Lodging and Updating RORC information with ACRA: A Bird’s Eye View

Identifying the Ultimate Beneficial Owner (UBO) or Registrable Controller is an essential component of the Customer Due Diligence (CDD) process in Anti-Money Laundering (AML) compliance.

The Accounting and Corporate Regulatory Authority (ACRA) maintains a central registry of registrable controllers of companies, foreign companies, and LLPs functioning in Singapore. For this purpose, ACRA requires companies, foreign companies, and LLPs to lodge and update their RORC information with ACRA. Here’s the article explaining the ACRA’s regulatory requirements for maintaining RORC.

Persons Qualified to Become Registrable Controllers

A registrable controller or beneficial owner is a natural or legal person having a significant interest or control over a company or a Limited Liability Partnership (LLP). For companies and foreign companies with a share capital, a registrable controller is someone having a significant interest, including:

- Interest in more than 25% of the shares of the company or foreign company (irrespective of the class of shares or the value of shares) or

- Interest in shares (except treasury shares) holding more than 25% of the voting power of the company or foreign company.

For companies or foreign companies without a share capital (such as companies limited by guarantee), a registrable controller is someone having a significant interest, includes:

- Direct or Indirect share in more than 25% of the capital or profits of the company or foreign company

Having significant control includes having the following:

- The right to appoint or remove directors who have a majority of the voting rights in the director meetings,

- More than 25% of the voting rights in the matters that are decided by voting of shareholders

- Exercises or has the right to exercise significant influence over the company or foreign company

If a person exercises or has the right to exercise any of the above significant interests or controls, then such a person is a controller. Companies, foreign companies, and LLPs have to set up and maintain a Register of Registrable Controllers (RORC).

Indirect Holding

Companies need to consider and analyse situations where an individual or a legal entity may not directly hold the above rights and may indirectly hold control through a legal entity or a chain of legal entities.

Setting Up the RORC

Companies, foreign companies, and LLPs are required to set up and maintain the RORC either at their registered office address or at the office of their Registered Filing Agent (RFA).

The RORC is not the same as the electronic registers of private companies maintained by the Accounting and Corporate Regulatory Authority (ACRA), the register of members that public companies maintain with themselves or the register of directors and nominee shareholders.

The Register must include the date of entry/update, name of the controller, particulars of the controller and notes or remarks regarding the date on which notice was sent to the beneficial owner and the date on which confirmation was received.

Companies, foreign companies, and LLPs are required to disclose the location of their RORC in their annual return filing. However, they are not required to disclose the location of their RORC to the Accounting and Corporate Regulatory Authority (ACRA).

RORC can be maintained in electronic and physical formats. However, the register is a confidential document which must not be made public.

Worried about the Outcome of ACRA’s AML Compliance Review?

Let go of all your ACRA compliance concerns with AML Singapore.

Measures for Identifying Registrable Controller

Companies, foreign companies, and LLPs are expected to take reasonable steps to identify the beneficial owners. This section discusses the measures that can be taken by companies, foreign companies, and LLPs to identify their registrable controllers.

Taking Reasonable Measures

Companies, foreign companies, and LLPs must take reasonable measures to identify their beneficial owners, such as:

- By sending a physical or electronic notice to every director of the company every year,

- By sending yearly physical or electronic notice to every member of the company who has more than five per cent of the voting share in the company,

If they are aware of the identity of the registrable controllers of the company, foreign company or LLP.

Sending Out Notices

Companies, foreign companies, and LLPs must send notices to persons that they know or have reasonable grounds to believe are registrable controllers of the company, foreign company or LLP.

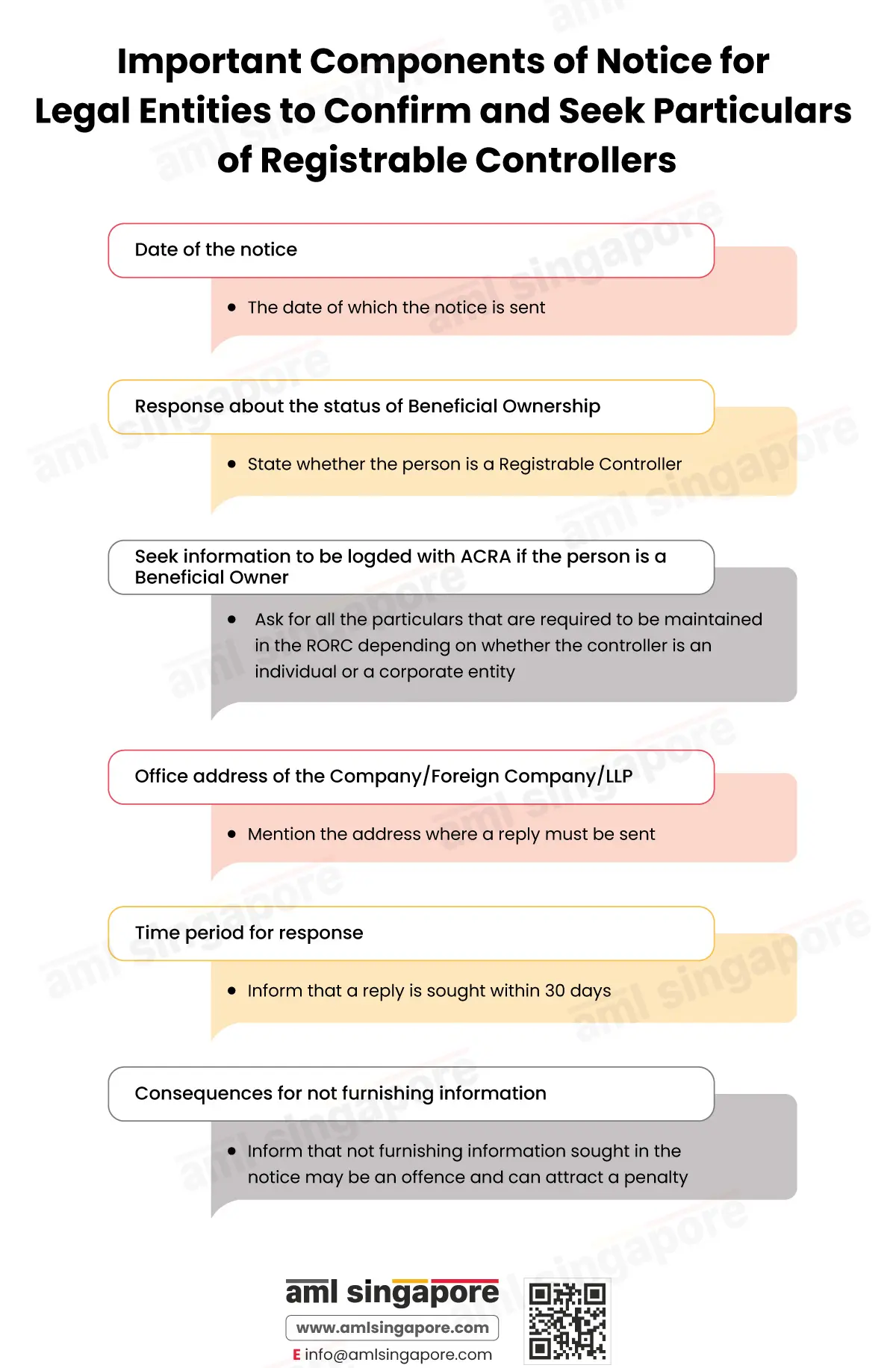

The notice must clearly seek the status of beneficial ownership, request for particulars if the addressee confirms that they are a beneficial owner and mention the address to which a reply must be sent, with a timeframe and the regulatory consequences of not responding to the notice.

The notice can be sent in either electronic or physical format.

By implementing these initiatives, companies, foreign companies, and LLPs can fulfil their regulatory obligations towards identifying the beneficial owners.

Obligation for Companies, Foreign Companies, and LLPs with Ambiguity in Identifying Their Registrable Controller

Companies, foreign companies, and LLPs are obligated to identify their registrable controllers or beneficial owners.

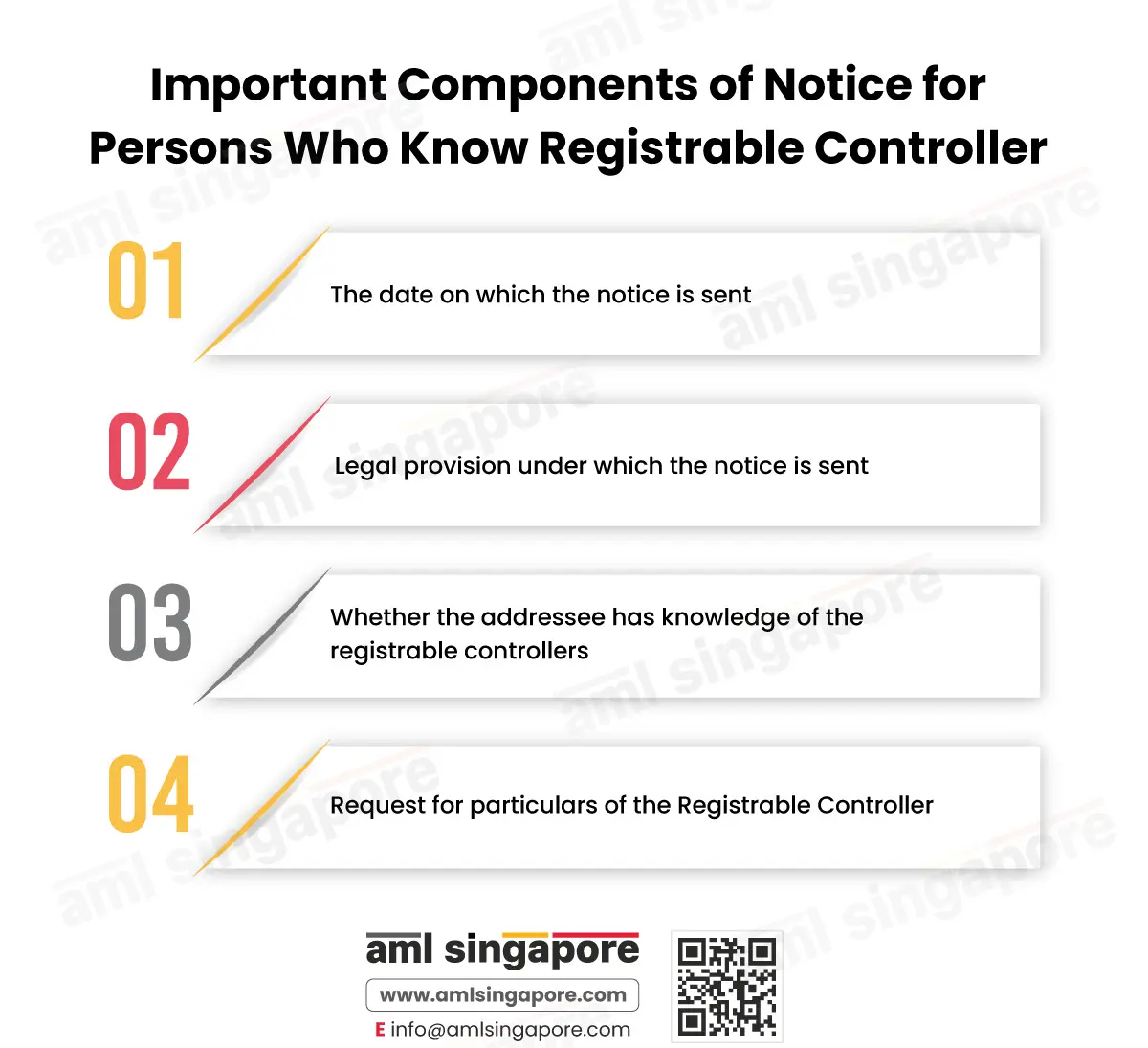

However, if they are not able to identify their registrable controllers, they must send notices to individuals and legal persons that the company knows or has reasons to believe that such persons know or have reasonable grounds to know the identity of a person who is a registrable controller of the company, foreign company or LLP.

Upon taking reasonable measures, if the companies, foreign companies, or LLPs are of the opinion that they do not have a beneficial owner or are unable to identify them, then all the directors with executive control and Chief Executive Officers (CEOs) of the company shall be taken as the registrable controller.

In such a case, companies, foreign companies, and LLPs must enter the following details:

- A note stating that the company or LLP knows or has reasonable grounds to believe that the company has no registrable controller or has not been able to identify the registrable controller.

- The note must also mention that all the CEOs and directors with executive control are taken to be registrable controllers of the company

- The particulars of CEOs and directors to be taken will be the same as that taken for individual controllers.

What Information Must Be Lodged with ACRA

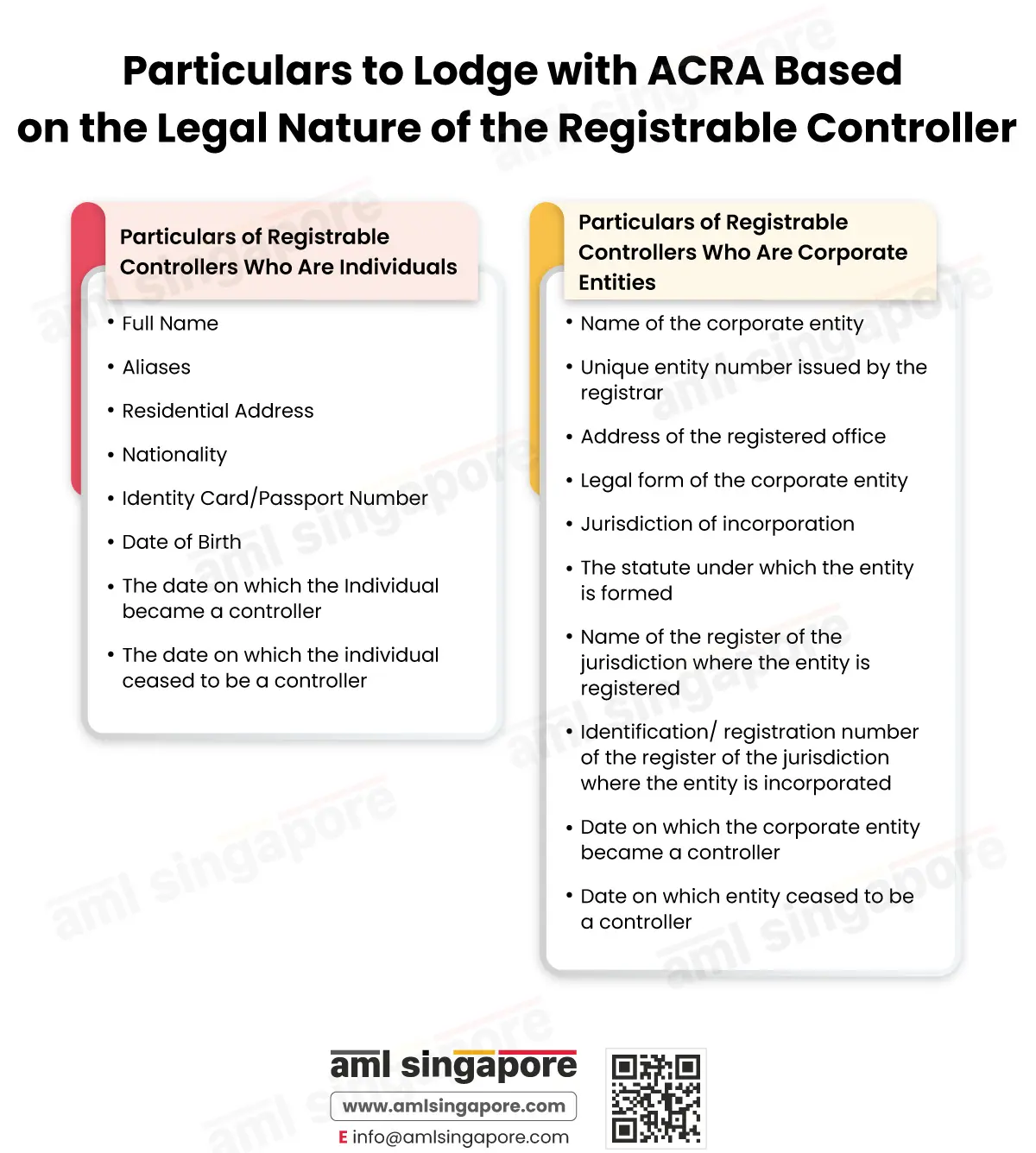

The Accounting and Corporate Regulatory Authority (ACRA) requires companies, foreign companies, and LLPs to lodge particulars of its Registrable Controllers. These particulars are differentiated based on whether the controller is an individual or a corporate entity.

An individual who has significant interest or control over the company, foreign company or LLP is an individual controller.

A body corporate or legal entity incorporated or existing in Singapore or a foreign company registered under the Companies Act having significant interest or control is a corporate controller.

Particulars of Controllers Who Are Individuals

Companies, foreign companies, and LLPs must collect the following information:

- Full name of the individual.

- Aliases (if any).

- Residential Address.

- Nationality of the individual.

- Identity card/passport number.

- Date of Birth.

- The date on which the individual became a controller of the company, foreign company or LLP.

- The date on which the individual ceased to be a controller of the company, foreign company or LLP.

Particulars of Controllers Who Are Corporate Entities

Companies, foreign companies, and LLPs must collect the following information:

- Name of the entity controller.

- A unique identity number is issued by the registrar (if any).

- The legal form of the entity controller.

- Address of the registered office of the entity.

- Jurisdiction where the entity is formed or incorporated.

- The statute under which the entity controller is formed or incorporated.

- Name of the register in the jurisdiction where the entity is registered.

- Identification or registration number of the entity in the register of the jurisdiction where it is formed or incorporated.

- The date on which the entity became controller of the company, foreign company or LLP.

- The date on which the entity ceased to be a controller of the company, foreign company or LLP.

The obligation to maintain RORC information with ACRA does not exempt companies, foreign companies, and LLPs from keeping the same information with themselves.

Lodging Information through a Registered Filing Agent or Self-Submission

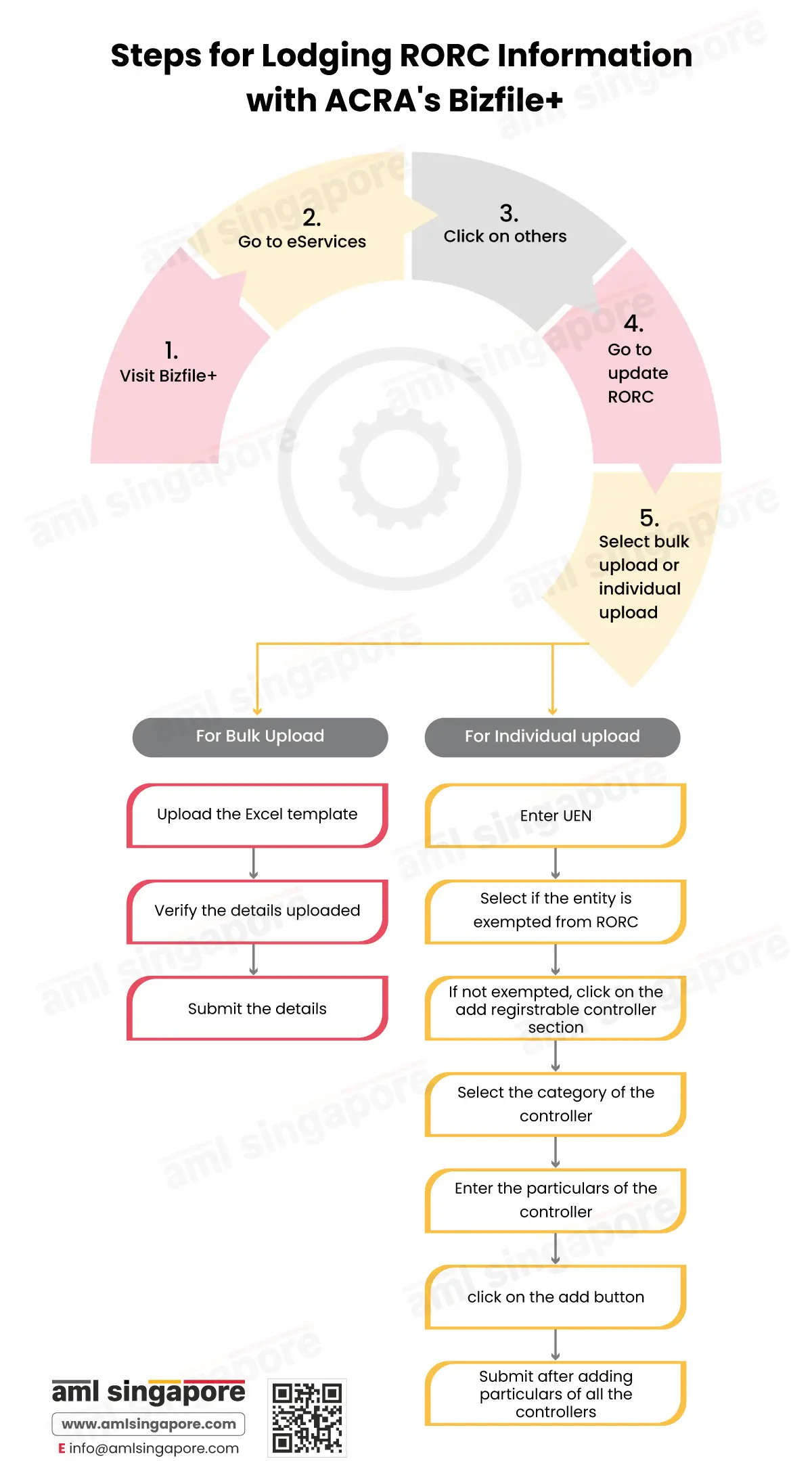

Companies, foreign companies, and LLPs can lodge the RORC information either by themselves or through their Registered Filing Agents (RFAs) using ACRA’s online portal Bizfile+.

Bulk Upload Option for RFAs

RFAs can bulk upload RORC information for multiple entities (such as foreign corporate entities, societies, trusts, and entities with UEN not issued by ACRA) identified as controllers using a prescribed Excel template that can be uploaded on Bizfile+.

The records uploaded through the bulk option are processed a day after they are uploaded. Hence, the lodgers are notified by email the next day after uploading. The information uploaded can be viewed through the transaction status enquiry option on Bizfile+ using the transaction number that is provided to the lodger.

Registered Filing Agents (RFAs) can only lodge RORC information for entities in their client list. Before Bulk uploading the information, RFAs need to ensure that they are authorised by their client to lodge and update RORC information on behalf of that client. However, no specific filing access is required for RFA to lodge their client’s RORC information with ACRA.

Individual Upload Option for Self-Submission

Individual companies, foreign companies, and LLPs can upload information for a single entity using the individual upload option by entering the Unique Entity Number (UEN). Companies must verify if they are exempted from updating RORC information. Unexempted entities should then decide the category of the registrable controller, whether it is a corporate entity or an individual, and then enter the relevant information.

Upon uploading all the particulars, the lodger must verify the information before finally submitting it to ACRA and keep a record of the acknowledgement receipt.

Updating RORC Information with ACRA

Companies, foreign companies, and LLPs have to keep the RORC information with ACRA accurate and up to date by periodically sending out a notice to all the registrable controllers asking if a relevant change in the particulars has occurred or if any of the particulars in the RORC are incorrect.

If the company, foreign company, or LLP receives credible information that the particulars of its registrable controllers are incorrect or outdated, then such company or LLP must notify its registrable controller to share correct information. Such notice can be sent physically or electronically. There is no regulatory requirement for a director or secretary’s signature on the notice or for the notice to be sent through a registered address.

If a company, foreign company, or LLP that could not previously identify or did not previously have a registrable controller updates the particulars of a registrable controller. Then, the company or LLP must also enter a note in the register that its directors and CEOs cease to be the registrable controllers, along with the date on which the particulars are added.

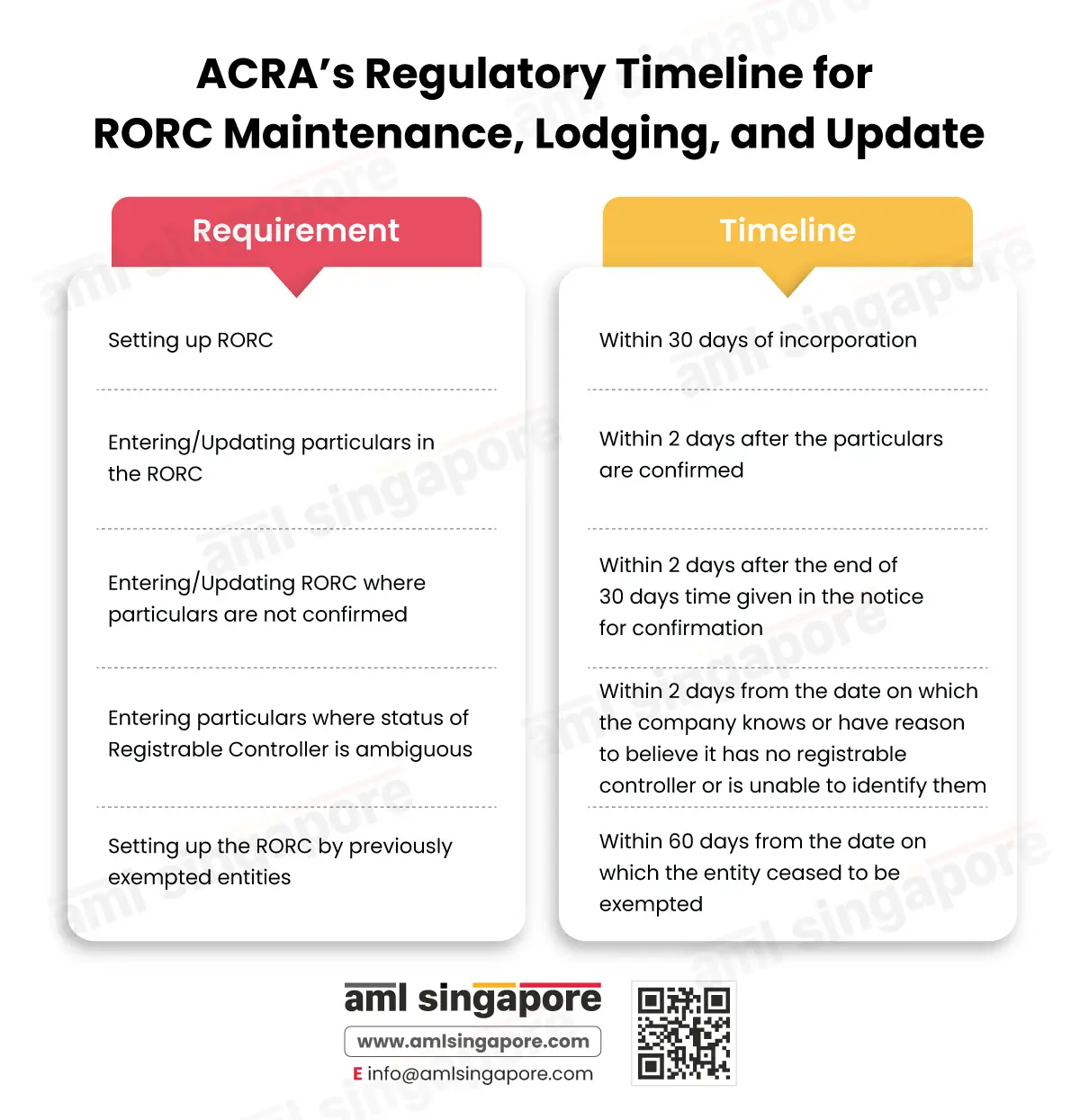

ACRA’s Regulatory Timelines for RORC Maintenance, Lodging and Update

There exists a timeframe that companies, foreign companies, and LLPs need to abide by when keeping, lodging or updating RORC information. The RORC must be set up within thirty days of incorporating the company or LLP.

Within thirty days, companies, foreign companies, and LLPs take reasonable measures to identify the beneficial owners and seek confirmation from such persons by sending out notices. Once a confirmation is received in reply to the notice, companies, foreign companies, and LLPs must enter the particulars within two days of confirmation.

However, if no confirmation is received, companies, foreign companies, and LLPs must enter the particulars that they have in their possession within two days after the end of thirty days from the date on which the notice was sent.

If the company, foreign company, or LLP is satisfied that it has no registrable controller or is unable to identify them, then the company, foreign company, or LLP must enter the particulars and note within two days from the date on which the company, foreign company, or LLP forms such an opinion.

If there are any changes in the particulars entered in the RORC, the company, foreign company, or LLP must update the changes in the RORC within two days from the date on which such change comes into the knowledge of the company.

Never Miss a Deadline with AML Singapore

AML Singapore is there with you at every step in ensuring timely compliance

with ACRA regulations

Penalties for Not Maintaining RORC Information with ACRA

The Companies Act, 1967 and the Limited Liability Partnership Act, 2005 requires companies, foreign companies, and LLPs (unless exempted) to comply with the RORC obligations. If the compliances are not met, then companies, foreign companies, and LLPs are liable for a penalty of up to 5,000 SGD.

The regulatory framework in Singapore also mandates controllers to disclose information to be mentioned in the RORC and update the company, foreign company, or LLP about any changes in the RORC particulars. Failure to meet this requirement can result in a penalty of up to 5,000 SGD for the controller.

Common Mistakes to Avoid while Filing RORC Information

Maintaining, lodging and updating RORC information can be a tedious task. Therefore, companies, foreign companies, and LLPs should try to avoid the following commonly occurring mistakes:

- Not checking if the entity falls under the exempted category

- Furnishing incomplete or incorrect information without any justification with ACRA where complete information is not available with the company, foreign company or LLP

- Missing statutory timelines for filing or updating information

- Not identifying registrable controllers having significant interest or control

- Wrongly identifying registrable controllers that do not meet the criteria for holding significant interest or control

- Not verifying details entered on Bizfile+ before submitting it to ACRA

Best Practices for Maintaining RORC

- Documenting copies of the notices sent to the registrable controllers and receipt of their replies.

- Reviewing and updating the RORC information annually by checking for any material changes with the beneficial owners.

- Documenting reasons for satisfaction about accuracy and relevancy of RORC particulars if the company/LLP opts not to send a notice for updating particulars to its registrable controllers.

- Sending notice electronically through a registered email address with the signature of a Key Managerial Person (KMP), for instance, a director or secretary.

- Review the register of members and constitution to determine if an individual or corporate entity qualifies as a registrable controller.

- Attach relevant supporting documents, such as the National Registration Identity Card (NRIC), passport copy, utility bills and certificate of registration, when lodging RORC information copy of foreign controllers with ACRA.

- Keep a note of persons who have access to RORC.

Conclusion

Companies, foreign companies and LLPs equipped with a comprehensive understanding of the process of setting up and maintaining RORC and lodging and updating RORC information can effectively fulfil the regulatory requirements set by ACRA.

Frequently Asked Questions

The Monetary Authority of Singapore (MAS) has issued notice for VCCs that requires them to maintain a register of registrable controllers. However, there are no lodging requirements for the same

Yes, the RORC should contain information about the past controllers, including the date on which the individual or entity ceased to be a controller

Records uploaded using the bulk option are processed a day later. Hence, an email is sent to the lodgers on the next day regarding the number of records processed

No, there is a feature for amendment of RORC information on Bizfile+. Hence, there is no requirement to file a notice of error

Yes, companies, foreign companies, and LLPs are required to identify their beneficial owners and maintain a register of registrable controllers that is separate from other statutory registers that they are required to maintain

Need Professional Assistance in Lodging and Updating RORC Information with ACRA?

AML Singapore simplifies compliance with ACRA’s regulatory requirements

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 9 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.