AML compliance for the luxury goods market in Singapore

AML compliance for the luxury goods market in Singapore

Money laundering threats are a common stain on all kinds of luxury goods. Worldwide, financial criminals consider art, antiques, gems and stones, yachts, and watches to be an accessible medium to launder money. So, AML compliance for the luxury goods market is essential to eliminating money laundering.

Recently, Singapore fell prey to such a money laundering scandal in the luxury goods market in 2023. The criminals earned dirty money through illicit means and cleaned them up in the legal Singaporean financial system. Using this money, they bought several luxury goods, which the police seized during investigations. This scam brought the country’s regulatory authorities’ attention back to strengthening AML regulations for the luxury goods market.

Let’s examine these AML regulations in Singapore. Moreover, we’ll discover the AML compliance initiatives that luxury goods market operators must implement to reduce the risks of financial crimes. These measures mitigate money laundering risks and prevent criminals from exploiting this market.

AML compliance mandate concerning luxury goods

The AML regulations in Singapore apply to “precious products”.

Recently, the Singapore authorities introduced a Bill seeking to expand the scope of “precious products.” Previously, this term was restricted to high-value products wherein at least 50% of value was attributed to precious stones or precious metals (PSPM). Now, with the newly proposed definition of “precious products,” the mandatory condition of having a PSPM element in a product to qualify as a “precious product” has been relaxed.

Now, the “precious products” would include the following items subject to the prescribed threshold, and the dealers engaged in such precious products would be subject to AML compliance in Singapore:

Jewellery, watches, ornaments, apparel, accessories, etc., of value exceeding S$ 20,000, irrespective of the value attributable to the PSPM.

Considering the money laundering vulnerabilities associated with luxury items, the definition of “precious product” is proposed to be amended to include high-value luxury items traded at premium prices because of the brand label associated with the item or the involvement of craftsmanship.

Such products include high-end watches, accessories, apparel, etc., though they involve very little or no element of precious metals or precious stones. Criminals have exploited these products, resulting in the laundering of illegally obtained proceeds.

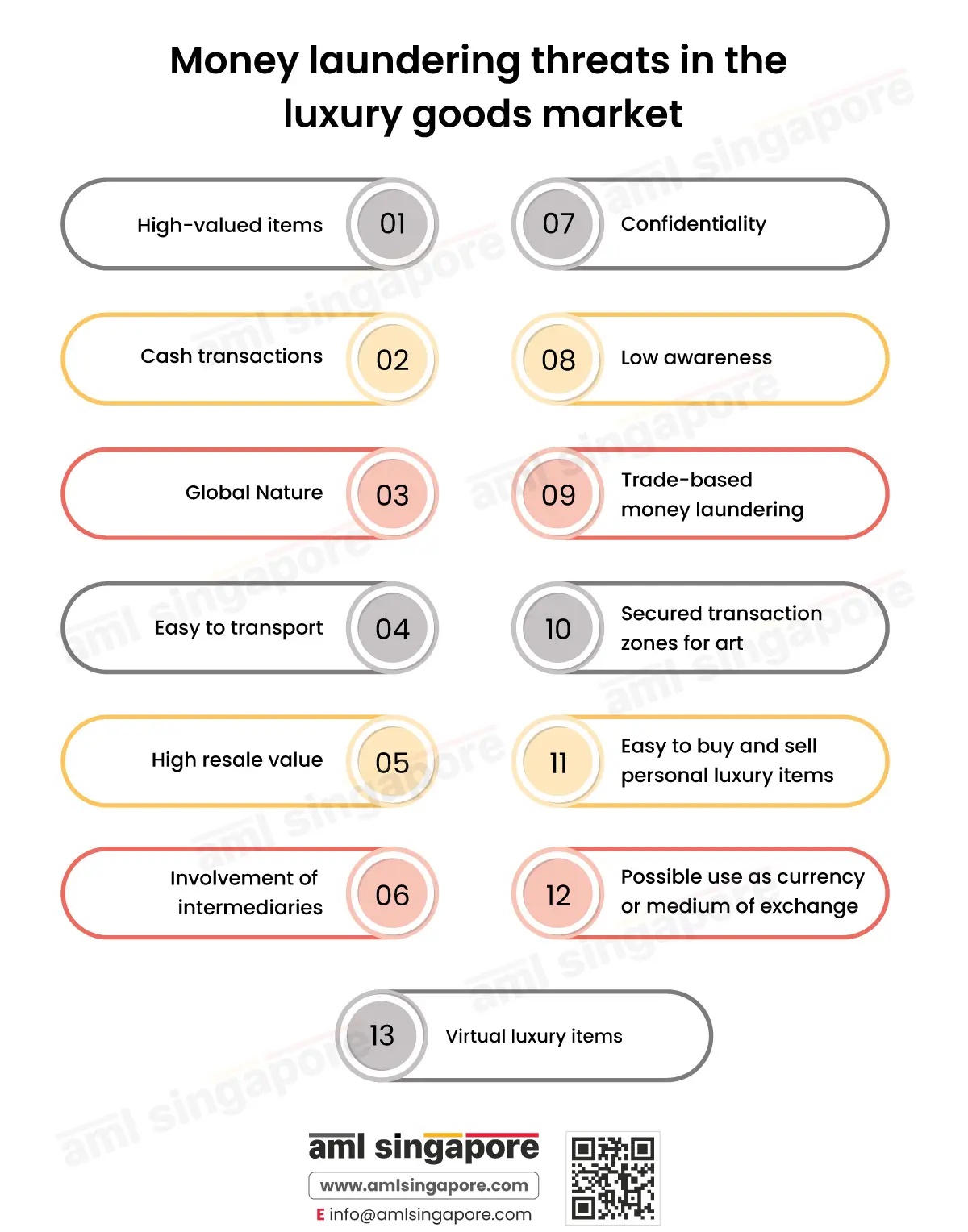

Money laundering threats in the luxury goods market

The risks associated with luxury goods are high due to the following reasons:

High-valued items

Luxury items are high-valued goods, attracting money launderers who exploit them in several ways. High-valued items make it easier for money launderers to launder vast sums of money.

Cash transactions

The purchase and sale of luxury goods are mainly through cash transactions. Thus, it becomes difficult for authorities and police to track their source and destination.

Global Nature

You can transact luxury items globally across multiple jurisdictions. This feature increases your exposure to money laundering and similar other threats, with no restriction on the boundaries.

Easy to transport

These goods are easily transportable, and questioning and interrogation are minimal or non-existent. You can carry some of these items, like jewellery, luxurious apparel or ornaments, across borders without hassles.

High resale value

One unique characteristic of luxury items is their high resale value. There is a high demand for these goods among wealthy and high-net-worth individuals. These goods also fetch a good resale value, specifically in the case of rare and unique collectibles. So, criminals leverage this feature to their benefit.

Involvement of intermediaries

Luxury items provide an easy way to use shell companies or third parties to buy, sell, and manage these assets. This means you buy these items not directly but using offshore or foreign accounts. The anonymity and privacy associated with these intermediaries increase the possibility of money laundering activity, concealing the true identity of the criminal or launderer.

Confidentiality

The luxury goods markets enjoy a sense of confidentiality and discretion. You need not provide details on the actual owners of these goods. That is why the risk of financial crimes is high.

Low awareness

Dealers in such luxury items are unaware of the AML compliance requirements worldwide and nationally. Moreover, they are ignorant of the risks of such financial crimes to their business.

Trade-based money laundering

Trade-based money laundering is possible in the case of luxurious items carrying a premium associated with the brand, which is abstract. It is an accessible market for over- or under-invoicing. You can manipulate the prices to show higher or lower rates for laundering money. Criminals might also create false invoices to show a purchase and sale transaction despite no such activity.

Secured transaction zones for art

Another primary factor that has cropped up in recent years is the construction of Freeports. These are storage spaces in transit zones near airports to facilitate art purchase and sale transactions. These are secured zones offering privacy and anonymity to buyers and sellers. In these spaces, no tax is applicable on art and antiques, so you are also saved from those costs.

Easy to buy and sell personal luxury items

Money laundering in personal luxury items is easy because anyone can buy these from any country. Ineffective due diligence measures at borders lead to easy transit to the country of residence. Thus, provoking the launderers to evade taxes on such items and launder money without coming into the spotlight of the origin country’s regulator. Moreover, no one asks the beneficial ownership of these personal luxury items.

Possible use as currency or medium of exchange

Luxury goods obtained illegally are used as a means of payment or to barter another luxury item. Thus, you can place dirty money in the legal market as a currency.

Virtual luxury items

Now, these luxury items are also available in virtual form. So, the risks associated with virtual assets also apply to them. Specifically, they can avoid many regulatory mandates and sanctions.

Thus, these are the possible ways criminals can engage in money laundering through luxury goods transactions.

Accordingly, recognising the legal requirement and the associated risk, you must prevent criminals and launderers from saving your business from exposure to financial crimes. If you don’t, you will be AML non-compliant, inviting fines and penalties. It can lead to criminal action against you, reputational damage, or loss of business. So, you must adopt appropriate techniques to prevent them.

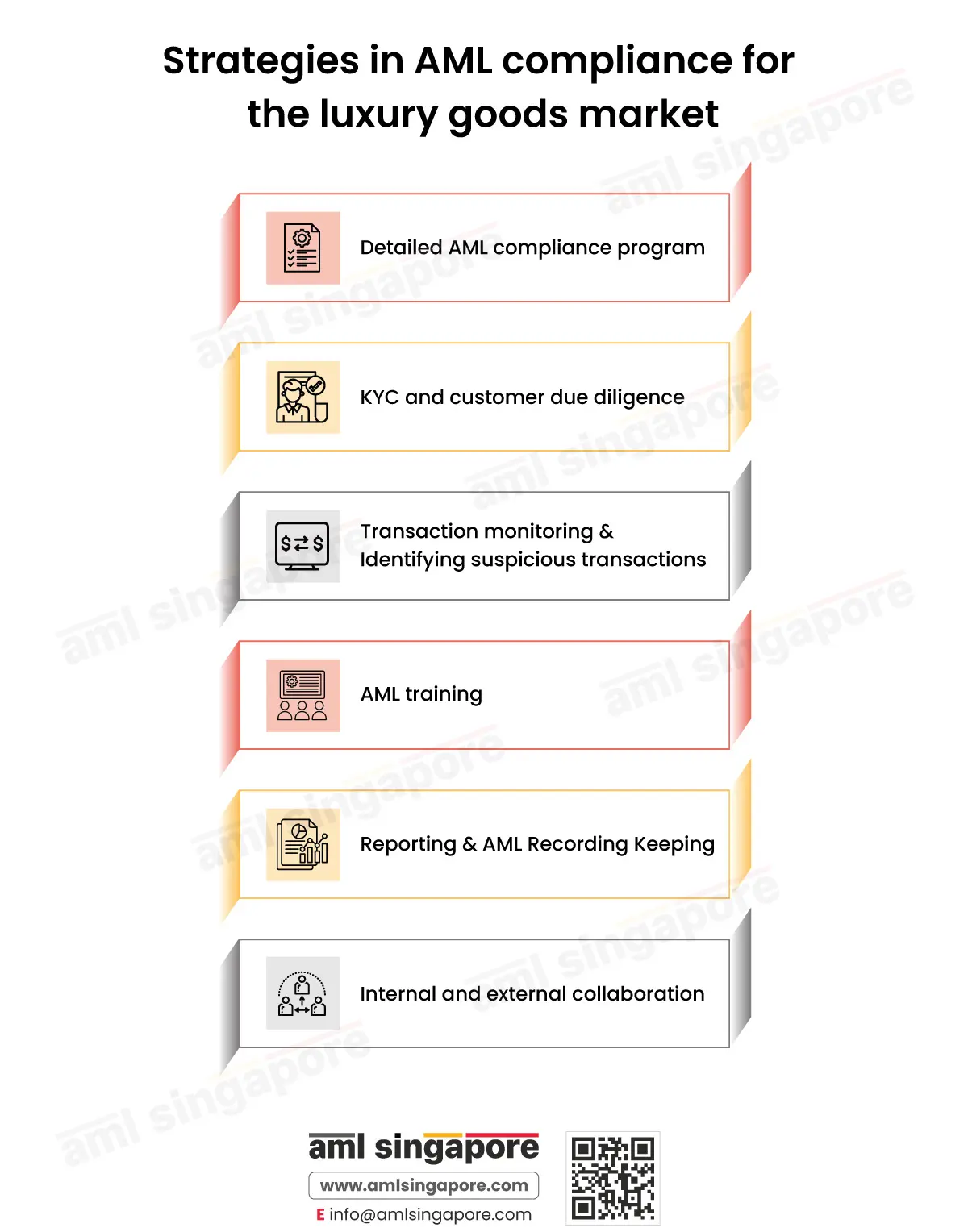

Strategies in AML compliance for the luxury goods market

Strategies to Ensure AML Compliance in Luxury Goods Market

Detailed AML compliance program

The high risks of money laundering require a detailed strategy for fighting it. You need to know your plan for complying with AML regulations. It is also essential to prevent and mitigate the potential money laundering threats.

So, design a comprehensive customized AML compliance program. It must have adequate policies and controls to fight these financial crimes. This includes procedures for KYC, CDD, transaction monitoring, and sanction screening. Keep updating them on time to align with the evolving regulations and innovations in money laundering.

The strategy must also define the skills you need in your business to handle AML compliance. Based on this, you can hire people for AML compliance-specific jobs. It also enables you to design relevant AML training for your AML activities. Thus, the strategy directs you on how to go about your AML compliance.

This AML compliance program must align with the following acts applicable to luxury items businesses in Singapore:

- Corruption, Drug Trafficking, and Other Serious Crimes Act (CDSA)

- Terrorism (Suppression of Financing) Act (TSOFA)

- Precious Stones and Precious Metals (Prevention of Money Laundering and Financing of Terrorism) Act, 2019

- Precious Stones and Precious Metals (Prevention of Money Laundering and Financing of Terrorism) Regulations, 2019

KYC and customer due diligence

AML compliance requirements need you to know about your customers. So, you must focus your efforts on conducting KYC and customer due diligence of your customers. Collect the following details on your customers and verify the same using reliable, independent sources:

- Name, address, occupation

- Nationality

- Transaction’s purpose and objective

- Source of funds and wealth

- Beneficial owners of luxury items

- Expected mode of payment

The most critical information is where the money is coming from and where it is going. Also, the information bit on beneficial ownership. Both these data points help you establish any potential linkages to financial crimes.

You must create your customers’ risk profiles based on all these details. The risk profile helps you categorise customers as low, medium, and high risks. It is also necessary to screen your customers against different national, regional, and international watchlists, including but not limited to:

- Terrorists

- Politically Exposed Persons (PEPs)

- Sanctions

- Individuals involved in corruption, bribery, and other illegal acts

So, you must be extra careful while dealing with high-risk customers. All these information-gathering and analysing processes need you to deal with more paperwork.

Transaction monitoring & Identifying suspicious transactions

Monitoring your customers’ transactions is critical to spot suspicious ones. You must be aware of the red flags to detect them. Once you know them, it is easier for you to detect them. You can investigate them further and take action based on the results.

Understanding the layering of transactions is essential. This is where launderers play smartly to hide dirty money in clean money. So, you must create custom transaction rules based on your customers’ risk profiles and transaction patterns. Look for signs that raise doubt in your mind, like the following:

- Large cash transactions

- Concealing beneficial ownership

- Inconsistency of the transaction with the customer’s profile

- Customers from high-risk jurisdictions

- Involvement of layers of intermediaries in transactions

Using a technological solution to monitor transactions is a smart move. You can ensure accurate results, complete monitoring, and faster processing. But do not ignore adding the human touch to transaction monitoring. Check the suspicious ones manually to understand the customer behaviour behind possible money laundering.

AML training

You must make it a point to give due importance to AML compliance in your entity. All employees must understand how significant AML compliance is in preventing financial crimes.

Thus, whether you want to create an AML culture in your business, monitor transactions, conduct CDD, or report suspicions, your employees must know how to do all this. If your employees are unaware of the reason and procedures, your AML compliance will go haywire.

So, pay attention to training your employees on AML measures and strategies. Such training must teach the following topics:

- Significance of AML compliance for your industry

- Methods of conducting KYC, due diligence, and sanction screening

- Monitoring transactions, identifying and reporting suspicions

Until employees know the what, why, and how of AML procedures and controls, it is challenging to get their focused dedication; only when they give their 100% can you ensure a culture of AML compliance. It will help you prevent money laundering risks and follow Singaporean AML requirements.

Reporting & AML Recording Keeping

As crucial as transaction monitoring and due diligence are to AML compliance, similar criticality is held by reporting and record-keeping. You will be checking transactions to identify the suspicious ones amongst those. You will also be monitoring your customers to detect their levels of risk to your business. If you forget to maintain records of these results, they do not serve the complete purpose.

Recording and reporting these procedures and results is significant. Since you need to file suspicious activity reports and cash transaction reports, you must have a well-defined procedure for them. Define the people responsible for them, the procedure, and the format. Also, explain any internal reporting process you must follow for AML compliance.

Similarly, maintain records of each of your AML procedures. Save everything, be it KYC records, due diligence reports, customer risk profiles, transaction monitoring results, or AML training manuals. As stipulated in the regulations, maintain these records for at least five years.

Internal and external collaboration

An often overlooked AML strategy is internal and external collaboration, communication, and cooperation.

Smooth communication on AML between departments eases your AML compliance journey. You must discuss the AML procedures that overlap with your activities and challenges, deliberate on potential solutions, and consider their impact. You must also communicate well with senior management to discuss suspicious transactions and customers. The management must communicate the AML policies and procedures to the employees.

Besides internal communication, external cooperation is necessary with:

- Industry regulators for AML expectations & guidance

- Peers for shared database in KYC, sanctions screening, and due diligence

Thus, you must collaborate with your industry players to achieve AML compliance and free the luxury goods market from money laundering threats.

AML Singapore – your AML compliance journey partner

These AML compliance strategies can ensure your luxury items business sparkles. But doing it all alone while dealing with the rising competition is daunting. So, the best option is to partner with a specialist AML compliance services provider. And who better than AML Singapore to join hands with to move ahead in your AML compliance journey?

Amidst all these money laundering concerns regarding luxury items, you have a beacon of hope in AML Singapore. We help you with all the necessary strength to fight money laundering. Our consultants provide support to protect the integrity of financial transactions.

Our consultants are here to help you with any of the AML compliance strategies listed above. Not only this, we create a customised strategy to suit your business needs. These AML measures ensure you protect your luxury items from exposure to money laundering threats.

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 9 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.