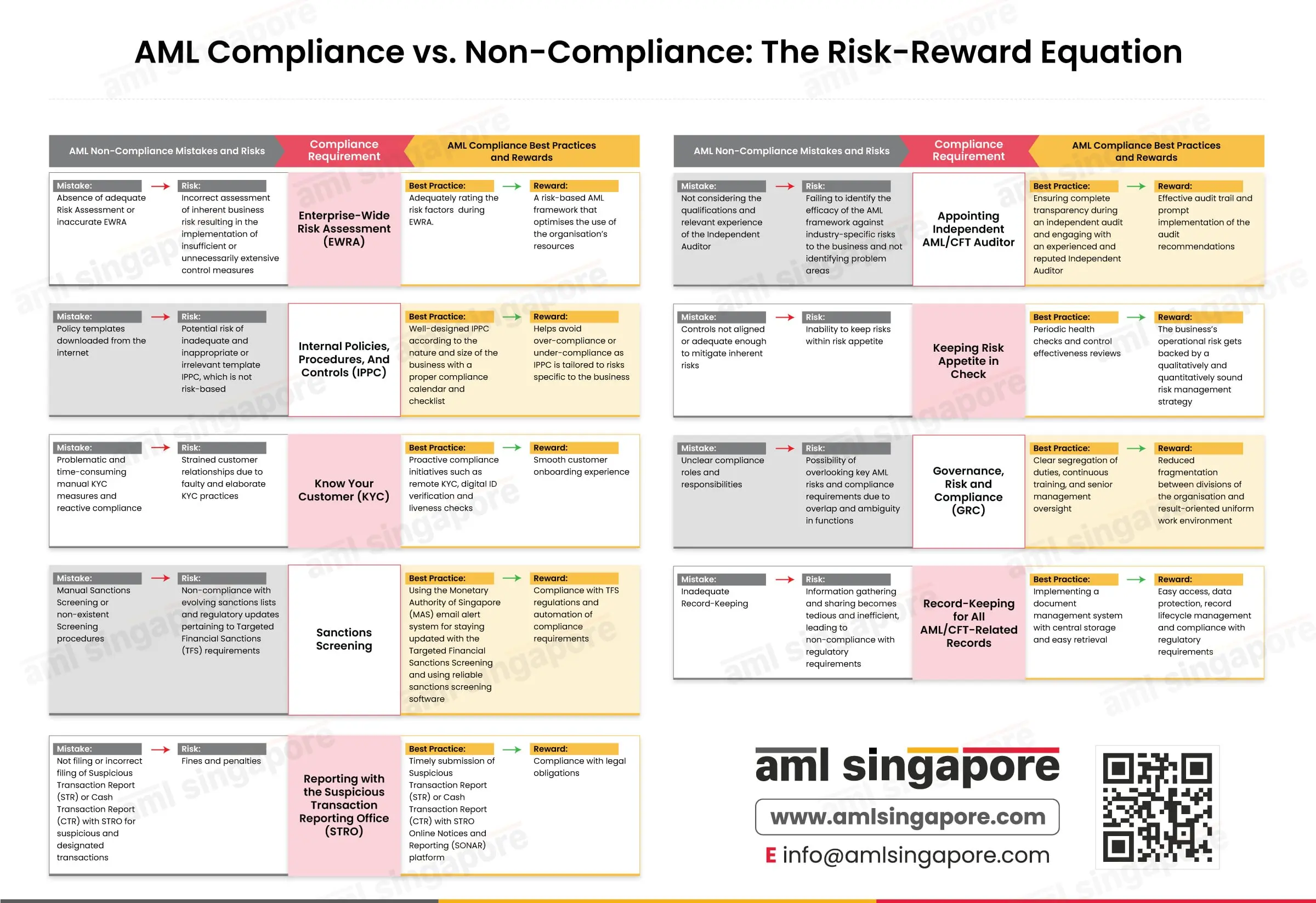

AML Compliance vs. Non-Compliance: The Risk-Reward Equation

AML Compliance vs. Non-Compliance: The Risk-Reward Equation

AML compliance is a regulatory requirement for businesses that are covered as regulated entities. However, businesses may often wonder how AML compliance can benefit their day-to-day business operations.

A clear difference in proper AML compliance and Non-Compliance can be seen through the risk and reward outcomes that businesses face.

The Risk-Reward Equation: AML Compliance vs. Non-Compliance provides insights into the common mistakes made by businesses and their impact as opposed to industry-wide recognised best practices that can improve business operations.

Enterprise-Wide Risk Assessment

- Risks and consequences of mistakes in AML compliance: The absence of adequate Risk Assessment or inaccurate EWRA leads to incorrect assessment of inherent business risk, resulting in the implementation of insufficient or unnecessarily extensive control measures.

- Best practices and rewards of AML compliance: Adequately rating the risk factors during EWRA allows businesses to judge their inherent risks and place proportionate controls leading to optimum utilisation of business’s resources.

Internal Policies, Procedures and Controls (IPPC)

- Risks and consequences of mistakes in AML compliance: Policy templates downloaded from the Internet can lead to the potential risk of inadequate, inappropriate, or irrelevant template IPPC, which is not risk-based.

IPPCs are highly subjective to a business’s risk, industry nature and size of operations. Businesses often use readily available policy templates for their own operations that may or may not align with their industry-specific regulatory requirements and risk appetite. - Best practices and rewards of AML compliance: A well-designed IPPC tailored to the business’s nature and size and its regulatory framework can help businesses avoid the possibility of over-compliance or under-compliance.

Know Your Customer (KYC)

- Risks and consequences of mistakes in AML compliance: Problematic and time-consuming manual KYC measures and reactive compliance that lead to the risk of strained customer relationships due to faulty and elaborate KYC practices.

- Best practices and rewards of AML compliance: Businesses that efficiently utilise advanced solutions, such as conducting digital ID verification and liveness checks, are rewarded with smooth customer experience and proper compliance.

Sanctions Screening

- Risks and consequences of mistakes in AML compliance: Businesses that perform manual sanctions screening or do not have screening procedures in place may run the risk of non-compliance with evolving sanctions lists and regulatory updates in accordance with the Targeted Financial Sanctions (TFS) requirement.

- Best practices and rewards of AML compliance: Businesses that are updated with the regulatory changes in the Targeted Financial Sanctions (TFS) regime with the Monetary Authority of Singapore’s email alert system can effectively ensure that they are not dealing with designated individuals or entities and protect their business integrity.

Reporting with the Suspicious Transaction Reporting Office (STRO)

- Risks and consequences of mistakes in AML compliance: Reporting Suspicious Transaction Reports (STR), Cash Transaction Reports (CTR), and designated transactions is an essential regulatory requirement in Singapore. Businesses that fail to submit this report or incorrectly file with STRO are at risk of penalties.

- Best practices and rewards of AML compliance: Businesses that file timely regulatory reports with the STRO Online Notices and Reporting (SONAR) platform remain compliant with regulatory requirements.

Appointing Independent AML Auditor

- Risks and consequences of mistakes in AML compliance: When appointing an Independent AML Auditor, businesses may overlook the qualifications and relevant experience of the auditor. This can lead to failure in identifying the efficacy of the AML framework against industry-specific risks to the business and not identifying problem areas.

- Best practices and rewards of AML compliance: Ensuring complete transparency during an independent audit and engaging with an experienced and reputed auditor is rewarded with an effective audit trail and prompt implementation of the audit recommendations.

Keeping Risk Appetite in Check

- Risks and consequences of mistakes in AML compliance: Controls not aligned or adequate enough to mitigate inherent risks. Businesses that do not give enough weightage to taking a risk-based approach in AML compliance may not be able to keep their risk appetite in check.

- Best practices and rewards of AML compliance: Periodic AML health checks coupled with frequent measures to review the efficacy of control measures can help businesses maintain their risk appetite backed by a qualitatively and quantitatively sound risk management strategy.

Governance, Risk and Compliance

- Risks and consequences of mistakes in AML compliance: Unclear roles and responsibilities within the AML compliance department can cause businesses to miss important compliance requirements due to ambiguity and uncertainty.

- Best practices and rewards of AML compliance: Clear segregation of duties can ensure smooth cooperation within an organisation with reduced fragmentation between divisions of the organisation.

Record-Keeping for All AML/CFT Records

- Risks and consequences of mistakes in AML compliance: Inadequacy in record-keeping can make it difficult for businesses to ensure proper information gathering and sharing, which may obstruct their adequate compliance with regulatory requirements.

- Best practices and rewards of AML compliance: A comprehensive document management system can help ensure proper record maintenance, as well as data protection and lifecycle management functions and compliance with the regulatory requirements.

Conclusion

Learning from common mistakes and incorporating best practices can help businesses strengthen their AML compliance measures.

Related Posts

AML Singapore is here to help you reap the reward of proper AML compliance

We combine our expertise in Singapore laws and global experience to help you remain compliant