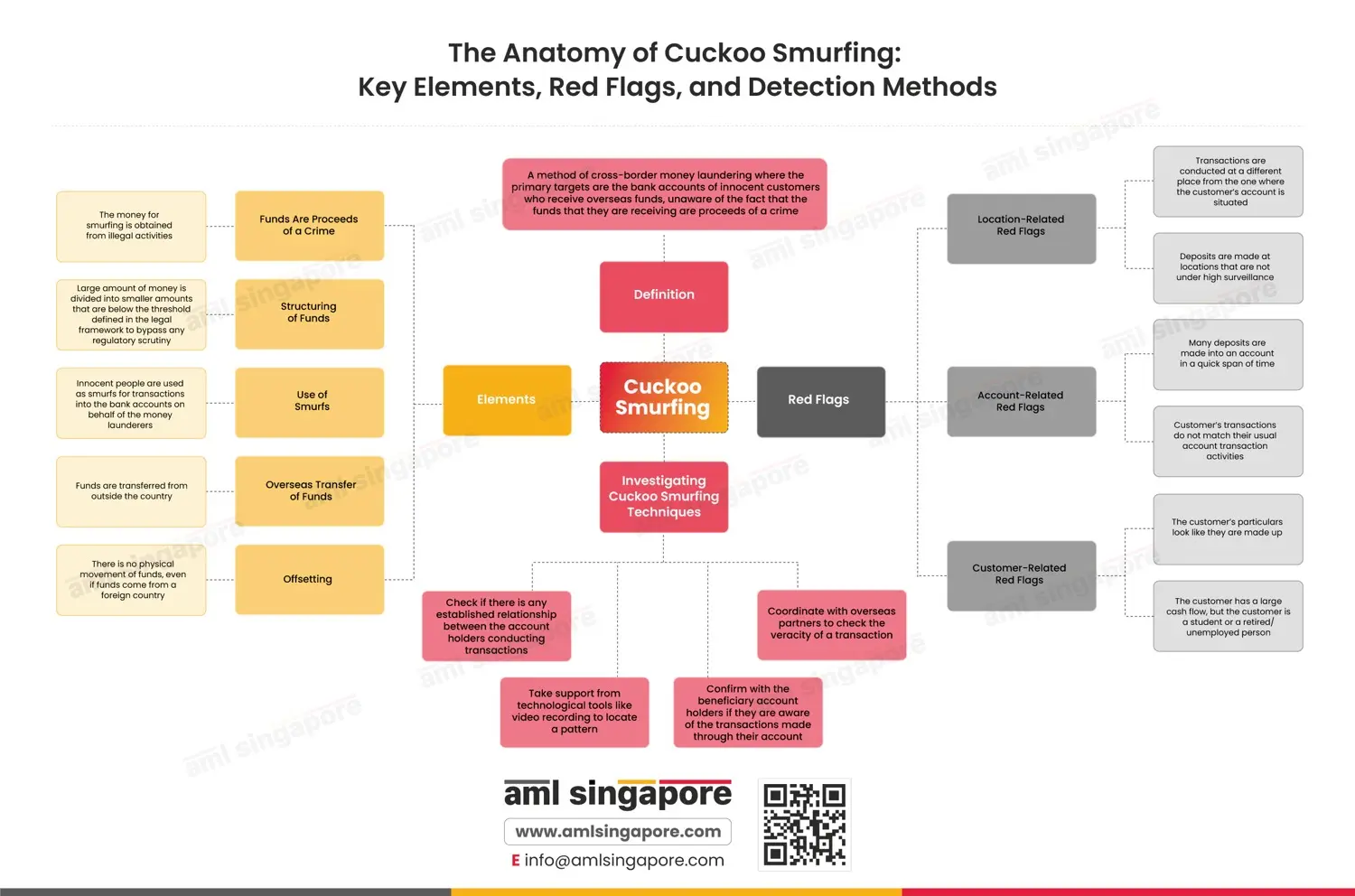

The Anatomy of Cuckoo Smurfing: Key Elements, Red Flags, and Detection Methods

Ever seen a cuckoo bird placing its eggs in another bird’s nest and other birds taking care of those eggs like their own? The concept of cuckoo smurfing derives its name from this phenomenon, where an innocent account holder is misused by criminals for moving their illegal funds.

In this infographic, learn all about the concept of cuckoo smurfing, its common elements, red flags, and methods of detection.

What is Cuckoo Smurfing

Cuckoo Smurfing is a method of cross-border money laundering where the primary targets are the bank accounts of innocent customers who receive overseas funds, unaware of the fact that the funds that they are receiving are the proceeds of a crime. Criminals mix up legitimate funds with illegal money to hide the source of illegal funds.

Elements of Cuckoo Smurfing

Although there are different ways in which criminals execute cuckoo smurfing, the following are the common elements of this technique that financial institutions can look for:

- Funds Are Proceeds of a Crime: The money for the purpose of smurfing is obtained from illegal activities

- Structuring of Funds: A large amount of money is divided into smaller amounts that are below the threshold defined in the legal framework to bypass any regulatory scrutiny

- Use of Smurfs: Innocent people are used as smurfs for transactions into the bank accounts on behalf of the money launderers

- Overseas Transfer of Funds: Funds are transferred from outside the country

- Offsetting: There is no physical movement of funds, even if funds come from a foreign country

Red Flags Indicating Cuckoo Smurfing

Financial institutions in Singapore can identify cuckoo smurfing techniques by checking for a combination of the following red flags:

Location-Related Red Flags

- Transactions are conducted at a different place from the one where the customer’s account is situated

- Deposits are made at locations that are not under high surveillance

Account-Related Red Flags

- Many deposits are made into an account in a quick span of time

- Customer’s transactions do not match their usual account transaction activities

Customer-Related Red Flags

- If the customer’s particulars look like they are made up

- The customer has large cash flow, but the customer is a student or a retired/unemployed person

How to Investigate Cuckoo Smurfing Techniques

- Check if there is any established relationship between the account holders conducting transactions

- Coordinate with overseas partners to check the veracity of a transaction

- Take support from technological tools like video recording to locate a pattern

- Confirm with the beneficiary account holders if they are aware of the transactions made through their account

Protect Yourself from Cuckoo Smurfing

A sound understanding of emerging money laundering techniques like cuckoo smurfing can help financial institutions protect themselves from the risks of financial crimes.

Related Posts

Worried about your Company’s AML Compliance Requirements?

Let go of all your business-related compliance concerns with AML Singapore.