AML/CTF/CPF Regulatory Framework for Precious Stones and Precious Metals Dealers (PSMD) in Singapore

AML/CTF/CPF Regulatory Framework for Precious Stones and Precious Metals Dealers (PSMD) in Singapore

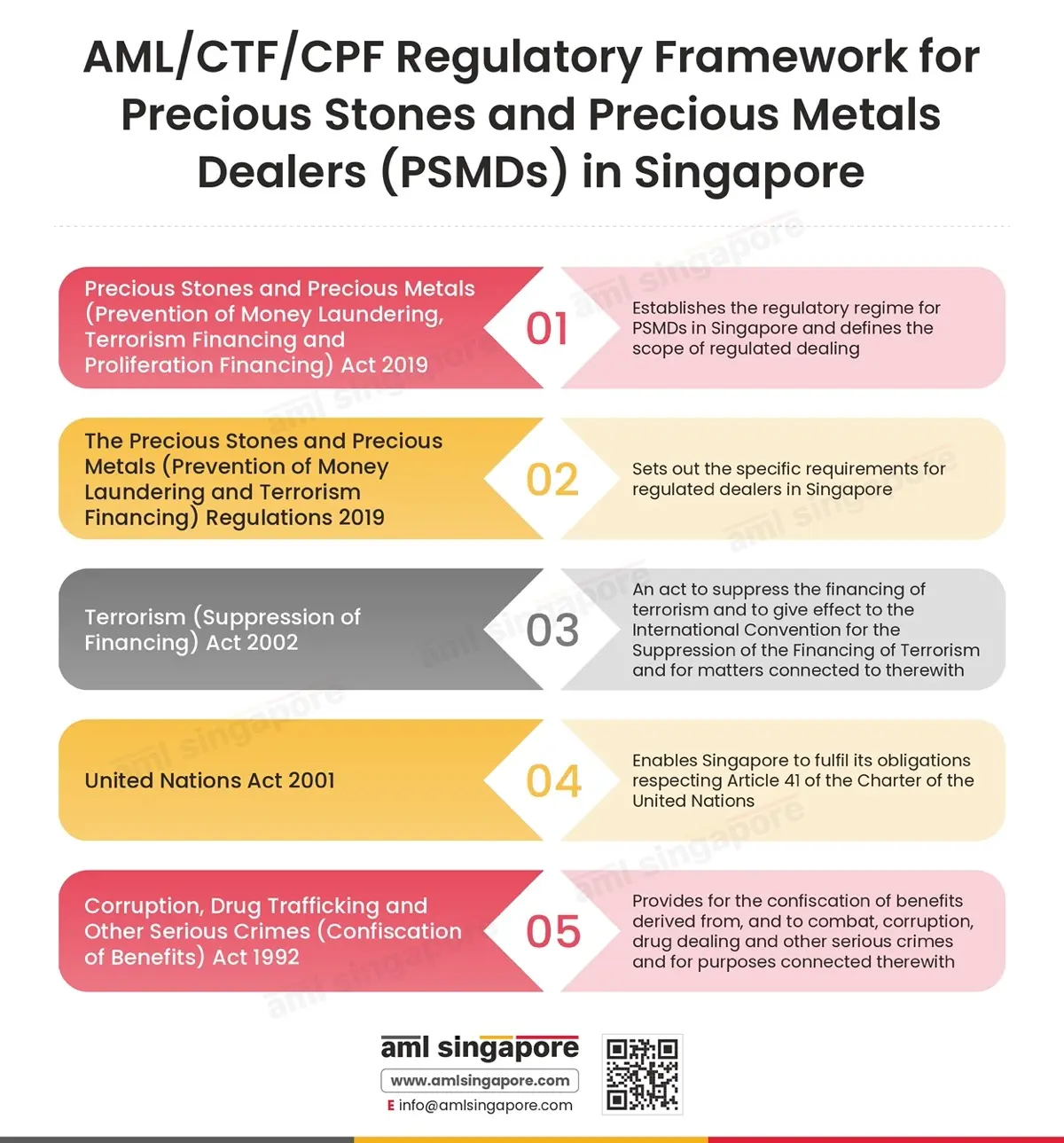

AML/CTF/CPF Regulatory Framework for Precious Stones and Precious Metals Dealers (PSMDs) in Singapore.

Singapore has a very stringent AML/CTF/CPF regulatory framework for Precious Stones and Precious Metals Dealers (PSMDs). Singapore’s primary legislation to combat money laundering is the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act, 1992 (CDSA), and all regulated dealers must follow the regulatory requirements.

What is a regulated dealer?

A regulated dealer is defined as a person who carries on a business of regulated dealing or a business as an intermediary for regulated dealing.

What is regulated dealing?

Any of the following activities in relation to precious stone, precious metal, precious product:

- Manufacturing

- Importing or possessing for sale

- Selling or offering for sale

- Purchasing for the purposes of resale.

Additionally, selling or redeeming asset-backed tokens is also considered to be regulated dealing

The Precious Stones and Precious Metals (Prevention of Money Laundering, Terrorism Financing, and Proliferation Financing) Act 2019 (“PSPM Act”) establishes the regulatory regime for PSMDs in Singapore and defines the scope of regulated dealing.

The Precious Stones and Precious Metals (Prevention of Money Laundering and Terrorism Financing) Regulations 2019 (“PMLTF Regulations”) set out the specific requirements for regulated dealers in Singapore.

Terrorism (Suppression of Financing) Act 2002 was enacted to suppress the financing of terrorism and to give effect to the International Convention for the Suppression of the Financing of Terrorism and for matters connected to that.

United Nations Act 2001 enables Singapore to fulfil its obligations respecting Article 41 of the Charter of the United Nations.

Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act 1992 provides for the confiscation of benefits derived from, and to combat, corruption, drug dealing and other serious crimes and for purposes connected therewith.

Summarising the AML/CTF/CPF Regulatory Framework for Precious Stones and Precious Metals Dealers (PSMDs) in Singapore

A strong understanding of the regulatory framework can help regulated dealers strengthen their safeguards against money laundering, terrorism financing, and proliferation financing risks.