How to implement a risk-based approach to AML?

How to implement a risk-based approach to AML?

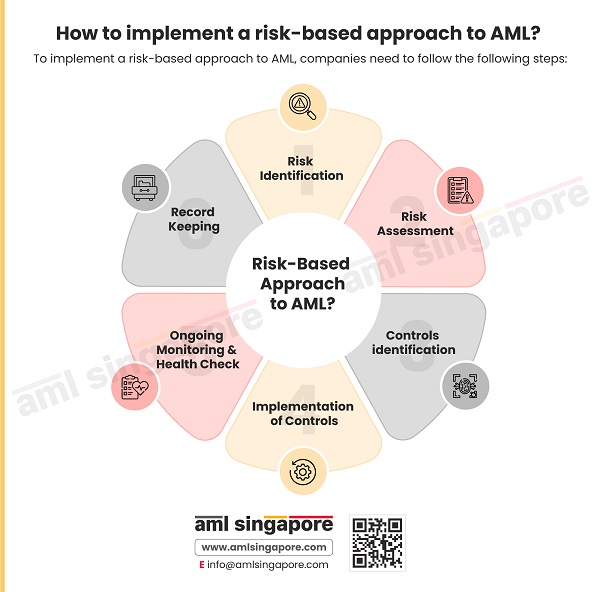

The risk-based approach is a methodology where you identify the risks, assess them, and manage them by the level of damage they can cause. The above-added infographic showcases the six steps to implement a risk-based approach to anti-money laundering which are:

- Risk Identification: Identifying the type of risk associated with the customer, product, service, geography, delivery channel, and technology.

- Risk Assessment: Assess the risk for its impact on the business and the probability of its occurrence.

- Controls Identification: Identify and align suitable controls with the risks assessed.

- Implementation of Controls: After the identification, one needs to implement the controls in all the AML-related processes and then check their effectiveness by understanding how they are working along with your AML processes.

- Ongoing Monitoring and Health Check: Keep monitoring the performance of controls and keep them updated as per the new risks, increase or decrease in the likelihood of occurrence, and change in the nature of the business. One needs to ensure that the risk remains under the risk appetite of the company

- Record keeping: Maintain records related to ML/TF and customers’ risk assessment, records related to risk factors and their likelihood and impact, and records related to KYC, screening, STR, and ongoing monitoring.

By following this approach, you will be able to counter money laundering and terrorist financing risks effectively and stay compliant.