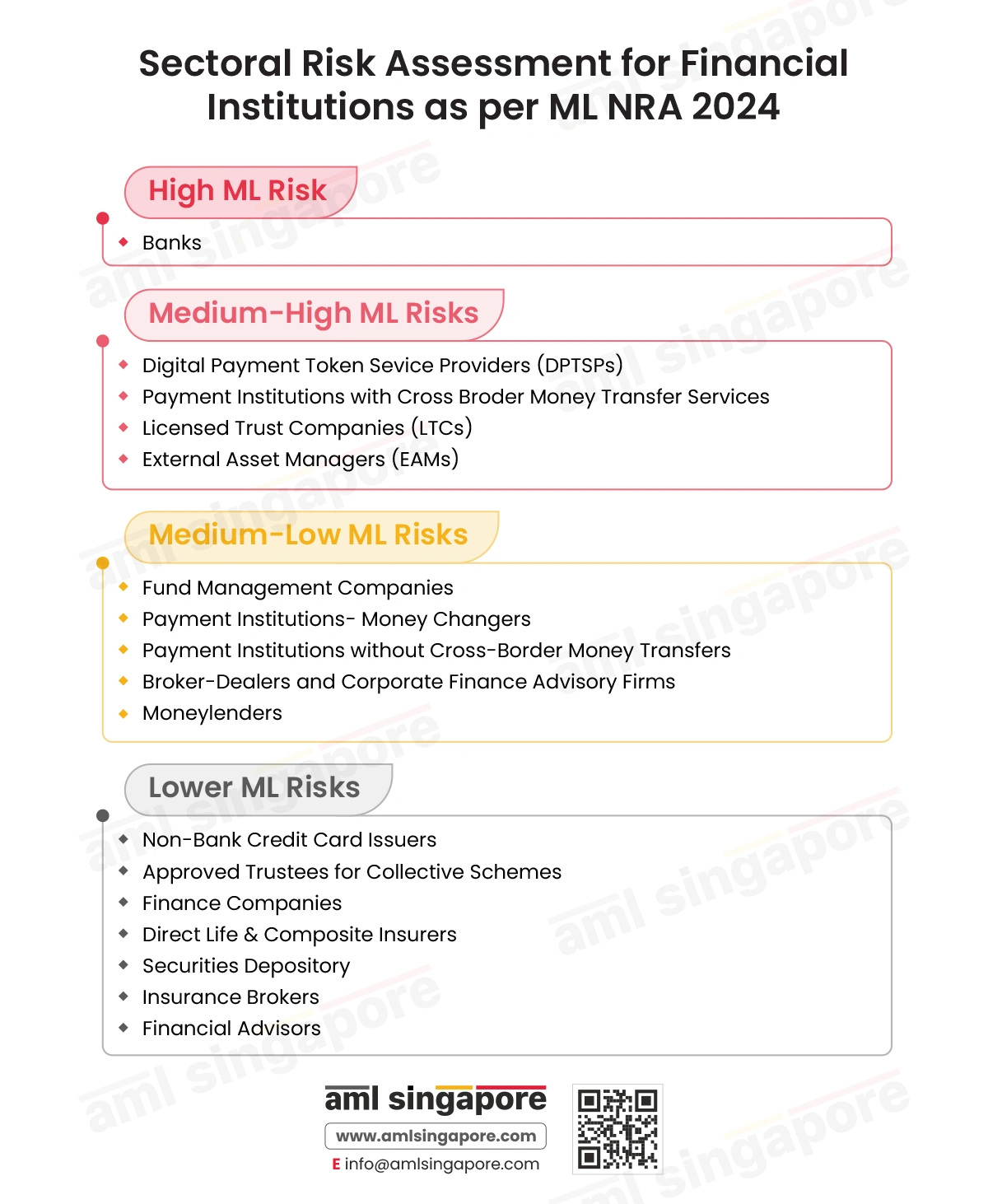

Sectoral Risk Assessment for Financial Institutions as per ML NRA 2024

Sectoral Risk Assessment for Financial Institutions as per ML NRA 2024

Singapore presently has many financial institutions offering numerous services and products. The National Risk Assessment (NRA) 2024 classifies the financial sector institutions based on their vulnerability to Money Laundering (ML)/ Terrorism Financing (TF) and Proliferation Financing (PF) risks. The infographic provides insights on the Sectoral Risk Assessment for Financial Institutions as per ML NRA 2024.

Institutions at a High Risk of ML/TF/PF Threats

Banks

The NRA 2024 identifies the banking sector as at the highest risk of ML/TF/PF threats as it observes illicit funds are commonly laundered using bank accounts through rapid fund transfers, especially in cross-border transactions.

This sectoral risk assessment for the banking industry will help entities take a suitable risk-based approach.

Institutions at a Medium to High Risk of ML/TF/PF Threats

Digital Payment Token Service Providers (DPTSPs)

The NRA 2024 recognises three broad means of exploitation of DPTs in Singapore:

- Payment Method: Ransomware or impersonation frauds where the payment/settlement fee is demanded in DPTs.

- Market Products: E-commerce frauds that sell DPTs or schemes that involve Initial Coin Offerings (ICOs).

- Targeted Item: Unauthorised transactions like online wallet/address hacks and frauds resulting in theft of DPT.

Digital Payment Token Service Providers are at a Medium to High Risk for ML/TF/PF threats. This sectoral risk assessment for the DPTSPs will help those dealing with them take a suitable risk-based approach.

Payment Institutions- Cross Border Money Transfer Services

As per the NRA 2024, shell or front companies, including companies that engage in fictitious transactions for cross-border movement of illicit funds from fraud or overseas cheating or tax evasion, launder proceeds via payment institutions providing cross-border money transfer services.

Payment institutions are exposed to Medium to High Risk for ML/TF/PF threats. This sectoral risk assessment for the Payment Institutions engaged in cross-border money transfer services will help those dealing with them take a suitable risk-based approach.

Licensed Trust Companies (LTCs)

It is observed in the NRA that trusts and trust-like arrangements are used by criminals to hide the origin of their funds or the beneficial owners of illicit assets, for instance, in case of foreign tax evasion. The misuse of LTCs is usually conducted with the help of intermediaries.

LTCs are exposed to Medium to High Risk for ML/TF/PF threats. This sectoral risk assessment for the LTCs will help regulated entities take appropriate risk-based countermeasures while dealing with them.

External Asset Manager (EAM)

External Asset Manager (EAMs) are fund managers for High-Net-Worth Individuals (HNWI) and are susceptible to ML/TF/PF risks as the High-Net-Worth Individuals (HNWIs) that they deal with may be Politically Exposed Persons (PEPs) or may relate to high ML/TF/PF risk jurisdictions.

According to the NRA 2024, monies of HNWIs are often segregated into multiple accounts. Thus, EAMs often must deal with complex structures as a part of wealth management services. Moreover, they deal with high-value cross-border transactions, so their services can be misused for foreign corruption, tax evasion, and ML/TF/PF activities.

EAMs are exposed to Medium to High Risk for ML/TF/PF threats. This sectoral risk assessment for the EAM will help regulated entities take a risk-based approach while dealing with them.

Institutions at a Medium to Low Risk of ML/TF/PF Threats

Fund Management Companies (FMCs)

FMCs provide advisory and fund management services to their customers, for which FMCs engage with brokers or banks to implement investment strategies. The NRA observes that these services can be used to integrate illicit funds into the financial system.

FMCs are exposed to Medium to Low Risk for ML/TF/PF threats. This sectoral risk assessment for the FMCs will help regulated entities take a risk-based approach while dealing with them.

Payment Institutions- Money Changers

Money Changers provide services to buy and sell foreign currency notes, but criminals can use these services to convert illegal funds from local currency notes to foreign currency with greater denominations for cross-border movement or smuggling illegal funds.

Payment institutions- money changers are exposed to Medium to Low Risk for ML/TF/PF threats. This sectoral risk assessment for the FMCs will help regulated entities take a risk-based approach while dealing with them.

Payment Institutions without Cross-Border Money Transfers

E-money accounts are pre-paid payment products that can be used to pay for goods and services. The NRA suggests that these e-money accounts are an attractive avenue for criminals because of the anonymity of their funding. These accounts are also abused for fraud and cheating, like credit card fraud and unauthorised transactions, the proceeds of which can be moved using e-money accounts.

Payment Institutions without cross border money transfers are exposed to Medium to Low Risk for ML/TF/PF threats.

Capital Market Service Providers- Broker-Dealers and Corporate Finance Advisory

Broker-dealers are entities that engage in acquiring, subscribing, or underwriting capital market products, while the corporate finance advisory firms provide advisory services to investors and institutions about the capital market products.

The NRA 2024 finds that the global nature of the capital market makes its participants, i.e., broker-dealers and corporate finance advisors, vulnerable to the washing of illicit funds by converting them into capital market products like securities.

As per the sectoral risk assessment, capital market service providers are exposed to Medium to Low Risk for ML/TF/PF threats.

Moneylenders

Moneylenders provide loans to individuals who are unable to obtain credit from banks and do not possess any valuables for pledging to a pawnbroker. This sector is vulnerable to ML/TF/PF risks as criminals may use their illicit funds for lending to conceal the origin of the funds.

As per the NRA 2024, moneylenders are exposed to Medium to Low Risk for ML/TF/PF threats.

Institutions at a Low Risk of ML/TF/PF Risks

Non-Bank Credit Card Issuers

Credit cards can be subjected to fraud, where stolen or fake identities are used by criminals to obtain credit cards that can be used to fund criminal activities and conversely also be subjected to funds coming from illicit activities for repayment.

As per the NRA 2024, Non-Bank Credit Card Issuers are exposed to minimal risk of ML/TF/PF threats.

Approved Trustees for Collective Investment Schemes

Entities approved by the Monetary Authority of Singapore (MAS) to act as trustees for collective investment schemes and authorised by law to offer them to retail investors are known as approved trustees. So far, no misuse of approved trustees has been observed in Singapore. Hence, the sector poses low ML/TF/PF threats.

Approved Trustees for Collective Investment Schemes are exposed to a Low Risk for ML/TF/PF threats.

Finance Companies

Finance companies offer limited services, like fixed and savings deposit services and credit facilities, to individuals and businesses. The NRA 2024 observes that finance companies are not misused for ML/TF/PF purposes.

As per NRA 2024, finance companies are exposed to Low Risk for ML/TF/PF threats.

Direct Life and Composite Insurers

The insurance sector is susceptible to ML/TF/PF risks as insurance money can be laundered by the assignment of policies and payments to third parties. However, the frequency of such instances is low. Thus, Direct and Composite Insurers face low ML/TF/PF risks.

As per sectoral risk assessment, direct life and composite insurers are exposed to a minimal risk for ML/TF/PF threats.

Securities Depository

The Central Depository (CDP) acts as a trustee for all securities deposited with the CDP. While there has been no instance of misuse of CDP for ML/TF/PF purposes, it is still vulnerable to ML risks as funds and assets can be laundered through the securities market.

As per sectoral risk assessment, Securities Depository are exposed to a low risk for ML/TF/PF threats.

Financial Advisers

The services provided by Financial Advisors are limited as they do not directly manage clients’ funds, so their ML/TF/PF risks are low. However, there have been instances of misrepresentation by financial advisors that moderately increase the sector’s risks.

As per sectoral risk assessment, financial advisors are exposed to a low risk for ML/TF/PF threats.