Micro Money Laundering: Decode The Hidden Risk for AML Compliance

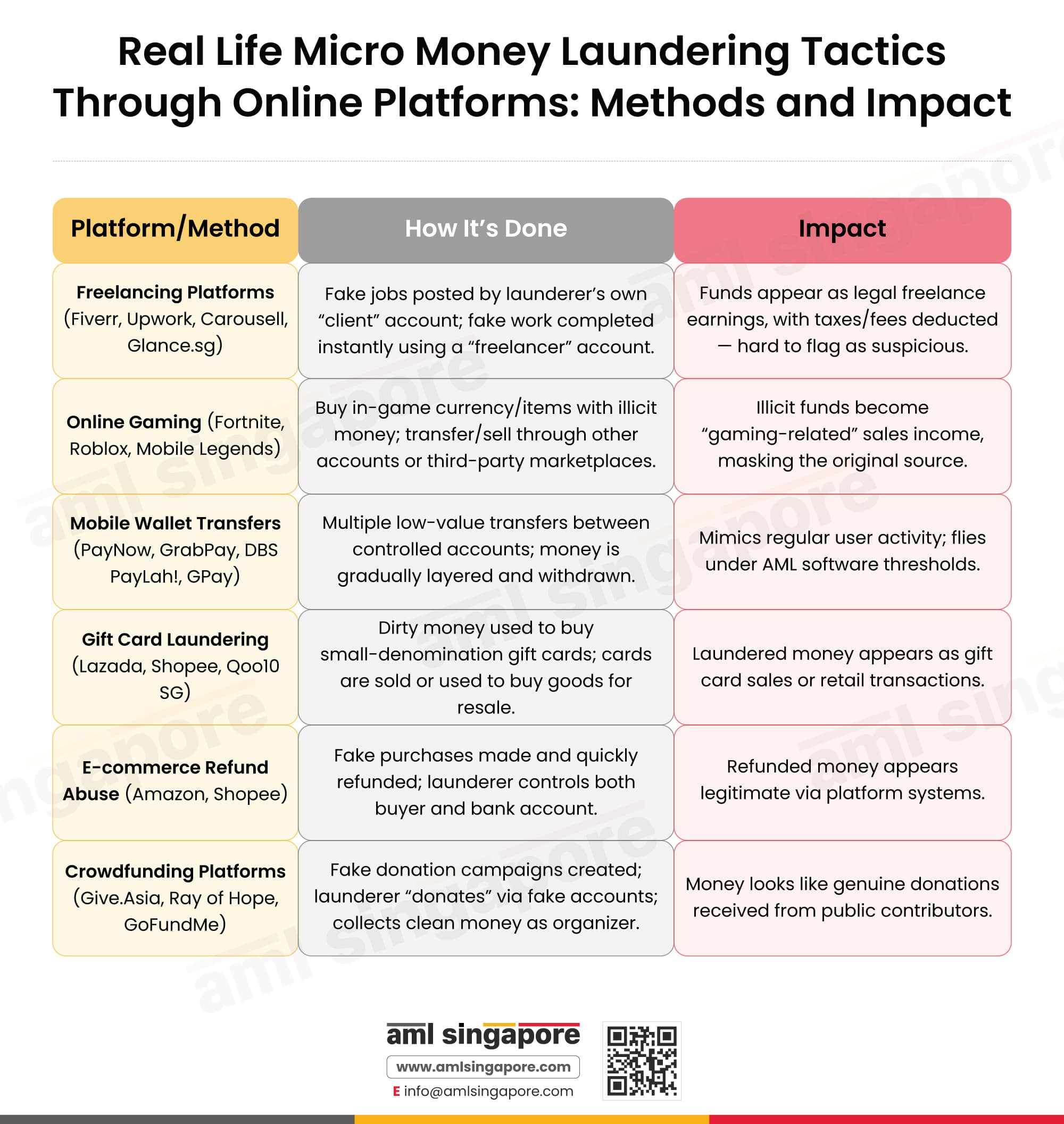

This article attempts to discuss the concept of micro-money laundering in the Singapore context with examples of local digital transactions, gaming and online shopping platforms, which helps AML compliance professionals and enthusiasts to learn about how its done so that they can protect their businesses from being misused by criminals to launder money. This blog gives visual representation of real life micro money laundering tactics used by criminals through various online platforms in Singapore.

Micro money laundering: The New Typology Every AML Compliance Professional Must Know

While traditional money laundering involves moving large sums of illicit money through banks, casinos, and offshore accounts, a new and subtler threat has emerged — Micro Money Laundering (MML). This involves breaking down large transactions into smaller untraceable amounts which spread across different platforms and accounts. It is the new age digital money laundering strategy used increasingly by criminals to conduct financial crimes today.

What Does Micro Money Laundering Mean?

Let us understand in detail what micro money laundering is. It is the movement of illicit funds in smaller denominations instead of transferring large sums of money, making it appear legitimate so as to avoid detection of such movement and the source of funds. This is typically done by usings hundreds of small value transactions through various digital means like digi wallets, e-commerce platforms, or video games etc. Criminals usually exploit these platforms as they usually have weaker or fragmented KYC/AML framework.

In today’s digital/online world, micro money laundering is increasing drastically. There are various payment networks available today that make it easy to sale/purchase by paying online. As the digital landscape continues to evolve, criminals keep finding more innovative and sophisticated ways to commit fraud and other financial crimes. Online users that fall prey are often unaware and are targeted by taking advantage of loopholes in the compliance framework.

Criminals have always taken advantage of the anonymity that comes with the internet. Massive volumes of micro transactions are carried out daily using digital platforms. Such small transactions often go unnoticed, but the cumulative amount is a cause of concern for regulatory authorities all over the world.

Micro-Laundering Is Real. Are You Prepared to Fight?

AML Singapore offers expert help to shut them down.

How Does Micro-Money Laundering Take Place?

The micro money laundering process mimics the classic three stages of money laundering—placement, layering, and integration, but adapts them to the digital and micro-transaction ecosystem.

Placement

Illicit funds are divided and loaded into multiple accounts, sometimes using prepaid cards or digital wallets.

Layering

These funds are moved across platforms, such as mobile payment apps, gig platforms (like freelancing or rideshare apps), or gaming currencies.

Integration

The laundered money is finally withdrawn as clean income, often disguised as legitimate earnings, refunds, or peer-to-peer payments.

Micro Money Laundering Tactics used by Criminals

Let us understand better with real life micro money laundering tactics used by criminals through various online platforms in Singapore are:

Why is Micro-Money Laundering on the Rise?

One major reason why micro money laundering is flourishing today is lack of awareness. As this is relatively new, businesses and regulatory authorities fail to recognize the associated risk. It hides in plain sight small, frequent transactions that mimic usual user behavior, making them harder to detect with conventional AML systems. While companies focus on growth, compliance often takes a back seat, leaving gaps that savvy criminals quickly exploit.

Today, technology is no less than a double-edged sword, while businesses leverage it for innovation and expansion, criminals use it just as enthusiastically for unlawful gains. They move money silently through Digi wallets, e-commerce platforms, etc.

Digital Financial Ecosystems:

A surge in platforms like Venmo, GrabPay, DBS PayLah!, Google Pay, Fiverr, and games like Roblox or Fortnite has created vast ecosystems of low-value, high-frequency transactions.

Regulatory Blind Spots:

Many of these platforms are not classified as financial institutions, allowing them to operate outside the scope of strict AML regulations.

Low Transaction Monitoring Thresholds:

Small transactions typically fall below traditional AML alert thresholds, making them ideal for laundering without detection.

How Can Businesses Mitigate Micro-Money Laundering Risk

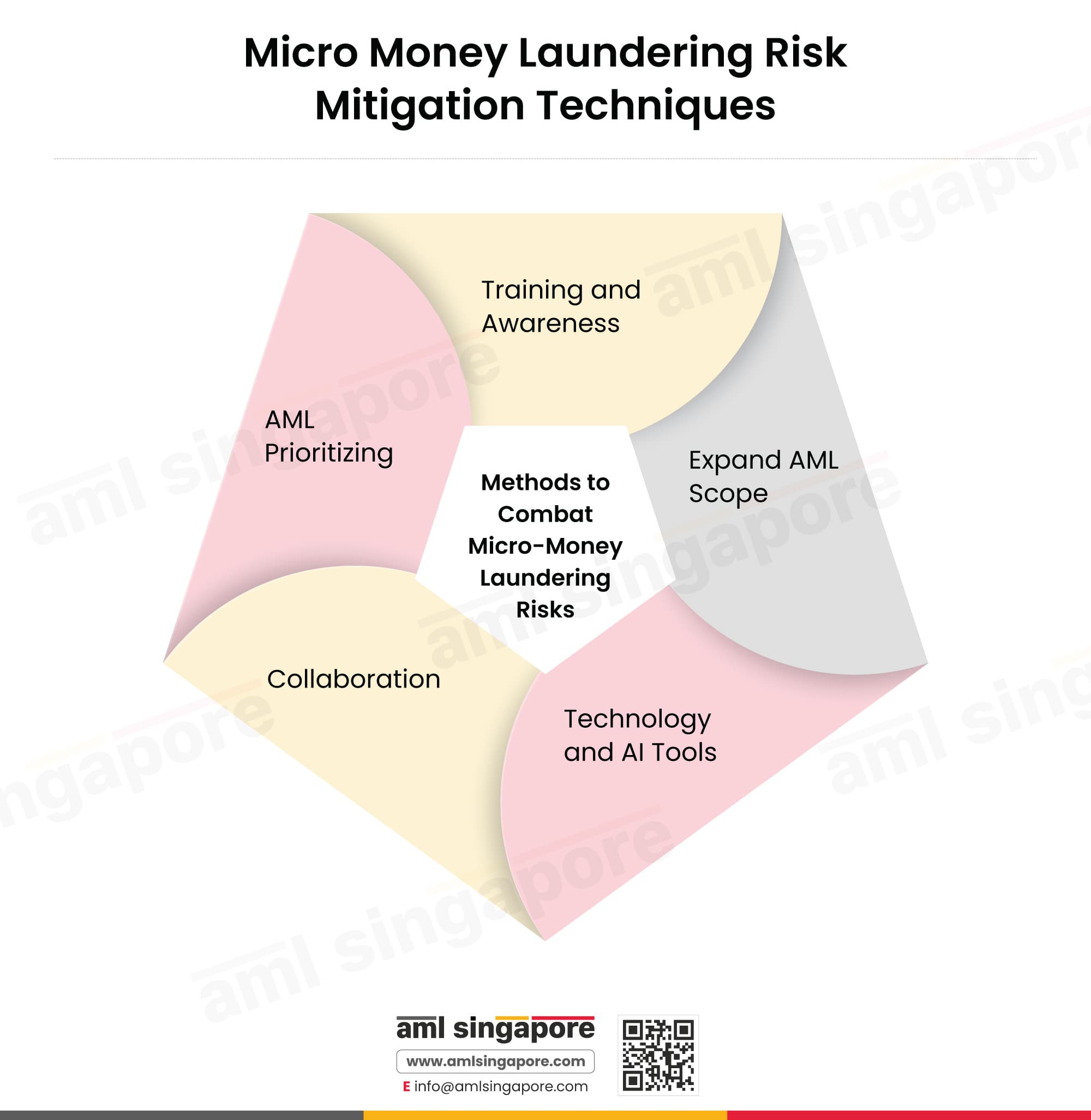

As micro-money laundering rapidly evolves along with digital transformation, businesses and regulatory authorities must adopt a more proactive, tech savvy, and collaborative approach to counter this emerging threat. Here are some ways regulated entities can combat Micro. Money Laundering (MML):

1. Training and Awareness

AML Compliance teams, risk officers, and frontline staff must be educated about the subtle red flags and various methods of micro-money laundering. Training sessions must include real-life case studies, so that they are able to conduct thorough risks assessment, and identify red flags, etc.

2. Expand AML Scope

Regulators must expand the scope of AML compliance ambit and implement such laws that strictly cover e-commerce platforms, gaming companies, and micro payment apps, etc.

3. Technology and AI tools

Organizations must use AI and machine learning-based tools to detect unusual patterns in low-value, high-frequency transactions. Behavioral analytics must be used to flag suspicious activities. KYC, Customer Due Diligence (CDD), Enhanced Due Diligence (EDD) must be conducted using advanced technologies.

4. Collaboration

Industry wide threat intelligence sharing forums must be established to share intel on criminals. Businesses and regulators must partner with each other to identify money laundering typologies early.

5. AML prioritizing

AML should not be seen as a back-office task and each employee must actively participate. It must be integrated into product design, user onboarding, and ongoing operations. Management and board must also oversight AML framework in the organization to ensure efficiency and effectiveness.

Final Thoughts: Small Amounts, Big Consequences

Micro-money laundering may be low in value per transaction, but its cumulative impact on the financial system and economy is huge. The only way forward is a strategic blend of awareness, regulation, technology, and cooperation. Businesses that maintain a robust compliance system are always better equipped to protect themselves and their customers from becoming unintentional facilitators of financial crime through understanding real life micro money laundering tactics used by criminals through various online platforms in Singapore.

Strengthen Your AML Framework Today!

We help businesses in Singapore to detect micro-laundering risks and stay audit-ready.

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise- Wide Risk Assessments to implementing the robust AML Compliance framework. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.