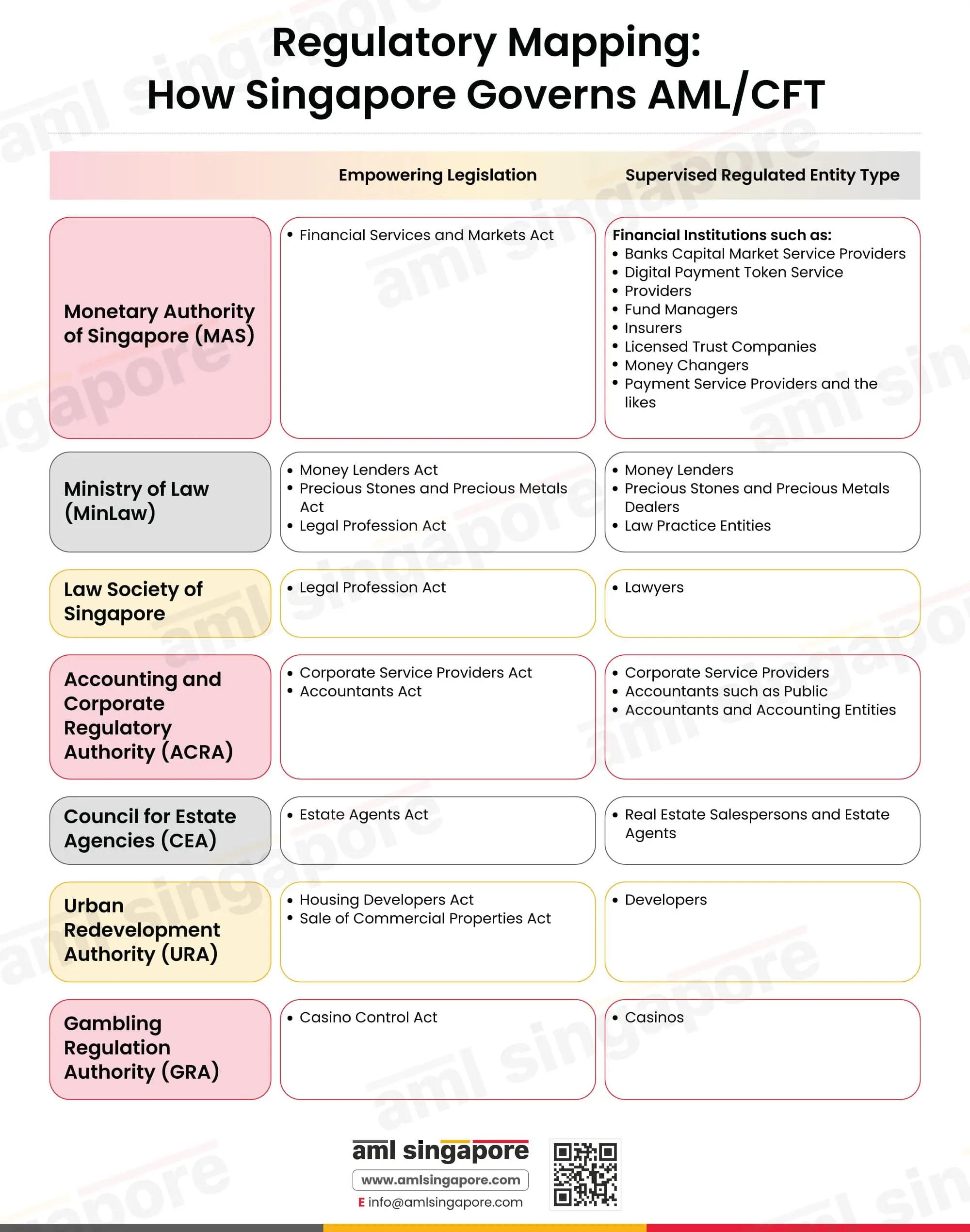

AML/CFT Supervisory Authorities in Singapore: Who Regulates Whom?

This infographic makes it easy to navigate through the complex supervisory and regulatory compliance landscape for AML/CFT Regulated Entities. It provides visual map of AML/CFT Supervisory Authorities in Singapore that oversee the AML/CFT compliance measures of various Regulated Entities and professionals, such as Financial Institutions, Precious Stones and Precious Metals Dealers (PSMDs), Accountants and accounting professionals, Law firms, and Legal Practitioners, Corporate Service Providers (CSPs), Real Estate Salespersons and Real Estate Agents, Casinos, Developers, and so on.

Financial Institutions

Financial institutions such as Banks, Capital Market Service Providers, Digital Payment Token Service Providers, Fund Managers, Insurers, Licensed Trust Companies, Money Changers, Payment Service Providers, etc., are governed under the Financial Services and Markets Act and are supervised by the Monetary Authority of Singapore.

Financial Services and Markets Act, 2022 (FSMA)

The FSMA is the sector-wide legislation for financial services and markets in Singapore, which was passed in April 2022. The FSMA’s Part 4 contains provisions on Anti-Money Laundering and Counter Financing of Terrorism (AML/CFT). The act empowers MAS to regulate the financial sector and its activities along with various other legislations.

Monetary Authority of Singapore

MAS is the financial sector regulator. It provides various publications, notifications, circulars, annual reports, information papers, statistics, news, and relevant directions to Regulated Entities coming under its purview. In the AML/CFT supervision context, it has published information and consultation papers on topics such as:

- Strengthening AML/CFT Name Screening Practices

- Consultation Papers on AML/CFT for FI to FI Information Sharing

- National Strategy for Countering CFT

- Consultation Papers on Capital Market Intermediaries, to name a few.

Money Lenders, Precious Stones and Precious Metals Dealers, Lawyers and Law Practice Entities

Regulatory requirements and supervisory bodies for money lenders, precious stone and precious metals dealers, lawyers, and law practice entities are detailed hereunder:

Money Lenders Act, Precious Stones and Precious Metals Act, and Legal Profession Act

The Money Lenders Act was enacted in 2008. It contains provisions for the Registrar to refuse to issue or renew a moneylending license on the grounds of a conviction under any laws related to preventing ML, TF and PF activities, whether in Singapore or any other country. Further, it contains provisions empowering the Minister to make rules to detect and prevent ML, FT, and PF activities and requires moneylenders to report suspicious transactions that might potentially involve ML, FT, and PF risks, including fines and penalties for non-compliance.

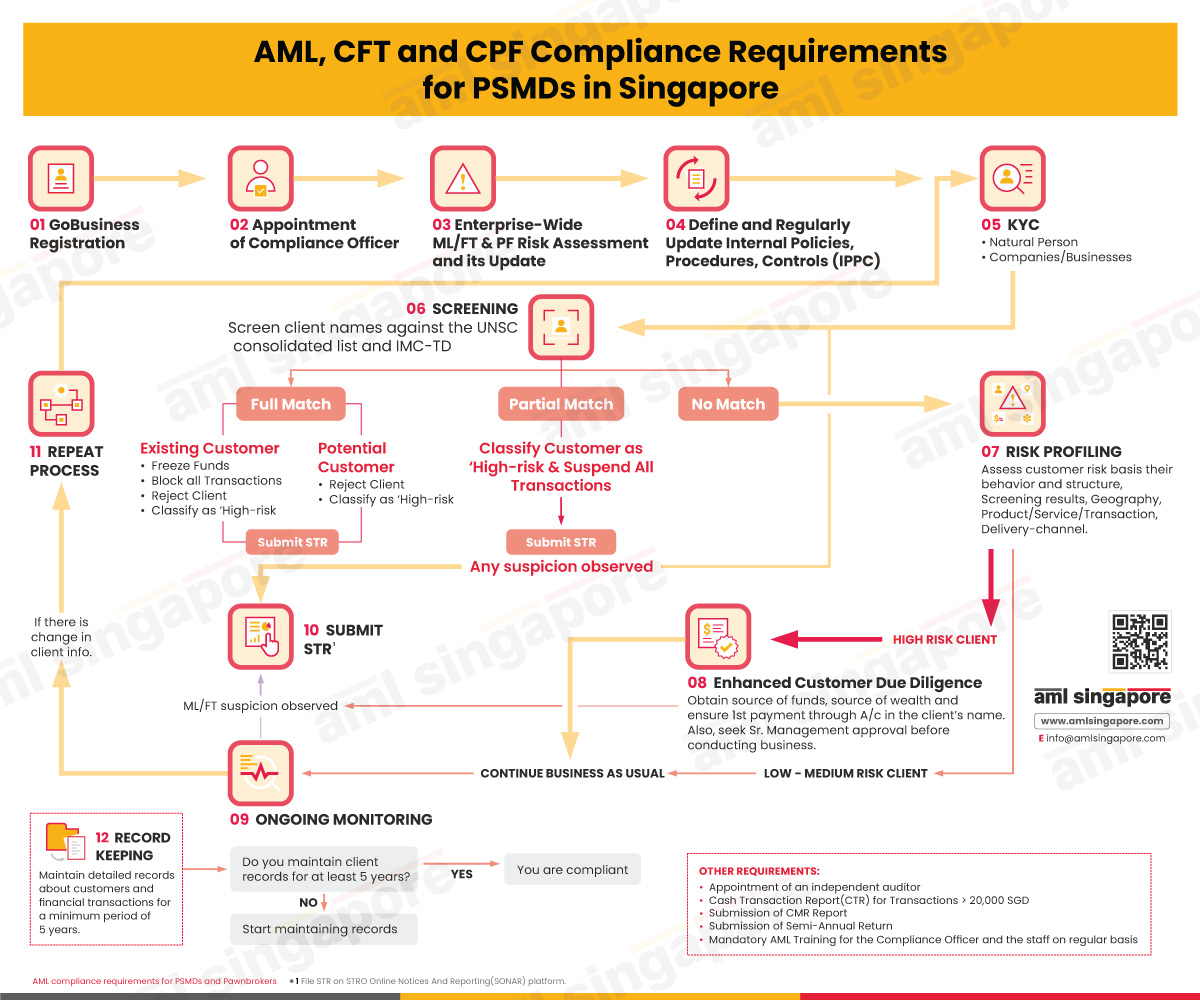

The Precious Stones and Precious Metals Act requires PSMDs to perform AML Compliance Obligations, making SGD 20,000 the “Threshold Amount” for the same and imposing legal obligations on PSMDs to meet these obligations to prevent ML/FT and PF through their business.

The Legal Profession Act 1966 is the principal law governing lawyers and legal professionals in Singapore.

- Part 5 provides for the establishment of the Law Society of Singapore to oversee lawyers’ conduct and adherence to the Act.

- Part 5A of the act, which came into effect in May 2024, provides for the prevention of ML, TF, and PF through adequate Customer Due Diligence and Suspicious Transaction Reporting and imposes record-keeping obligations.

Ministry of Law (MinLaw) and Law Society of Singapore

The Ministry of Law (MinLaw) oversees the AML Compliance obligations of PSMDs and Moneylenders.

However, the governing or supervising law firms and legal practitioners are slightly complex, as elaborated below.

- Sections 70H and 133 empower the Director of Legal Services, Ministry of Law, to suspend or revoke a law firm’s licence when a contravention of Part 5A of the Legal Profession Act 1966 is found.

- Whereas Section 70F empowers the Law Society of Singapore to inspect and oversee legal practitioners’ compliance with Part 5A of the Legal Profession Act 1966.

Corporate Service Providers and Accountants, such as Public Accountants and Accounting Entities

Corporate Service Providers (CSPs) and Accountants, such as Public Accountants and Accounting Entities (PAOCs), are legislated under the CSP Act and Accountant Act and supervised by ACRA.

Corporate Service Providers Act and Accountants Act

The Accountants Act 2004 defines and governs accounting firms, corporations, and entities. However, the CSP Act brings forth the regulatory requirements pertaining to specific corporate services provided by such accounting firms or corporations.

The CSP Act 2024 and CSP Regulations 2025 provide for AML/CFT compliance by the following entities and professionals, such as:

- Corporate Service Providers (CSPs)

- Accounting Service Providers (ASPs), including Public Accounting Entities (PAEs)

- Registered Filing Agents (RFAs)

- Registered Qualified Individuals (RQIs)

whenever they engage in “designated activities” as defined in the act.

Accounting and Corporate Regulatory Authority (ACRA)

ACRA is entrusted as the Regulatory Authority for business registration, financial reporting, public accountants, and CSPs. It provides a gateway to Bizfile and various resources such as publications, annual reports, guides, and other material for entities that are under its purview.

Real Estate Salespersons and Estate Agents

Real Estate Salespersons and Estate Agents are regulated by the Estate Agents Act and supervised by the Council for Estate Agencies.

Estate Agents Act

Part 4A of the Estate Agents Act 2010 provides for the prevention of ML, PF, and TF through CDD and Counterparty due diligence measures, it also provides for record-keeping, filing of STRs and imposes fines and penalties upon contravention.

Council for Estate Agencies (CEA)

The CEA is a statutory board that is formed under the Ministry of National Development and regulates, supervises, and develops the real estate agency industry in Singapore. It provides effective regulation, industry development and consumer education. It also provides e-Services and publications to help the sector achieve AL/CFT compliance.

Real Estate Developers

The Housing Developers Act and the Sale of Commercial Properties Act regulate the real estate developers indulging in the construction of property for sale, and the URA acts as the Supervisory body for the same.

Housing Developers Act and the Sale of Commercial Properties Act

Part 3A of the Housing Developers (Control and Licensing) Act 1965 imposes CDD, additional measures, and measures related to TFS, record-keeping, STR reporting, and development and implementation of AML/CFT programmes on housing developers in Singapore.

The Sale of Commercial Properties Act 1979 provides for performing CDD measures and TFS measures to ensure alignment with FATF recommendations under Part 5A of the act. It also provides for the development and implementation of AML/CFT policies and procedures.

Urban Redevelopment Authority (URA)

URA is Singapore’s conservation and land use planning authority. It develops long-term plans and master plans for sustainable development while overseeing housing developers’ compliance with AML/CFT requirements.

Casinos

Casinos in Singapore are regulated under the Casino Control Act and supervised by the Gambling Regulatory Authority, which is explained more elaborately below.

Casino Control Act

The Casino Control Act 2006, through its Part 8 on Casino Internal Controls, provides for CDD to combat ML, TF, and PF risks when the casino operator:

- Receives a sum of or enters into a cash transaction of SGD 4,000 or more in a single transaction

- Has reasonable suspicion that the patron poses ML, TF or PF risks

- Doubts the authenticity or veracity of patron information.

Gambling Regulatory Authority

GRA supervises the gambling industry in Singapore. Its objectives include ensuring law and order, honest gambling, and harm minimisation. It also issues standards and notices and manages licenses and approvals for gambling services.

Navigating Supervisory and Regulatory Compliance Requirements by AML/CFT Regulated Entities in Singapore: Parting Thoughts

Regulated Entities must ensure that they have in place a robust AML/CFT compliance programme that helps them ensure alignment with their relevant AML/CFT supervisory authorities in Singapore, such as, Monetary Authority of Singapore (MAS), Accounting and Corporate Regulatory Authority (ACRA), Gambling Regulatory Authority (GRA), Ministry of Law (MinLaw), Urban Redevelopment Authority (URA), Council for Estate Agencies (CEA).

We know who is watching and what they require,

We help you comply better and more efficiently.