Factors for conducting Enterprise-Wide Risk Assessment under Singapore AML Laws

Factors for conducting Enterprise-Wide Risk Assessment under Singapore AML Laws

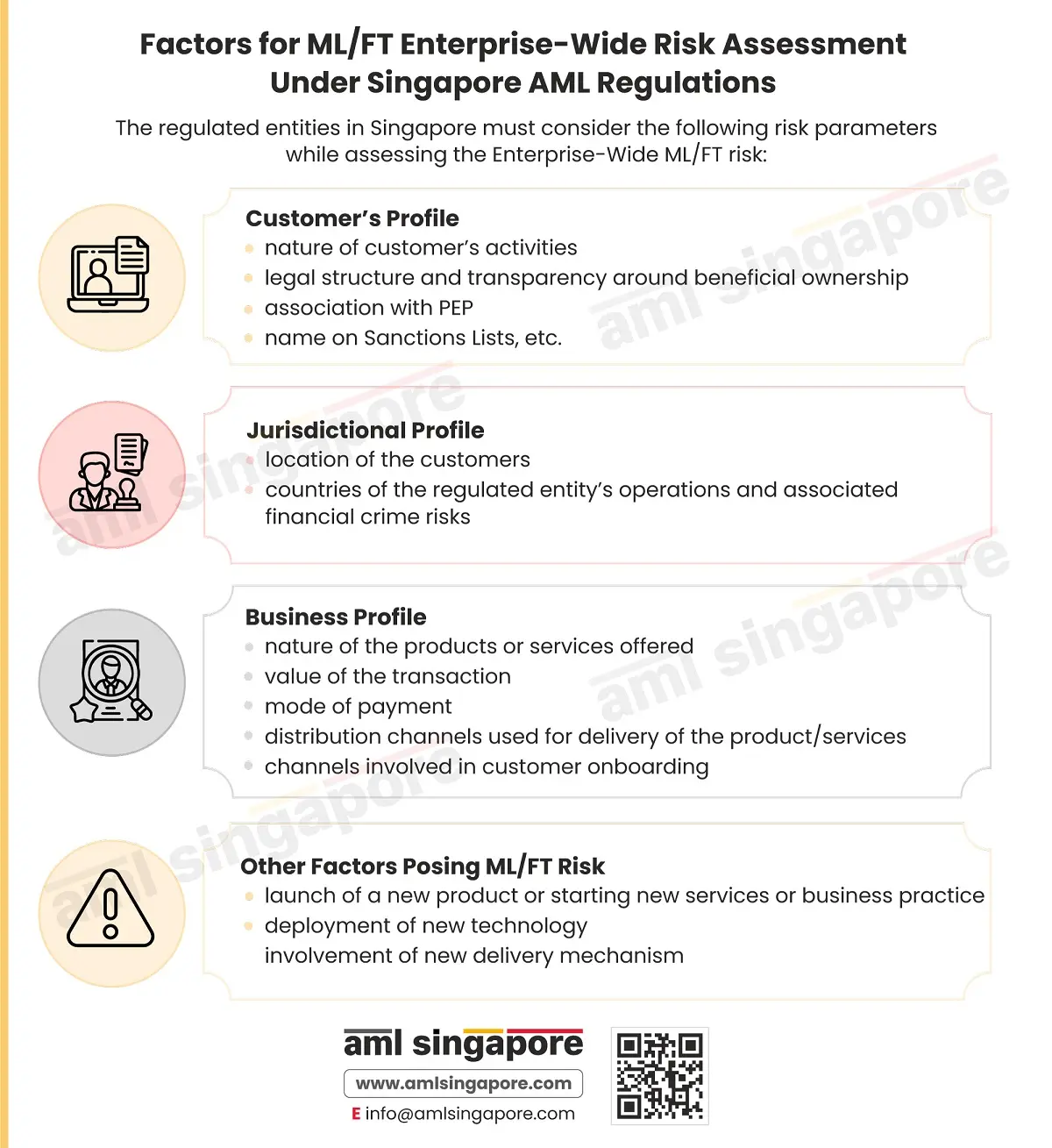

The Singapore AML Regulations provide that the regulated entities – whether a Financial Institution or the Designated Non-Financial Businesses and Professions (DNFBPs) – must conduct the Enterprise-Wide Risk Assessment to evaluate the business’s overall exposure to money laundering and terrorism financing risks. The regulated organizations must consider some of the critical risk factors to ensure the accuracy and comprehensiveness of the outcome of the business risk assessment.

These risk factors include the following:

- The nature of the customers the entity is engaged with, including the customer’s business profile, type of structure, etc.

- The location or geographies in which the company is operating and the countries from which its customers are hailing or actively associated with

- The overall business profile of the regulated entity, covering:

- the type of products and services offered,

- size, volume, and complexities of the transactions, including the mode of payments accepted

- delivery and distribution channels deployed, etc.

Further, the regulated entities must assess the risk vulnerabilities associated with launching any new product or service, including using any emerging technology or deploying any new delivery channel.

Here is a visual chart discussing the critical risk parameters a regulated entity must consider while performing the Business Risk Assessment (BRA) or Enterprise-Wide Risk Assessment (EWRA) regarding Singapore’s AML regulatory framework.

At AML Singapore, we assist businesses in evaluating the ML/FT risks and the potential impact on operations, factoring all the relevant risk elements relevant to the business. Basis the outcome of the risk assessment, we help the regulated entities design the tailor-made AML framework – Internal Policies, Procedures, and Controls (IPCC) to manage the assessed ML/FT risks.