AML/CFT Training Essentials: Know, Educate, Comply

AML/CFT Training Essentials: Know, Educate, Comply

The regulated entities in Singapore must carry out their Enterprise-Wide Risk Assessment and prepare their AML/CFT policy, procedures, and controls to counter ML/TF risks. One of the vital elements of AML/CFT compliance is AML/CFT training.

Key Elements of AML/CFT Training

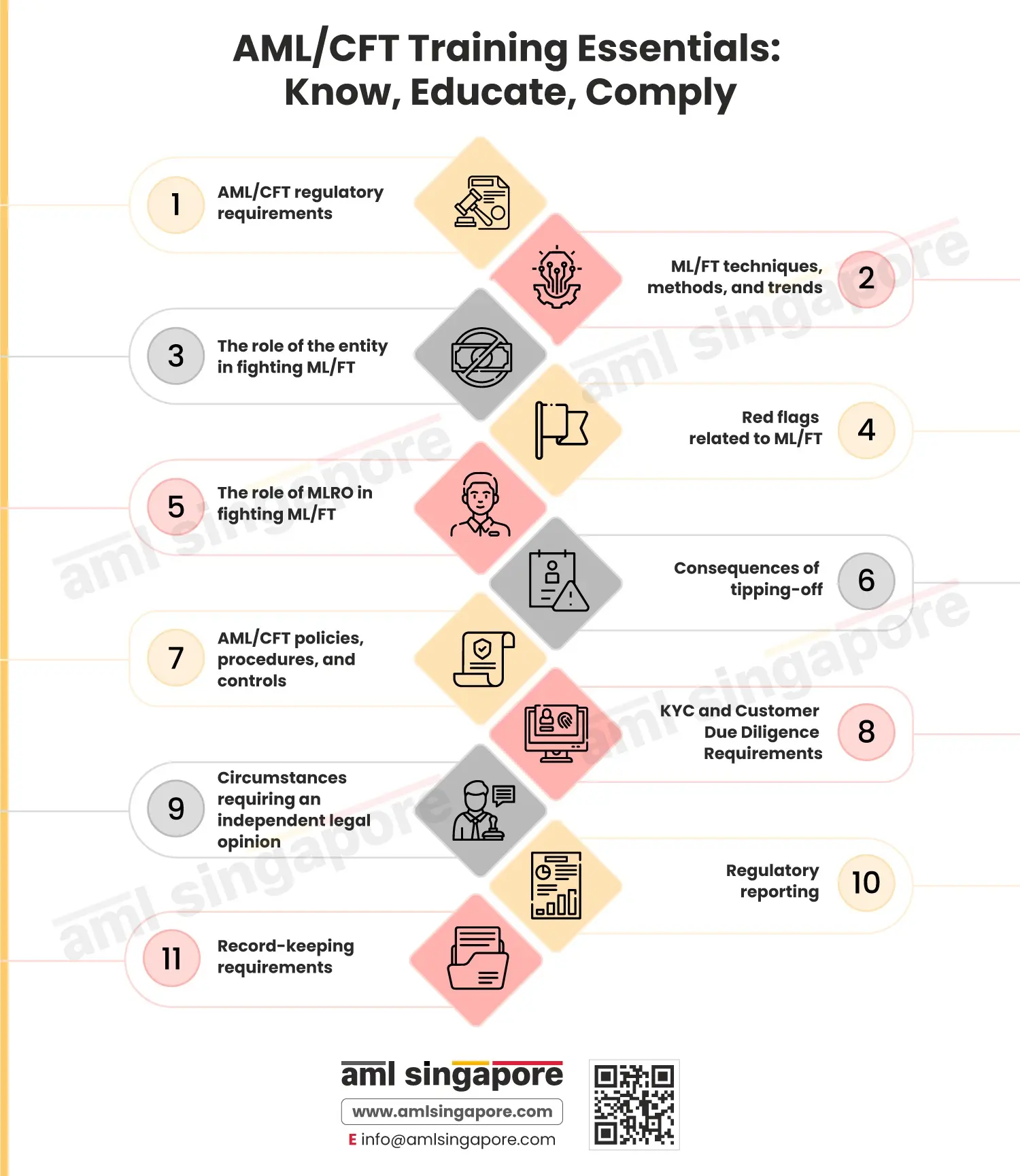

The AML/CFT Training program should cover the following topics:

- AML/CFT regulatory requirements

- ML/FT techniques, methods, and trends

- The role of the entity in fighting ML/FT

- Red flags related to ML/FT

- The role of MLRO in fighting ML/FT

- Consequences of tipping-off

- AML/CFT policies, procedures, and controls

- KYC and Customer Due Diligence Requirements

- Circumstances requiring an independent legal opinion

- Regulatory reporting

- Record-keeping requirements

The firms are required to take a risk-based approach and tailor their policies and procedures to maintain the risks within their risk appetite.

It is essential that the AML/CFT compliance staff is well-versed with the AML/CFT regulatory requirements in Singapore. Further, they should also know the current and emerging ML/FT techniques, methods, and trends. The staff dealing with the customers must know the red flags associated with customers and transactions and act diligently when they suspect money laundering or terrorist financing.

It is important to understand the role a company plays in countering the risks of money laundering and terrorist financing. The front-line staff, managers, and owners should know their role and have sufficient resources to fulfil that.

The role of the MLRO in overall AML/CFT compliance is vital. He is responsible for the overall AML/CFT program implementation.

There are severe consequences of tipping off. The staff must know their legal responsibilities while dealing with customers. Further, a clear understanding of KYC and Customer Due Diligence (CDD) is required to counter risks associated with the customers.

The compliance staff must know the regulatory reporting and record-keeping requirements to fulfil their function. They must be trained when to seek independent legal opinion to safeguard the company’s interests and remain compliant with the requirements of the law.