Best practices for building a strong AML/CFT compliance culture

Best practices for building a strong AML/CFT compliance culture

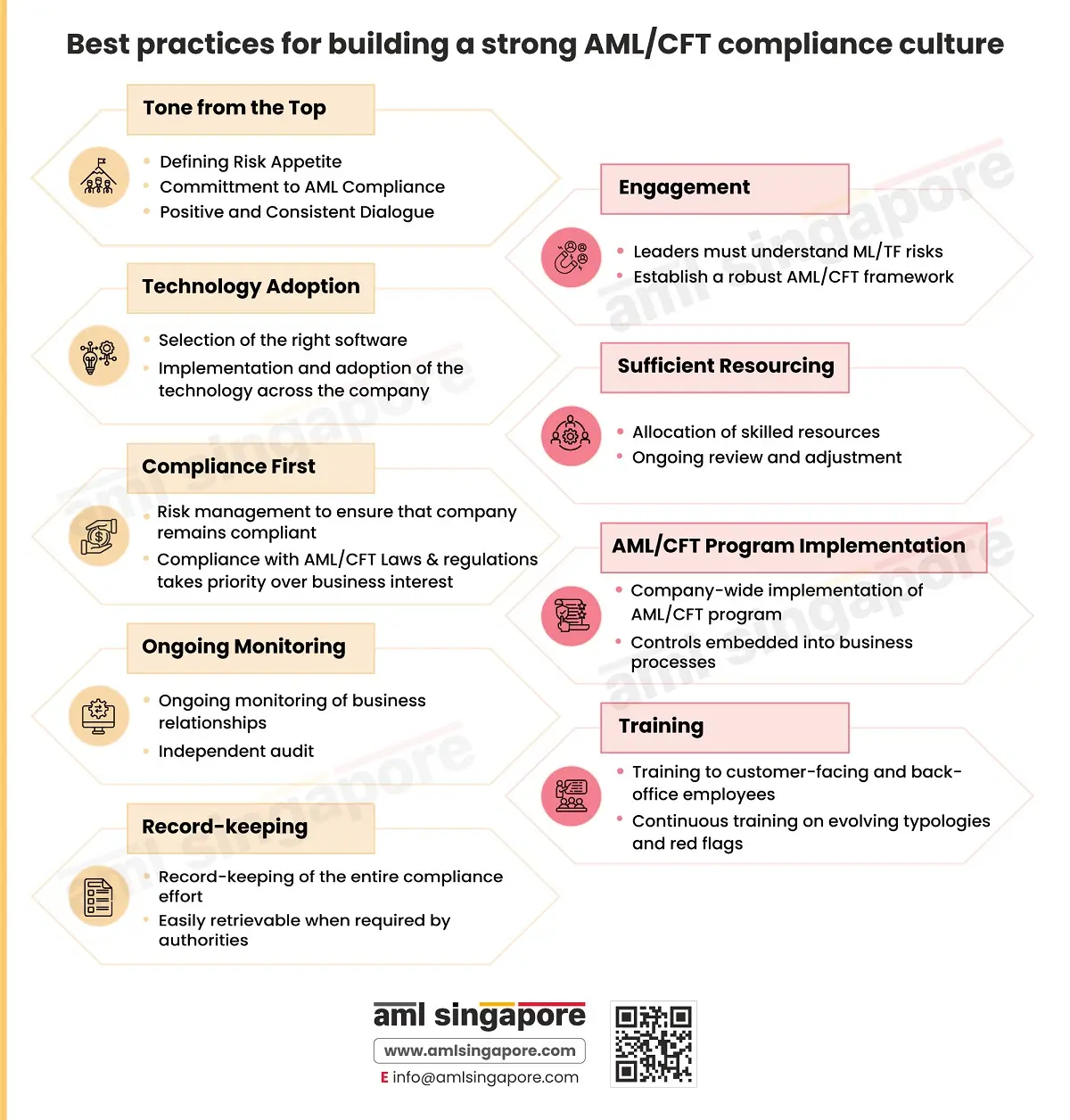

Regulated entities in Singapore must ensure compliance with the AML/CFT laws and regulations. The company must have a strong AML/CFT compliance culture to comply with legal requirements. To build a robust AML/CFT compliance culture, the company has to adopt various best practices. This infographic provides various best practices for building a strong AML/CFT compliance culture in the company.

1. Tone from the Top:

The top management has to set the right tone for compliance-related matters. The dialogue with the managers and staff must be positive and consistent, showing the commitment towards AML compliance. It should define the company’s risk appetite so that risk management revolves around it.

2. Engagement:

3. Technology Adoption:

4. Sufficient Resourcing:

5. Compliance First

6. AML/CFT Program Implementation:

7. Ongoing Monitoring

The Ongoing monitoring of business relationships helps identify suspicious activities and transactions, which in turn helps fight money laundering and terrorist financing. Independent audit ensures the company’s compliance effort aligns with the legal requirements.