ACRA AML/CFT Requirements Review (Inspection) of Public Accountants and Accounting Entities

All accounting entities and public accountants in Singapore carrying out covered activities are required to undergo periodic ACRA inspections, through which their Anti-Money Laundering and Counter-Financing of Terrorism (AML/CFT) compliance measures are inspected by ACRA. The ACRA is responsible for forming and appointing the Public Accounts Oversight Committee (PAOC), which is responsible for appointing an entity reviewer to carry out the ACRA AML/CFT Requirements Review process of all accounting entities and individual practitioners.

The Accounting and Corporate Regulatory Authority (ACRA) registers and regulates public accountants and individual practitioners in Singapore as per the rules and standards prescribed under the Accountants Act, 2004.

The Accountants Act, 2004, also referred to as ‘the act’, is the primary legislation in Singapore governing accountancy services provided by accounting entities and professionals. The Accountants (Prevention of Money Laundering and Financing of Terrorism) Rules 2023 require accounting entities and their practitioners to have in place, an adequate AML/CFT compliance framework, consisting of internal policies, procedures and controls (IPPC) for combating Money Laundering (ML), Financing of Terrorism (FT), and Proliferation Financing (PF) risk effectively.

Accounting entities and individual practitioners’ AML/CFT IPPC is subject to ACRA AML/CFT Requirements Review.

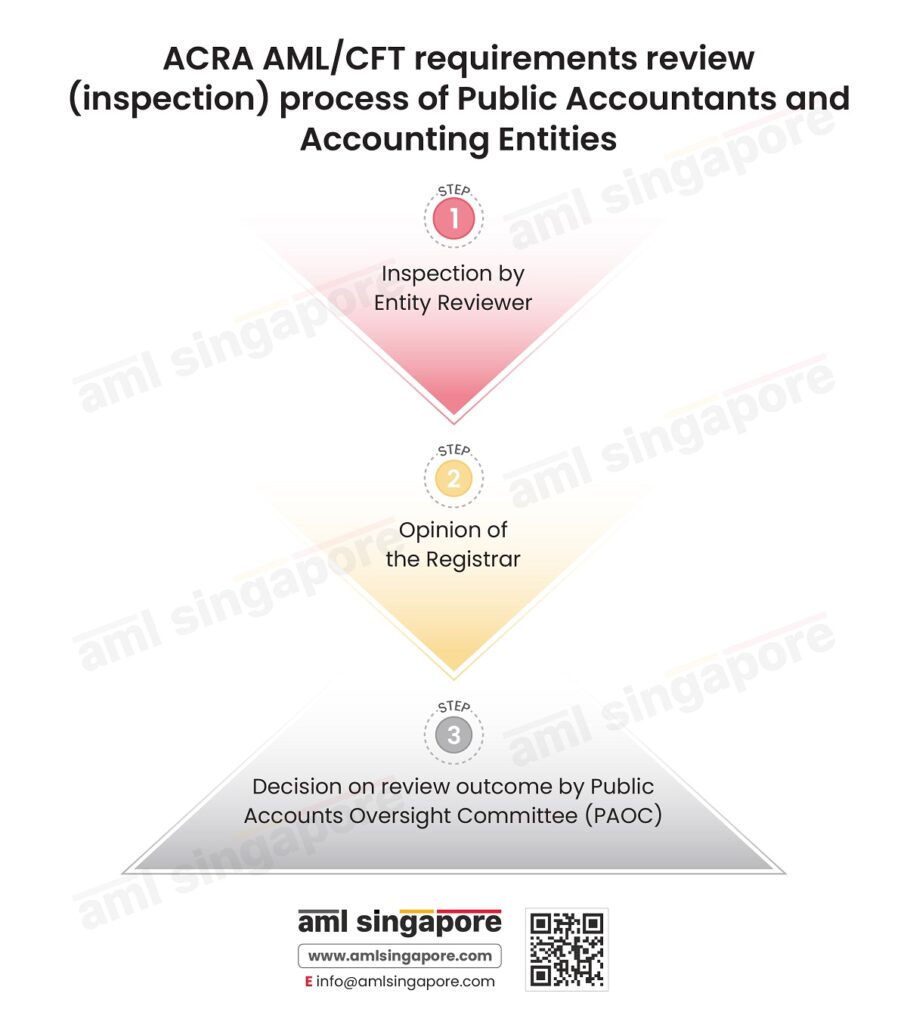

ACRA AML/CFT Requirements Review (Inspection) Process of Public Accountants and Accounting Entities

The ACRA AML/CFT Requirements Review process comprises of following steps:

1. Entity Reviewer Inspects AML/CFT Compliance Requirements

The entity reviewer carries out an AML/CFT requirement review. For this purpose, the entity reviewer has the power to:

- Examine any records or the description of records in the possession or under the control of the accounting entity or practitioner that the reviewer entity believes are relevant to review.

- Seek explanations or further details of any records or documents, excluding any such record or document containing privileged communication to or from a legal practitioner.

- Upon concluding the review, the entity reviewer submits a report to the Registrar.

2. Opinion of the Registrar

After considering the report submitted by the entity reviewer, if the registrar is of the opinion that the accounting entity or any of its practitioners have breached any of the AML/CFT requirements, it shall submit a report to the Public Accounts Oversight Committee PAOC (Firm Level).

3. Decision by the Public Accounts Oversight Committee (PAOC)

Upon submission of the report by the registrar, the PAOC assesses and decides the consequences of non-compliance with AML/CFT requirements by accounting entities and practitioners.

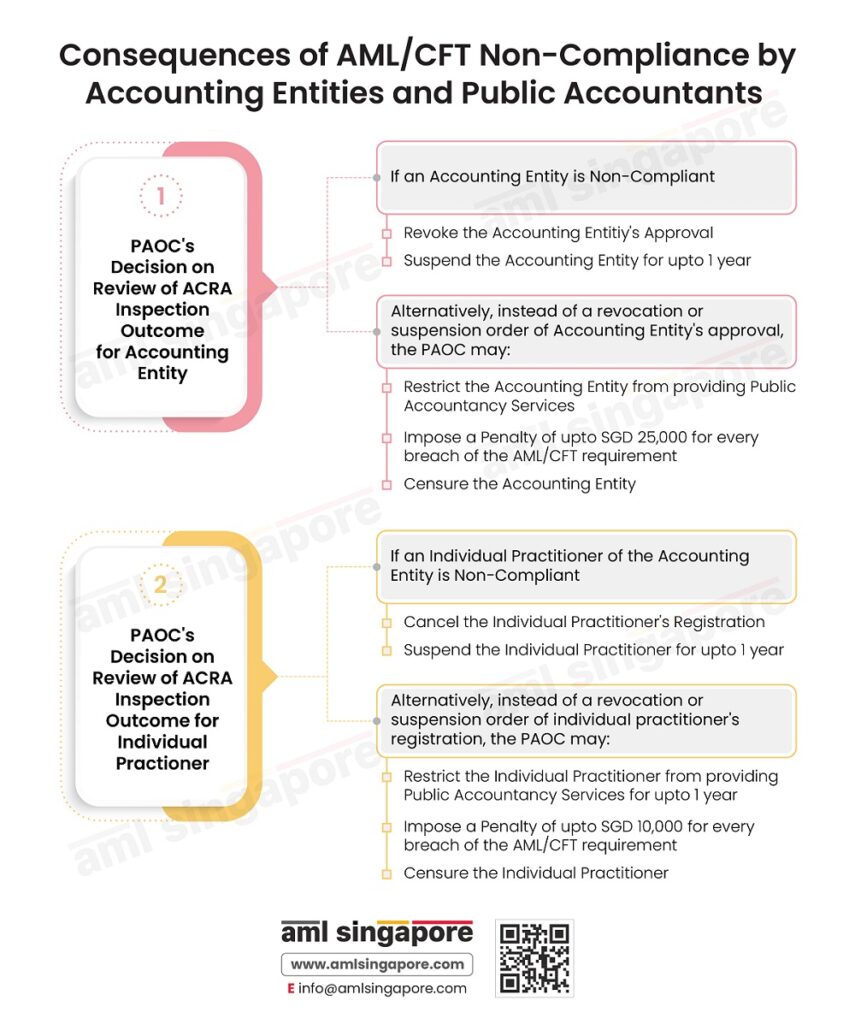

Consequences of AML/CFT Non-Compliance by Accounting Entities and Public Accountants

The Public Accounts Oversight Committee (PAOC) is the final authority to decide on the outcome of AML/CFT requirements inspection as the PAOC determines procedure for conducting ACRA inspection of any accounting entity and public accountants

Upon considering the ACRA inspection report of the Registrar, if the PAOC (Firm Level) is satisfied that the accounting entity or its individual practitioners are non-compliant, with AML/CFT compliance requirements,

The following consequences may follow where the PAOC may direct the following orders:

- Revocation of the approval granted to the accounting entity or cancellation of the registration of individual practitioners.

- Suspension of the accounting entity from providing accountancy services or suspension of an individual practitioner for up to one year.

Alternatively, instead of a revocation or suspension order, the PAOC can direct one or more of the following orders:

- Restrict the accounting entity or individual practitioners from providing public accountancy services in a manner it deems fit for up to one year.

- Impose a penalty of SGD for individual practitioners for every breach of the AML/CFT requirements.

- Censure the accounting entity or an individual practitioner.

The PAOC is also empowered under the law to prescribe to public accountants and accounting entities, any standardised methodology, procedures, code of professional conduct, or other requirements necessary to enable them to identify, prevent, and mitigate ML/FT and PF risks, with timely reporting of suspicious activities and transactions to regulatory authorities, and maintaining adequate records of AML/CFT measures taken.

Conclusion

The PAOC in Singapore is responsible for deciding on the registrar’s opinion based on the ACRA inspection carried out by the entity reviewer. The PAOC, upon finding any incidence of non-compliance with the prescribed AML/CFT requirements, shall take punitive action.

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise- Wide Risk Assessments to implementing the robust AML Compliance framework. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.