Proliferation Financing Risk Assessment

Proliferation Financing Risk Assessment

Weapons of Mass Destruction (WMD) Proliferation refers to the activities, such as the manufacturing and development of nuclear, chemical, and biological weapons and their means of delivery and related materials. While, Proliferation Financing (PF) refers to the activities of raising, moving, or making funds or other economic resources available to the person for the illicit purpose of WMD proliferation.

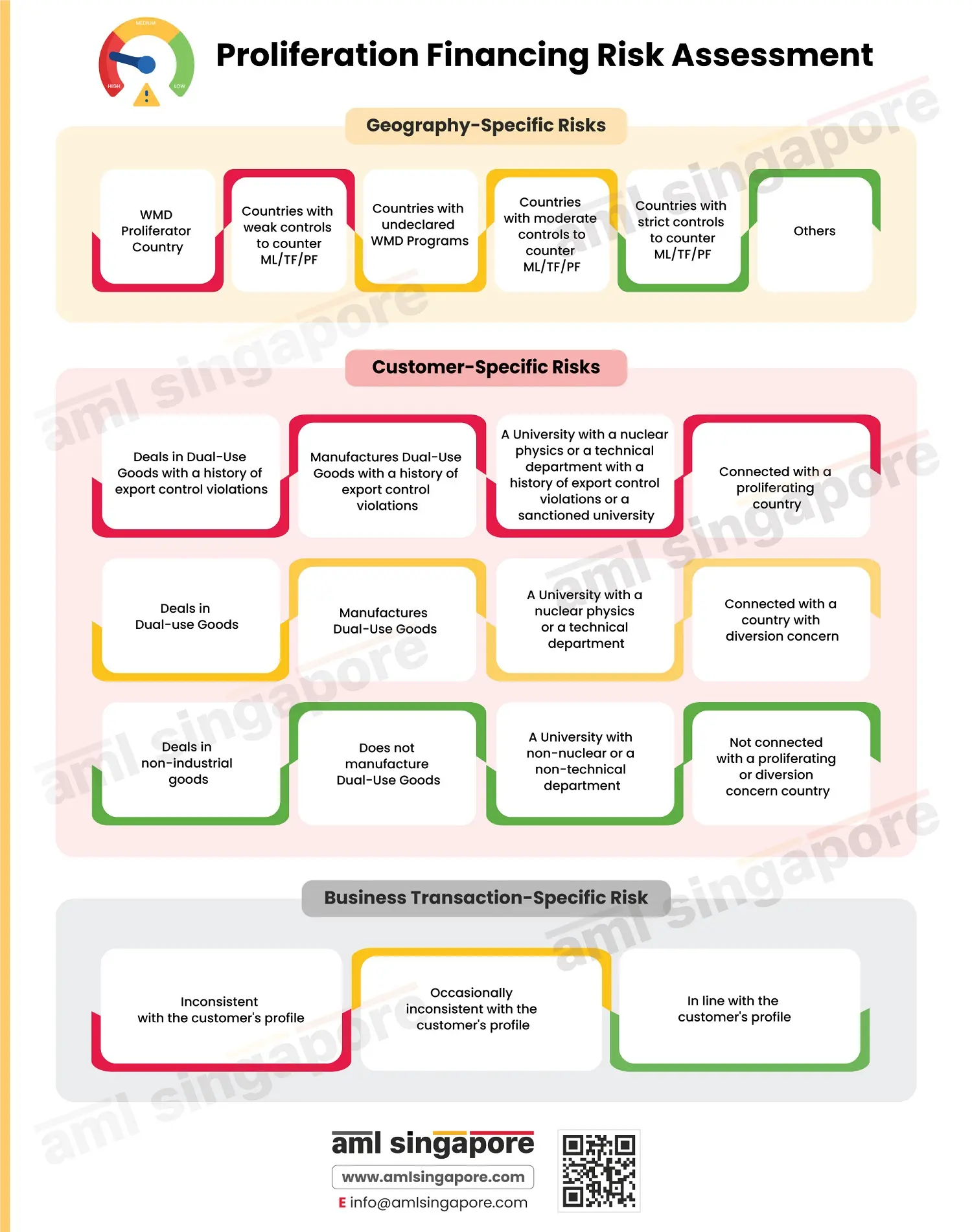

To mitigate proliferation financing risks, it is important to assess the business’s exposure to PF and identify the PF risks associated with each customer by including the PF-specific risk parameters in the customer risk profiling methodology. For evaluating the overall PF vulnerabilities, the regulated entity must consider the risks specific to geography, products, customer profiles, and business transactions.

These assessed risks are then categorized into three categories: high, medium, and medium. Similarly, depending upon the PF risks associated with customers along with other risk-posing factors, you can label each of your customers as high, medium, or low-risk.

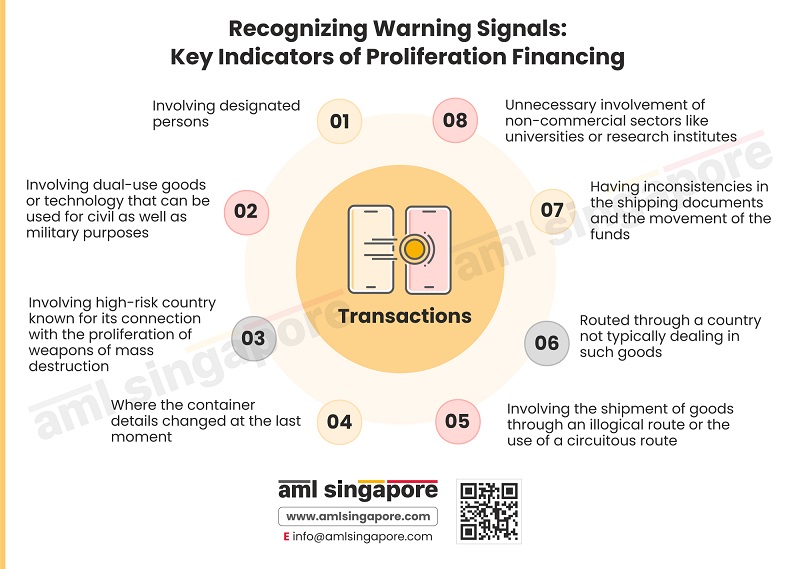

The PF risk assessment must include the parameters such as the involvement of the jurisdiction (associated with the business relationship) in WMD proliferation, the level of the regulatory framework for combating financial crimes, including PF, the customer’s engagement with dual-use goods, overall customer profile and the consistency with nature of transactions executed, etc.

Check out AML Singapore’s detailed infographic to understand the PF risks better and what parameters are considered for determining the PF risks.

Related Posts

AML Compliance for Foreign Dealers of PSPM in Singapore

Understanding WMD Proliferation and Proliferation Financing (PF)

Money Laundering Vs Terrorist Financing Vs Proliferation Financing