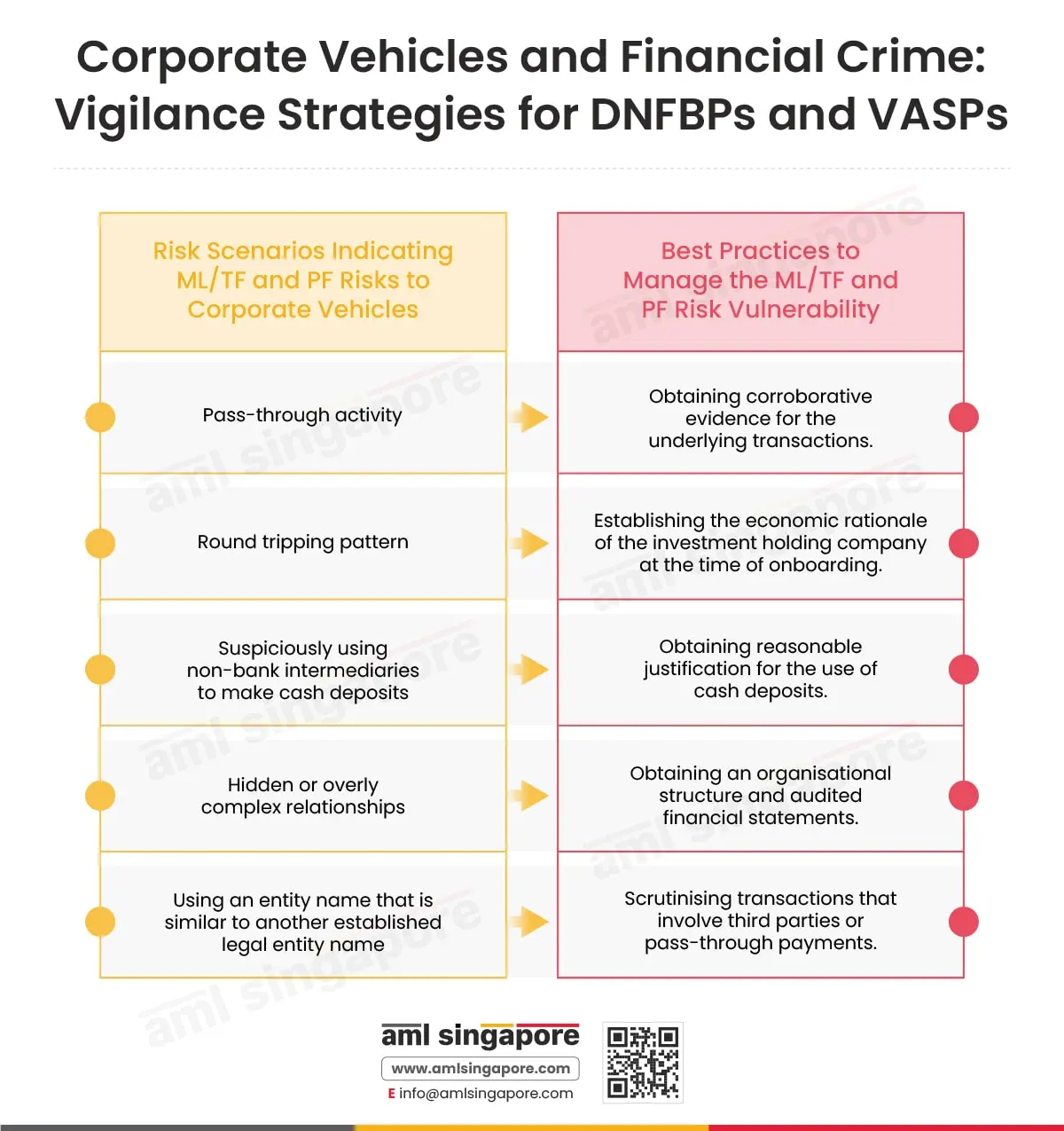

Corporate Vehicles and Financial Crime: Vigilance Strategies for DNFBPs and VASPs

Corporate Vehicles and Financial Crime: Vigilance Strategies for DNFBPs

Corporate vehicles or legal persons, such as trusts, foundations, partnerships and companies, play a crucial role in commercial and entrepreneurial activities. However, these structures can be misused by criminals for Money Laundering (ML), Terrorism Financing (TF) and Proliferation Financing (PF) by disguising beneficial ownership or by integrating proceeds of illegal activities into the financial system. Learn how corporate vehicles and financial crimes are connected and explore the best practices to mitigate ML, TF, and PF risks.

This infographic elaborates on the ML/TF/PF risk scenarios arising out of the misuse of corporate vehicles and the contemporary best practices to mitigate such risk.

Risk Scenarios 1: Pass-Through Transactions

Transactions with no real economic interest are passed through legal persons and are characterised by a sudden spike in transaction activities followed by multiple cash withdrawals and a relatively greater volume of trade that is not proportionate with past transactions.

Best Practice to Manage the Pass-Through Transaction Risk

Collecting corroborative evidence for the transactions undertaken by the company where the transactions do not appear to be in line with other transactions or with common industry practices.

Risk Scenarios 2: Round Tripping Pattern

Funds are passed through multiple companies to reach the original company by a series of transactions.

Best Practice to Manage Round-Tripping Risk

Determining if the limited liability company has any subsidiaries during the onboarding process and analysing the holding pattern and alignment of the business nature of the subsidiary company with the holding company.

Risk Scenario 3: Suspiciously Using Non-Bank Intermediaries to Make Cash Deposits

Companies use money changers or remittance agencies (MCRA) to move funds from a foreign country to Singapore, but they have no established links to the actual source of their funds or usual business practices.

Best Practice to Manage the Misuse of Non-Bank Intermediaries for Cash Deposits Risk

Taking reasonable justification from the company for using cash deposits instead of remittances through banks.

Risk Scenarios 4: Hidden or Overly Complex Relationships

Founders or nominee shareholders create multiple layers of intermediary companies, incorporated in different jurisdictions, between a legal entity and its Ultimate Beneficial Owners (UBOs) without any reasonable justifications.

Best Practice to Manage Risk Associated with Complex Relationships and Ownership Structures

Obtain an organisational structure that explains the relationship between various companies and their UBOs and review audited financial statements of the parent and subsidiary companies.

Risk Scenario 5: Using an Entity Name that is Similar to Another Established Legal Entity Name

Criminals use names that are associated with well-known entities to show the authenticity of their entity using forged documents or transactions.

Best Practice to Manage Legal Entity Impersonation Risk

Scrutinising transactions where there is a pattern involving third parties or pass-through payments.

Conclusion

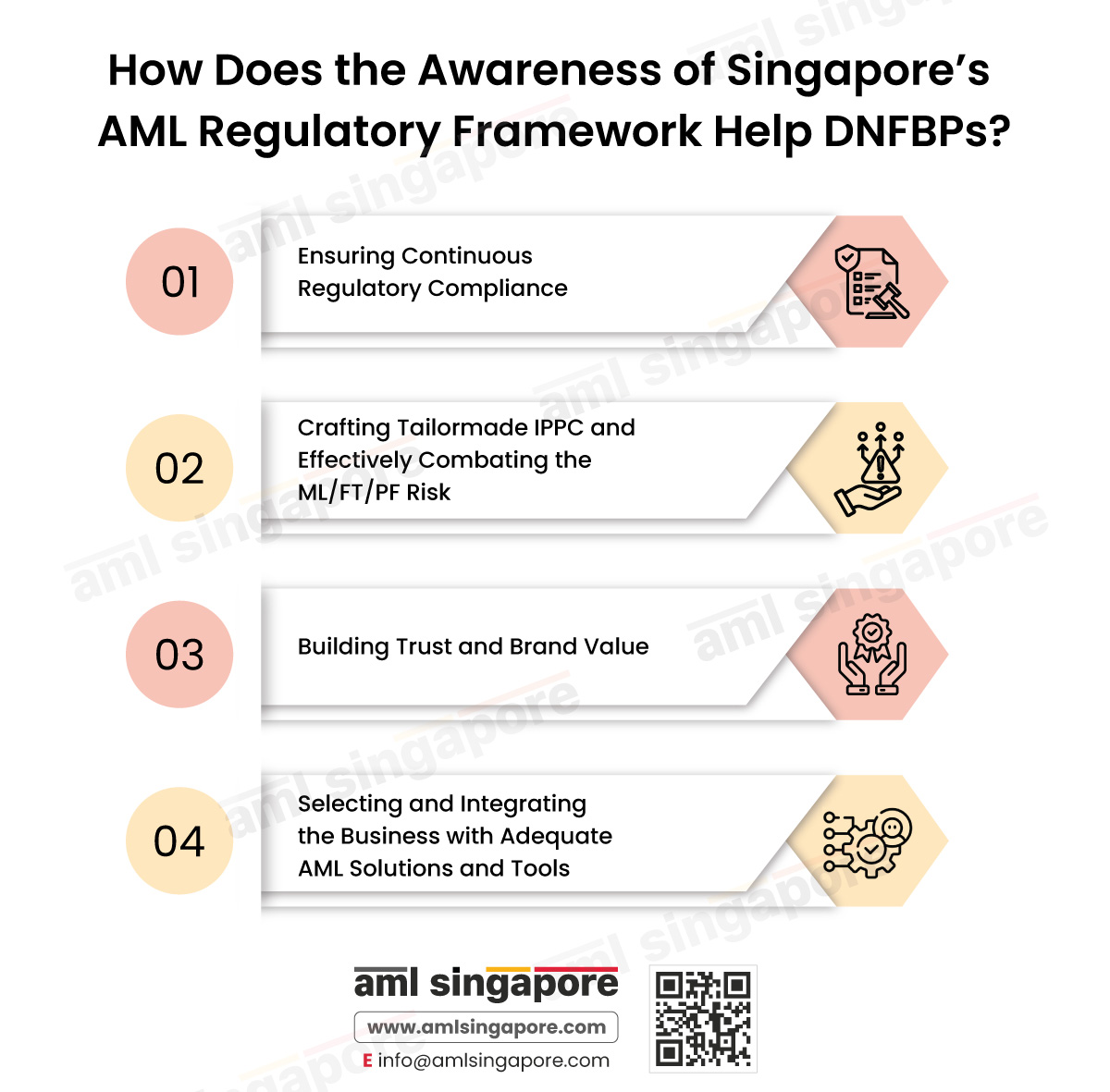

Corporate vehicles often become conduits in financial crime. Being aware of the various misuses of corporate vehicles can, hence, be an important aspect for Designated Non-Financial Businesses and Professions (DNFBPs) and Virtual Asset Service Providers (VASPs) in managing the ML/TF/PF risks to their business.