Compliance framework. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.