Critical Money Laundering Risks Identified in NRA 2024

Critical Money Laundering Risks Identified in NRA 2024

Singapore’s National Risk Assessment (NRA) depicts a reformed understanding of the country’s threats and challenges of money laundering (ML), terrorism financing (TF) and proliferation financing (PF). It provides insight into the sectoral vulnerabilities and risk factors.

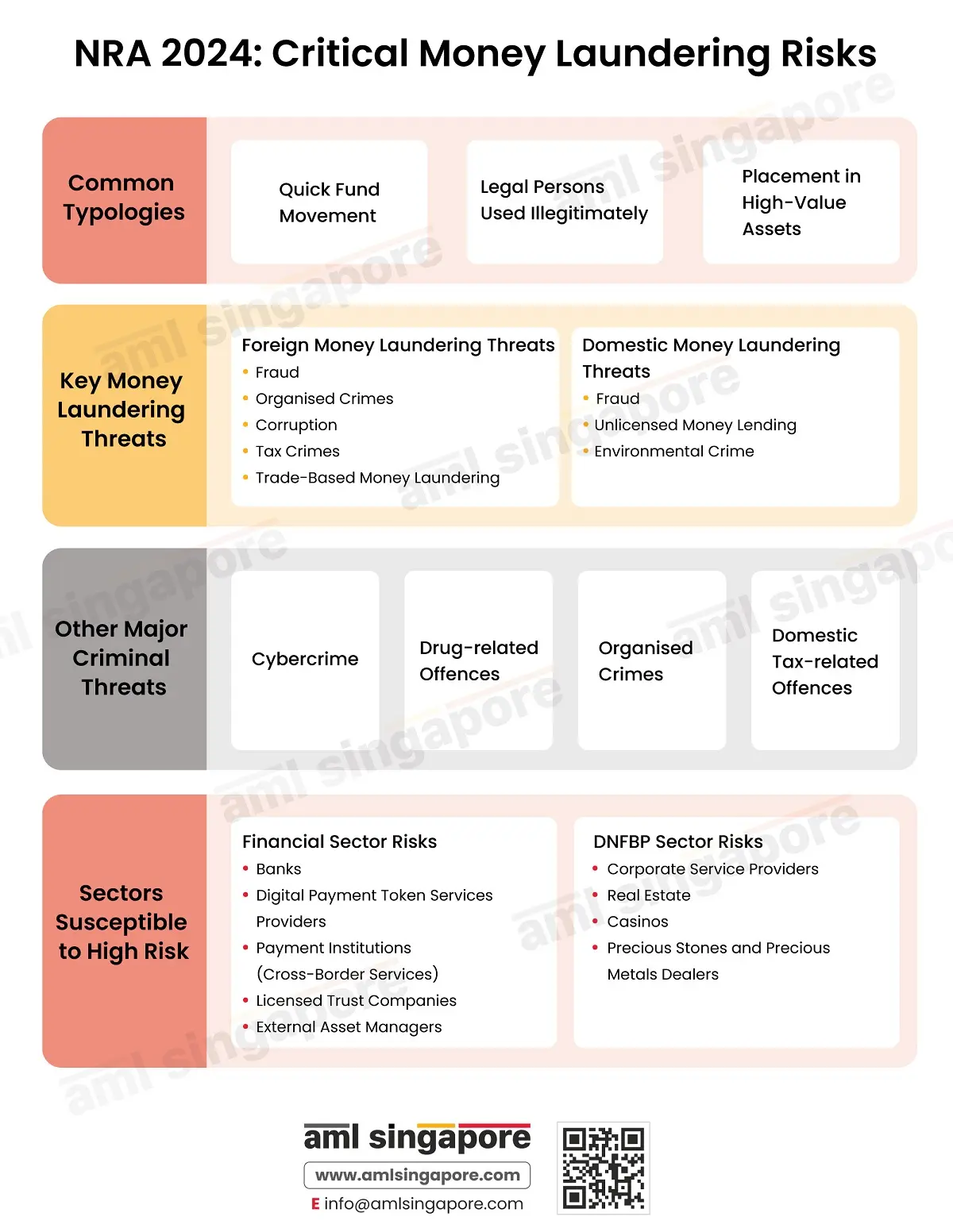

Common Typologies

The NRA 2024 identifies the following most common techniques used by criminals to transfer illicit funds:

- Quick movement of funds through bank accounts,

- Illegitimate use of legal persons and legal arrangements (E.g. Shell Companies)

- Using high-value assets such as real estate, precious stones, and metals to place illicit funds.

Key Money Laundering Threats

Singapore’s National Risk Assessment classifies the major ML threats into:

Foreign ML Threats

The following types of cross-border ML threats are identified by NRA:

Fraud

It is the biggest source of Foreign ML Threats and includes cyber-enabled threats, syndicate offences and misuse of legal persons.

Organised Crimes

The NRA 2024 flags illegal online gambling as a key ML threat.

Corruption

The risk of corruption proceeds from the Asia Pacific region being laundered in Singapore is high.

Tax Crimes

Being a wealth management hub, Singapore faces inherent money laundering risks that involve foreign tax crimes.

Trade-Based Money Laundering (TBML)

The NRA 2024 points out that the limited oversight of banks over open account transactions places the sector at a high risk of TBML.

Domestic ML Threats

Fraud

Fraudulent activities, specifically cyber-enabled Fraud and Criminal Breach of Trust (CBT) executed by persons in a position of responsibility.

Unlicensed Moneylending (UML)

The NRA observes that syndicates are using UML businesses to give out loans and receive repayments from different debtors to avoid being caught.

Environmental Crime

It is caused by illegal wildlife trade, logging, and waste management crimes combined with corruption.

Other Major Criminal Threats

Apart from the key ML threats, Singapore’s National Risk Assessment identifies other significant ML threats of interest:

Cybercrime

Ransomware payments using illicit money are among the top cyber-related offences identified by NRA.

Drug-related Offences

Singapore’s proximity to the ‘Golden Triangle’ and presence of active transnational organised groups makes it vulnerable to the laundering of drug offence-related funds.

Domestic Organised Crimes

The banking and real estate sector is more vulnerable to the ML threat of organised crime because the amount of illicit funds is greater.

Domestic Tax-related Offences

The National Risk Assessment reports fraudulent claims of Goods and Services Tax (GST) refunds under the electronic Tourist Refund Scheme (eTRS).

Sectors Susceptible to High Risk

The NRA categorically recognises the ML/TF/PF risks faced by the financial sector and by the Designated Non-Financial Businesses and Professions and identifies sectors that are at an elevated risk of money laundering, terrorism financing and proliferation financing.

Financial Sector Risks

Singapore’s National Risk Assessment 2024 reports that the country’s financial sector is at a high risk due to its open economic structure. Here is a list of financial sector institutions that face high ML/TF/PF risks:

Banking

Banks pose the highest ML risks to Singapore.

Digital Payment Token Services Providers (DPTSP)

There is an increasing use of Digital Payment Tokens for transferring proceeds of fraud and cybersecurity-related offences.

Payment Institutions- Cross-Border Money Transfer Services

Payment Institutions’ money transfer service is misused by shell or front companies for the movement of illicit funds.

Licensed Trust Companies (LTCs)

LTCs are used by criminals to conceal the origin of illicit funds and their beneficial owners.

External Asset Managers (EAMs)

High-net-worth individuals may misuse EAMs for ML activities relating to foreign corruption and tax evasion.

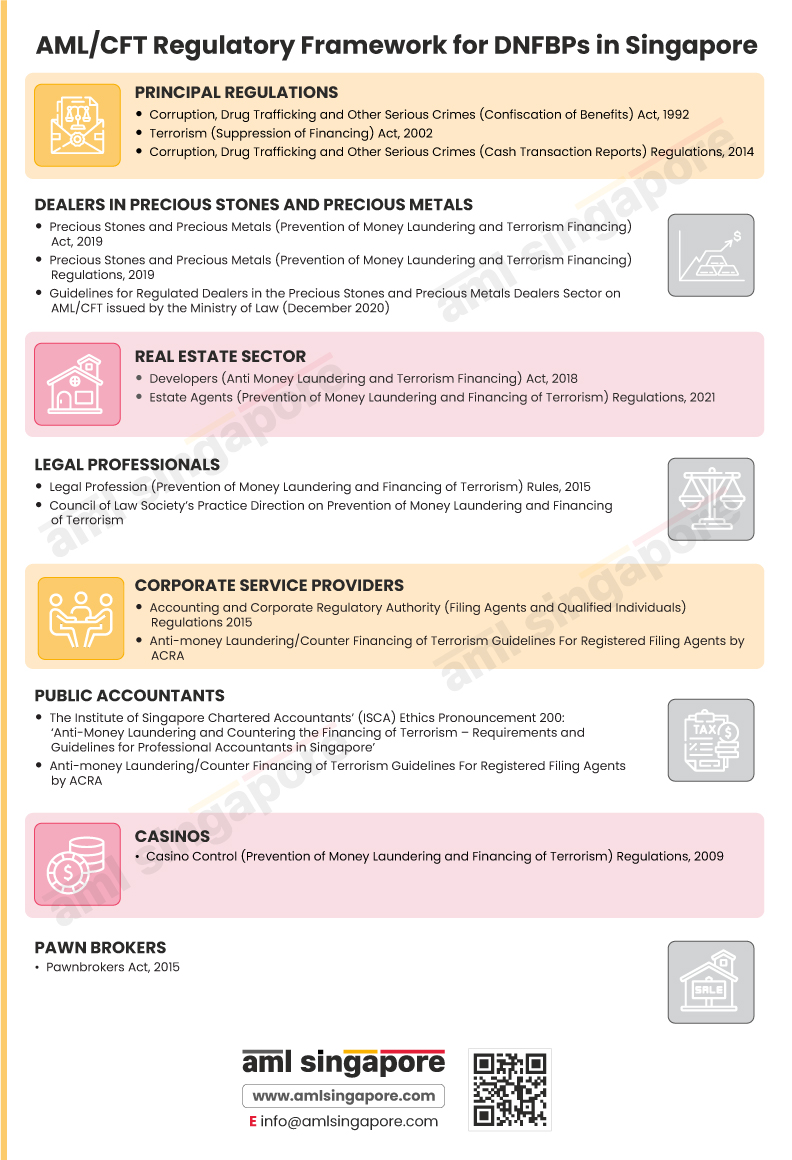

Designated Non-Financial Business and Profession (DNFBP) Sector

Singapore’s National Risk Assessment identifies DNFBPs (Designated Non-Financial Businesses and Professions) as vulnerable to being misused for ML/TF/PF activities as they facilitate high-value transactions. Following DNFBPs stand at a higher risk of ML/TF/PF risks

Corporate Service Providers (CSPs)

CSPs are vulnerable to ML/TF/PF risks as their services may be used for setting up shell companies or covering the identities of beneficial owners.

Real Estate

Criminals use the real estate sector to launder large funds in one transaction by buying and selling properties.

Casinos

Casinos are a cash-intensive industry, highly misused to conceal the origin of illicit funds.

Precious Stones and Precious Metals Dealers (PSMD)

Precious Stones and Precious Metals (PSPM) are used to convert illicit funds and store them into high-value assets.

The sectoral risks and Key ML threats defined in Singapore’s National Risk Assessment provide a complete picture for market participants to assess their risk factors and implement corresponding compliance measures.