ACRA Requirements for the Register of Registrable Controllers

ACRA Requirements for the Register of Registrable Controllers

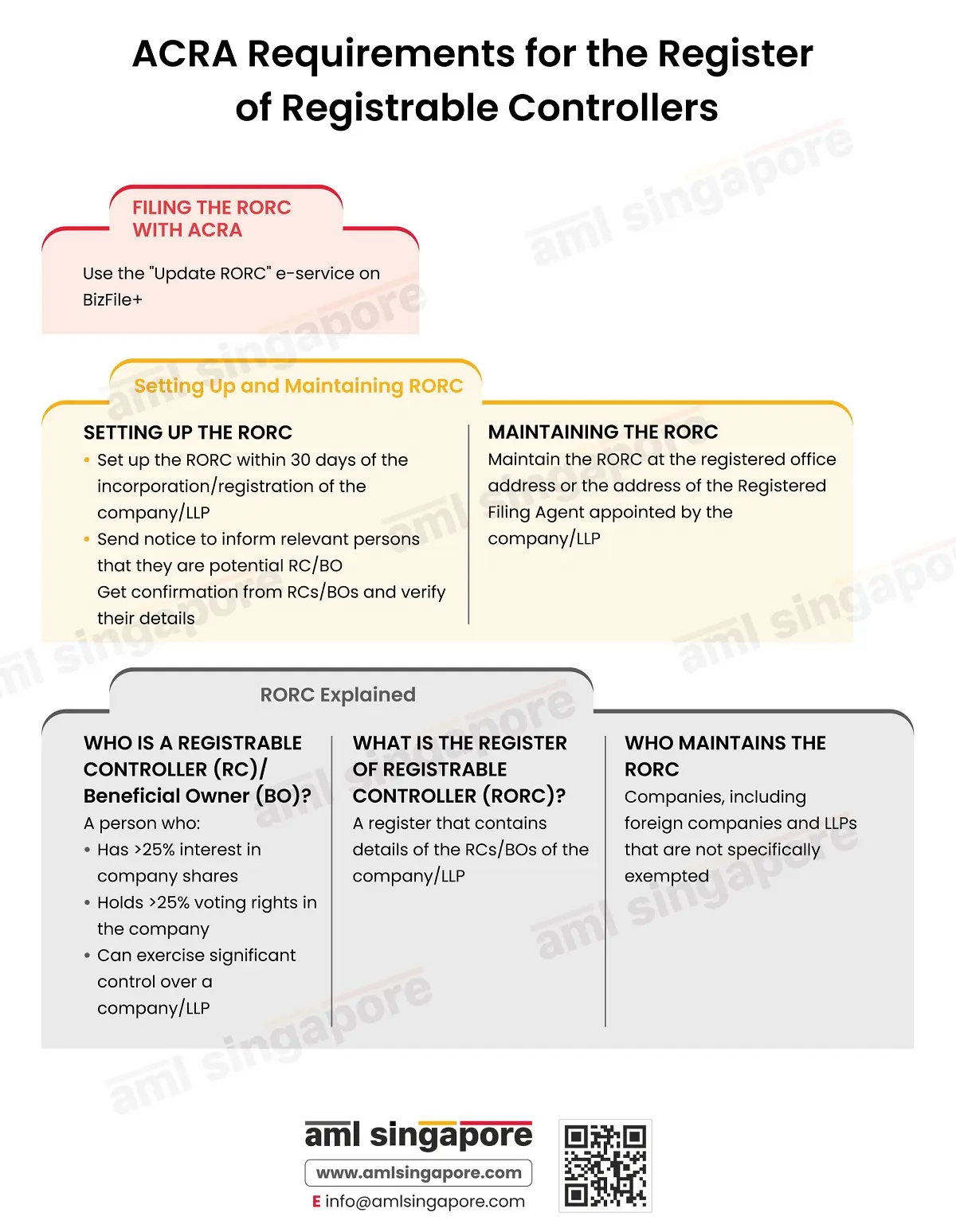

The Accounting and Corporate Regulatory Authority (ACRA), since 2017 has mandated companies, including foreign companies and Limited Liability Partnerships (LLPs), to maintain a Register of Registrable Controllers (RORC).

Registrable Controllers (RCs), also known as Beneficial Owners (BOs), are the individuals who:

- Have more than 25% interest in the shares of the company, or

- Hold more than 25% of members’ voting rights in the company, or

- They are in a position to exercise significant control or influence over a company or LLP.

Setting up the RORC

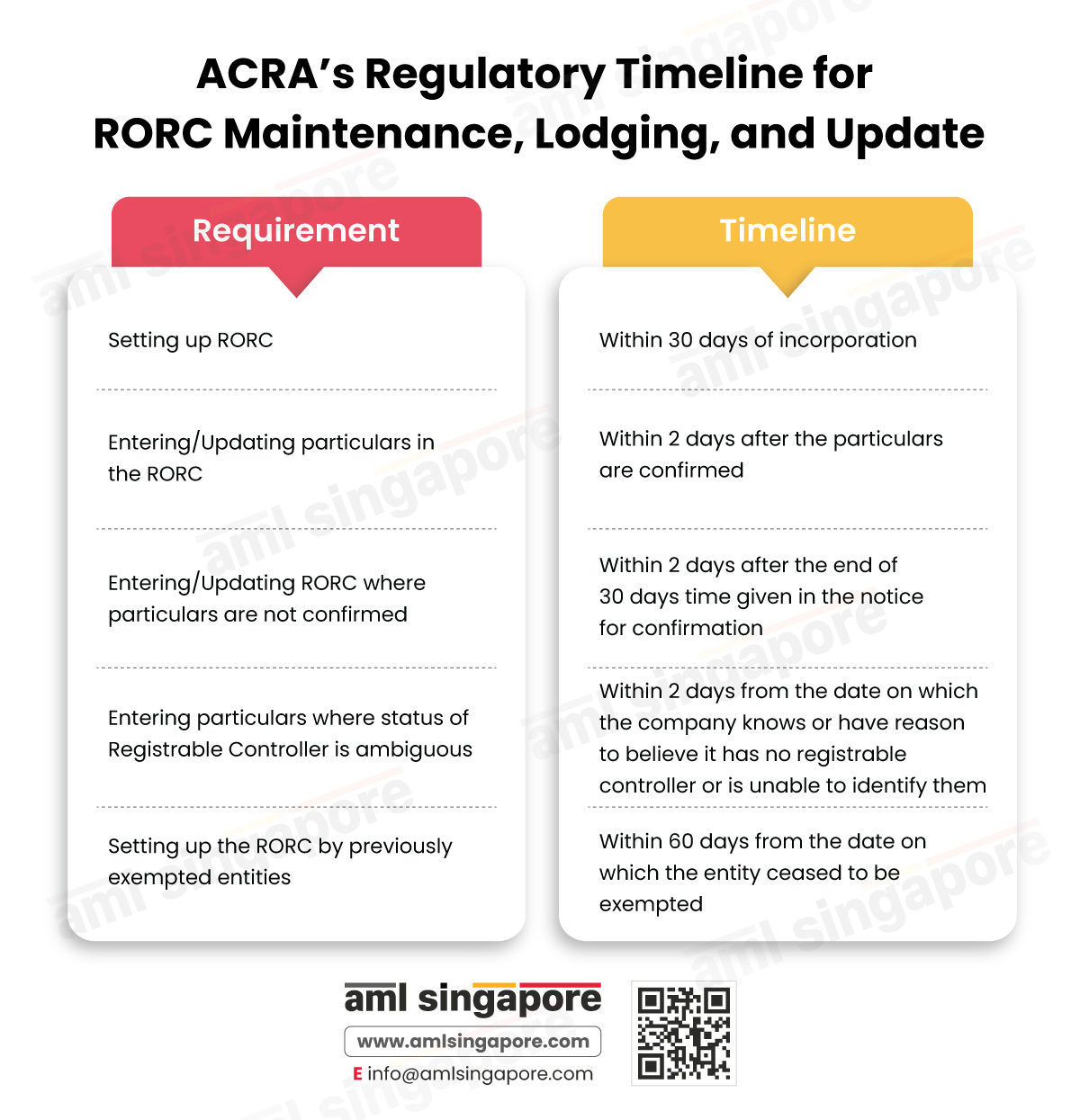

All companies, including dormant companies, LLPs incorporated in Singapore and foreign companies, unless exempted, have to set up a Register of Registrable Controllers in Singapore within 30 days of incorporation or registration of the company.

The company/LLP must take reasonable steps, such as sending notices to individuals who can be potential RCs to:

- Get their confirmation about being a RC, and

- Verify their information.

Since 2022, ACRA has mandated entities to identify individuals with executive control as their RCs if previously the entity could not identify a RC.

Maintaining the RORC

Entities can keep the Register of Registrable Controllers (RORC) at their registered office address. For entities that have outsourced their corporate secretarial work to a corporate service provider who is a Registered Filing Agent (RFA), the company can authorise the RFA to keep the entity’s RORC at the RFA’s registered office address.

However, in the event of a breach of RORC requirements, the legal obligation remains with the company, foreign company or LLP. The RORC can be maintained in electronic or physical format.

Filing the RORC with ACRA

In addition to maintaining the Register of Registrable Controllers (RORC) with themselves, companies, foreign companies, and LLPs also have to lodge RORC’s particulars with ACRA’s central register within two days of setting up the register or after the entity’s RORC is updated. This requirement does not extend to Variable Capital Companies (VCCs) and entities which are struck off.

Only authorised position holders of companies, foreign companies and LLPs or group secretaries can lodge ROC information with ACRA. Entities can also authorise the RFAs to lodge RC’s information, but the entity’s legal liability in case of any enforcement actions taken by ACRA shall reside with them.

Access to the Register of Registrable Controllers

The Register of Registrable Controllers (RORC) is not a public document. It can only be viewed by company directors and secretaries because they are responsible for maintaining and lodging the RORC. Shareholders who do not hold any office in the company cannot view the RORC. LLPs must not disclose or make the RORC or any of its particulars available for public inspection. Auditors are also not entitled to view the RORC.

However, the RORC and related or supporting documents kept by the entities and the ACRA central RORC can be made available only to law enforcement agencies for the purpose of administering or enforcing the laws under their purview.

Entities can file RORC with ACRA using BizFile+, ACRA’s online filing portal.