Exploring the Benefits of Risk-Based Approach

Exploring the Benefits of Risk-Based Approach

The Singapore AML regulations provide for applying the Risk-Based Approach to combat financial crimes like money laundering and terrorism financing effectively. This Risk-Based Approach is a mechanism that directs the regulated entities’ AML/CFT efforts in sync with the financial crime risk identified. Thus, the extent of risk mitigation measures to be adopted depends on the severity of the assessed risk.

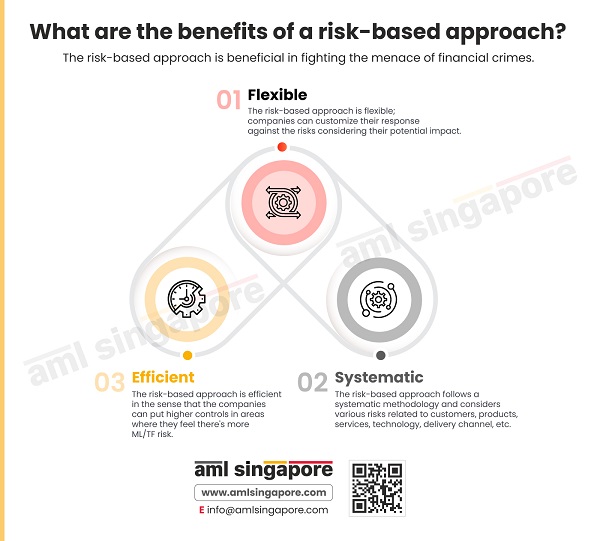

Leveraging the following benefits of Risk-Based Approach while designing and implementing the AML program is very critical for every regulated entity – whether a Financial Institution or Designated Non-Financial Business or Profession (DNFBP):

- Flexibility: The Risk-Based Approach (RBA) is flexible and dynamic, wherein the level of controls can be implemented based on the nature of the risk exposure and its potential impact, the size and nature of the business operations, etc. RBA allows every regulated entity to personalize its financial crime risk mitigation plan.

- Efficient: RBA allows the regulated entity to optimally utilize the resources and tools to manage the assessed risks, i.e., solid and enhanced controls for activities or customers posing a higher risk, rather than burdening the entire business operations with stringent measures not required for the assessed vulnerabilities.

- Systematic: RBA follows a methodical approach to assess the risk, considering the relevant risk factors like customer base, geographies, nature of products/services, etc., and helps in determining the comprehensive financial crime risk profile for the business.

Here is an infographic highlighting the benefits of adopting the Risk-Based Approach to develop a robust AML compliance function and effectively implement the same to manage the day-to-day exposure to money laundering and terrorism financing.

AML Singapore is a leading AML consultancy service provider, assisting regulated entities in conducting Enterprise-Wide Risk Assessments and identifying the correct set of mitigation measures required for such assessed risks. With AML Singapore’s assistance, implement the tailor-made AML solution developed on the foundation of a Risk-based Approach and effectively harp on your exposure to money laundering and terrorism financing.