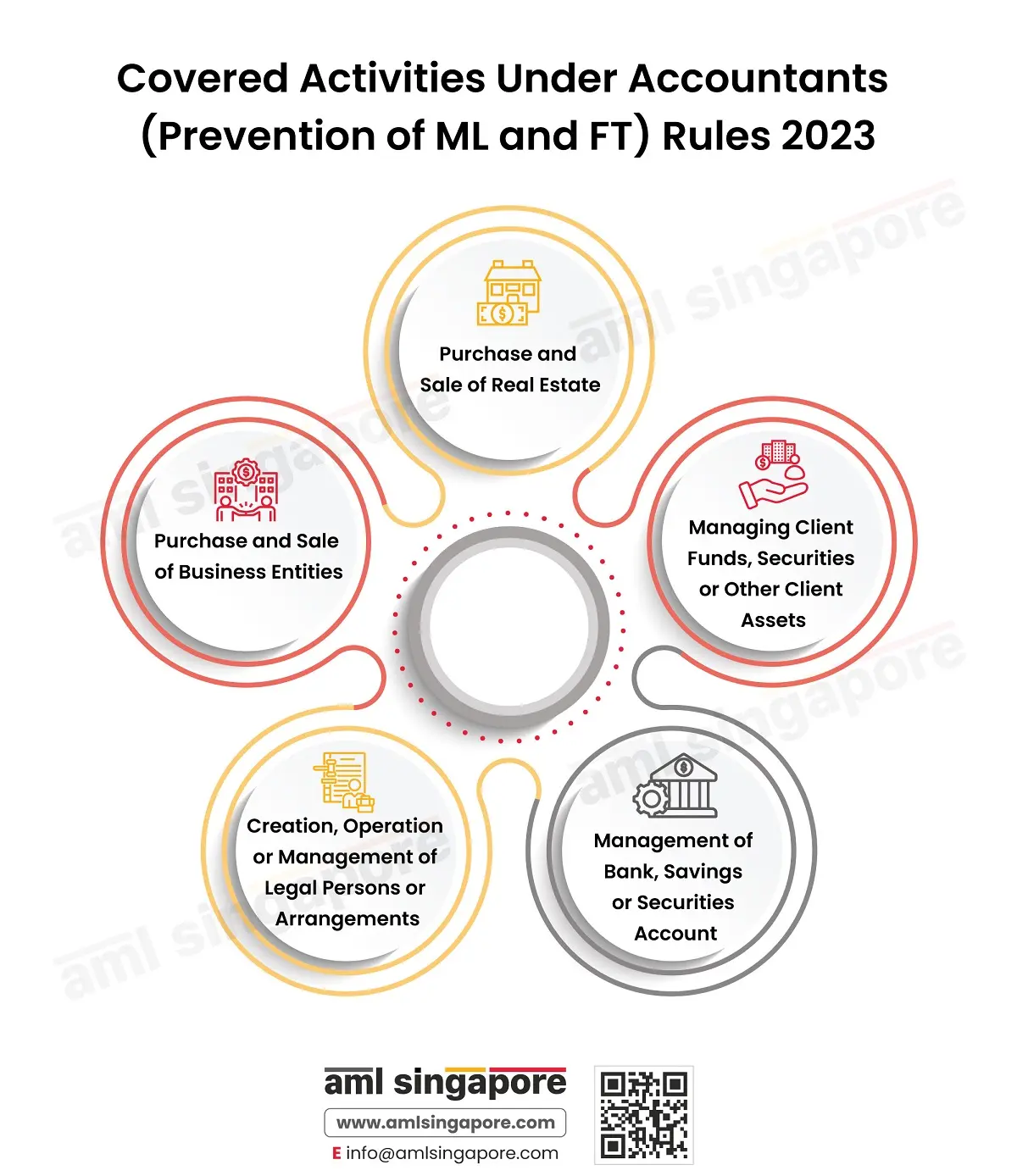

Covered Activities under Accountants (Prevention of ML and FT) Rules, 2023

Covered Activities under Accountants (Prevention of ML and FT) Rules, 2023

In Singapore, accounting firms, corporations or companies, and LLPs that are approved by the Public Accountants Oversight Committee as per the provisions of the Accountants Act 2004 are referred to as accounting entities.

Individual Practitioners are corporate practitioners in the case of an accounting corporation or accounting LLP. In the case of an accounting firm, individual practitioners are public accountants who are:

- A partner or employee of an accounting firm, or

- Practising as a public accountant in an accounting firm.

Public accountants are individuals who are registered or deemed to be registered in accordance with the Accountants Act.

When such accounting entities or individual practitioners, in the course of their business, perform or prepare to perform transactions for their clients regarding the following activities-

- Purchasing and selling Real Estate,

- Managing client funds, securities or other client assets,

- Managing client’s bank, savings or securities accounts,

- Organising contributions for the creation, operation or management of companies,

- Creating, operating or managing legal persons, i.e. any entity other than an individual which can establish a permanent business, professional or commercial relationship with an accounting entity or own a property, or

- Creating, operating or managing legal arrangements (including express trust),

- Purchase and sale of business entities.

They are subjected to AML/CFT requirements prescribed in the Accountants (Prevention of Money Laundering and Financing of Terrorism) Rules 2023.