KYC Essentials: For Identifying the Customers under AML Singapore Laws

KYC Essentials: For Identifying the Customers under AML Singapore Laws

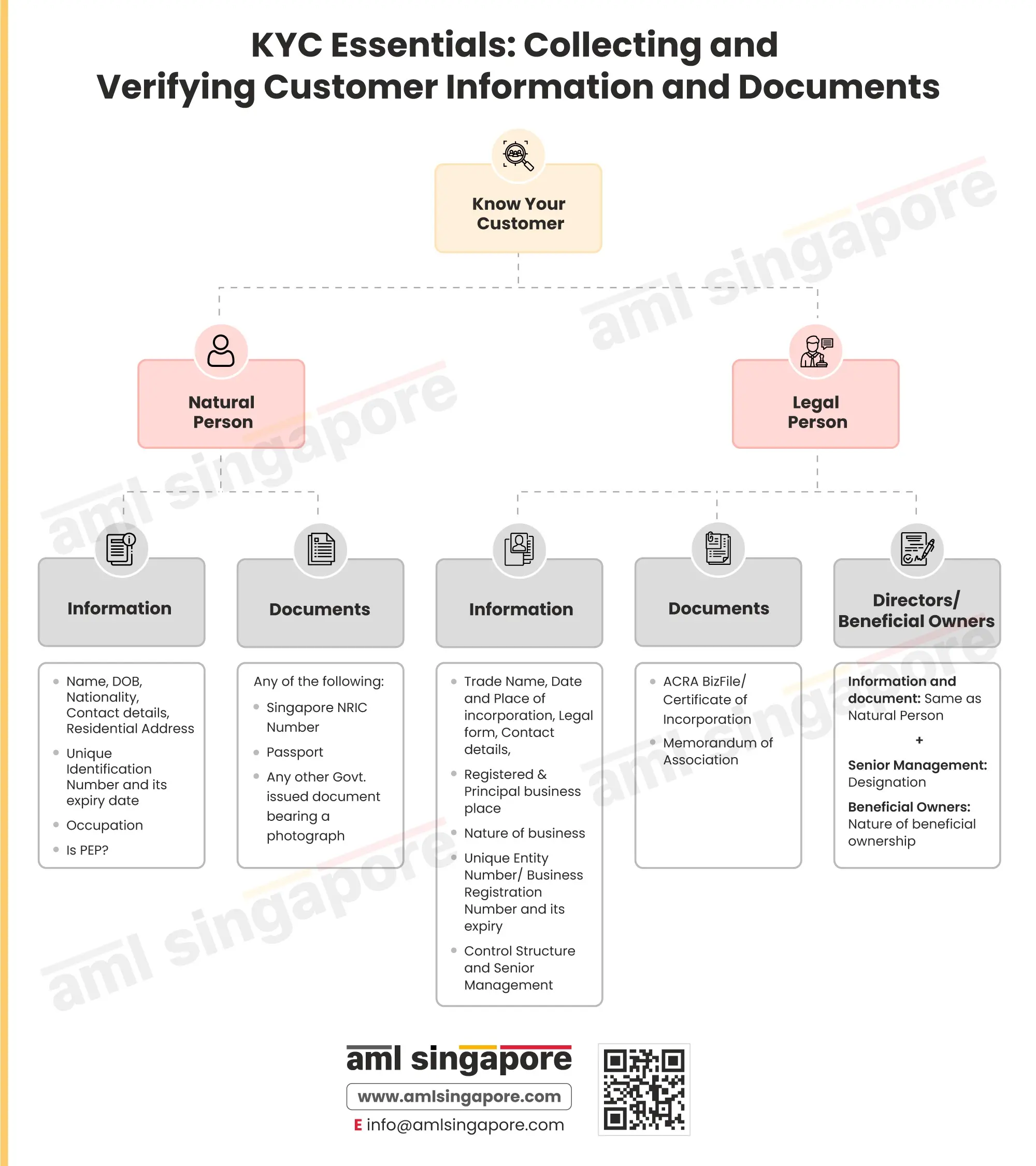

The AML regulations in Singapore require the Financial Institutions and the DNFBPs to implement adequate policies and systems to identify the customers and verify their identity. Here, the regulated entities should develop a comprehensive Know Your Customer (KYC) process to comply with the regulatory obligation and identify the customers it engages with to avoid any penetration of criminals in the business.

When talking about a natural person, the key identifying information is pertinent, such as full name, date of birth, nationality, and contact details, including residential address. Further, the regulated entity must obtain the customer’s unique identification number and its expiry, along with supporting identity document. Inquiry around the occupation and the person’s connection with a Politically Exposed Person (PEP) is also very crucial.

For a corporate customer, information about the company, its business, its place of registration/operations, and details about the senior management and the beneficial owners is mandatory. Corresponding documents to corroborate these details must be sought. The regulated entity must also perform a KYC process for the directors and beneficial owners, as applied to an individual customer.

Here is an infographic discussing the critical information that must be sought as part of the KYC process and the documents to be obtained to verify the information from the individual and the corporate customers.

Let AML Singapore assist you in developing your KYC system, ensuring that you comply with the regulatory requirements while safeguarding your business against financial criminals.