Cyclical Process of Risk-Based Approach: Important to Combat Financial Crime

Cyclical Process of Risk-Based Approach: Important to Combat Financial Crime

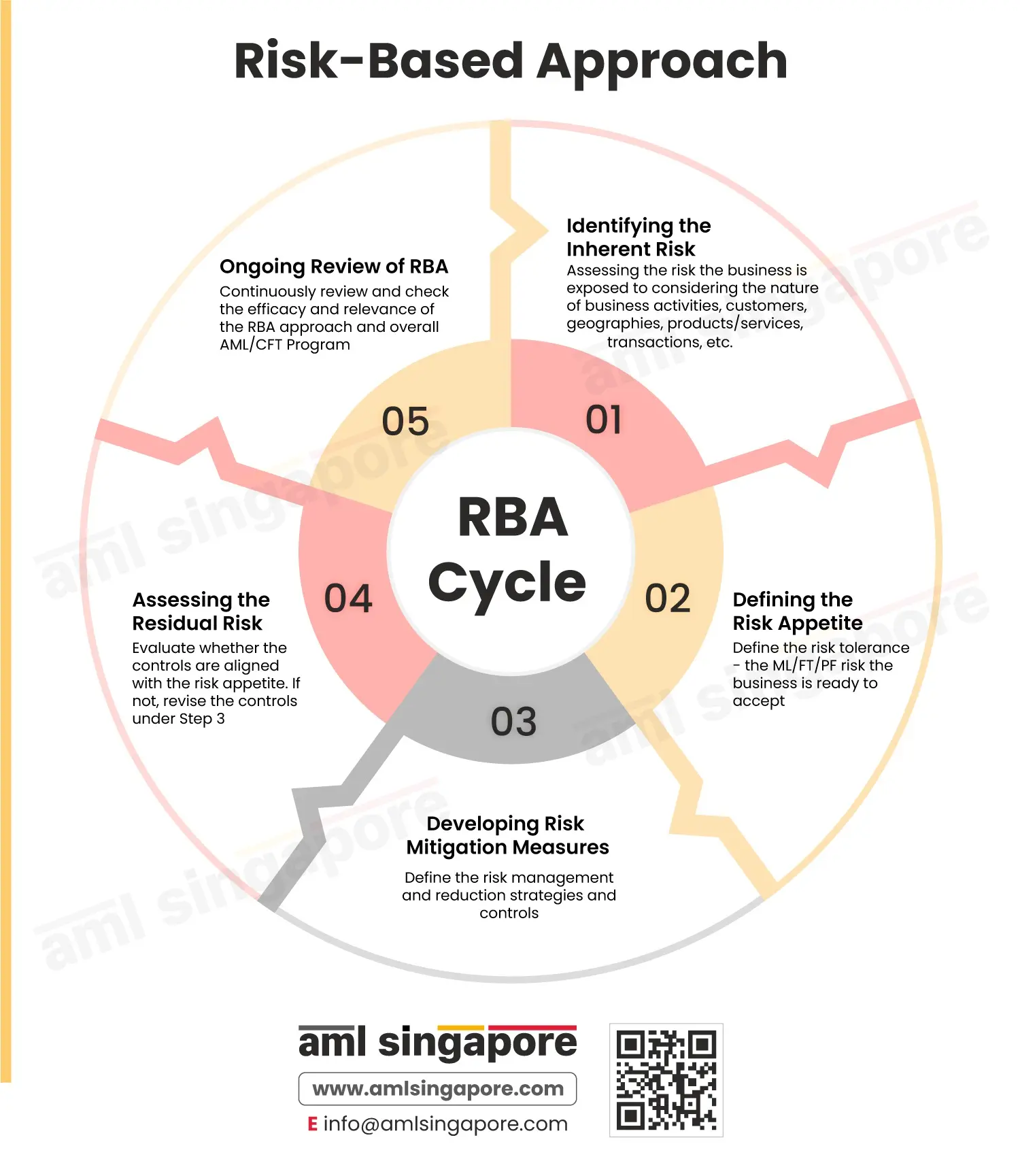

The Risk-Based Approach (RBA) is central to the anti-money laundering regime, highlighting the importance of assessing the risks and deploying the resources and controls to manage such risks.

Let’s understand the ongoing process of the Risk-Based Approach.

- Identifying and assessing the inherent risk:

It is important to evaluate the risk the business may face considering the nature and size of the operations. While assessing the inherent risk and its potential impact on the entity, the risk scenarios related to the type of customer dealt with, products and services offered, the geographies the entity is operating in or the jurisdiction of the customers, the complexity and volume of the transactions, etc. must be factored. - Determining the business’s risk appetite:

The degree and nature of risk differ for every business. The entity must determine and document the extent of such financial crime risk the business is ready to bear. Such risk tolerance limits must be determined and approved by the management. This risk appetite serves as the baseline, flagging the mark beyond which the entity would not accept any risk and deploy adequate controls to combat the same. - Implementing the necessary risk mitigation measures:

Once the entity has a holistic idea of the business’s risk profile and the degree of risk it is willing to take, the exercise begins to determine, design, and deploy the risk mitigation measures and controls. The entity must frame a risk management plan and strategy, capturing the controls that shall be implemented to reduce or eliminate the ML/FT/PF vulnerabilities. - Assessing the residual or net exposure:

Once the controls and risk mitigation tactics are developed, they must be evaluated to determine their effectiveness and relevance in fighting the assessed risks. The entity must examine if there are potential threats even after deploying the controls and whether such balance risk exposure is within the entity’s risk appetite. If the residual or net risk, post factoring in the controls, exceeds the defined risk tolerance limits, then it’s an alarm to refine the controls and implement some advanced measures. - Ongoing review of the adopted Risk-Based Approach:

As the business grows and in the world of evolving ML/FT/PF typologies and trends, the entity must keep a continuous watch on the efficiency and validity of the RBA and the underlying AML/CFT program adopted by the entity. The entity must ensure that the assessed business risk is valid, and if there is any emerging risk the business is expected to face, then the same must be considered. The strength of the controls must be examined and if necessary, new or modified risk mitigation measures must be implemented. Only when RBA is in sync with the business can the entity’s risk management plan and resources work effectively.

Here is an infographic elaborating the cyclical process of the Risk-Based Approach, which the regulated entities must understand and implement to safeguard the business against financial crime risks and comply with AML regulations in Singapore.

If seeking any support around AML compliance or developing the ML/FT risk management structure, reach out to AML Singapore.

AML Singapore offers end-to-end AML support, beginning with Enterprise-Wide Risk Assessment, customizing the Internal Policy, Procedures, and Controls (IPPC), training the staff on the AML framework, etc.