Key Red Flags in Employee Due Diligence

Key Red Flags in Employee Due Diligence

Singapore is a leading global financial centre that creates various business opportunities. To take advantage of these opportunities, regulated entities need to employ people to fulfil their client demands. However, when employing, regulated entities must consider key red flags in Employee Due Diligence process to mitigate risks and ensure AML compliance.

The Regulated entities in Singapore should incorporate conducting Employee Due Diligence into their AML internal policies, procedures and controls (IPPC) to safeguard themselves against any money laundering (ML), financing of terrorism (FT) and proliferation financing of weapons of mass destruction (PF) risks posed by employees.

Employee Due Diligence is a process by which regulated entities can screen their prospective and existing employees and their respective backgrounds to determine their suitability and manage ML/FT and PF risks. By conducting Employee Due Diligence adequately, regulated entities in Singapore can better detect and deter financial crime by ensuring their employees have a spotless track record, reflecting their integrity and accountability towards curbing ML/FT and PF.

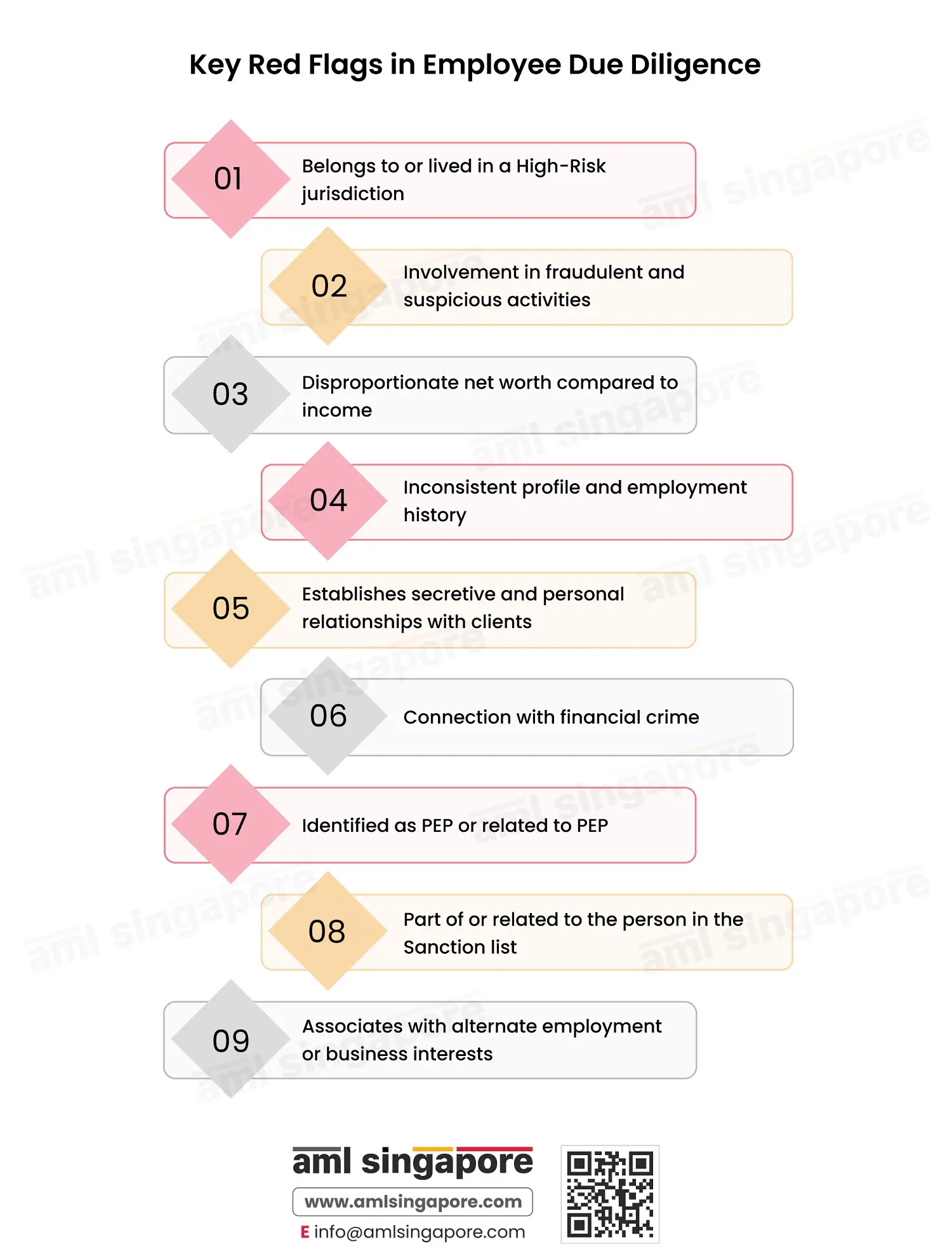

Following is the list of key red flags associated with an employee that regulated entities should be aware of during the Employee Due Diligence process:

1. Belongs to or lived in a High-Risk jurisdiction

Employees residing or having lived in geographies known for weak AML/CFT regimes should be monitored and investigated, as this raises concerns about their intentions to work with regulated entities.

2. Involvement in fraudulent and suspicious activities

An employee involved in fraudulent and suspicious activities, like forging documents, giving or receiving bribes, kickbacks or professional favours, should be thoroughly investigated to identify bribery and related financial crimes. Regulated entities must keep checking on employees to confirm their identities are not misused to promote ML/FT or PF activities.

3. Disproportionate net worth compared to income

Employees whose lifestyles, assets, or conduct show a significant gap between their reported income and their net worth could indicate their involvement in ML/FT activities and potential financial irregularities such as tax evasion, identity theft, layering funds or involvement in money laundering. Thus, regulated entities should monitor and investigate their employees’ sources of wealth

4. Inconsistent profile and employment history

An individual’s CV or employment history speaks volumes about their integrity and conduct. Illogical anomalies in a CV or employment history should be examined deeply. Frequent job changes, drastic industry changes, taking up employment with a significantly lower pay scale at a remote location, and an unverifiable employment history may suggest integrity issues. Regulated entities must get reviews from previous employers to learn about the employees’ conduct and ensure that employees were not engaged in illicit criminal activities.

5. Establishes secretive and personal relationships with clients

Employees who engage in secretive or personal relationships with clients beyond company protocols could risk regulated entities against ML/FT activities by facilitating collaboration, collusion or elements of bribery to evade sanctions flags between employees and clients. Thus, regulated entities should monitor and restrict employees from entertaining clients outside of their scope of work.

6. Connection with financial crime

Regulated entities should thoroughly investigate any associations of their existing and prospective employees with financial crime to mitigate ML/FT risks and prevent financial crimes.

7. Identified as PEP or related to PEP

A Politically Exposed Person (PEP) poses high risks for ML/FT due to the nature of the influence they hold based on their position. An employee identifying as a PEP or having close relations with PEPs can indicate a higher risk of corruption or improper influence. Regulated entities should conduct proper employee due diligence before employing them.

8. Part of or related to the person in the Sanction list

Employees who are part of businesses or are related to persons whose names come up on the sanction lists, domestically or internationally, should be carefully scrutinised to ensure AML compliance.

9. Associates with alternate employment or business interests

Employees involved in multiple employment or business interests pose a risk due to undisclosed conflicts of interest. They could use multiple employment to hide the source of money obtained from illegal activity.

With a suitable Employee Due Diligence, regulated entities can strengthen their internal risk management structure. As employees are involved in routine business activities, regulated entities should be mindful of the red flag indicators related to employees to avoid hiring people who could potentially be involved in ML/FT activities.

Identifying and addressing these red flags during the Employee Due Diligence process is essential for mitigating potential risks and ensuring the integrity of the regulated entities and their workforce.