Implement a Transaction Monitoring Program to strengthen the AML Efforts

Implement a Transaction Monitoring Program to strengthen the AML Efforts

Why is Transaction Monitoring a critical component of the AML Program?

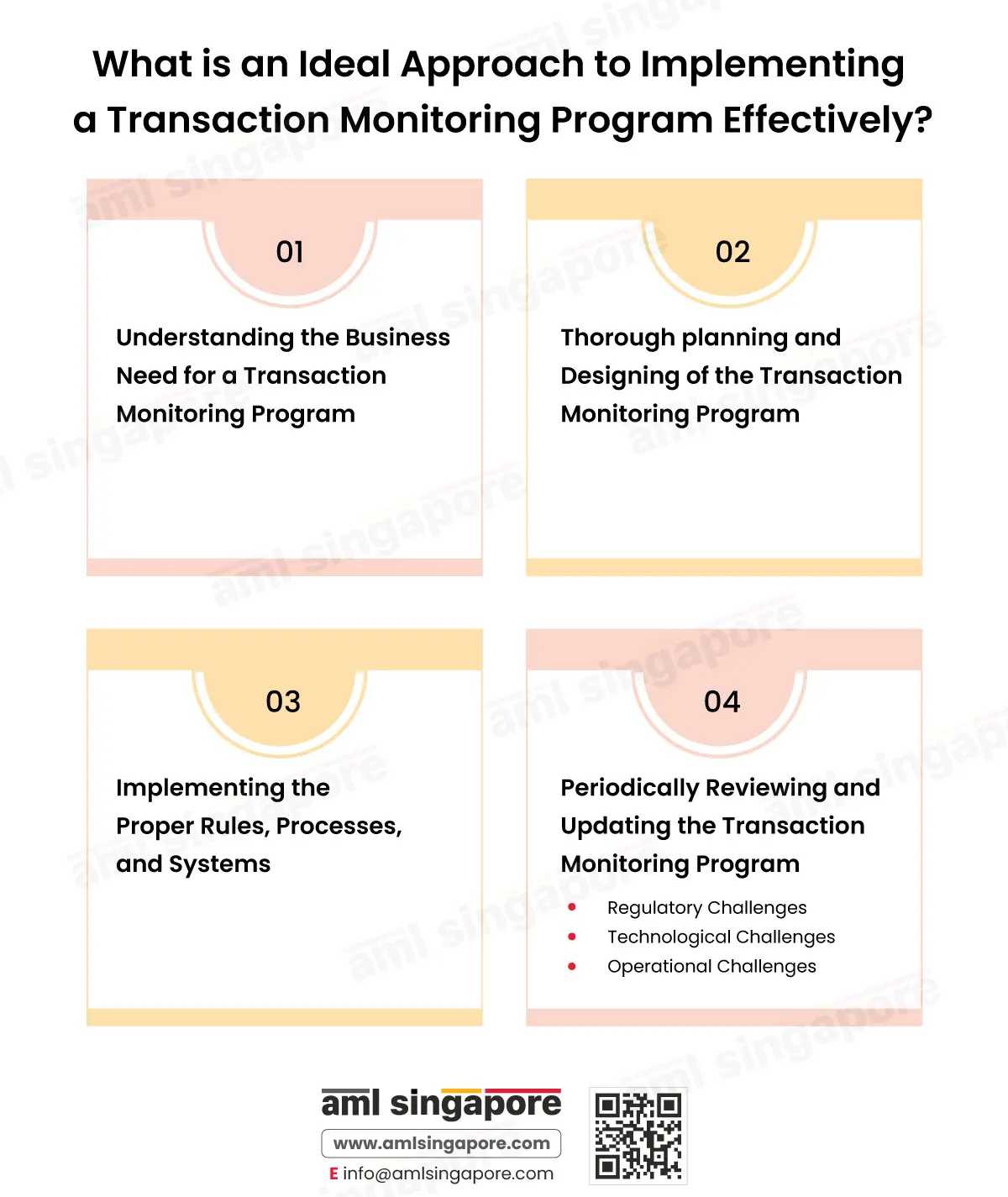

What is an ideal approach to implementing a Transaction Monitoring Program effectively?

The effectiveness of the transaction monitoring program depends on how well the regulated entity has designed and implemented the same. The regulated entities may follow the below-mentioned steps to set up the transactions monitoring program systematically:

Understanding the business need for a Transaction Monitoring Program

The transaction monitoring program must be based on the entity’s risk exposure to the financial crime and the regulatory obligations imposed thereupon. Thus, the first step is to conduct the Enterprise-Wide Risk Assessment and determine the degree of risk each risk parameter poses to the business. The outcome of the risk assessment shall help the entity prioritize the resources and work out the scope of the monitoring program and the outcome expected in the context of different risk factors.

Moreover, considering the regulatory landscape will align the transaction monitoring program with applicable laws, enabling the entity to stay AML compliant.

The objective and scope of the transaction monitoring program must be well documented.

Thorough planning and designing of the Transaction Monitoring Program

Having worked out the need for a transaction monitoring program, the regulated entity must proceed with developing a program plan and design its implementation method. This stage involves prioritizing the risk areas and identifying and allocating the resources required. Here, the regulated entities would ponder upon the involvement of the human resources and the technology and tools required.

The entity must develop transaction monitoring policies and procedures, define the roles and responsibilities of the concerned personnel, integrate the program with the customer due diligence process, and other relevant aspects on which the program would rely for input data.

Implementing the proper rules, processes, and systems

Periodically reviewing and updating the Transaction Monitoring Program

Regulatory Challenges

The latest developments in the applicable regulations and laws must be tracked and analyzed for their impact on the monitoring program. The required changes must be included in the transaction monitoring policies and systems to ensure adherence to the recent regulated amendments, avoiding any non-compliance consequences.

Technological Challenges

The integration of the monitoring program with the existing systems must be checked to ensure that complete and accurate data is flowing for transaction monitoring. Data validation exercises must be conducted regularly to maintain the systems’ effectiveness and ensure that no suspicious transactions go undetected.

If required, the weaknesses in the system must be managed by deploying technological updates or, if required, investing in advanced solutions.

Operational Challenges

The monitoring rules and rationales must be reviewed regularly to ensure that the alerts generated by the system are relevant, reducing the wastage of time and resources on unnecessarily investigation the false alerts flagged by the system.

Further, there shall be periodic refresher training for the relevant team members around the transaction monitoring program and conducting preliminary investigations of the highlighted transactions. This will ensure that the team is aware of the enhancements made to the entity’s transaction monitoring program, enabling them to resolve the alerts in a timely manner.

Only when the transaction monitoring program is systemically designed and implemented; its objective of detecting the risk indicators and preventing financial crime can be achieved.

How can AML Singapore assist you in designing and implementing the Transaction Monitoring Program to foster the AML framework?

With our years of experience working on AML implementation across entities in different sectors and jurisdictions, AML Singapore can assist you with designing a robust AML Program, including the much-needed Transaction Monitoring Program. We understand your exposure to financial crime and overall business profile and assist in selecting the appropriate technology and software that helps you stay compliant with Singapore’s AML regulations and safeguard your business against money laundering and terrorism financing.

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise- Wide Risk Assessments to implementing the robust AML Compliance framework. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.