An insight in overall AML Controls: Tackling ML/FT risks with Risk-Based Approach

An insight in overall AML Controls: Tackling ML/FT risks with Risk-Based Approach

The AML regulations in Singapore provide for adopting the Risk-Based Approach, enabling the regulated entities in Singapore to deploy the risk mitigation measures proportionate to the risk rather than following a general or “one-size-fits-all” approach.

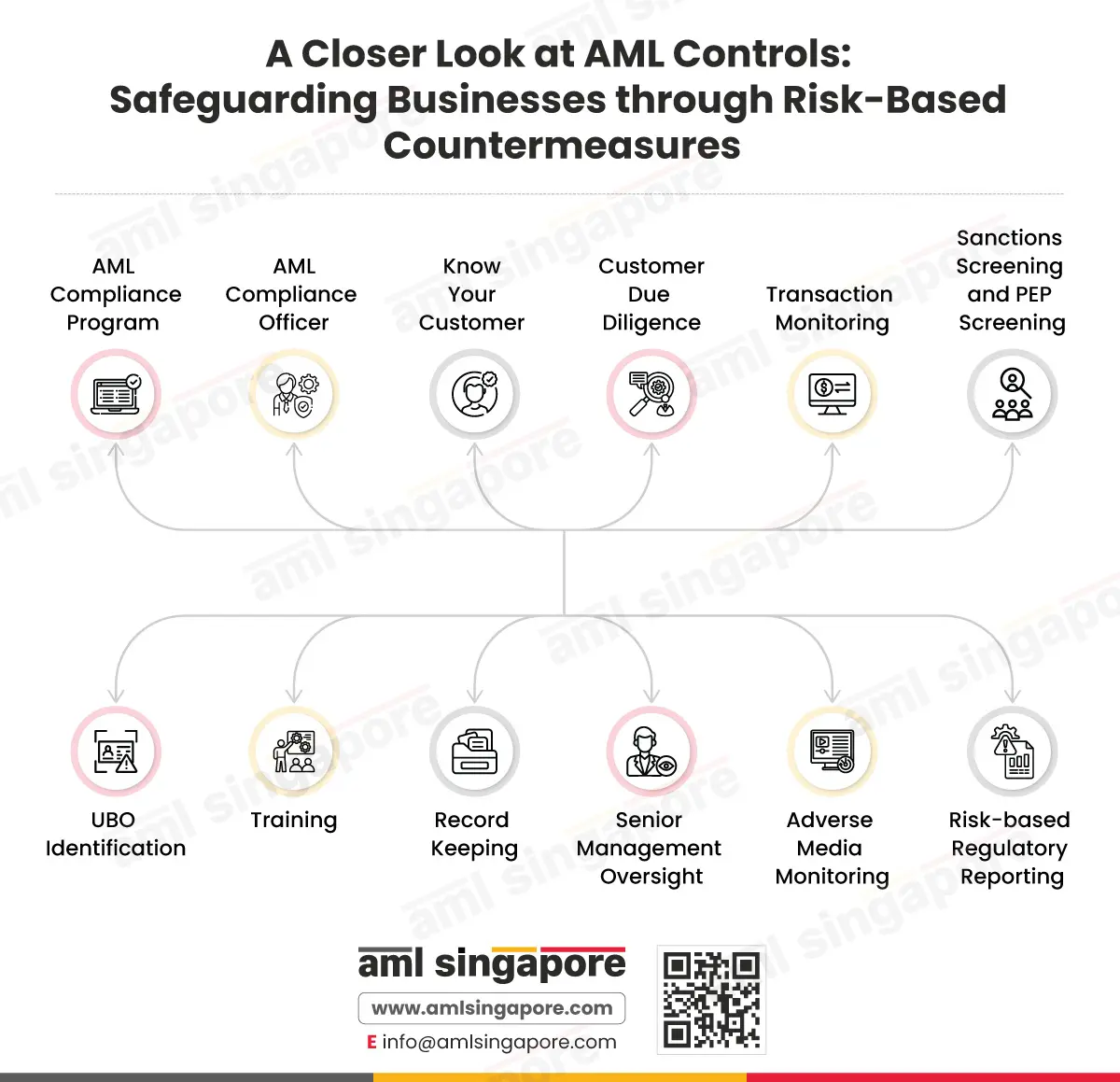

Here is an infographic highlighting the critical controls that a regulated entity in Singapore must implement to combat the money laundering and financing of terrorism risks, in line with the Risk-Based Approach:

- Developing the AML compliance program, which aligns with assessed financial crime risk

- Appointing a competent AML compliance officer to ensure effective implementation of the Internal Policies, Procedures, and Controls (IPPC)

- Adopt the Know Your Customer (KYC) process to identify the customers

- Implement strong Customer Due Diligence (CDD) measures to assess the customer risk and deploy adequate due diligence measures to manage the risk (including Enhanced Due Diligence measures)

- Continuously monitor the transactions to detect any suspicious activity

- Conducting Sanctions Screening to identify if the customer is a sanctioned individual or entity and Conducting Politically Exposed Persons Screening to identify if the customer is a Politically Exposed Person or a close relative or associate thereof

- Identification of the beneficial owners when dealing with corporate clients or legal arrangements

- Developing a robust AML Training Program for the team, including senior management

- Maintaining all the relevant AML records in an organized manner for the prescribed period

- The Senior management must review and approve the IPPC and oversee the implementation of the AML/CFT program

- The customers and their beneficial owners must be regularly monitored to check for any available adverse media, as this impacts the overall risk profile of the customer

- Timely reporting of red flags to Singapore’s Suspicious Transaction Reporting Office (STRO)

A comprehensive AML framework is necessary to fight back against financial crimes. Here is AML Singapore, a leading AML consultancy firm, to assist the regulated entities in developing robust AML controls aligned with the regulatory requirements and the outcome of the Enterprise-Wide Risk Assessment.