Elements of Internal Policies, Procedures & Controls (IPPC) under Singapore’s AML Regulations

Elements of Internal Policies, Procedures & Controls (IPPC) under Singapore's AML Regulations

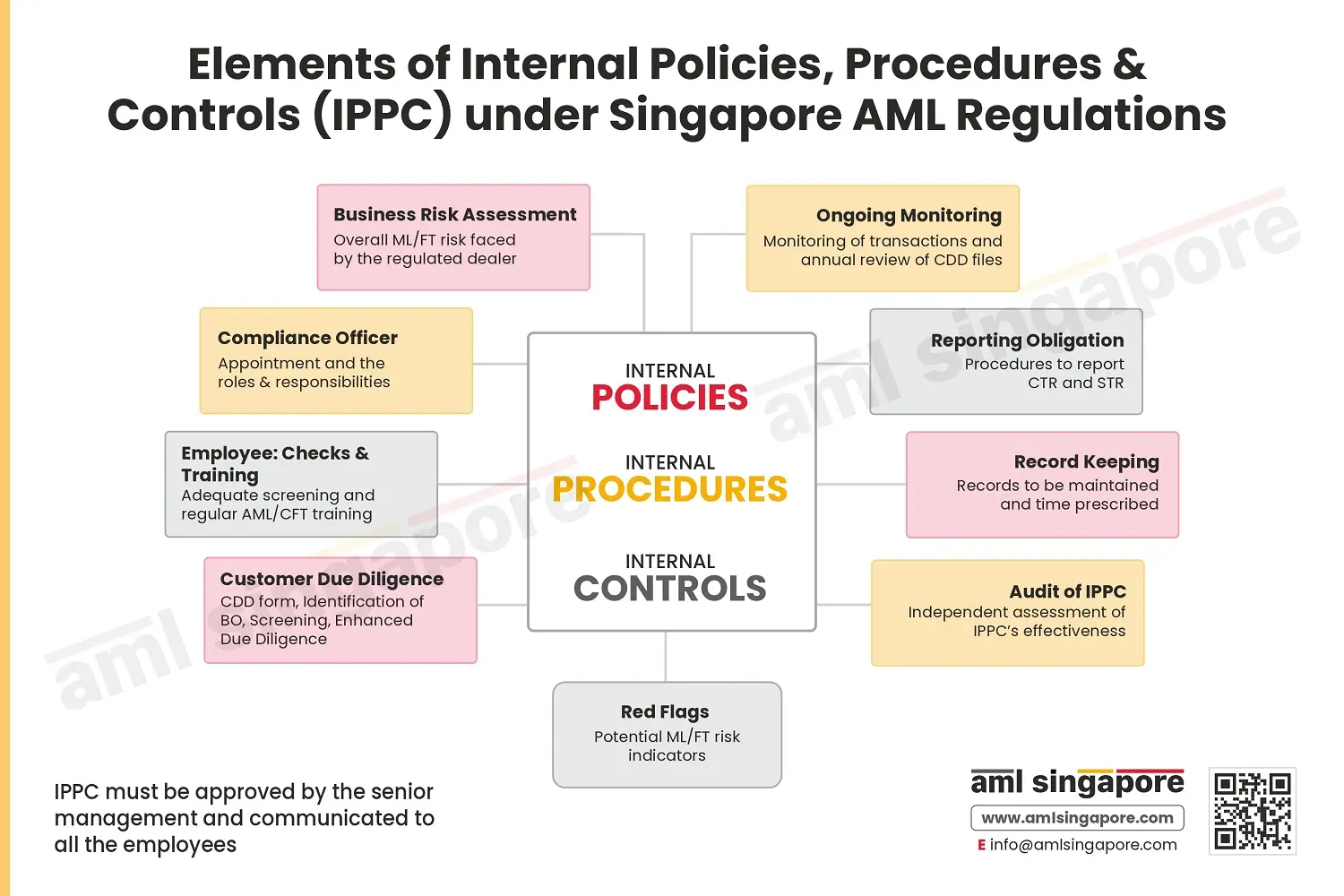

Singapore has developed a strong regulatory framework around anti-money laundering and combatting the financing of terrorism. The AML/CFT regulations mandate the regulated entities to implement a comprehensive AML compliance framework through Internal Policies, Procedures & Controls (IPPC). The key elements of Internal Policies, Procedures & Controls under Singapore AML regulations are:

- Business Risk Assessment: Laying down the methodology of identifying the overall ML/FT risk business is exposed to, including the risk factors to be considered.

- Compliance Officer: Designating a person to act as Compliance Officer and clearly specifying the Compliance Officer’s roles and responsibilities in managing AML Compliance Program.

- Employee Training Program: Designing a comprehensive AML training program for the employees and the senior management to ensure solid AML compliance culture.

- Customer Due Diligence: Clear policies, procedures, and systems to perform KYC, identifying the Beneficial Owners of the customers, screening, customer risk assessment, Enhanced Due Diligence process, etc.

- Red Flags: ML/FT red flags must be included in the IPPC and communicated well with the entire team to ensure the employees understand the risk indicators and identify suspicious activities.

- Ongoing Monitoring: Monitoring procedures, controls and systems must be well defined for monitoring the customer relationship and the ongoing transaction monitoring.

- Reporting Obligation: IPPC must lay guidelines around the AML regulatory reporting procedures and best practices for filing Cash Transaction Reports (CTR), Suspicious Transaction Reports (STR) and Semi-Annual AML Returns (SAR).

- Record Keeping: AML documentation policy must be well defined, including AML records to be maintained, how the records will be maintained, archival policy, and minimum time for which the records shall be maintained.

- AML Audit: AML audit function must be part of the policy, focusing on ensuring the quality and effectiveness of the AML measures.

Here is a visual guide highlighting the key elements of the Internal Policies, Procedures, and Controls (IPPC) required to be designed and implemented under Singapore AML regulations.

AML Singapore is a consultancy firm focused on assisting regulated entities in Singapore in managing the AML Compliance journey. AML Singapore helps entities assess their ML/FT vulnerabilities and develop tailor-made internal AML policies, procedures, and controls, to ensure complete compliance with relevant AML regulations. We also assist clients in effectively implementing the IPPC and impart comprehensive training to the employees to adhere to this IPPC.