Key Indicators of Proliferation Financing: Recognizing Warning Signals

Key Indicators of Proliferation Financing: Recognizing Warning Signals

The Singapore AML regulations mandate that the regulated entities, such as financial institutions and designated non-financial businesses and professions (DNFBPs), must conduct a comprehensive risk assessment to understand their vulnerability to “proliferation financing.”

Proliferations financing refers to providing financial backing and services to organizations that use the funds to manufacture, acquire, possess, develop, transport, or perform any illegal activity related to nuclear, chemical, or biological weapons.

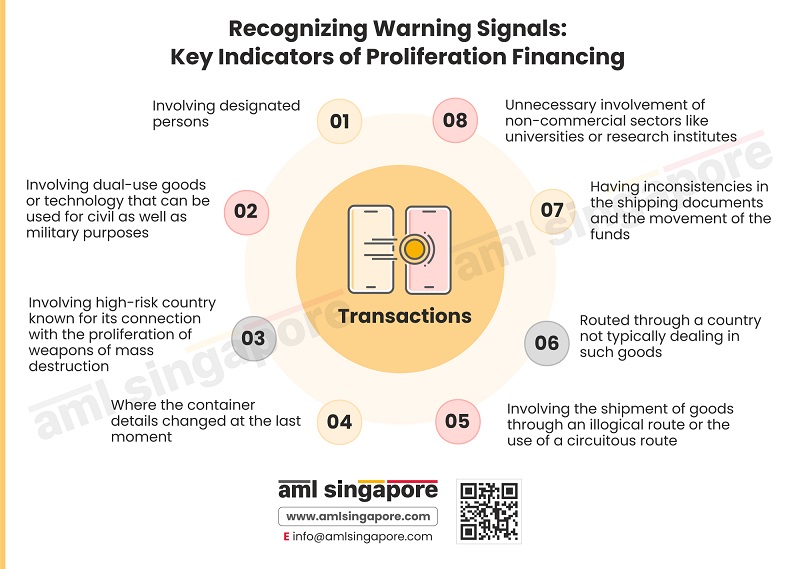

The infographic showcases warning signals of proliferation financing that can occur through your business. It explains the eight cases when a transaction can be potentially related to proliferation financing.

Take these instances as warning signals to counter proliferation financing:

- Transactions involving designated persons

- Transactions involving dual-use goods or technology that can be used for civil and military purposes

- Transactions involving a high-risk country known for its connection with the proliferation of weapons of mass destruction

- Transactions where the container details changed at the last moment

- Transactions involving the shipment of goods through an illegal route or the use of a circuitous route

- Transactions routed through a country not typically dealing in such goods

- Transactions having inconsistencies in shipping documents and the movement of the funds

- Transactions having unnecessary involvement of non-compliance sectors like universities or research institutes

Businesses must put these warning signals as alerts to get notified whenever such activity occurs and mitigate proliferation financing risks.

With our experience in countering proliferation financing and terrorist financing risks, AML Singapore can assist regulated entities in creating a robust, secure system against proliferation financing. We can assist businesses in conducting a risk assessment to pinpoint vulnerable junctures and create AML policies and procedures that minimize PF/TF risks.