Adverse Media Search: Strengthening Customer Due Diligence

Adverse Media Search: Strengthening Customer Due Diligence

As we know, Customer Due Diligence is one of the important anti-money laundering measures, focused on identifying the customers and their beneficial owners to establish that the person is the one he presents to be. This identification process must not be restricted to just verification of the identity document to match the name on this document and the “Know Your Customer” details furnished by the person. The effectiveness of the CDD process increases when efforts are made to detect any negative news or adverse media about the person.

In this article, we shall discuss what the phrase “adverse media” indicates, its nexus with AML compliance, and the best practices to be followed to avoid common mistakes generally endured when scanning negative news.

Understanding the Adverse Media Searches and its Role in AML Compliance

Adverse media are generally negative news about the person (individual or an entity) suggesting their association with criminal activities, including any severe non-compliance amounting to the execution of some illegal activities. This adverse information can be related to financial crimes like terrorism financing and money laundering or its connected predicate offences like smuggling, narcotics, corruption, etc.

In the context of AML compliance, adverse media search refers to scanning the customer’s name against reliable data sources to gather information and evaluate the person’s involvement in any crime that may impact the business’s exposure to money laundering or terrorism financing activities.

Adverse media search enables the regulated entity to dive deep into the person’s profile, making the CDD process robust. When any negative information or any criminal history about the person is identified, it helps the entity effectively gauge the risk the customer may pose to the business and make an informed business decision to maintain a business relationship with the person or, if yes, what risk mitigation measures to be adopted.

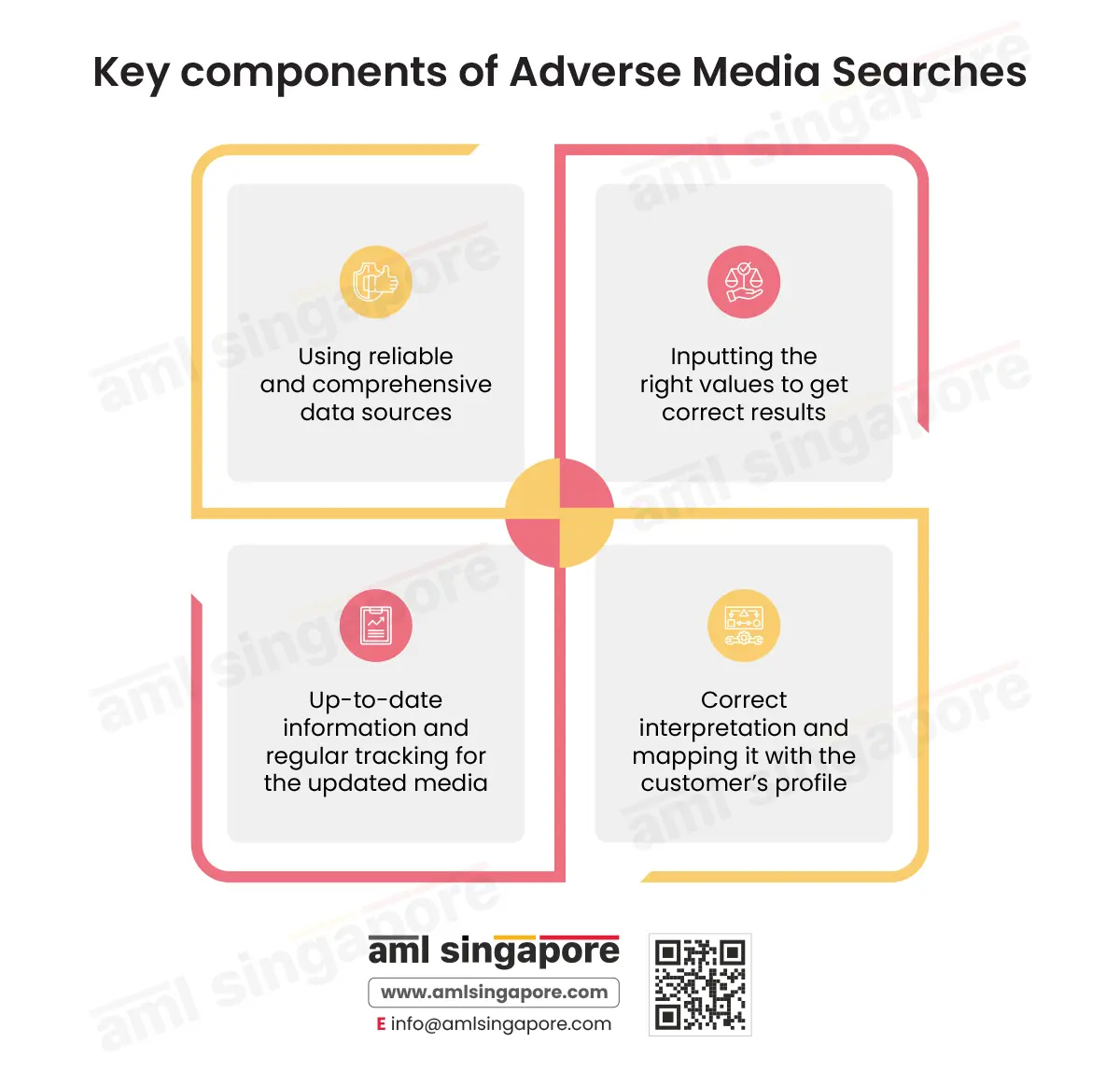

Decoding the Key Components of Adverse Media Searches

To ensure the effectiveness of the adverse media searches, the regulated entity must not overlook the following critical elements of the adverse media searches:

1. Using reliable and comprehensive data sources:

The entity must conduct negative news screening using a trustworthy and complete database. These data sources include official government websites, paid or subscription-based databases managed by reputable third parties, etc. Reliance can also be placed on credible news channels or platforms for gathering information. Given the global nature of financial crimes, the entities must also consider checking the information on international platforms.

and combating each source’s information. This can enable the AML Compliance Officer to effectively analyse and determine the customer’s risk.

Depending on the nature of the matter, the entity may also rely on social media platforms like Facebook or Twitter to corroborate any information available on online sources. However, relying solely on the results available on these platforms may not be sufficient, as these may be some personal opinions of the individuals without any investigation or evidence. Hence, the information or data on social media channels must be cautiously used.

2. Inputting the right values to get correct results:

It is essential to input the right details to achieve the desired outcome. The regulated entity must ensure that the adverse media screening is performed:

- using the correct spelling or full name of the person,

- using aliases of the person screened to yield the information put in the public domain using different names for the same person,

- relevant keywords must be used to filter down the results to the most relevant items which impact AML compliance (like “money laundering”, “financial crime”, “fraud”, “corruption”, “tax evasion”, etc.),

- if necessary, the entity may choose to provide the date range to understand the current adverse media details that may be most relevant.

The effectiveness of the adverse media search is highly dependent on the screening values used during the process.

3. Correct interpretation and mapping it with the customer’s profile:

When conducting an adverse media search, various possible matches may be found against the person, which may result in a false conclusion unless these available items of article or news are thoroughly evaluated to understand its nature. For example, while conducting a screening, you found an article where the matter is related to a person’s divorce from his spouse. Though this may, so-called, be treated as “adverse media”, it is not related to any financial crime that may impact the potential risk of the business. For AML compliance, such news about mere divorce matters (civil suits) is of no or very little significance, if any.

Thus, the person conducting the adverse media screening must be trained to spot the relevant news or media piece that may be relevant from an AML perspective and actually assist the entity in determining the potential ML/FT risk the customer may pose. The identified negative information must be mapped with the identification details of the person as available with the entity to ensure the relevance of the results.

Further, before concluding the results, the entity must reverify the source of such media to allocate a reasonable significance to such information.

Moreover, attention to detail is also crucial to ensure that no genuine adverse media results are skipped or dismissed, which may be relevant for an entity to assess the risk profile. With well-defined rules around understanding the context, the entity can differentiate between false positive results and legit negative information, ensuring accurate customer risk assessment and reducing the chances of misinterpretation.

4. Up-to-date information and regular tracking for the updated media:

Adverse media screening is also not a one-time activity, wherein the entity can rely on the results obtained when the person was screened once at the time of establishing the business relationships. In the fast-moving world where people can be anywhere anytime and with emerging sophisticated techniques to conduct crime, the reliance cannot be placed on outdated news and information. Only when the entity relies on valid and current data to perform the searches can the purpose of making such efforts be fulfilled.

Hence, the regulated entity must ensure that its existing customer base and their beneficial owners are screening for adverse media on an ongoing basis to immediately identify any availability of negative media that impacts the customer’s risk classification. This is impossible unless the processes and systems deployed by the entity for this screening can identify the changes in the data sources and promptly fetch the new information.

To achieve this, the entity must look for a solution or a tool that supports continuous scanning of the customers for adverse media and triggers an alert when any update is found.

Let’s empower the Customer Due Diligence Process with Adverse Media Searches

The regulated entities in Singapore must ensure that the Customer Due Diligence program, as defined in its Internal Policies, Procedures, and Controls (IPPC), covers the crucial element – Adverse Media Search. The outcome of these screenings must be factored into the entity’s customer risk assessment methodology as one of the contributing parameters that significantly impact the exposure.

Here, we are to assist you with designing and implementing the best practices for effective adverse media screening – AML Singapore. We can assist in identifying the suitable systems and procedures to carry out the negative news screening, training the team on how such a search must be performed and how the results must be interpreted to avoid any erroneous conclusions around the customer’s risk.

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 9 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.