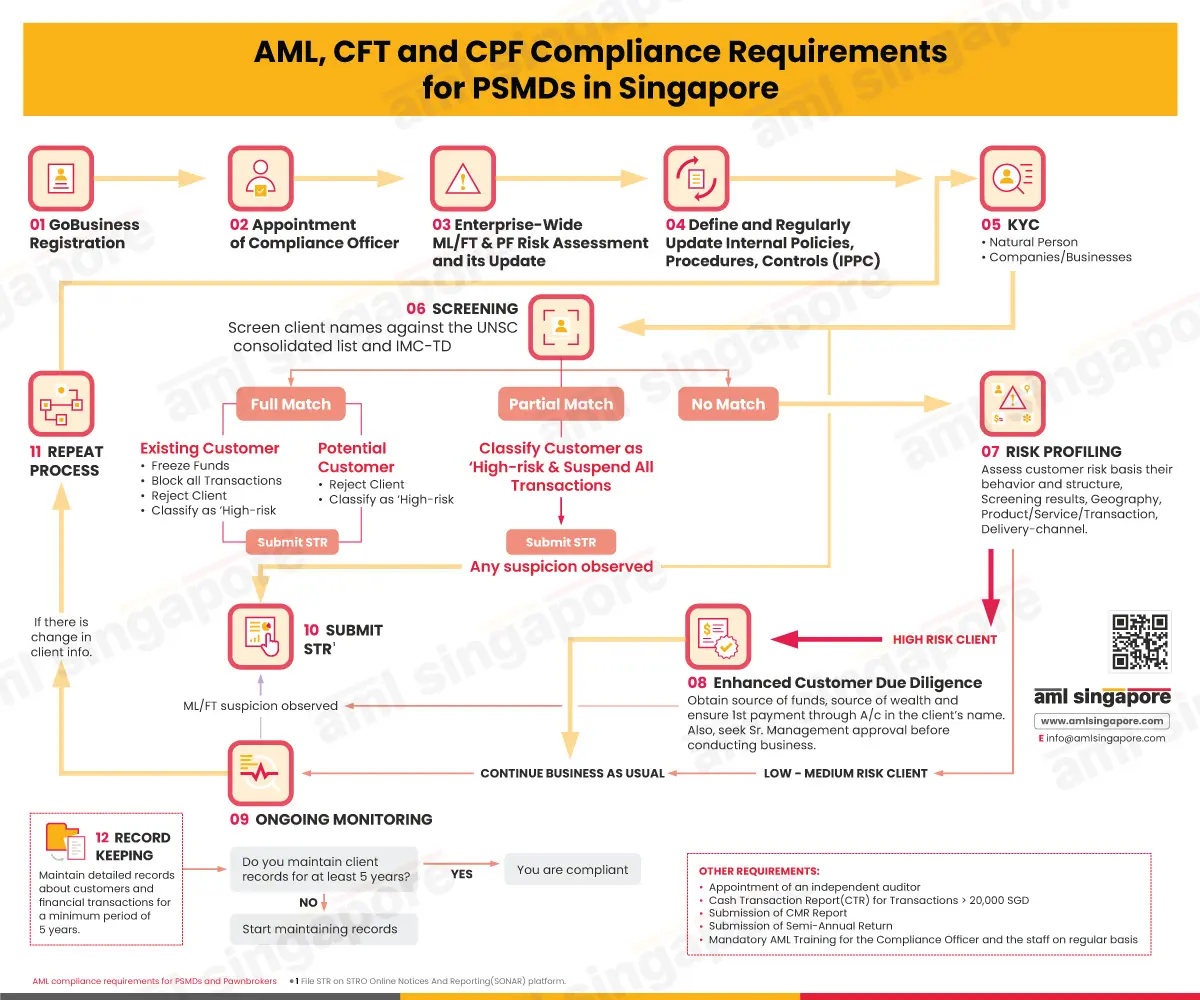

AML CFT and CPF Compliance Requirements for PSMDs in Singapore

AML CFT and CPF Compliance Requirements for PSMDs in Singapore

The Precious Stones and Precious Metals Dealer (PSMDs) in Singapore need to adhere to numerous Anti-Money Laundering (AML), Counter Financing of Terrorism (CFT), and Counter-Proliferation Financing (CPF) compliance requirements. This detailed stepwise infographic intends to act as a ready reference for PSMDs to understand their AML/CFT and CPF obligations in a summarized manner, guiding with the obligations arising out of:

- The Precious Stones and Precious Metals (Prevention of Money Laundering, Terrorism Financing and Proliferation Financing) Act 2019.

- Guidelines for Regulated Dealers in the Precious Stones and Precious Metals Dealers Sector on Anti-Money Laundering/Countering the Financing of Terrorism/Countering Proliferation Financing.

The AML CFT and CPF Compliance Requirements for PSMDs in Singapore are as follows:

- Registering with GoBusiness portal, a platform to facilitate PSMDs with the commencement of their AML /CFT and CPF compliance journey.

- Appointing a competent AML compliance officer to ensure effective implementation of the Internal Policies, Procedures, and Controls (IPPC)

- Conducting Enterprise-Wide ML/FT Risk Assessment to identify the ML/FT risks to the regulated entity

- Ensuring regular, timely, and accurate updating of the Internal Policies, Procedures, and Controls (IPPC).

- Adopting the Know Your Customer (KYC) process to verify prospective and existing customers as well as beneficial owner identification information of the legal entity or legal arrangement customer and documentation of the same.

- Conducting Screening to verify if the customer is a designated individual or entity. If found sanctioned, take step no.10.

- Undertaking Customer Risk Assessment and Customer Risk Profiling to classify the customer into high-risk, medium-risk, and low-risk.

- Performing Enhanced Customer Due Diligence for high-risk customers.

- Fulfilling Ongoing Monitoring Requirements.

- Timely reporting of suspicious activity or transactions by filing a Suspicious Transaction Report (STR) to Singapore’s Suspicious Transaction Reporting Office (STRO) using the SONAR platform.

- If there is no change in customer information, repeat the entire compliance process.

- Maintaining all the relevant AML records in an organized manner for a minimum period of five years.

While meeting other regulatory reporting requirements such as follows:

- Submission of Cash Transaction Report (CTR)

- Submission of Semi-Annual Return.

Conclusion

Ensuring adequate AML /CFT and CPF compliance is possible with the help of a proper understanding of the compliance requirements and ensuring that essential elements of the AML program are in place for the PSMD.

Related Posts

Worried about your Trust Company’s AML Compliance Requirements?

Let go of all your Trust Company-related compliance concerns with AML Singapore.