AML Record-Keeping in Singapore

AML Record-Keeping in Singapore

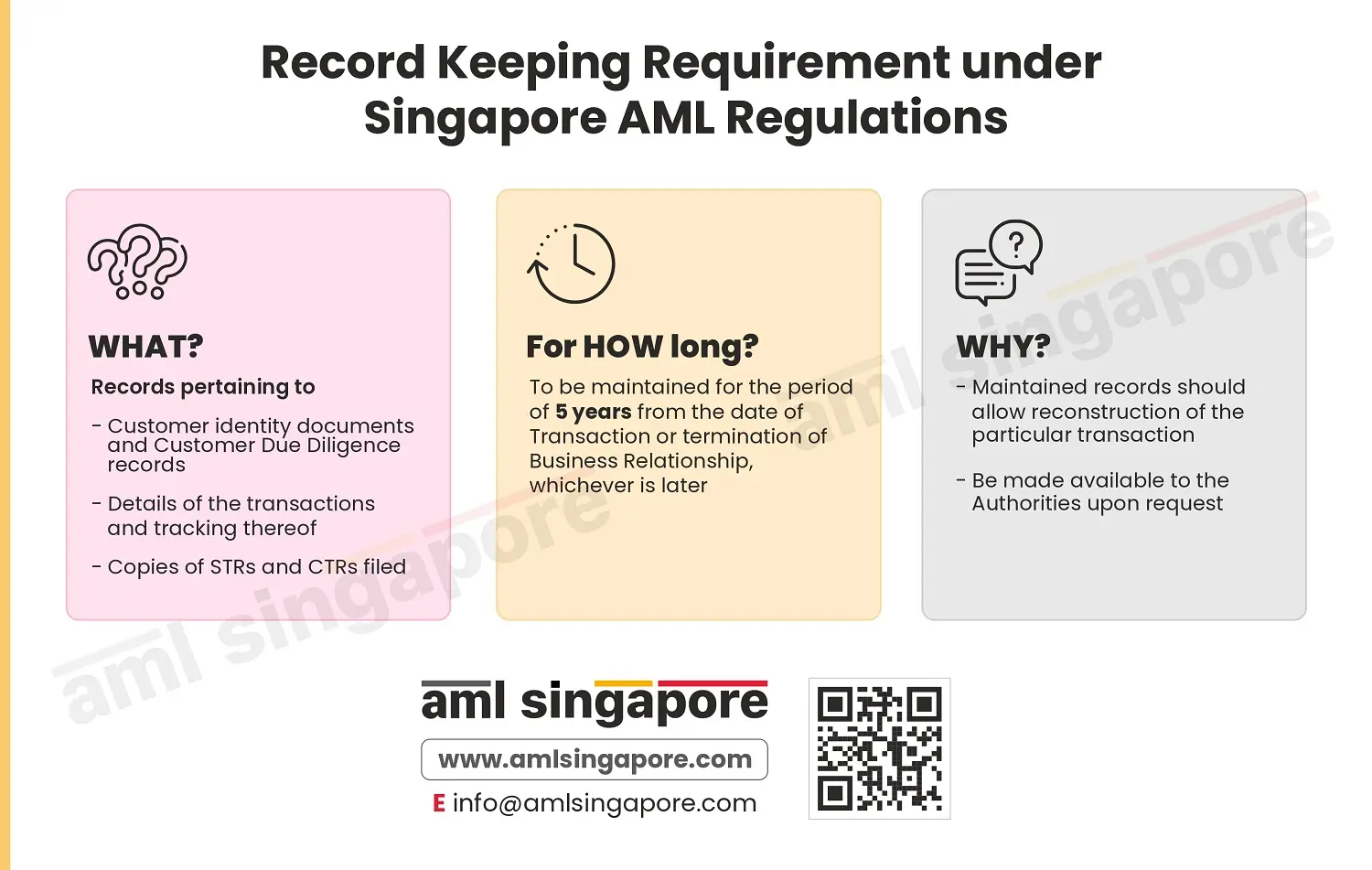

Singapore’s AML regulations provide that the regulated entities must maintain the AML-related records for at least five (5) years from the end of the business relationship or completion of the transactions, whichever is later.

The regulated entities are required to maintain the following documents from AML perspective:

- Customer Due Diligence-related information and documents, including identification documents received, the Know Your Customer form, customer risk assessment, additional measures applied, etc.

- Records of the transactions executed with customers, including the nature of transactions and value

- Copies of suspicious transactions identified and Suspicious Transaction Reports (STRs) filed

- Copies of any other reports filed with the authorities, such as Cash Transaction Report (CTR)

The records must be maintained in an organized manner that allows reconstruction of the transaction and must be easy to retrieve, that can be immediately made available to the authorities as and when requested.

Here is a brief infographic demonstrating the AML Record-Keeping requirements under Singapore AML regulations.

AML Singapore is a leading AML Consulting firm offering end-to-end AML support to regulated entities – from assessing ML/FT business risk to documenting the customized AML/CFT framework – internal AML policies, procedures, and controls. With us, train your team to stay AML compliant and ensure adequate AML documentation, as unless you have it recorded; you haven’t done it!