Socio-Economic Impact of Money Laundering in Singapore

Socio-Economic Impact of Money Laundering in Singapore

This blog highlights the socio-economic impact of money laundering in Singapore, aimed to guide AML compliance professionals and regulated entities to understand the consequences and take necessary preventive measures to mitigate the adverse impacts of money laundering, terrorism financing, and proliferation financing on the macro as well as micro levels.

Money laundering has a significant socio-economic impact, especially in developing countries with vulnerable institutional frameworks and financial systems. Introduction of illegal money into the economy creates instability by undermining fair market competition and diverting funds into criminal activities instead of development of the nation.

Money laundering enables organized criminal activities, corruption and terrorism which not only harms the economy but also destroys public trust and weakens the rule of law.

Social Impact of Money Laundering

Society bears severely damaging impact of money laundering as it enables and sustains criminal activities like human trafficking, terrorism, drug trafficking and corruption. Money laundering also leads to the diversion of resources into criminal activities and enhanced law enforcement, which reduces the fund allocation to development and public welfare programs. This leads to unfairness to ordinary citizens and affects them drastically. This also fosters the culture of impunity which weakens the social fabric of society.

Economic Impact of Money Laundering

Money laundering not only negatively impacts the financial institutions (FIs) or Designated Non-Financial Businesses and Professions (DNFBPs) but also the whole economy. Criminal activities affect the overall development of the economy and productivity in sectors like real estate and infrastructure that contribute to national development. ML leads to misallocation of resources, revenue loss to the government, and can even cause instability in exchange rates and interest rates. Developing countries and countries with weak AML regulations are at more risk and can even lead to blacklisting and losing foreign investment.

We are the best Anti-Money Laundering Service Provider in Singapore.

Contact us and prevent your business from being used as a conduit to commit financial crimes.

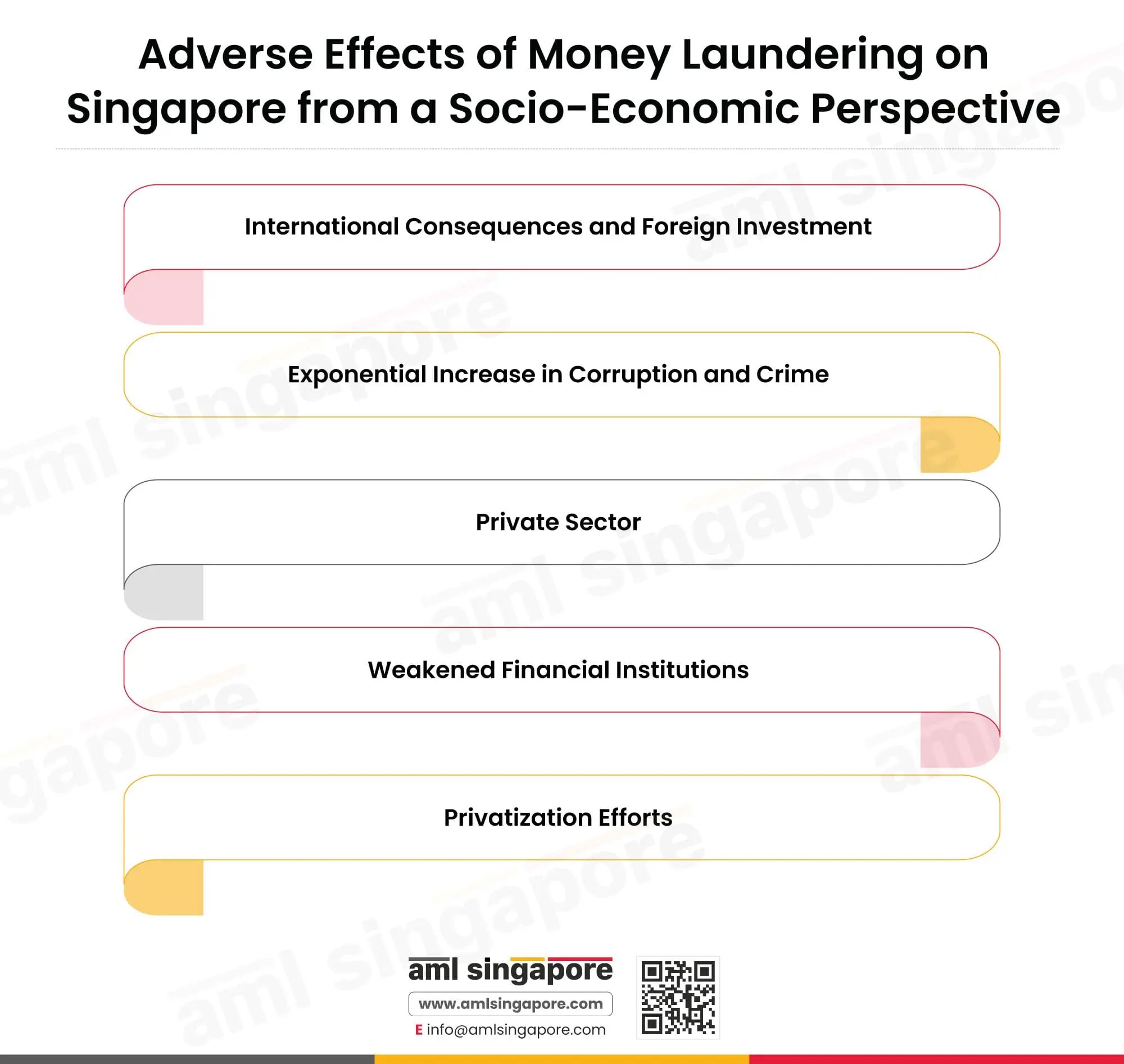

Adverse Implications of Money Laundering on Singapore from a Socio-Economic Perspective

Singapore is the world’s leading financial hub, and money laundering poses a serious threat to its reputation and global economic integrity. The ripple effects of ML can be far-reaching; it encourages criminal activities, attracts international scrutiny and destroys investor confidence. Let’s discuss more adverse effects of ML.

International Consequences and Foreign Investment

ML can isolate the country from the international financial circles and deter foreign investments. The banking system may also face restrictions in establishing or maintaining correspondent banking relationships with foreign FIs, making transactions expensive, increasing their scrutiny, and therefore limiting global financial integration.

Exponential Increase in Corruption and Crime

ML encourages organised crime by legitimising criminal proceeds. This facilitates crimes like human trafficking, drug trafficking, smuggling, terrorism financing, and cybercrime.

A country is also more prone to corruption if criminal activities like money laundering is happening in its jurisdiction. criminals even use bribery to lure public official to protect their interest. This not only evades justice but also erodes the integrity of the financial system of the country. This weakens the law and regulation enforcement, thus creating distrust in public and decline in governance.

Private Sector

Companies that get caught between money laundering operations unknowingly might face severe financial penalties, legal actions, and even sanctions and blacklisting. Businesses that are legitimate faces unfair competition as the businesses funded by criminal proceeds undercut prices and try to gain dominance in the market. Shell companies are also used by money launderers, where criminal proceeds can be used for investing in legitimate companies and businesses to control all sectors and industries. The private sector also bears the additional burden of enhanced compliance with requirements like employee training, reporting etc., increasing operational and administrative costs.

Weakened Financial Institutions

Financial institutions are the most vulnerable to financial crimes, while they are also the most crucial parties in detection and prevention of money laundering. FIs may face irreparable reputational damage, substantial penalties and fines, regulatory sanctions, lose credibility and even license revocation at times, if involved in laundering activities. The long-term impact of ML can lead to instability in the financial sector and the economy as a whole.

Privatization Efforts

Money launderers pose a significant threat to privatization efforts as they try to exploit these opportunities to convert illegal funds into clean assets by acquiring government enterprises and public properties. The presence of criminal influence in key sectors further enables illegal activities and deters investors and further privatization programs. This destroys public confidence in the economy and negatively impacts the growth and development of the country.

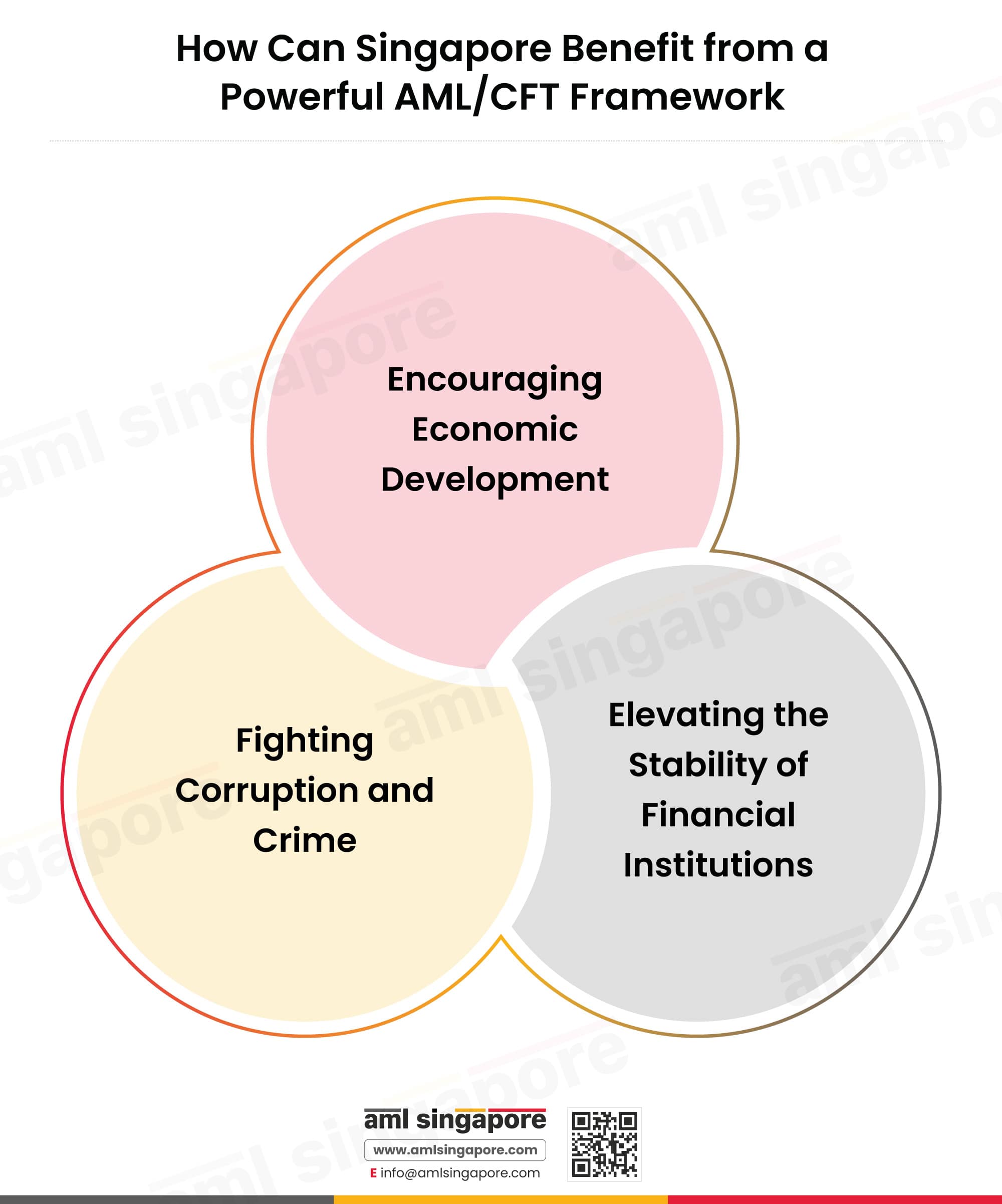

Leveraging the Advantages of a Powerful AML / CTF Framework in Singapore

A powerful AML/CTF framework is essential for safeguarding a Singapore’s economy and financial system. Here are a few benefits of having a robust AML / CTF framework:

Elevating the Stability of Financial Institutions

A strong AML/CTF framework enhances the overall health and credibility of financial institutions. Implementation of robust systems like KYC, costumer due diligence (CDD) process, ongoing monitoring, suspicious activity reporting etc. can help in detecting and preventing the flow of illicit funds. This protects the FIs and regulated entities in Singapore from financial loss and fraud, regulatory fines and penalties, and damage to reputation and public confidence. Following the best global practices also improves relationships with foreign FIs and leads to financial stability and a better banking environment.

Encouraging Economic Development

When financial systems are well-regulated, robust AML/CFT frameworks, and transparent, they attract both domestic and foreign investors.

This increases investor confidence in the economy, as they prefer to invest where their funds are secure and protected from being tainted and exposed to undue risks. Discouraging the flow of illicit money also helps legitimate businesses to thrive as it ensures fair competition. In the long run, a well-regulated financial system promotes long-term investments, facilitates access to global markets, job creation, innovation, and inclusive economic growth.

Fighting Corruption and Crime

Money laundering is often used to hide the illegal proceeds of criminal activities such as human trafficking, drug trafficking, fraud, bribery, corruption, terrorism financing, etc. By implementing a robust AML/CFT framework and enforcing strict reporting obligations, Singapore can identify suspicious transactions, track the origin of illegitimate funds and block the flow of such funds in the economy. This not only dismantles the criminal networks but also makes it harder for corrupt individuals to hide or legitimise illegal gains. AML contributes to a safer and transparent society, strengthens the rule of law, deters future criminal activities, and improves the overall governance of Singapore.

Final words

We now understand the significant social and economic impact that money laundering has on a country’s financial system and its economy. We have also seen that a robust AML/CTF framework is key to preserving financial integrity, promoting socio-economic development, and combating corruption and crime. We here at AML Singapore can be your valuable partner by offering expert guidance and solutions tailored to your business needs, for the effective and efficient implementation of AML/CTF policies and procedures within your organization. By doing so, businesses can play an active role in minimizing the negative socio-economic consequences of money laundering and fostering a more transparent and resilient economic environment.

Give us a call or email us

Let AML Singapore help you choose the best AML software for your business!

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 9 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.