AML Compliance for Foreign Dealers of PSPM in Singapore

AML Compliance for Foreign Dealers of PSPM in Singapore

Regulated dealers of Singapore who are based overseas but conduct regulated dealings in Singapore may not necessarily be aware of their detailed legal obligations when undertaking business activities in Singapore. However, when dealing in Precious Stones and Precious Metals (PSPM), they must be aware of their Anti-Money Laundering, Counter-Terrorism Financing, and Counter-Proliferation Financing (AML, CTF, and CPF) obligations. This article focuses on AML compliance for Foreign Dealers of PSPM in Singapore.

Who Is a Foreign Dealer of PSPM in Singapore

If a regulated dealer in Singapore

- Is registered outside Singapore, or

- Is incorporated outside Singapore, or

- Habitually resides outside Singapore,

And such a regulated dealer does not have

- A permanent establishment in Singapore, or

- A place of management in Singapore, or

- A branch in Singapore

Then, such a regulated dealer can be classified as a foreign dealer of PSPM in Singapore.

Why Should Foreign PSMDs Comply with AML Regulations

The overall jewellery and luxury goods market is susceptible to Money laundering, Terrorism Financing, and Proliferation financing (ML, TF, and PF) risks due to their cash-intensive nature and involvement of high-value goods.

However, this risk is heightened for foreign PSMDs due to greater complexities in the supply chain and more cross-border transactions. Thus, Foreign PSMDs must comply with AML regulations to protect their business against heightened ML, TF, and PF risks.

AML Compliance Obligations for All Foreign Dealers of PSPM in Singapore

All foreign dealers of PSPM in Singapore are required to adhere to transaction-based requirements that also apply to domestic regulated dealers. These transaction-based requirements include:

- Performing Customer Due Diligence or Enhanced Due Diligence stipulated in the Precious Stones and Precious Metals (Prevention of Money Laundering, Terrorism Financing and Proliferation Financing) Act 2019

- Filing Cash Transaction Report (CTR) with the Suspicious Transaction Reporting Office (STRO) for designated transactions and submitting a copy of the CTR with the Anti-Money Laundering/ Countering the Financing of Terrorism Division (ACD), Ministry of Law.

- Filing a Suspicious Transaction Report with STRO if any suspicion arises regarding the involvement of ML, TF, or PF activities.

AML Compliance Exemptions Granted to Transitory Foreign PSPM Dealers under Singapore Regulations

Foreign PSPM dealers are exempted from registering with the GoBusiness portal if they are conducting regulated dealing or acting as an intermediary for regulated dealing on a transitory basis.

This means that if a foreign dealer carries a business of regulated dealing or acting as an intermediary in Singapore for a period of 90 days or less in a calendar year, they are not required to register on the GoBusiness portal or comply with entity-based AML compliance requirements.

However, foreign dealers seeking this exemption must inform the Ministry of Manpower regarding their intention to perform a Work Pass Exempt (WPE) activity. Conducting WPE activities without notifying the Ministry of Manpower amounts to an offence in Singapore.

When Should Foreign Dealers Notify the Ministry of Manpower for Work Pass Exempt (WPE) Activities

Foreign dealers must notify the ministry about their Work Pass Exempt (WPE) Activity after arriving in Singapore and getting a short-term visa pass from the Immigration and Checkpoints Authority and before starting the exempt activity.

Particulars that Foreign Dealers Need to Submit Via E-Notification to the Ministry of Manpower for WPE Activities

When submitting an e-notification to the Ministry of Manpower for WPE activities, foreign dealers must furnish the following details

- Name

- Date of Birth

- Passport Number

- Disembarkation/Embarkation (DE) card number

- Expiry Date of the Passport

- Expiry Date of the Short-Term Visit Pass

- Type of Activity that the Foreign Dealer is Undertaking

- Total Period for Which the Foreign Dealer is Undertaking the Activity and the Start Date and End Date of Such Period

- Foreign Dealer’s Workplace Address

As a best practice, foreign dealers should print the acknowledgement letter if, in any case, they need to produce it in the future.

Extension of Foreign Dealer's Notification Duration for WPE Activities

Foreign dealers can apply to extend the duration of their notification for a WPE activity before the end date of the activity, as mentioned in the original notification. They can do so by re-submitting a new notification if they fulfil the following criteria:

- The foreign dealer’s total period of activity does not exceed 90 days in a calendar year.

- The foreign dealer’s Short-Term Visit Pass is valid for the term of extension that the foreign dealer seeks.

Is Your AML Program as Precious as the Goods You Trade?

Our Comprehensive AML compliance solutions match the value of precious products

GoBusiness Registration for Foreign Dealers

If a foreign dealer carries on a business in Singapore for more than a period of 90 days, then the foreign dealer will have to register on the GoBusiness portal.

Getting a Foreign Singpass or Corppass Account before GoBusiness Registration as a Foreign Dealer

Foreign dealers require a valid Foreign Singpass or Corpass Account for transacting with selected government digital services in Singapore, such as accessing digital services on GoBusiness portal.

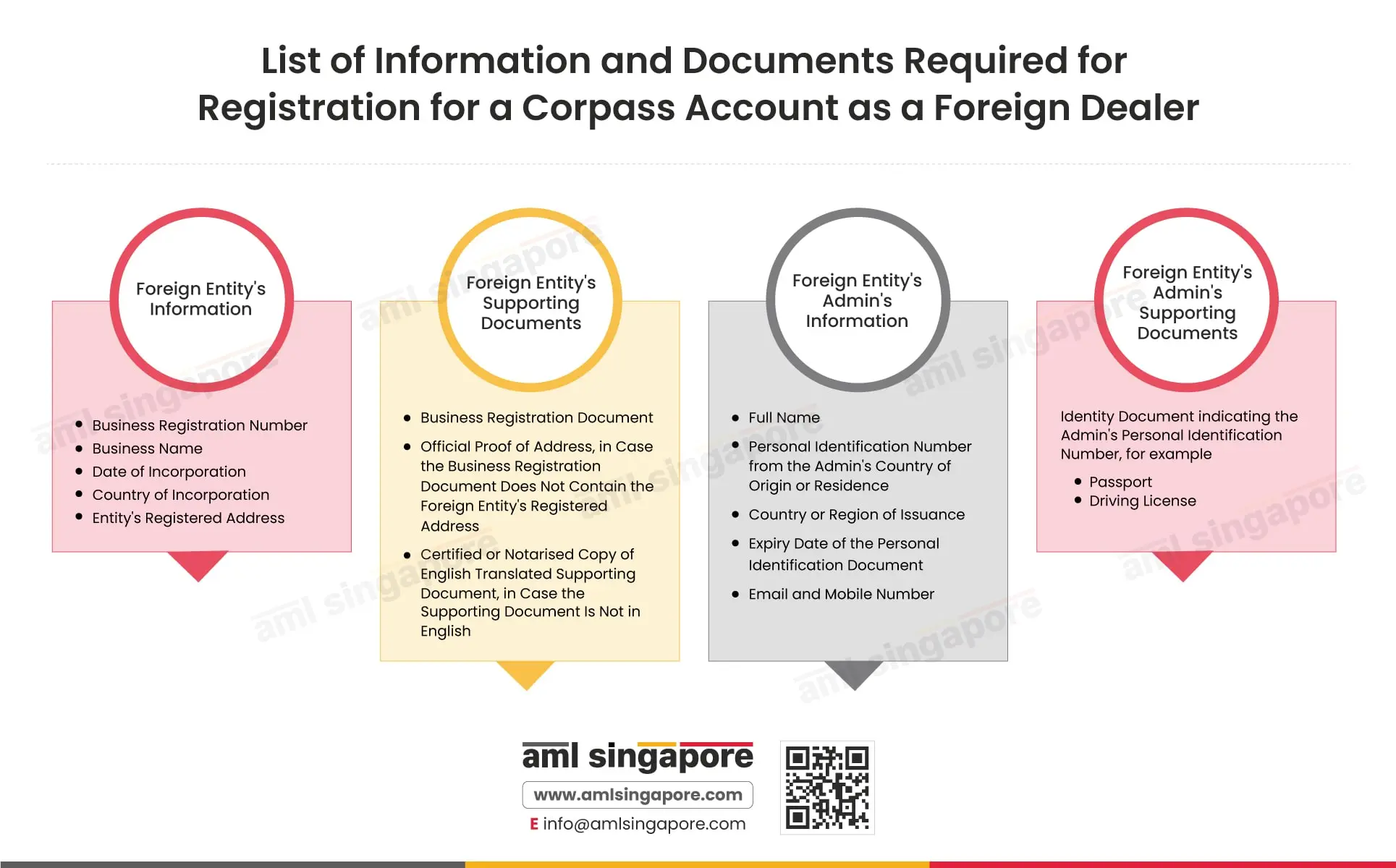

Here is a list of information and documents required for registration for a Corpass Account:

- Foreign Entity’s Information

- Business Registration Number

- Business Name

- Date of Incorporation

- Country of Incorporation

- Entity’s Registered Address

- Foreign Entity’s Supporting Documents

- Business Registration Document

- Official Proof of Address, in Case the Business Registration Document Does Not Contain the Foreign Entity’s Registered Address

- Certified or Notarised Copy of English Translated Supporting Document, in Case the Supporting Document Is Not in English

- Foreign Entity’s Admin’s Information

- Full Name

- Personal Identification Number from the Admin’s country of origin or residence

- Country or Region of Issuance

- Expiry Date of the Personal Identification Document

- Email and Mobile Number

- Foreign Entity’s Admin’s Supporting Documents

- Identity Document indicating the Admin’s Personal Identification Number, for example

- Passport

- Driving License

- Identity Document indicating the Admin’s Personal Identification Number, for example

GoBusiness Registration Process for Foreign Dealers

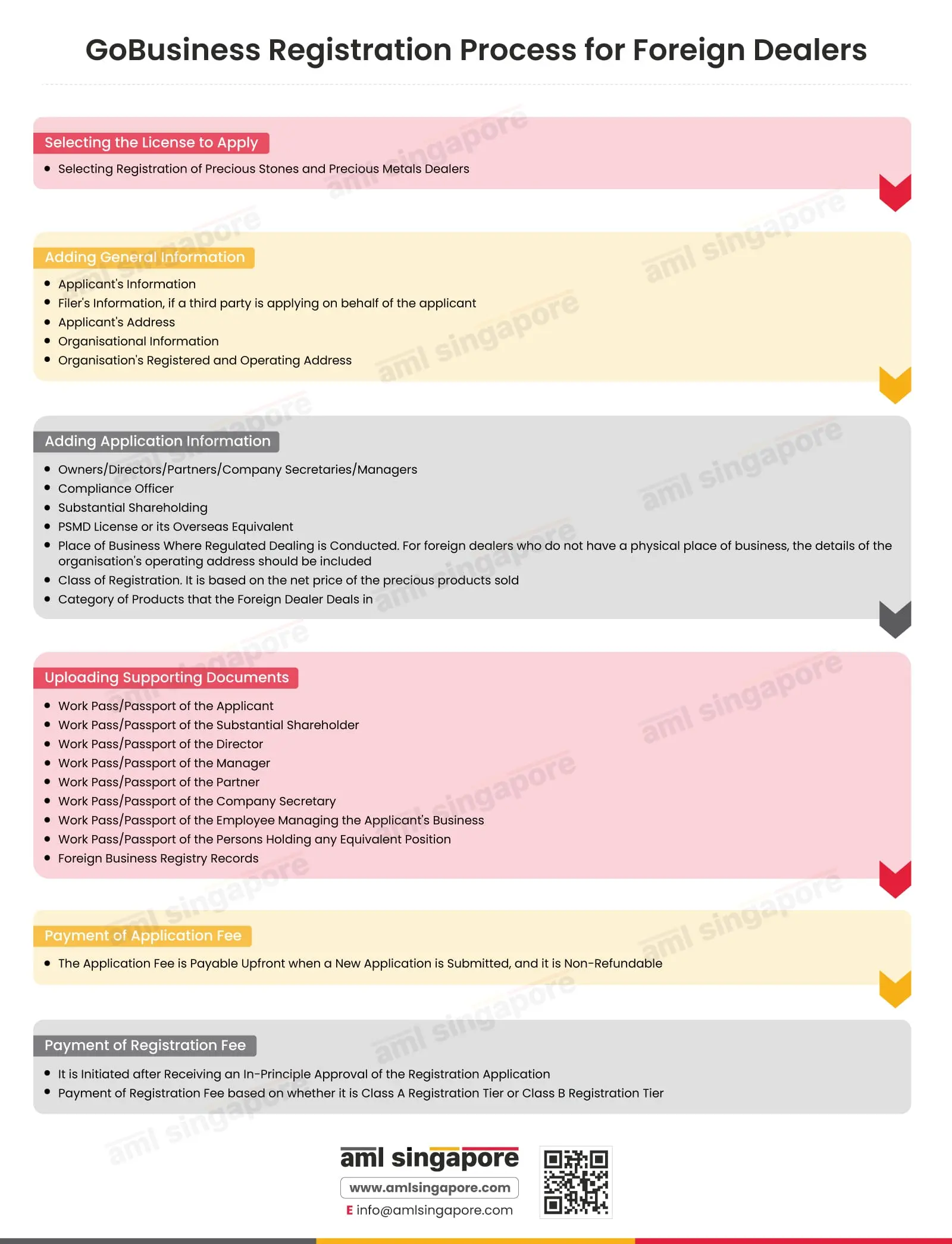

Foreign Dealers can follow the following steps for GoBusiness registration:

Step 1: Selecting the License to Apply

- Selecting Registration of Precious Stones and Precious Metals Dealers

Step 2: Adding General Information

- Applicant’s Information

- Filer’s Information, if a third party is applying on behalf of the applicant

- Applicant’s Address

- Organisational Information

- Organisation’s Registered and Operating Address

Step 3: Adding Application Information

- Information about Owners/Directors/Partners/Company Secretaries/Managers

- Information about the Compliance Officer

- Information about Substantial Shareholding

- Information about PSMD License or its Overseas Equivalent

- Place of Business where regulated dealing is conducted. For foreign dealers who do not have a physical place of business, the details of the organisation’s operating address should be included

- Determining the class of registration based on the net price of the precious products sold

- Category of products that the foreign dealer deals in

Step 4: Uploading Supporting Documents

- Work Pass/Passport of the applicant

- Work Pass/Passport of the Substantial Shareholder

- Work Pass/Passport of the Director

- Work Pass/Passport of the Manager

- Work Pass/Passport of the Partner

- Work Pass/Passport of the Company Secretary

- Work Pass/Passport of the Employee managing the applicant’s business

- Work Pass/Passport of the Persons holding any equivalent position

- Foreign Business Registry Records

Step 5: Payment of Application Fee

- The application fee is payable upfront when a new application is submitted, and it is non-refundable.

Step 6: Payment of Registration Fee

- It is initiated after receiving an in-principle approval of the registration application

- Payment of Registration Fee based on whether it is Class A registration tier or Class B registration tier

Entity-Based AML Compliance Obligations for Registered Foreign Dealers of PSPM in Singapore

Registered foreign dealers of PSPM in Singapore are required to perform entity-based AML compliance functions such as

- Conducting Enterprise-Wide Risk Assessment to gauge the business’s risks from ML, TF, and PF activities

- Developing Internal Policies, Procedures, and Controls (IPPC) to manage the ML, TF, and PF risks to which the business is exposed.

Summarising the AML Compliance Requirements for Foreign Dealers of Luxury Goods in Singapore

While individuals or businesses outside Singapore may not be fully aware of all their compliance functions, this article ensures that the foreign dealers of luxury goods in Singapore are well aware of their AML compliance obligations.

Unlock Global Business Opportunities with AML Singapore

Trust our experts for best-in-class AML compliance

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 9 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.