Precious Metals and Precious Stones subject to AML compliance in Singapore

Precious Metals and Precious Stones subject to AML compliance in Singapore

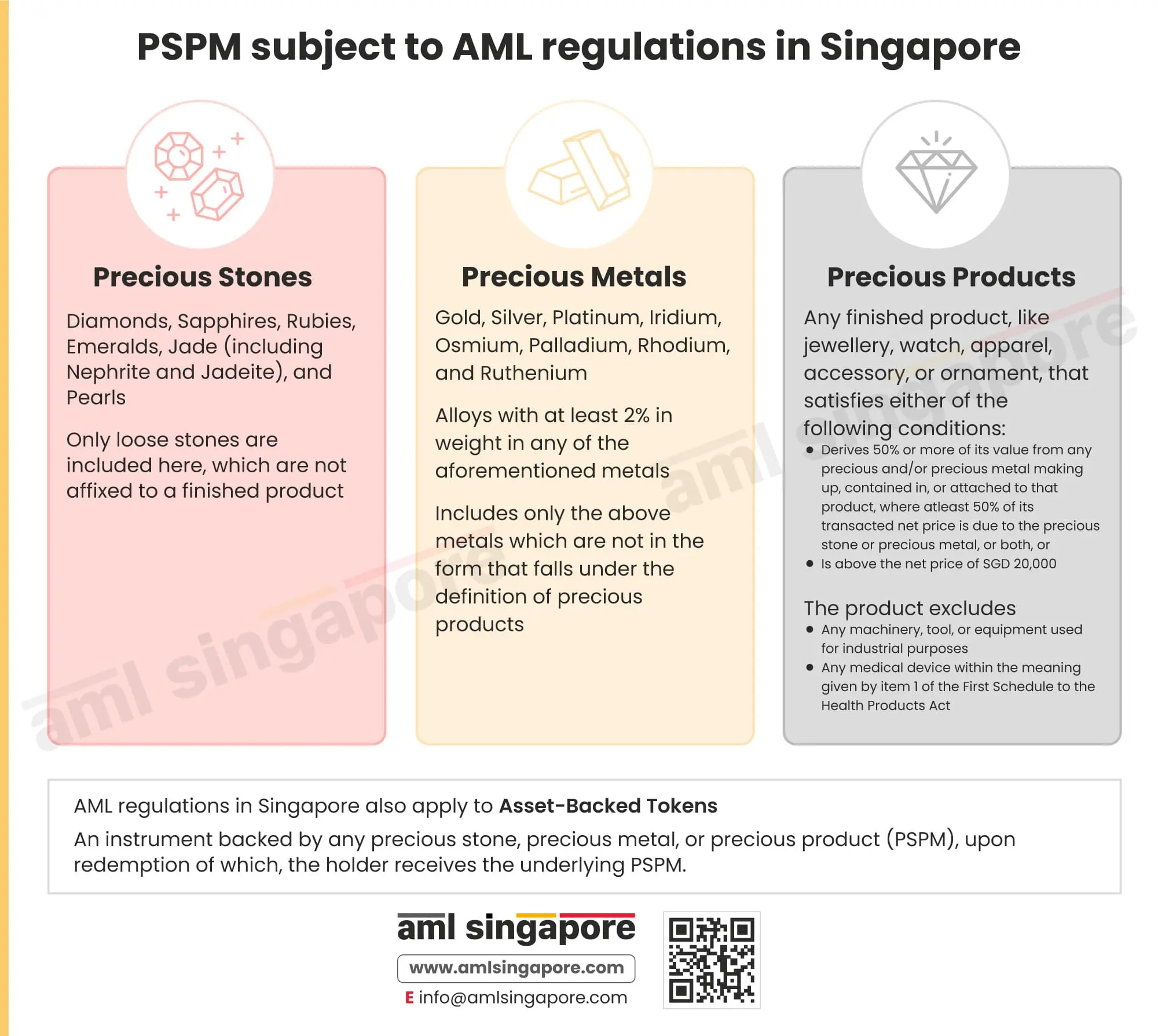

The AML regulations in Singapore mandate that regulated dealers design and implement AML/CFT measures when dealing with specified Precious Metals and Precious Stones.

For AML compliance, along with gold and silver, the precious metals include rhodium, palladium, osmium, platinum, iridium, and ruthenium. It also includes alloys consisting of these metals exceeding the specified threshold.

Similarly, AML’s ambit for precious stones covers diamonds, sapphires, emeralds, rubies, jade, and pearls, when transacted loosely without being attached to any item.

Furthermore, the AML regulations also include precious products, i.e., items made up of precious stones or precious metals, which form 50% or more of the total value of the product or products whose net price is above SGD 20,000 (subject to exclusions).

The regulated dealers engaged in Asset-Based Tokens (instruments backed by PSPM) would also be subject to AML obligations in Singapore.

Here is an infographic highlighting the precious metals and precious stones subject to the AML regime in Singapore.

AML Singapore is an AML Consulting firm providing end-to-end AML support to regulated entities, including regulated dealers engaged in specified precious stones and precious metals. We assist the regulated dealers in assessing the ML/FT risk exposure and customizing the AML/CFT internal policies, procedures, and controls (IPPC) to mitigate the assessed risk.