Guide to Beneficial Owner under Singapore AML regulations

Guide to Beneficial Owner under Singapore AML regulations

Several terms and jargon are used when discussing anti-money laundering laws and the various compliance requirements. One of them is identifying the beneficial owners (‘BO’). Let us discuss the beneficial ownership from an AML compliance perspective under Singapore’s AML regulations.

Cases of financial crimes involving money laundering and terrorist financing are increasing daily. Also, criminals are misusing the advancement in technology to evade government scrutiny. So, it has become more pertinent than ever to identify the beneficial ownership of customers and other stakeholders to get a clear picture of the identity of all the people and entities involved in the business relationship.

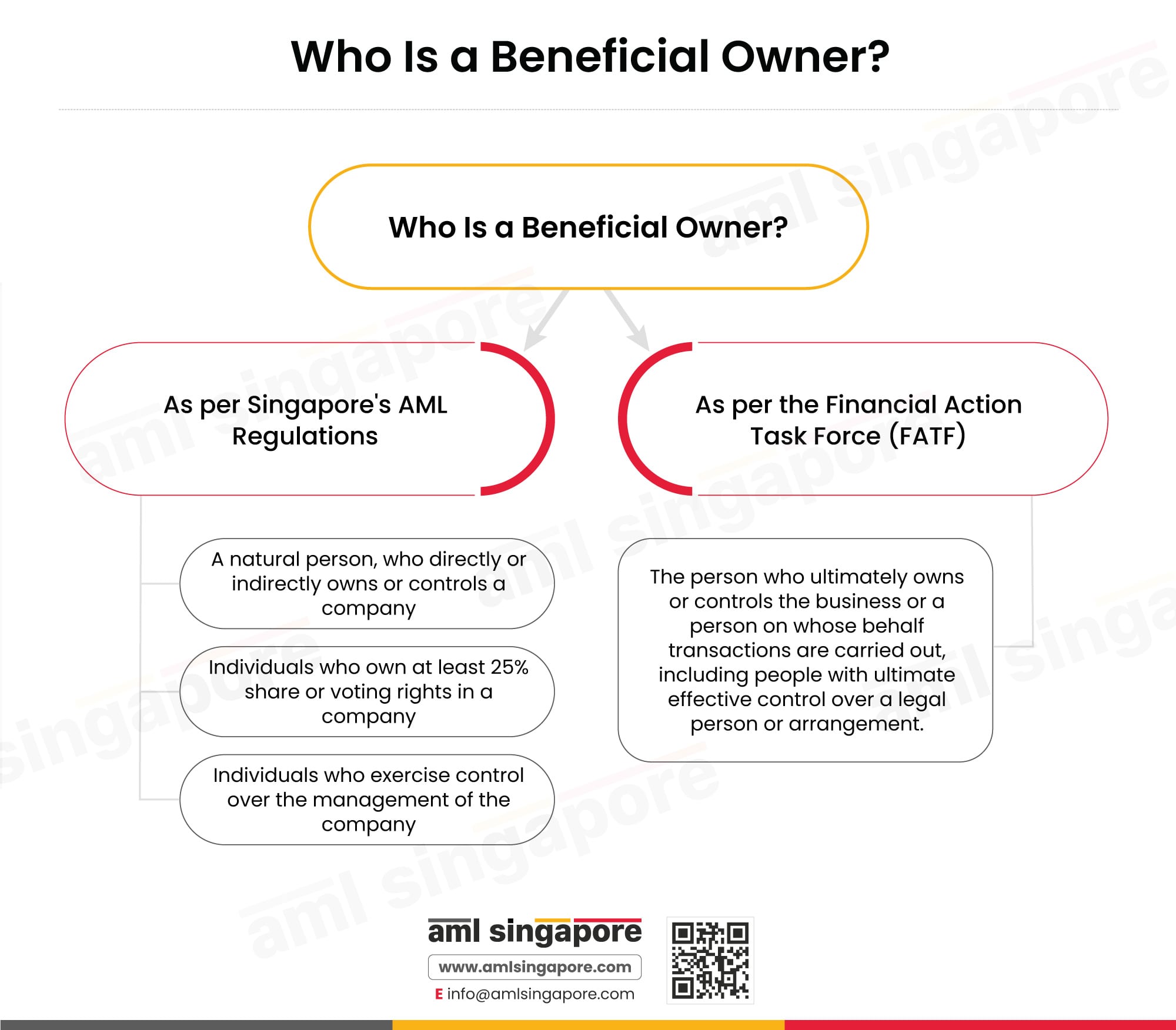

Who is a Beneficial Owner?

A beneficial owner can be described as a person who is the owner of a business or a person who controls it. Knowing the legal entity and the person who manages the company is likely to get the maximum benefit from the transaction with the business organization. It will help correctly assess the customer-specific risk of associating with the business and the management of the same. Knowing the BO will allow the company to effectively carry out the KYC process and comply with the AML laws by knowing the person identity who will benefit most from the business relationship.

As per the FATF, the beneficial owner is the person who ultimately owns or controls the business or a person on whose behalf transactions are carried out. The FATF also says that the BO includes people with ultimate effective control over a legal person or arrangement.

As per the Singapore AML regulations, the Beneficial Owner is defined as a

- natural person, who directly or indirectly owns or controls a company,

- Individuals who own at least 25% share or voting rights in a company,

- Individuals who exercise control over the management of the company.

Beneficial Owners and the KYC processes

KYC refers to Know Your Customer, a primary legal requirement that financial institutions and DNFPBs must adopt, followed by the performance of the Customer Due Diligence process. The basic rule here is to collect the customer information to identify and verify the customer’s identity. It helps in risk assessment. The main objective is that the individual or the entity with whom the institution will establish a business relationship is legit and the activities are not illegal.

KYC and BO identification are critical for legal and natural persons (as one person would be working on behalf of another person without a legal arrangement). An individual likely classified as BO is subjected to the KYC process. Their identification details should be obtained and verified. This verification should be continued until a natural person who owns or controls that legal person is identified.

Regulations in Singapore – AML as well as BO

It is known that governments worldwide have first implemented the AML rules, while the regulations regarding identifying the BO were introduced subsequently (mostly in recent times).

The AML laws provide BO identification as part of Know Your Customer measures. The objective of BO identification under the AML laws is to make business transactions more transparent and discourage criminals’ use of legal structures for carrying out money laundering and terrorism financing activities.

Processes that need to be followed for BO identification

Financial institutions and DNFBPs must follow the recommended processes to collect information about the BO. The business entities should seek the documents and other essential information during the customer onboarding. The details include the business’s name, the place of operation, the nature of the business, registration number, etc. The objective is to collect relevant information about the ownership of the business and know who controls the company and who has the power or influence to direct the transactions. The regulated entities may seek the documents such as organization structure, Memorandum of Association, or Register of shareholders and Senior Management to identify the beneficial owners.

Collecting beneficial ownership information is necessary if there has been a significant change in the account or transaction activities. It will identify who benefits the most from the association or acting behind the corporate veil.

Failure of BO identification and risk assessment procedures

The requirements related to BO identification aim to introduce regulatory mechanisms regarding beneficial owner data so that the artificial structure is not exploited to carry out illegal activities or financial crimes like money laundering.

The AML regulations provide enormous penalties for non-compliance with AML compliance requirements. Since the identification of BO forms part of the KYC process and, thus, of AML compliances, this must be adhered to. Further, by non-identifying BO, financial institutions and DNFBPs would be assumed to encourage the shell legal structures to carry out financial crimes. This will result in hefty administrative penalties and reputational damage to the regulated entities.

Preparing yourself to identify BOs and stay AML compliant

AML laws are becoming stricter and financial institutions, and other regulated entities must adopt a comprehensive AML/CFT framework to avoid penalties for non-compliance. The strictness results from the rising money laundering cases and high-profile cases in the public domain. Such cases question the integrity of the business entities and the government, which is expected to take actions to combat money laundering and financing terrorism.

The best way to prepare for a challenging future and comply with AML regulations is to develop and adopt a proactive approach to KYC and CDD measures, including robust KYC questionnaires and procedures to dive into the structure of the legal person to understand the ownership and control interest. It would ensure that the business entity has accurate details of the legal structure and the beneficial ownership of the customer to trace down the source of the financial crimes easily.

Relying on professional AML consultants would be the best recommendation for implementing a comprehensive AML/CFT framework. We, AML Singapore, offer end-to-end services such as in-house AML compliance department setup, conducting enterprise-wide risk assessment (EWRA) comprehensive AML training to the Compliance Officer and the team, assistance in the selection of the right AML software, and periodic AML/CFT health check needed to stay AML compliant and avoid penalties.

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise- Wide Risk Assessments to implementing the robust AML Compliance framework. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.