The Interplay Between KYC and AML: A Strategic Compliance Perspective

The Interplay Between KYC and AML: A Strategic Compliance Perspective

KYC (Know Your Customer) and AML (Anti-Money Laundering) are two crucial processes in safeguarding businesses and financial institutions from illicit activities and financial crimes, each serving a different purpose. This article highlights what KYC and AML are, along with how they are different and how they work in alignment to protect financial institutions, businesses, customers, and the overall integrity of the financial system.

What is KYC?

KYC is a process adopted by financial institutions and businesses to verify the identity of customers to prevent fraud, Money Laundering (ML), Terrorist Financing (TF) and financial crimes. For conducting KYC, businesses need to gather information such as personal identification, address details, and the source of funds to ensure that they are not only dealing with legitimate customers but also that the funds being used are from legitimate sources. KYC is an essential part of Singapore’s AML regulations, which helps maintain a transparent and secure financial environment. KYC helps regulated entities to identify suspicious customers and prevent money laundering.

What is AML?

AML is a set of practices, regulations and laws designed to prevent money laundering, which involves identifying, mitigating, and reporting to the relevant regulatory authority about suspicious activity or transactions that might be linked to illegally sourced funds originating from predicate offences.

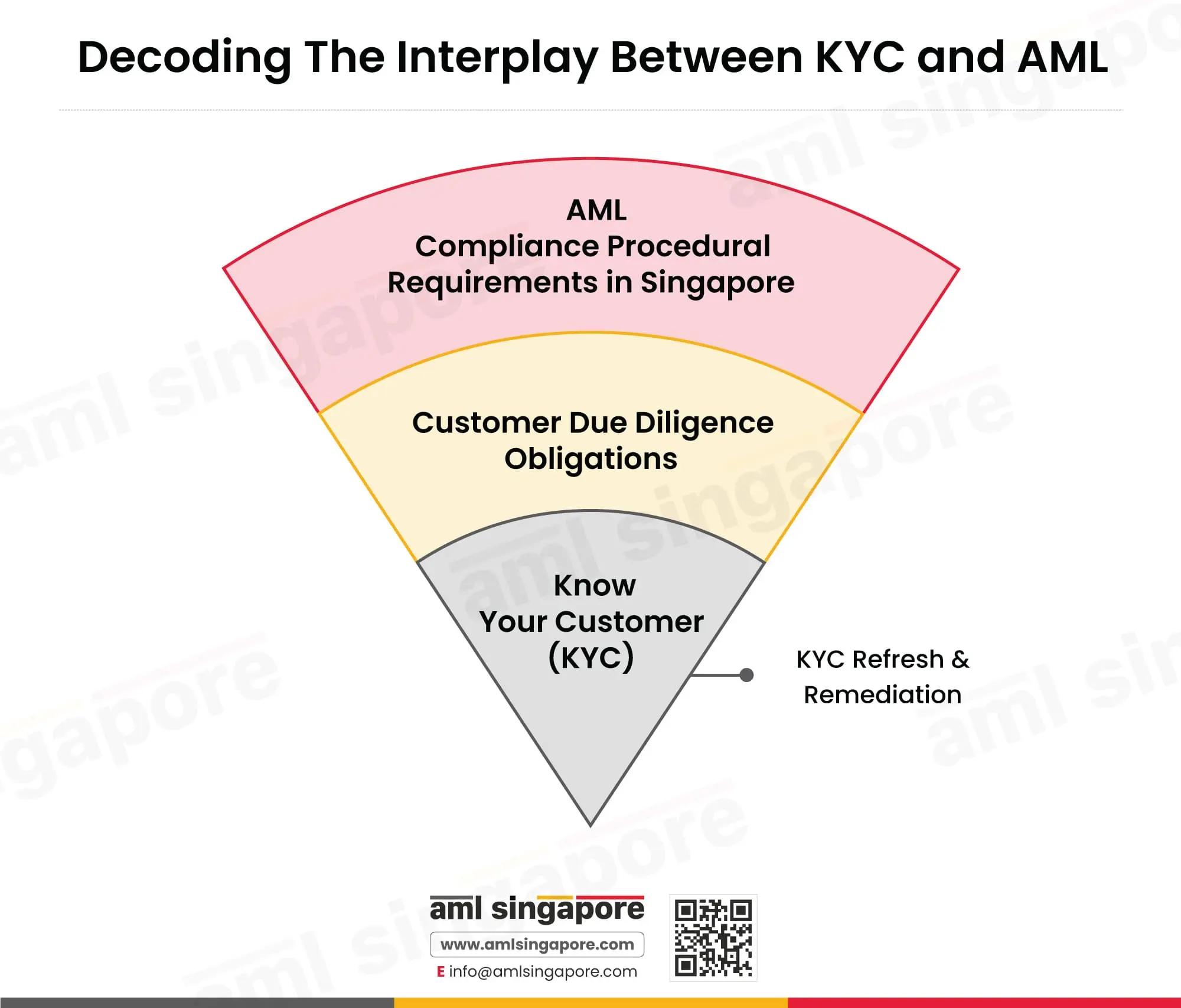

The objective of AML efforts is to detect and stop illicit money from integrating into the economy by implementing control measures prescribed by AML/CFT laws. KYC is one of the strategies and control measures used to identify and prevent money laundering, along with others like customer due diligence (CDD), ongoing monitoring, suspicious activity reporting (SAR), record-keeping, etc.

We are the best Anti-Money Laundering Service Provider in Singapore.

Contact us and prevent your business from being used as a conduit to commit financial crimes.

How do KYC and AML Procedures Differ yet Correlate?

In today’s era, where businesses have a global presence, and they transact through digital platforms, they need to be extra cautious about who they are dealing with. Financial institutions, regulated entities, and banks need to make sure that the money they are handling is not illegally sourced or used for illegal purposes. That’s where KYC (Know Your Customer) and AML (Anti-Money Laundering) come into play.

Although KYC and AML are closely related, they serve different purposes and have different frameworks, processes, and objectives.

KYC is like a detailed introduction, which includes collecting and verifying ID documents and proof of address and getting a better understanding of expected financial activities to get to know who the businesses are dealing with.

On the other hand, AML is a much broader term. It involves several processes like ongoing monitoring, identifying suspicious activities or unusual transactions, and reporting them to the appropriate authorities.

So, in simple terms, KYC is about knowing a customer at the start, while AML is about continuously watching to deter criminal activities. KYC is one part of the bigger AML picture. Together, they help keep the financial system clean and trustworthy.

Decipher Key Differences and Inter-Relationship Between KYC and AML

KYC and AML are not only different in their intent and purpose but are closely interrelated, where one helps fulfil the other’s regulatory compliance requirements.

| Differentiating and Correlating Aspects | KYC (Know Your Customer) | AML (Anti-Money Laundering) |

| Concept | The process to identify and verify the customers | System and internal framework to detect and prevent illegal financial activities emanating from customers |

| Primary Purpose | To know who the customer is | To stop how illicit money enters or moves through the business, through customers |

| Timing | At the beginning — during account opening or customer onboarding, and periodic refresh according to AML policy of the regulated entity, based on legal requirements prescribed in sector-specific laws and guidelines | Continuously — during the entire customer relationship through ongoing monitoring of business relationship based on legal requirements prescribed in sector-specific laws and guidelines |

| Requirements | Checking ID, Address Proof, Doing Background Checks | Monitoring Transactions, flagging suspicious activity, Reporting and implementing robust AML compliance framework |

| Focus | Carrying out AML Compliance processes such as

| Identifying unusual fund movements or criminal activities like

|

| Subset/Superset | KYC is the first step of the AML Compliance process | AML is the broader process, and KYC is a part of it |

AML Compliance Process in Singapore

The AML compliance process involves checking large amounts of data to identify red flags of money laundering or fraud, which manually isn’t easy to do. That’s why financial institutions and businesses need to use the right tools and experts who understand the AML framework and how it works. Using automation and AML software makes the whole process faster, more accurate, more effective, and more affordable. Software is less prone to human error, which means higher accuracy and increased efficiency in catching real problems.

Standard Components of the AML Compliance Process

- Customer Due Diligence (CDD)

This includes checking customers’ identity documents (NRIC/passport) and addresses and evaluating what kind of transactions they are likely to do. - Ongoing Monitoring

This involves monitoring the customer’s transactions over time. If any unusual or suspicious transaction or activity occurs, it should be flagged. - Suspicious Transaction Reporting (STR)

If something doesn’t look right (like large cash deposits or weird money transfers), it must be reported to the Suspicious Transaction Reporting Office (STRO) by filing STR. Click to read more about transaction red flags requiring the filing of STR. - Record Keeping

Proper records of customer details and their transactions must be kept for at least 5 years from the end of the business relationship or the final transaction. This helps to comply with AML/CFT regulations and assist in investigations. - Risk Assessment

Every customer or transaction has a risk level. ML NRA (Money Laundering National Risk Assessment) and LP RA (Legal Persons Risk Assessment) are used to take a risk-based approach to AML/CFT/CPF efforts, focusing on high-risk areas (like politically exposed persons or those from high-risk countries) and prioritising resources accordingly. - Employee Training

It includes regular staff training to spot red flags, understand AML regulations, identify ML/FT Risks, know the reporting procedures, and follow AML procedures properly. - Independent Audit

AML/CFT policies and controls should be reviewed regularly by independent parties to make sure they are effective and compliant with MAS requirements. - Compliance with MAS Guidelines

Rules and guidelines issued by the Monetary Authority of Singapore (MAS) should be followed, which is the main financial regulator in the country.

Future Proofing AML Compliance Through Automation

AML Compliance Automation also helps businesses to keep up with new rules and regulations promptly, without any delays. These tools are designed to handle everything, from AML and CFT (Counter Financing of Terrorism) to KYC (Know Your Customer) requirements, all in one place. For a strong AML system, financial institutions should also include training their staff properly as part of an effective AML framework so they can spot red flags, report suspicious behaviour, and avoid false alarms. In short, good AML software and proper training save time, reduce costs and help companies follow the rules smoothly and effectively.

Explore our Services

Access our cost-efficient AML Services to protect your business from ML/FT risks.

What is the Role of AML Software?

AML software plays an important role in helping financial institutions detect and prevent illegal activities such as money laundering, fraud, and terrorist financing. It helps monitor transactions on a real-time basis to identify unusual or suspicious behaviour.

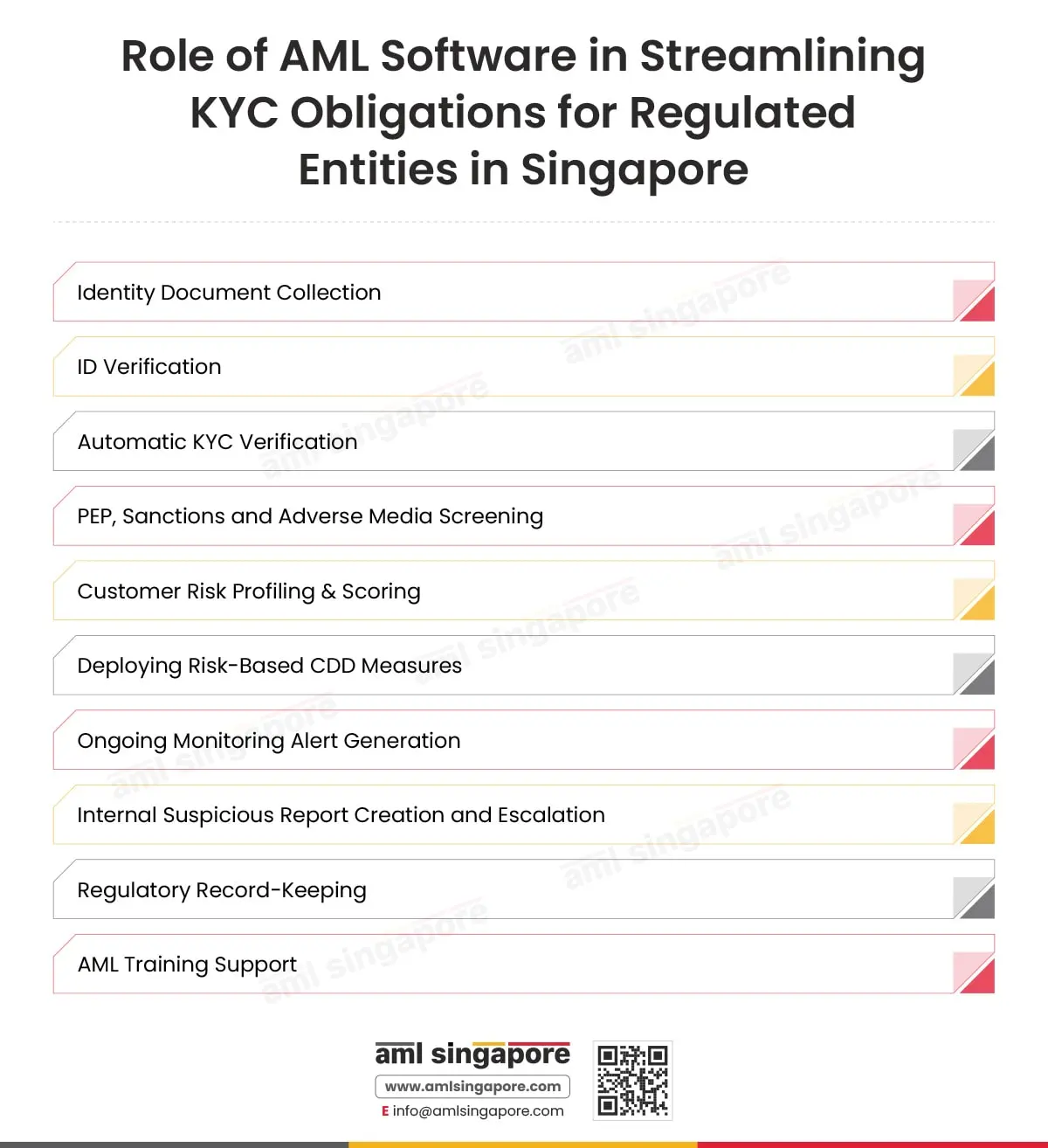

How AML Software Streamlines KYC Obligations

AML Software streamlines KYC Obligations by:

It helps in the automatic verification of customer identities through KYC processes, evaluates customer’s risk profiles and assigns risk scores based on their activity. It also enables customer screening against PEP and sanctions lists issued by local and global authorities.

When potential threats are detected, the software generates alerts and helps create suspicious transaction reports according to STRO and regulatory-specific guidelines.

Financial institutions are required to establish robust AML training programs to meet their AML/CFT requirements as per MAS.

This not only gives employees the technical know-how on how to work with the software but also enables them to be prompt with identifying suspicious activities, flagging them, and reporting them to the authorities on time.

Overall, AML software ensures that banks and other regulated entities stay compliant with legal requirements and maintain the safety and integrity of the financial system.

Conclusion

As financial crime risks continue to evolve globally, it is essential for regulated entities to strengthen their AML/CFT frameworks. Having robust AML controls in place not only protects the organisation against financial crimes but also helps to stay compliant with local and global regulations. Partnering with a trusted AML compliance firm can help provide expert guidance to select the right AML software tailored to business needs and ensure compliance with regulatory requirements.

Give us a call or email us

Let AML Singapore help you choose the best AML software for your business!

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise- Wide Risk Assessments to implementing the robust AML Compliance framework. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.