AML Program Failure: Decoding the Causes and Corrective Measures

AML Program Failure: Decoding the Causes and Corrective Measures

The AML Program, commonly called “AML Compliance Program” is a critical component of AML compliance efforts. Failure of the AML Program exposes the business to financial crime risks, jeopardizes its reputation, and results in hefty non-compliance penalties.

At all times, the AML measures adopted by the regulated entity must be adequate and effective in identifying the money laundering activities and aligned with Singapore’s AML regulations. It is pertinent to identify the reasons for the AML program’s failure to implement the necessary rectification measures for enhancing its quality and effectiveness.

Let us understand what should be included in an ideal AML program, what causes the AML program to fail, and what remedial measures are to be adopted to correct the failure and strengthen the AML Compliance Program.

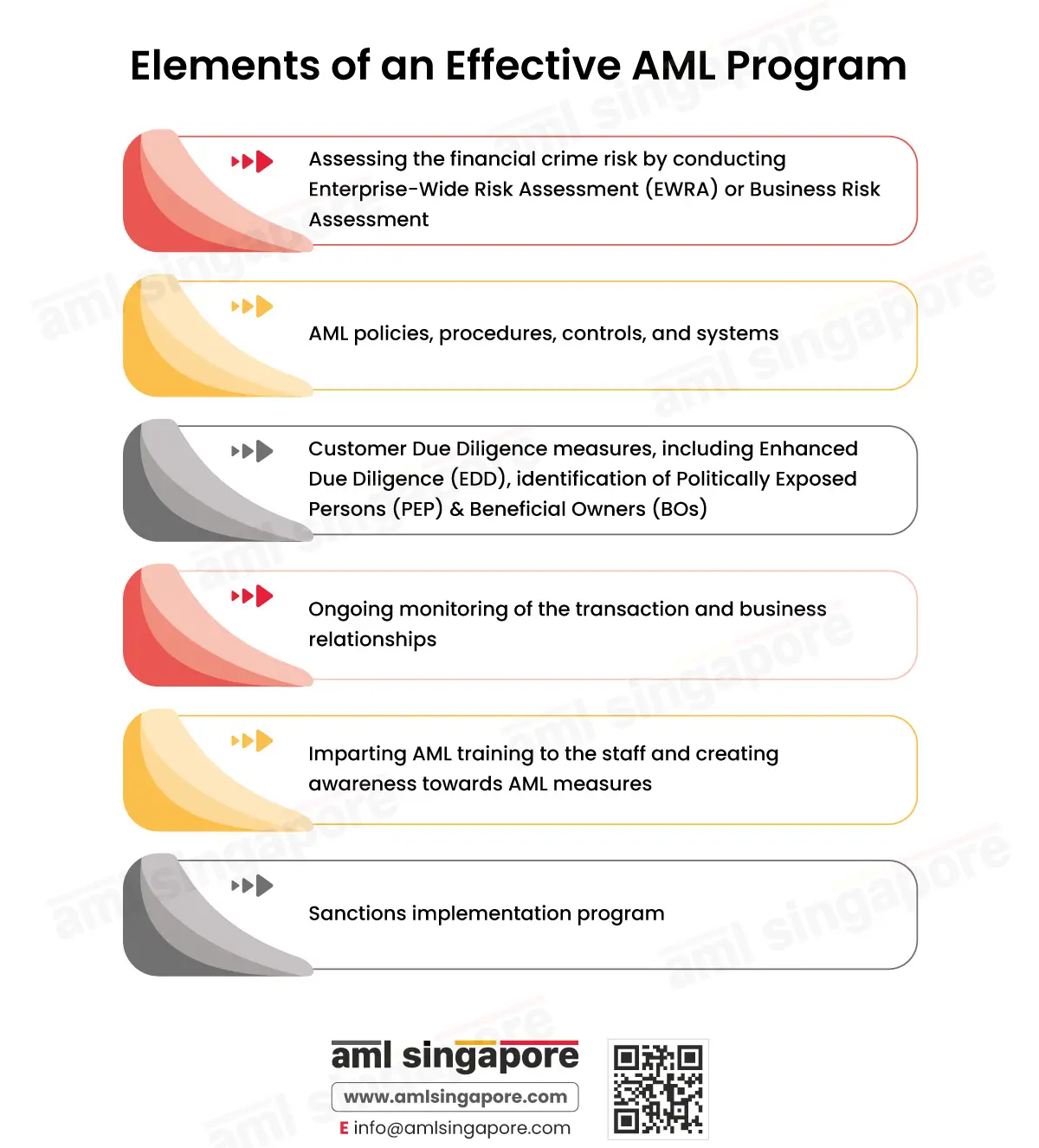

What are the elements of an effective AML Program?

An AML program comprises a comprehensive framework of guidelines the business must follow to stay AML compliant and protect itself from money laundering and terrorism financing threats.

AML framework or program involves:

- Assessing the financial crime risk by conducting Enterprise-Wide Risk Assessment (EWRA) or Business Risk Assessment

- AML policies, procedures, controls, and systems

- Customer Due Diligence measures, including Enhanced Due Diligence (EDD), identification of Politically Exposed Persons (PEP) & Beneficial Owners (BOs)

- Ongoing monitoring of the transaction and business relationships

- Imparting AML training to the staff and creating awareness towards AML measures

- Sanctions implementation program

A robust and effective AML program includes all the relevant guidelines that will help the business prevent money laundering and financing of terrorism, keeping pace with the emerging trends in the global market and overall business risk.

Any flaws in the AML measures adopted by the company that results in non-compliance with AML regulations or violates the requirement of identifying and preventing financial crime instances, the regulated entities are subjected to heavy administrative fines and other legal proceedings.

So, what causes the AML programs to fail and put the organization, the stakeholders, and the customers at risk? Let’s discuss the top reasons for the failure of AML programs and ways to improve the overall AML efforts of the company.

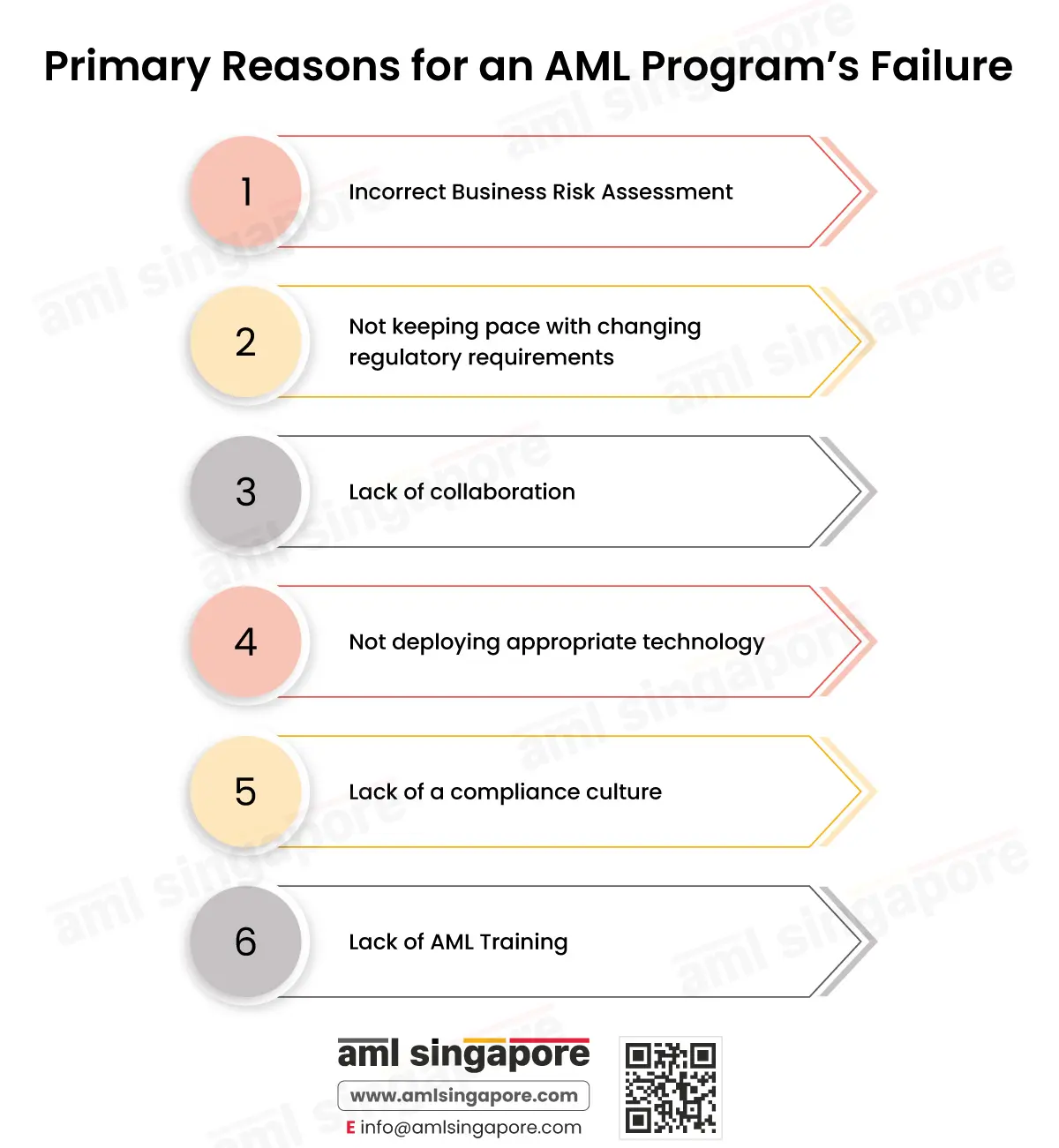

Understanding the primary reasons for an AML Program’s failure and its corrective measures

1. Incorrect Business Risk Assessment:

Businesses can integrate an effective AML compliance policy, controls, and procedures only when they correctly assess the risk of being exploited by the money launderers. These could arise from the nature of customers, the type of products and services offered, the geographies of business operations, etc.

Suppose the business is unable to assess the business risk correctly. In that case, the AML program can fail miserably, as the business risk assessment is the foundation for designing the policies and AML controls.

An AML program not in sync with the actual ML/FT risk exposure will be ineffective in mitigating the risks and ultimately result in regulatory non-compliance.

Solution: The companies must periodically review the business risk assessment and update the same, considering the changes in the business operations, evolving money laundering risk typologies, and the latest regulatory amendments. The AML program must always be proportionate to the assessed business risk to ensure that implemented AML measures directly tackle the identified risk and not merely a tick-box approach by adopting a “fit-for-all” AML program.

2. Not keeping pace with changing regulatory requirements:

Regulated entities often struggle to keep pace with the ever-changing regulatory requirements. The government and regulatory authorities issue improved guidelines and quash some of them based on the changes in the market environment and developing ML/FT threats. The AML regulatory landscape is updated repeatedly, and ensuring the regulated entity complies with these new obligations becomes challenging.

Solution: Coordination amongst the industry peers and following the official sources is one of the best ways to keep your AML knowledge up-to-date. You can also rely on domain experts who update your AML program as and when the regulations are amended. Further, regulatory compliance, such as screening, technology solutions, and tools, can be an excellent option to stay compliant with updated sanctions lists and avoid penalties.

3. Lack of collaboration:

The compliance program cannot be successful until the management, the compliance officer, and the relevant stakeholders collaborate internally and externally with the regulatory authorities to trace suspicious transactions and prevent money laundering.

Solution: Collaboration among the management, all the employees, and the compliance officer is necessary to ensure effective implementation of the AML rules and regulations. A unified approach towards AML efforts will help you achieve the goals predefined for the AML compliance process.

Further, the compliance officer maintains a healthy relationship with the authorities to seek their timely feedback and directions to improve the quality of AML function.

4. Not deploying appropriate technology:

Criminals are devising new ways to launder money, including misuse of developing technologies. Without adequate technologies, it would be challenging for businesses to detect the red flags. Further, with tools and software, the accuracy of AML measures like real-time screening and ongoing monitoring is always doubtful.

Solution: Businesses, too, must catch up with the times and use technology to identify money laundering attempts and thwart the challenges. Companies can use emerging technologies like Artificial Intelligence, Blockchain, etc., to improve the speed and accuracy of AML compliance, such as identity verification, and monitor bulky transactions and customer data to detect any unusual patterns or risk indicators. AML software enables the business to implement AML programs efficiently.

5. Lack of a compliance culture:

The compliance program is bound to suffer if there’s no awareness of the AML compliance process and inadequate information on the regulatory requirements. The compliance culture starts with the management. If the leadership tends to overlook the importance of an AML program, the employees and the stakeholders will undermine the importance of the program and fail to recognize the contribution that can help them stay AML compliant.

Solution: An organization must have a strong compliance culture that should start with senior management’s support and trickle down the organizational hierarchy. Awareness about the compliance regulations and responsibility towards the government, the company, stakeholders, and, most importantly, the customers pave the way for a robust AML compliance culture throughout the organization.

6. Lack of AML Training:

AML training is required to help employees and stakeholders understand the business’s ML/FT risk exposure and equip them to identify suspicious transactions. The training is essential for the employees to understand the AML compliance process, the regulatory requirements, the challenges involved, and the methods used to mitigate the risks. Lack of training is a significant cause of the failure of the AML compliance program.

Solution: Companies should make AML training a significant part of the AML compliance program. Mandatory AML training must be conducted for new employees, while an annual refresher course on AML must be arranged for all the employees to ensure that they understand their AML responsibilities and are updated on the latest AML developments. An AML Compliance Officer can conduct the training in-house, or a third-party AML professional may be appointed to design and impart comprehensive AML training for all the employees, senior management, and Compliance Officer.

Identifying the AML flaws and strengthening the AML compliance program

The businesses must adopt an independent AML audit function to ensure periodic review of the AML program, including internal policies, procedures, and controls, to test its quality, adequacy, and relevance in the context of AML regulations and overall business risk assessment.

These independent reviews shall assist the company in identifying the gaps or non-compliance instances that need immediate attention and redressal to prevent the business’s exploitation by the money launderers and avoid any administrative penalties. The observations or findings of the AML auditor must be addressed to the senior management, and the same must be remediated at the earliest to improvise the AML program.

AML Singapore is at your service to strengthen your AML Compliance Framework

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 9 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.