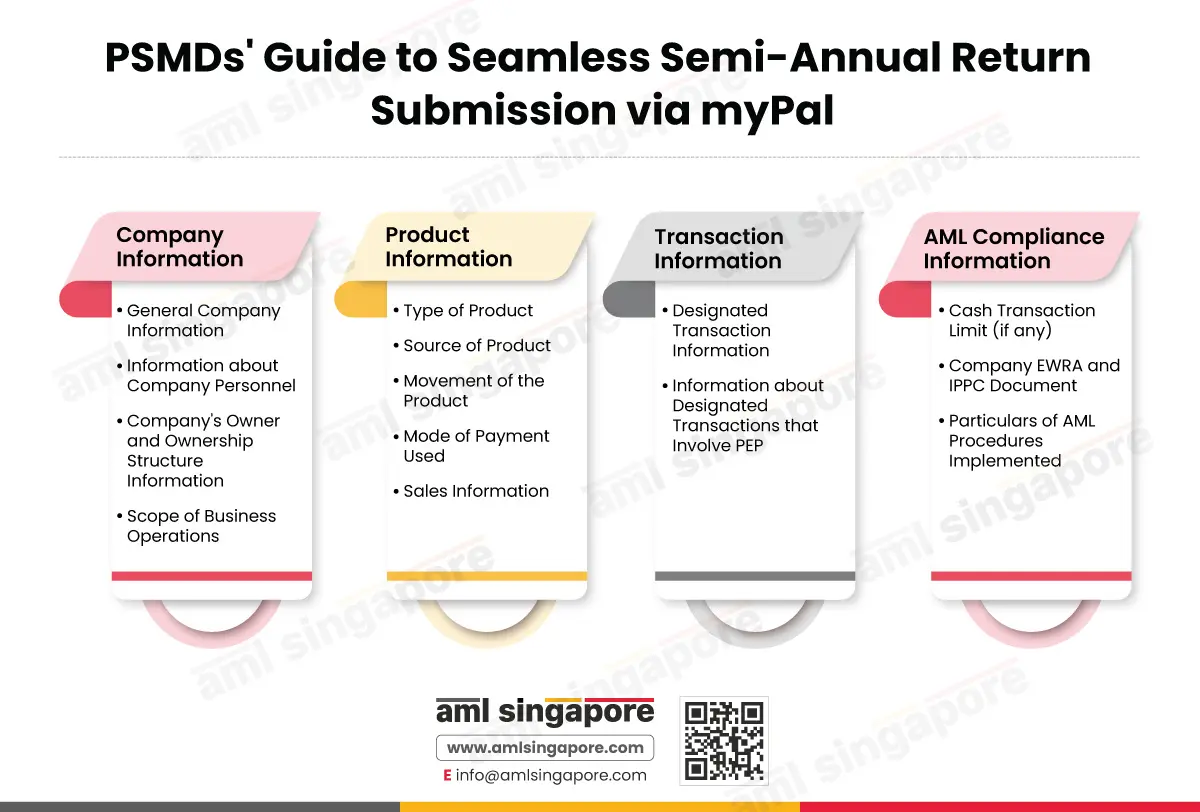

PSMDs’ Guide to Seamless Semi-Annual Return Submission via myPal

PSMDs' Guide to Seamless Semi-Annual Return Submission via myPal

Precious Stones and Precious Metals Dealers (PSMDs) in Singapore are obligated to submit a Semi-Annual Return (SAR) through the myPal portal. This infographic talks about documents and information that regulated dealers would require during the Semi-Annual Return Submission.

Company Information for Semi-Annual Return

A range of information related to the company’s structure and information is required, including:

General Company Information

Particulars about the company’s name and Unique Entity Number (UEN) and particulars of the filer, including their name, designation, and contact information.

Information about Company Personnel

Particulars about the number of employees, including the business owner and the number of directors engaged who are permanent residents of Singapore.

Company’s Owner and Ownership Structure Information

PSMDs are required to select a description that best describes their structure, such as:

- Whether their company is wholly owned by foreign entities.

- Whether the company’s business is owned by a local or international group, along with the jurisdiction of incorporation and operation of the group headquarters.

Scope of Business Operations

Companies need to notify if the company has business outside of Singapore and the level of contribution by the outside business to the company’s overall business.

Product Information for Semi-Annual Return Filing

In addition to their overall business information, regulated dealers are required to provide an accurate description of the product they deal with; such description involves:

Type of Product

Regulated dealers must specify the type of PSPM product they deal with. Precious Stone and Precious Metal (PSPM) products may include:

- Manufactured and unmanufactured precious metals

- Loose diamonds

- Precious products, fashion jewellery, luxury ornaments and apparel

- Astrology products

- Antique products

- Asset-backed tokens

Source of the Product

PSMDs must specify which country or region they source their PSPM products from.

Movement of the Product

PSMDs need to describe the movement of the product. They must specify if such movement is within the borders of Singapore or across the border to a foreign country and the parties involved, such as supplier or customer.

Mode of Payment Used

Regulated dealers are required to indicate the mode of payment used by the business, such as:

- Cash or cash equivalents such as cash vouchers, stored value cards, etc.

- Cheques

- Electronic payment methods

- Virtual Assets such as cryptocurrencies

Dealers have the liberty to specify any other form of payment that they may accept.

Sales Information

Regulated Dealers are required to inform the regulatory authorities about the total sales amount (including GST) in Singapore Dollars (SGD) after deducting the sales discount and the total number of transactions conducted during the reporting period by recording the total number of invoices raised.

Transaction Information for Semi-Annual Return Submission

As a part of the SAR, regulated dealers are required to provide information on the particulars of high-value transactions.

Designated Transactions

PSMDs must inform if they executed any transactions above 20,000 SGD that are considered to be designated transactions during the reporting period and add additional information about the customer, including the customer’s citizenship or country of incorporation.

Designated Transactions that Involve Politically Exposed Persons (PEP)

If any PSMD undertakes a designated transaction with a PEP during the reporting period, then they are required to input the citizenship details of the PEP in addition to the transaction information, such as the number of transactions and the total value of the transaction.

Anti-Money Laundering (AML) Compliance Information for Filing SAR

PSMDs are required to inform the regulatory authorities about the AML compliance practices they follow, such as:

Cash Transaction Acceptance Limit Policy

PSMDs must specify if they have established an internal policy to put a limit on the sum of money they shall accept in the form of cash.

The Company’s EWRA and IPPC Document

Dealers are required to upload their Risk Assessment and Internal Policy, Procedures, and Controls (IPPC) documents through the myPal portal.

Particulars of AML Procedures Implemented

Procedures established by the PSMD for:

- Identifying designated transactions

- Conducting Customer Due Diligence (CDD)

- Identifying PEP or other high-risk customers and conducting Enhanced Due Diligence (EDD) before transacting with them

- Ongoing Monitoring of Transactions

- Filing Cash Transaction Reports (CTRs) and Suspicious Transaction Reports (STRs)

- Conducting Employee Due Diligence

- Record Keeping

- Particulars of the AML training provided to the employees

AML Singapore’s Take on Seamless Semi-Annual Return Submission via myPal

PSMDs in Singapore are required to file SAR twice every year. Therefore, it is advisable to prepare the required information and documentation beforehand to avoid last-minute hassle.

Related Posts

Approach Us before the Deadline Approaches

On-Time Semi-Annual Return Submission Assured with AML Singapore