October 2025 FATF update: South Africa, Nigeria, Mozambique, Burkina Faso removed from increased monitoring list

Executive Summary:

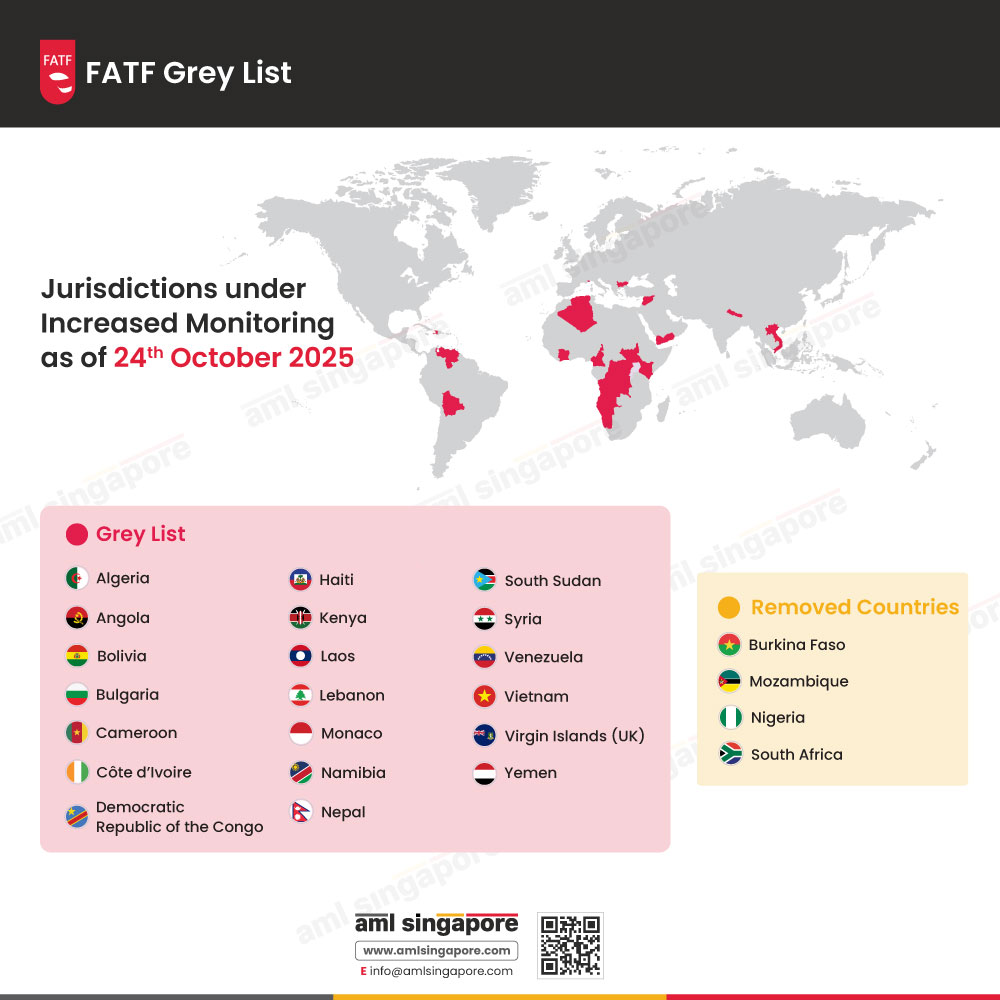

- Grey list: South Africa, Nigeria, Mozambique, Burkina Faso removed at the October 2025 Plenary.

- Blacklist: No additions or removals.

- Impact: Faster onboarding and fewer exception checks in these jurisdictions

- Actions now: Re-map country risk, reperform customer risk assessment, brief client-facing teams

October 2025 FATF update: South Africa, Nigeria, Mozambique, Burkina Faso removed from increased monitoring list

The third plenary session of the Financial Action Task Force (FATF) for the year 2025 concluded on 24th October 2025 according to which:

- South Africa

- Nigeria

- Mozambique

- Burkina Faso

were removed from the Grey List.

FATF acts as a global watchdog and sets policies of international standards to counter Money Laundering (ML), Terrorism Financing (TF) and Proliferation Financing (PF) related activities. FATF is primarily involved in evaluating the progress of the countries in strengthening financial integrity and combating financial crimes according to which, it lists the country in its Grey or Blacklist, depending upon the magnitude of the risk.

Actions Regulated Entities Operating within Singapore Must Take Upon FATF Grey List Update

All the Regulated Entities operating within Singapore, including Financial Institutions (FIs), Designated Non-Financial Businesses and Professions (DNFBPs), and other obligated entities, must take immediate action as per the latest FATF Grey List to ensure they comply with the latest requirements and address emerging risks.

ML/TF/PF Risk Assessment

Conduct a comprehensive Risk Assessment to examine the geographic risk exposure to an RE’s business as per the newly removed jurisdictions in the latest FATF Grey List. Also, Regulated Entities must update their Enterprise-Wide Risk Assessment (EWRA) to comply with the current FATF classifications and reassess the customers accordingly.

AML/CFT/CPF Policies and Procedures

Regulated Entities must ensure that all their internal policies, procedures, and risk mitigation measures are aligned with the latest FATF Grey List, and the jurisdictional risk rating mechanism is also revised. It involves the process of reviewing and revising the risk matrices to comply with the latest FATF Grey List updates.

Effective Enhanced Due Diligence (EDD)

Conduct Enhanced Due Diligence (EDD) for all customers who have any linkage with existing grey-listed jurisdictions as per the latest FATF Grey List. Regulated Entities should obtain additional documents from their existing customers to verify the source of funds and Beneficial Ownership status.

Ongoing Monitoring and Reporting

Regulated Entities must focus upon strengthening their Ongoing Monitoring protocols to efficiently detect and report customers who are exposed to grey-listed jurisdictions.

Staff Training and Awareness

Reporting Entities should focus upon conducting dedicated training sessions for the compliance team to make them learn about the implications of FATF Grey List changes and prepare for the updated due diligence requirements for affected jurisdictions.

FATF Grey List as of 24th October 2025

1. Algeria

2. Angola

3. Bolivia

4. Bulgaria

5. Cameroon

6. Côte d’Ivoire

7. Democratic Republic of Congo

8. Haiti

9. Kenya

10. Laos

11. Lebanon

12. Monaco

13. Namibia

14. Nepal

15. South Sudan

16. Syria

17. Venezuela

18. Vietnam

19. Virgin Islands (UK)

20. Yemen

Do not let the Updated FATF Grey List expose your Business to Regulatory Penalties