Navigating the AML/CFT Regulatory Framework for DNFBPs in Singapore

Navigating the AML/CFT Regulatory Framework for DNFBPs in Singapore

Designated Non-Financial Businesses and Professions (DNFBPs) are obligated to identify and report suspicious transactions. In this context, the DNFBPs must comply with the Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) regulatory framework in Singapore.

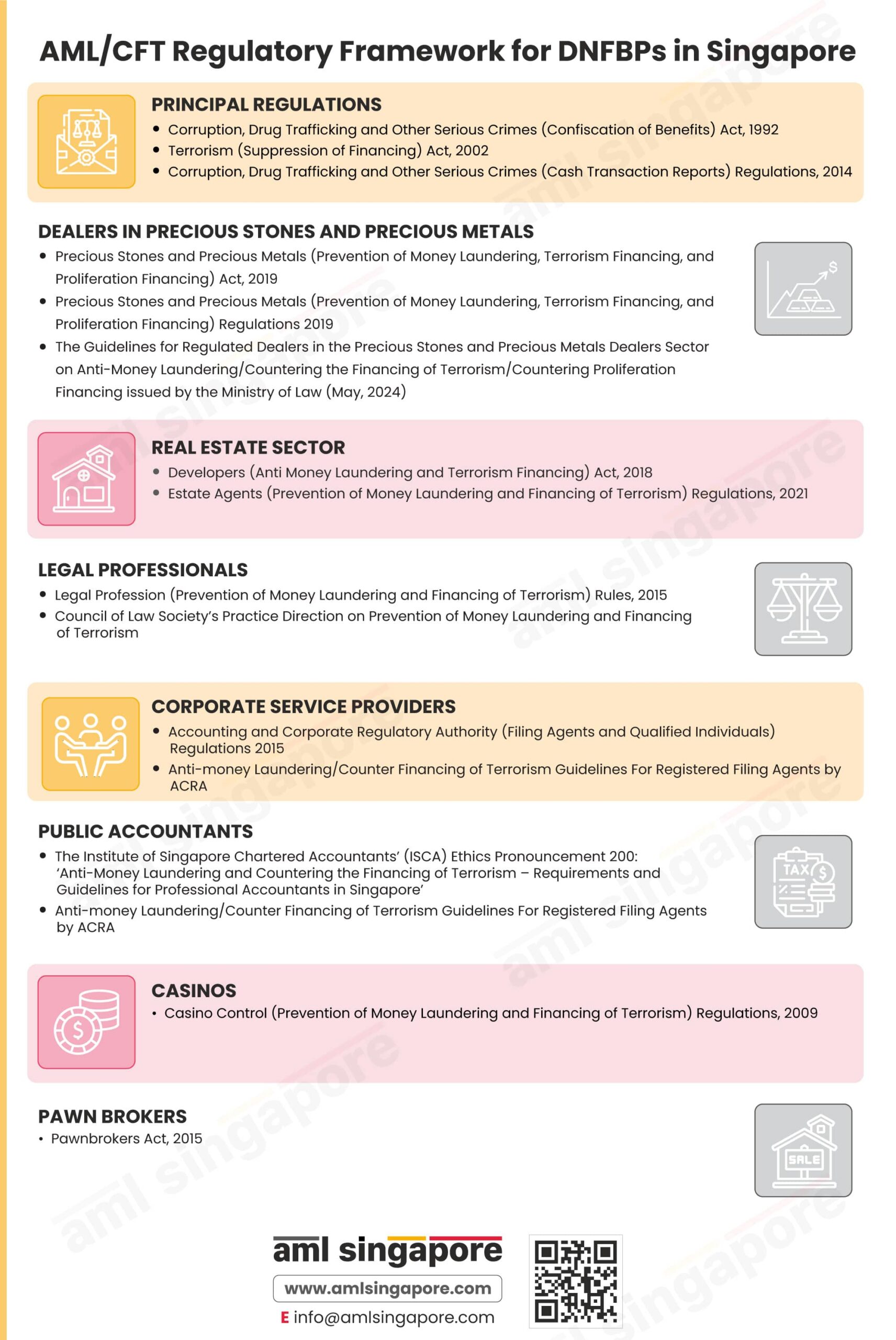

The primary regulations handling the AML/CFT regulatory framework in Singapore are the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act (CDSA) and the Terrorism (Suppression of Financing) Act (TSOFA). These regulations classify certain businesses and professions as DNFBPs, required to establish and implement adequate AML/CFT policies, procedures, and controls to identify and prevent financial crime activities.

The DNFBPs defined under AML/CFT regulations of Singapore include:

– Dealers in Precious Stones & Precious Metals

– Real Estate Sector (Agents & Developers)

– Lawyers

– Corporate Service Providers

– Public Accountants

– Casinos

– Pawn Brokers

To guide these DNFBPs, various regulatory authorities governing these businesses or professions have issued detailed guidelines and rulebooks, capturing the AML/CFT obligations for respective DNFBPs. DNFBPs must comply with the primary AML/CFT regulations, and the specific rules issued by the corresponding Supervisory Authority.

Here is a visual chart depicting the list of DNFBPs and the AML/CFT regulations to be adhered to by each of these DNFBP.

AML Singapore is a leading AML Consultancy provider, assisting the DNFBPs in designing and implementing the comprehensive AML framework, including internal policies, procedures, and controls to identify and timely report suspicious activities involving the proceeds of crime. AML Singapore also imparts AML training and helps businesses identify the appropriate AML software to stay AML compliant.